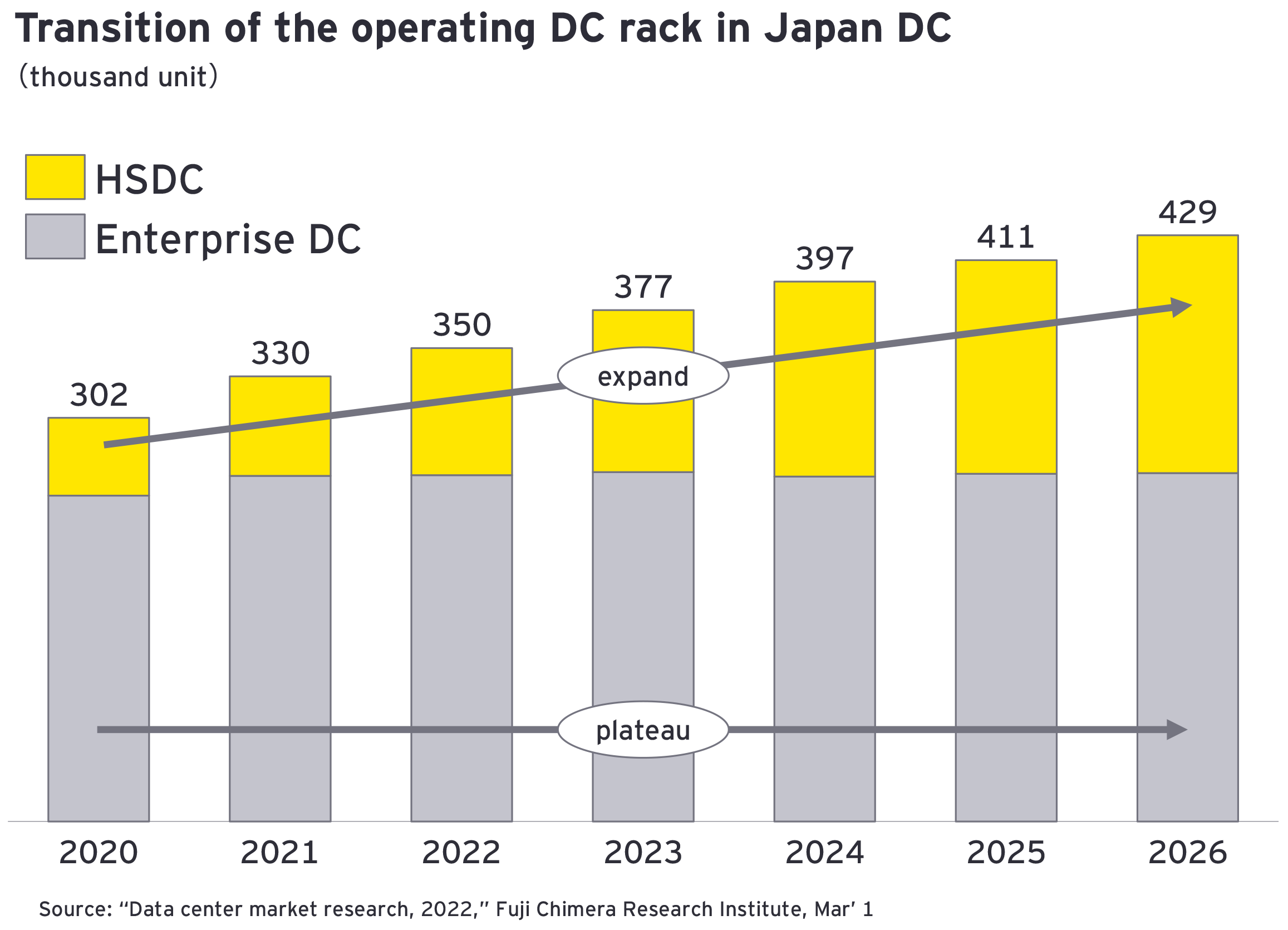

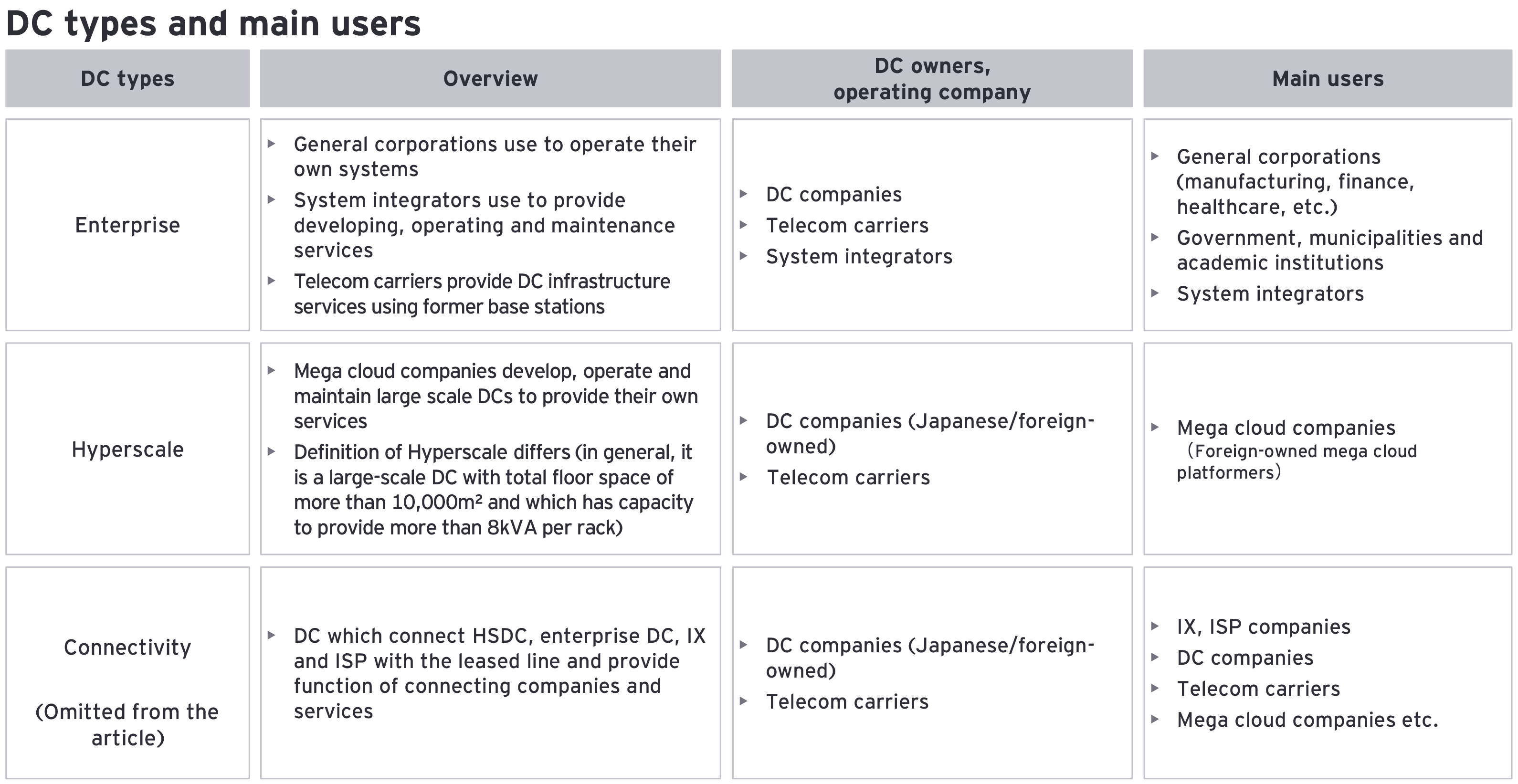

Due to the expansion of cloud services, global cloud service providers which generate big data represented by mega cloud platformers are actively investing in HSDC in Japan. In contrast, there is stable demand for traditional enterprise DC for mainstream companies.

