We are standing at a time of unprecedented risk because of the advent of digital but also unprecedented opportunity. It is full CEO engagement and investment now that will either propel you or sink you.

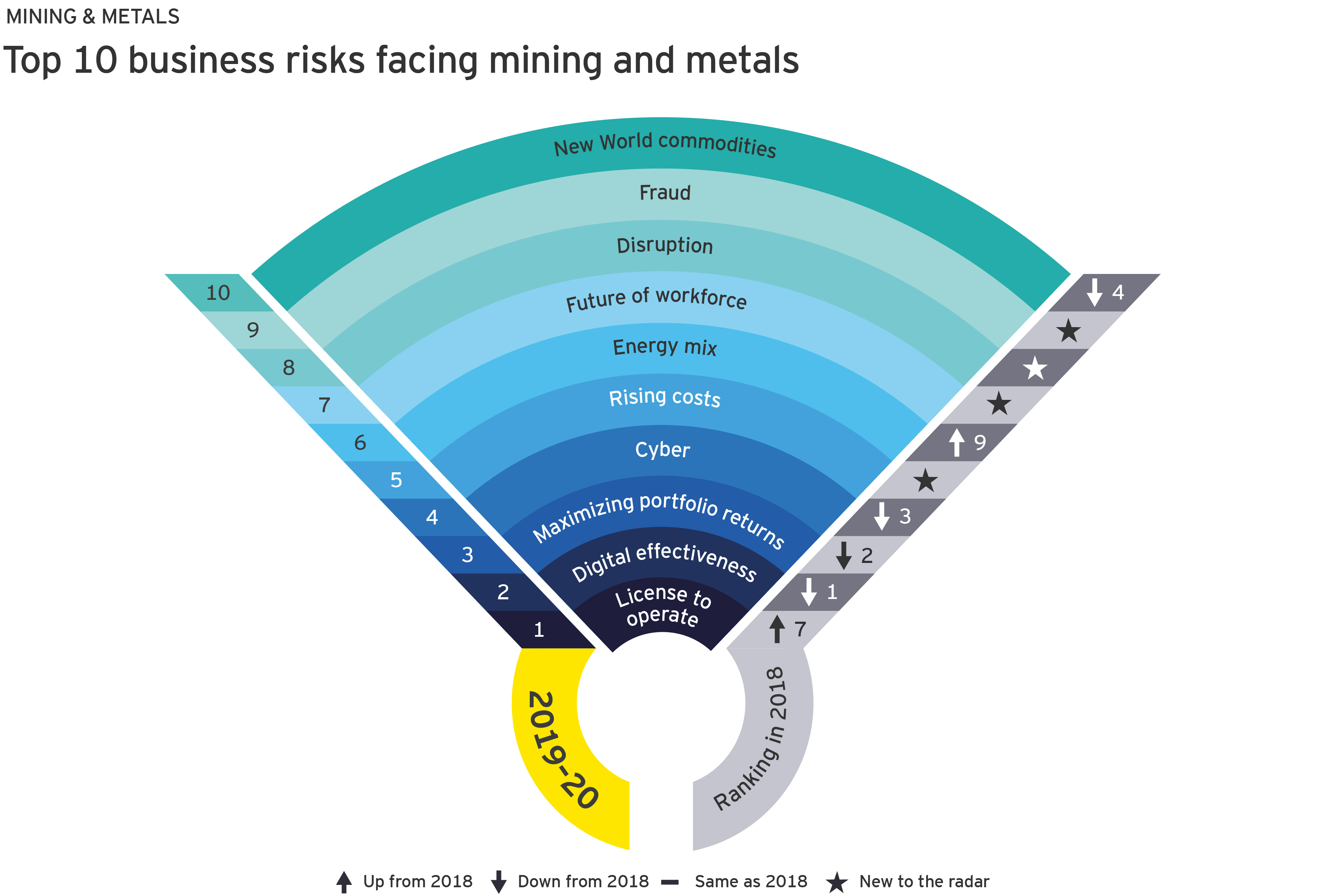

3. Maximizing portfolio returns

Is your strategy planning for the future or creating it?

Future returns will only be competitive in the long term if the right decisions over capital are made now. This would be across all strands of capital allocation:

- Buy: Acquisitive growth is preferred but good buys remain scarce

- Build: Brownfield projects are taking most of the capital

- Return: A preference to return capital, rather than invest, will remain a focus

- Transform (invest): Those who invest in digital and innovation will have an edge over competitors

4. Cyber

Is cybersecurity about more than just protection?

