Greece’s attractiveness policy seen as effective, with room for further improvement

Three out of four respondents (76%) consider the country's policies for attracting investors to be "very" (16%) or "somewhat" (60%) effective. However, the high percentage of respondents describing Greece's attractiveness policies as "somewhat" effective, suggests that there is room for further improvement.

Among specific attractiveness policies, companies appear more impressed by policies for attracting companies (76%), innovative activities (68%), and human talent (64%), followed by policies to attract business headquarters (58%) and establishing global centers for competitiveness/world-class clusters (54%).

Sustainability, technology, and talent

Participants were also asked to assess Greece’s performance compared to other countries, based on a series of criteria related to three critical factors influencing investment decisions today: sustainability, technology, and talent.

In all these areas, the majority of respondents stated that Greece is performing as well as other countries. The most positive perception for the country emerges with regard to sustainability, where, for five out of six individual criteria, those that feel that Greece is performing better than other countries outnumber those stating the opposite. However, with regard to criteria related to technology and talent, the picture that emerges is more mixed, with participants almost equally split between those who say that the country is performing better and those who say it is performing worse than other countries, indicating some key areas where further progress will be needed in the coming years.

Positive views on the management of the energy crisis

Greece outperformed others in handling the 2022 energy crisis, according to respondents. Two out of five respondents expressed positive opinions, with 36% stating that Greece managed the crisis "slightly better" and 7% "significantly better" than other countries, while 22% believed that the management of the crisis was comparatively worse.

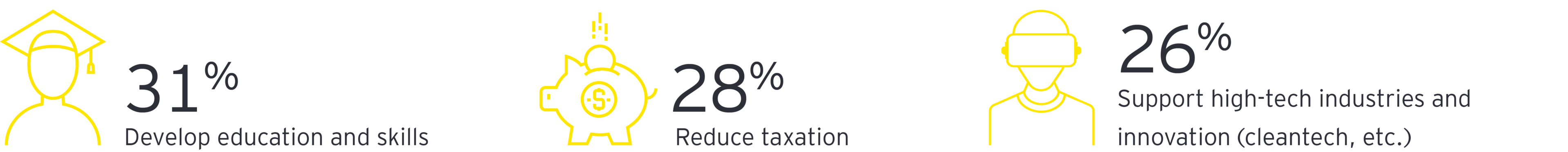

Human skills, taxation, high technology, and innovation remain top priorities

Regarding the areas the country should focus on to maintain its competitive position in the global economy, respondents continue to prioritize three key areas: developing education and skills (31%), reducing taxation (28%), and supporting high-tech industries and innovation, such as cleantech (26%).