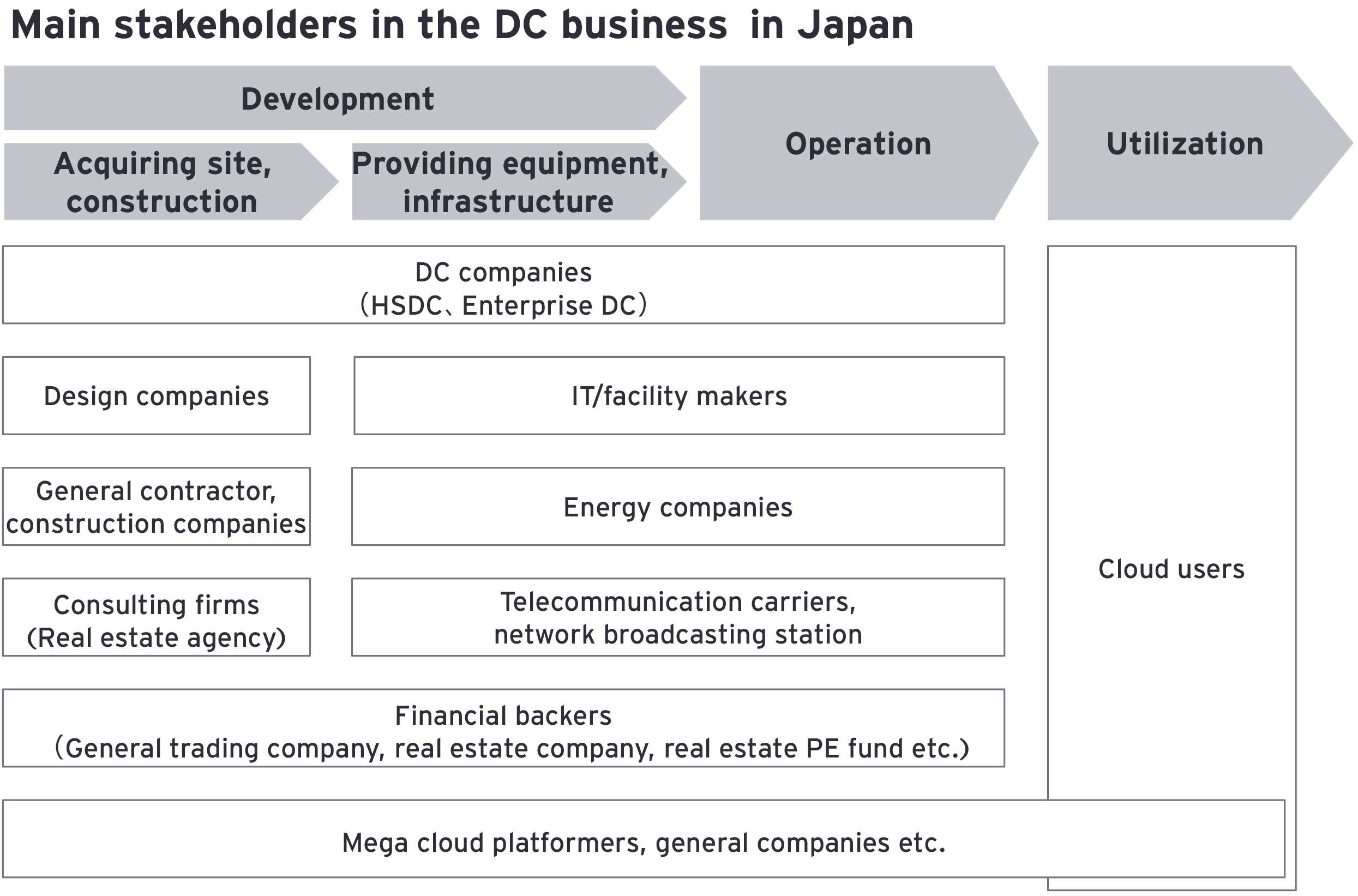

Did you know that various stakeholders are involved in a DC business, and there is a complex interaction between them in order to run their business?

Read our analysis of the DC market in Japan and how companies can take advantage of this business opportunity.

1. Japan DC market forecast

The DC market in Japan has a forecast value of $30 billion in 2026, up from $23 billion in 2021. With CAGR of 6.5%, there is also active investment in the market.

The expansion of public cloud services is the reason for this growth. Companies adopt public cloud services when they develop systems: they do not require massive investment in facilities, their operation is usually stable and they offer scalability and reliability. In addition, the demand for cloud services from end-users who are ordinary consumers has been increasing due to a change in lifestyles and the widespread introduction of remote working during the COVID-19 pandemic. As a result, there is accelerated investment by mega cloud platformers and DC companies which lease HSDC (HSDC companies). For these reasons, the HSDC market is currently leading the growth of the DC market.

However, the enterprise DC market developed by system integrators and telecommunications companies is also forecasting stable demand. The market is expected to plateau as there is a continuing need to maintain or update legacy systems: e.g. to manage a corporate business continuity plan (BCP), to migrate data to the private cloud for structuring back-up systems, to expand the hybrid cloud and the difficulties of data migration from the perspective of security and privacy for finance, healthcare and medical companies.

In today’s market environment, DC companies involved in enterprise DC are increasing their investment in a growing segment of the market: the hyper scale domain. Stakeholders, for example telecommunications and energy companies, are regarding the HSDC market as a business opportunity and expanding into the market.