All mining and metals organizations are digital by default — in an increasingly connected world, the digital landscape is vast, with every asset owned or used by an organization representing another possible entry point. As a result, the attack surface is only getting larger across physical assets, digital infrastructure and business processes. An innovative cybersecurity strategy is critical. The focus should be on how cybersecurity will support and enable enterprise growth. The aim should be to integrate and embed security within business processes and build a more secure working environment for all.

Every cybersecurity transformation should promote three key principles across culture, governance and capabilities:

- Expect excellence in security fundamentals

- Establish a strong governance program and a culture of accountability

- Build a commitment to continuous improvement

5. Rising costs

How can you cut costs and still remain competitive?

Cost inputs in the sector are highly susceptible to inflationary pressures. And during periods of higher commodity prices, mining input costs, such as wages, consumables, diesel and energy, often increase at a higher rate than general inflation.

In addition, incremental changes in how mines operate are resulting in rising costs. These include increasing complexity of mines, rising use of technology, a changing workforce and a rising investment in license to operate.

To offset this, organizations need to:

- Focus on sustainable cost-reduction programs

- Review capital tied up in high levels of pre-stripping, advance development and stockpiles

- Implement front- and back-office automation

- Divest in noncore assets

6. Energy mix

What is the recipe for tomorrow’s energy mix?

The cost of energy represents up to a third of a company’s total cost base, making it a keenly managed component of operations. But cost is only one aspect of a larger strategic decision. Others include:

- Social and reputational implications of choosing energy sources

- Viability of energy sources

- Management of the availability of energy over the entire mine life

To minimize these risks, companies are opting for a mix of energy sources — fossil fuels, hydroelectricity and renewable energy. In addition, to reduce costs and greenhouse gases, they will be investigating ways to replace diesel-powered equipment with electric ones.

The ultimate solution lies in the development of a range of novel ultra-efficient energy systems for mining operations, which make them greener, less expensive and more sustainable.

7. Future of workforce

How will mining tap into it next great resource?

Talent management practices often still mirror the commodity price cycle: miners hire in upswing and shed excess resources in a downturn. As a result, many workers laid off during the downturn have moved to other sectors and never came back. Other trends are reshaping talent and labor supply in the sector:

- Disruptive technology is changing the skills mix required

- The sector’s reputation makes attracting younger talent a challenge

- The global talent market has meant a wider talent pool but also increased competition for talent

Mining and metals companies need to ensure they have a strategic workforce strategy that enables them to attract the required capabilities for new ways of working, while at the same time re-skill those skill sets that will be changed in the future. It is also important to maintain the critical skills that are typically found in the older workforce.

8. Disruption

Unwelcome disruption or transformational opportunity?

Many consider disruption as being sector-wide, but disruption has already begun at the value chain level within the sector. For instance, automation has disrupted jobs and electrification has disrupted assets.

Broader sector disruption is inevitable, and it is also coming from outside the sector:

- Technology companies may become investors as a way of shoring up supply in minerals such as cobalt and lithium

- Sovereign states have the capital to become major stakeholders in the sector to secure supply for national industries and protect jobs

- Traders are cashed up and looking for opportunities to secure the supply of key commodities

Companies can respond to this risk by investing in digital and innovation, investing in new opportunities and strengthening relationships with sovereign stakeholders.

9. Fraud

Does fraud only become an issue when it’s exposed?

Fraud and corruption was identified as a significant risk by nearly one-quarter of survey respondents.

There are lessons to be learnt from the super cycle, particularly the implementation of stronger controls to deal with third parties such as contractors and suppliers. Overall, the ability to identify fraud has become more sophisticated, particularly with the growing interconnectedness of regulators, but social media also makes any allegations of impropriety visible with unprecedented speed. This places risk of fraud hand-in-hand with the risk to reputation and license to operate.

10. New World commodities

Competition for New World commodities is going to increase as they become central to the production of an ever-growing variety of high tech and green technologies, from batteries, smart phones and laptops to advanced defense systems.

Portfolio optimization is critical. Miners need to understand the interaction among various parts of their portfolio to enable decisions on investment, divestment and rationalization to enhance value of the entire portfolio. Decisions around where to invest and allocate capital will need to be taken long in advance. Miners will, therefore, need to adopt a level of flexibility in their business models to be agile to change and regularly review their portfolios, considering all future growth assets — new and old.

Πώς μπορεί να βοηθήσει η EY

Περίληψη

The sector is facing an era of disruption like nothing it has ever experienced before. Organizations need to use capital and collaboration to their advantage as they transform and protect themselves from disruption. Download the full report (pdf).