GoI’s major subsidies

One part of revenue expenditure reforms relates to subsidy reforms. The GoI has been able to show a steady reduction in major subsidies which were at its peak relative to GDP at 3.57% in the COVID year of FY21. Since then, this ratio has steadily fallen to 1.16% in FY25 (BE). In fact, the period from FY15 to FY20 witnessed a steady reform aimed at reducing the share of subsidies in GoI’s revenue expenditure primarily by better targeting and delivery to the intended beneficiaries by using India’s substantially improved public digital infrastructure.

Recasting fiscal consolidation path

A major thrust of the Interim budget was to signal that the GoI has been committed to restoring fiscal consolidation after the COVID shock. In fact, in FY19, the GoI’s fiscal deficit was reduced to 3.4% of GDP with a view to eventually reaching 3% as per the Fiscal Responsibility and Budget Management (FRBM) norms. However, in FY21, GoI’s fiscal deficit to GDP ratio increased to 9.2%, its highest level at least since FY1991. It took concerted effort from then onwards to put GoI’s fisc back on the path of fiscal responsibility in incremental steps. The FY25 interim budget projects FY26 fiscal deficit to GDP ratio at 4.5%. It may take three more years of incremental reductions of 0.5% points each to reach the level of 3% of GDP.

Finding space for growth supporting capital expenditure expansion

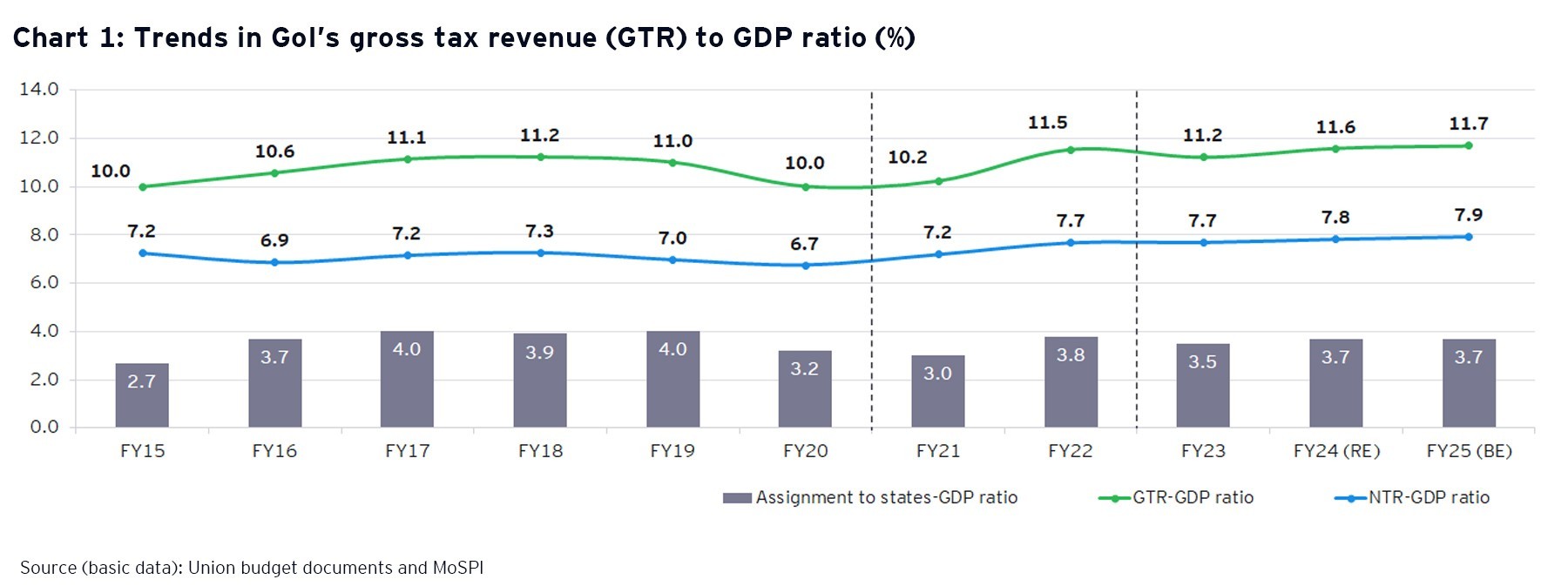

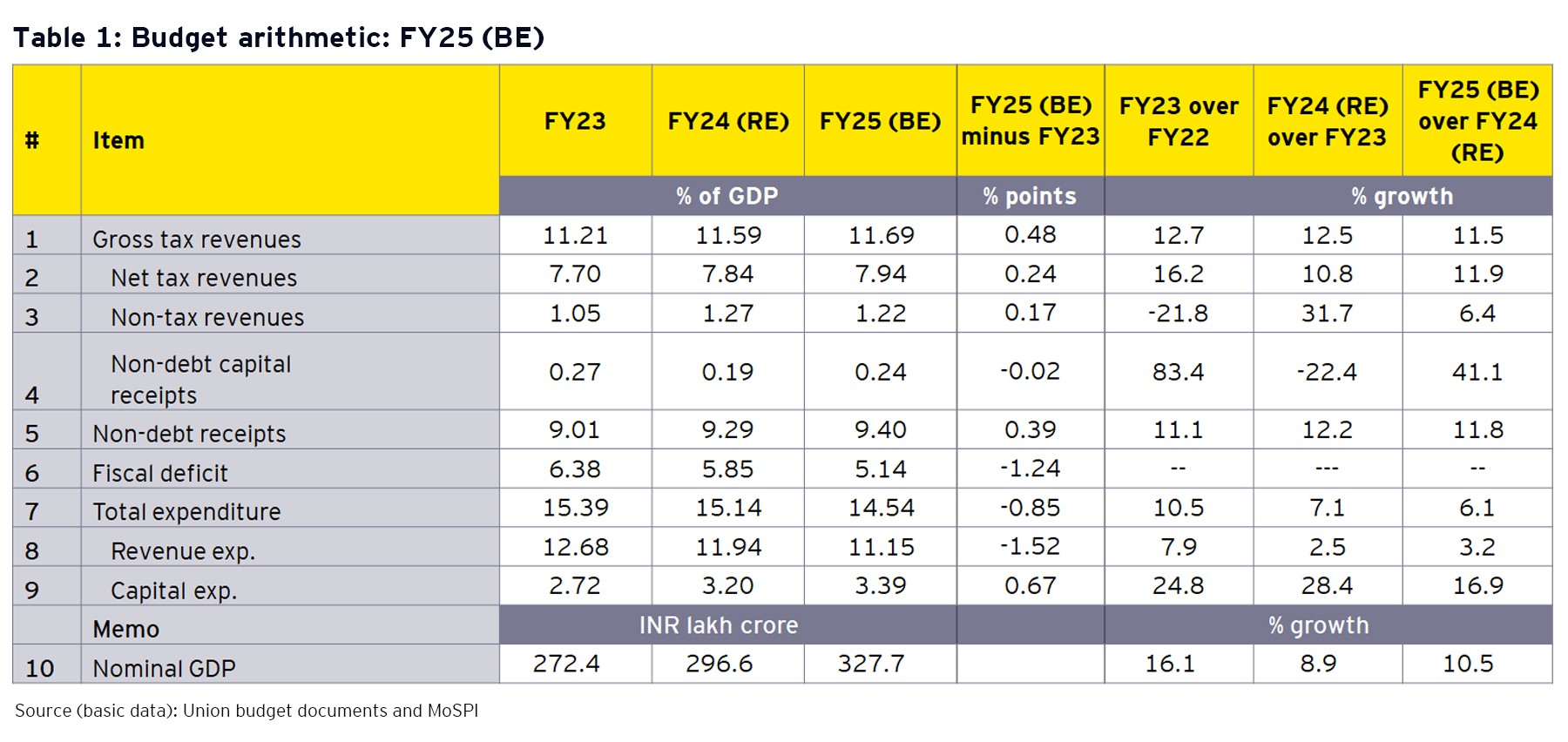

It is useful to understand the adjustments in the fiscal aggregates that enabled the creation of adequate fiscal space for the reduction in the fiscal deficit. The first positive element is the improvement in GoI’s GTR which rose from 11.2% of GDP in FY23 to 11.7% in FY25 (BE), providing additional fiscal space to the extent of 0.48% points and 0.24% points of GDP considering GoI’s gross and net tax revenues in FY25 (BE) vis-à-vis FY23. The lower margin in the latter reflects an increase in the share of states’ in GoI’s GTR. The second component of adjustment relates to reduction in revenue expenditures relative to GDP which has fallen from 12.68% in FY23 to 11.94% in FY24 (RE) and 11.15% in FY25 (BE). Comparing FY23 to FY25 (BE), there were additional non-debt receipts to the extent of 0.39% points of GDP and saving in revenue expenditures of 1.52% points. This fiscal space, amounting to 1.91% points of GDP, was utilized for two purposes: (1) reduction in fiscal deficit of 1.24% points and (2) increase in capital expenditures of 0.67% points of GDP. This is why we can consider the FY25 budget as sustaining growth while succeeding in achieving fiscal consolidation.