Chapter 1

Proactively manage public finances

Realizing the power of new technologies

Repairing public finances is foundational for many of the future actions governments will want to take. There is no substitute for rigorous, proactive cost control, fraud detection and balance sheet management. Every available avenue — automated fraud detection, debt refinancing, asset sales and leveraging real estate — needs exploring.

Although borrowing costs are at historic lows, governments will need to make debt refinancing an imperative. Strategic fiscal stability planning can provide a realistic assessment of future economic vulnerabilities and debt-carrying capacities. This can allow for robust on-the-go remediation solutions and long-term restructuring strategies. Against the backdrop of a tight fiscal environment, countries and creditors will need better data and tracking to allow for more efficient negotiations and restructuring. One approach is to adapt balance sheet management practices from a cash to an accrual basis in order to effectively prioritize public investment and establish the foundation for an inclusive economic recovery.

In some instances, AI is being used to reduce the financial burden on governments by predicting and preventing fraudulent health insurance and benefit claims. By analyzing the massive amount of data created within health care and social security systems, the AI technology can flag likely fraud before it occurs, and create an evidence base for fraud examiners and law enforcement to prosecute cases. In the US, federal government agencies have joined forces to tackle waste, fraud and abuse in the US$1t spent on Medicare and other health and human services programs. Using data analytics, the joint team has helped uncover US$1b in fraud in one year alone and brought to justice thousands of practitioners for malpractice.¹

The UK’s Department for Work and Pensions has rolled out and tested AI algorithms to track down fraudulent claims in its benefits and welfare programs. Governments elsewhere are using AI for disbursement as well as to control leakages in subsidies and welfare payments. Denmark, for example, is using AI and blockchain for faster and more effective processing of welfare payments.

Additionally, governments will also deploy new technologies to manage public finances better and deliver increased value for taxpayers’ money, with digital ledger technologies, such as blockchain, providing a more transparent and accurate view of spending.

Related article

However, fraud detection alone is unlikely to close the widening fiscal gap. Prioritizing better asset management can help governments increase revenue while simultaneously driving down expenditure. Governments hold a wide array of physical assets and real estate from bridges and roads to state-owned enterprises and schools. But they often lack knowledge about the true value of their assets. For example, a World Bank study found 98% of governments focused on new investments, while largely ignoring the vast number of assets and liabilities already under public sector management.²

Governments can also use portfolio management techniques to determine which ownership structures – including full public ownership, public-private partnerships or privatization of assets – are best suited for specific assets. This means utilizing strategies, such as the Public Expenditure and Financial Accountability (PEFA) framework, and digital tools, to assess risks and opportunities. Singapore, for example, has created a 3D map of government buildings to determine the demand and costs of maintaining its existing inventory under a range of scenarios.

Blockchain for better public finance outcomes

Public finance managers have traditionally lacked transparency as money moves from the central budget authority, through government ministries and departments, to delivery agents. By integrating financial and nonfinancial reporting in government, reconciling and consolidating information within and across government and external agencies, and producing near real-time performance reporting and advanced analytics, blockchain solutions – such as EY blockchain for public finance – can allow government to see, at any moment, where money is being spent and what is being achieved. This insight helps to improve decision-making and unlock better public finance outcomes.

Chapter 2

Reform taxation systems

Balancing revenue collection with economic growth

Higher levels of taxation may be pursued for at least a short period of time. But the pressures of globalization, automation and aging populations will require the comprehensive reform of the entire taxation system. In the future, due to evolving employment arrangements, fewer people will pay income and social security taxes than is the norm today in many countries. This has clear implications for finance ministries and those responsible for funding government services. It is likely to mean revenue authorities will be asked to administer taxes that are structured under new approaches and involving new types of taxpayers in order to maintain revenues.

First, we are likely to see an even greater focus from governments on increasing tax compliance. Many advanced tax authorities are using AI to analyze mountains of data and detect or even predict anomalies in tax return information that could signal noncompliance. They are also using behavioral economics to predict which taxpayers are likely to react positively to certain tax compliance interventions. The result is increased revenue collection and higher levels of tax compliance.

Second, several nations are looking at expanding the scope of existing indirect tax regimes or adapting traditional tax concepts. Given the growth of digital technology before and during the pandemic, more governments are introducing Digital Services Taxes (DST). A DST redefines how income taxes are determined and paid in jurisdictions where businesses operate and sell, even if they don’t have a physical presence.

Third, taxation will be simplified to a point where payment is automatic and effortless. At least eight countries now fully prepare tax returns for most of their individual taxpayers;³ in Estonia, it takes just five minutes to file a tax return. In these countries, revenue authorities have enough verified data that they can hand out prefilled tax returns and ask individuals to simply approve them – sometimes even over text message and, in the future, via digital assistants.

Related article

Similar approaches are being taken with regard to companies. In Brazil, for example, tax authorities no longer need to seek out data on commercial operations. The Brazilian authorities have required that business taxpayers invoice customers electronically, thus allowing the tax authority to monitor and access every transaction between taxpayers in real time. By receiving companies’ tax and accounting books electronically in a standardized file format, the tax authority can create the indexes needed to cross-reference the data generated by the taxpaying community.

Finally, in the coming decades, we may see governments move toward new kinds of taxes. For example, carbon taxes could increase government revenues, while also providing an incentive for firms to use and develop more environment-friendly production processes, and encourage investment in renewable energy. However, there are hurdles to overcome. While carbon taxes may induce energy innovation and efficiency, they may also impact business profitability and investment in certain sectors. Care needs to be taken not to stem economic growth, which is itself vital to repairing finances and avoiding the type of deep public spending cuts that followed the global financial crisis.

Related article

Summary

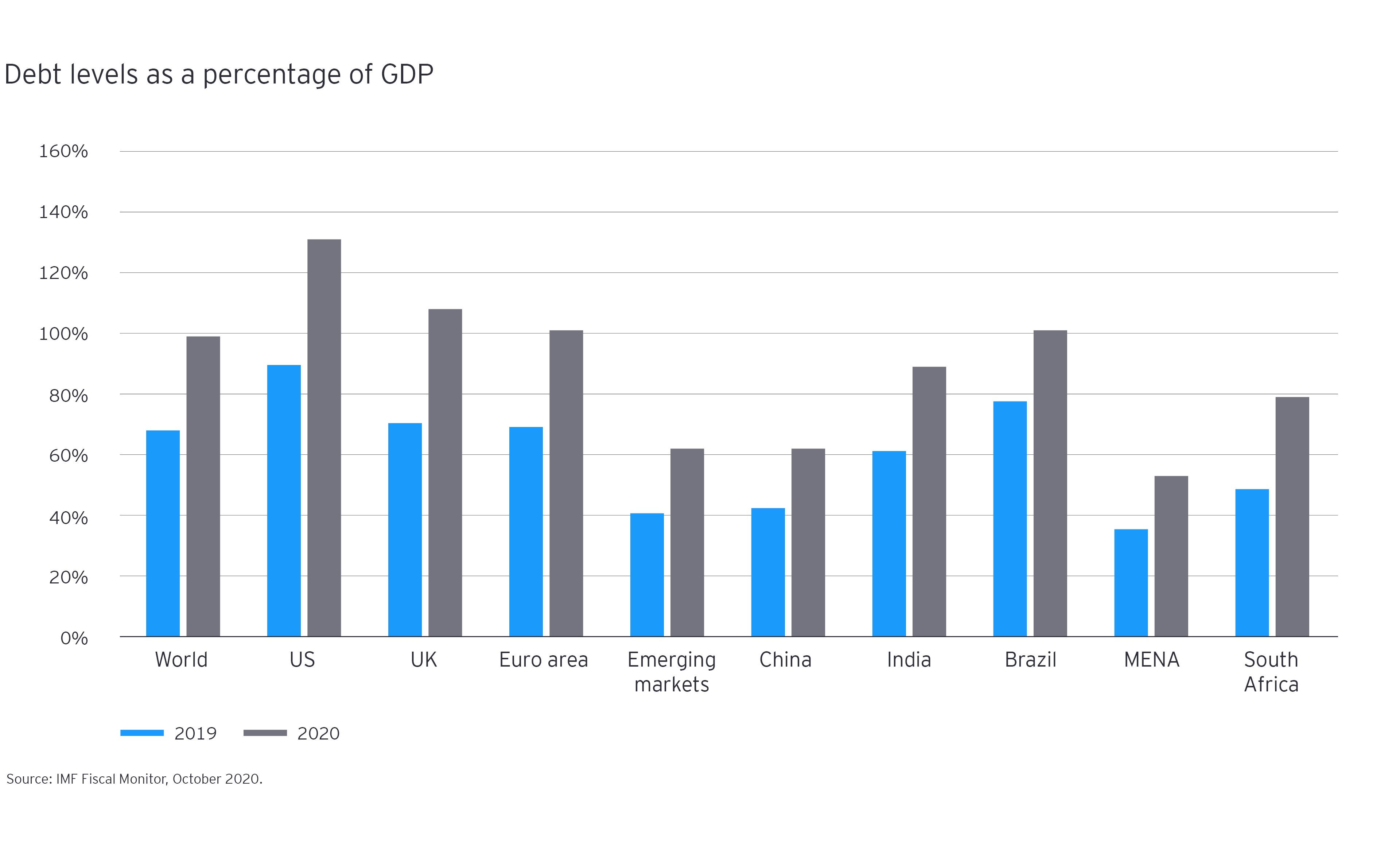

In the effort to preserve lives and livelihoods during the COVID-19 crisis, governments have spent more money and collected less in tax revenues. This has seen public debt rise to levels that are not sustainable in the long term. The good news is that governments now have at their disposal new, technology-enabled techniques that can help them better manage public finances, increase tax compliance and make better use of the assets that they own.