Oil and gas companies are performing asset-by-asset cost benefit analyses to determine when it makes sense to integrate digital — and with which technologies — and when it doesn’t.

Second, our survey found that the core challenges to technology adoption are, for the most part, not technical in nature, but rather, organizational and cultural. This can be particularly true in capital projects when there are two sets of decision-makers — those in headquarters and those operating the assets. Each of these decision-makers may select and purchase digital technologies for different reasons, and may have misunderstandings regarding the value of these technologies or place differing levels of importance on learning them.

The ability to adopt technologies in a timely manner, train workers to use them, and enable the skill sets in the current workforce all impact whether companies can truly “be digital” versus simply “doing digital.”

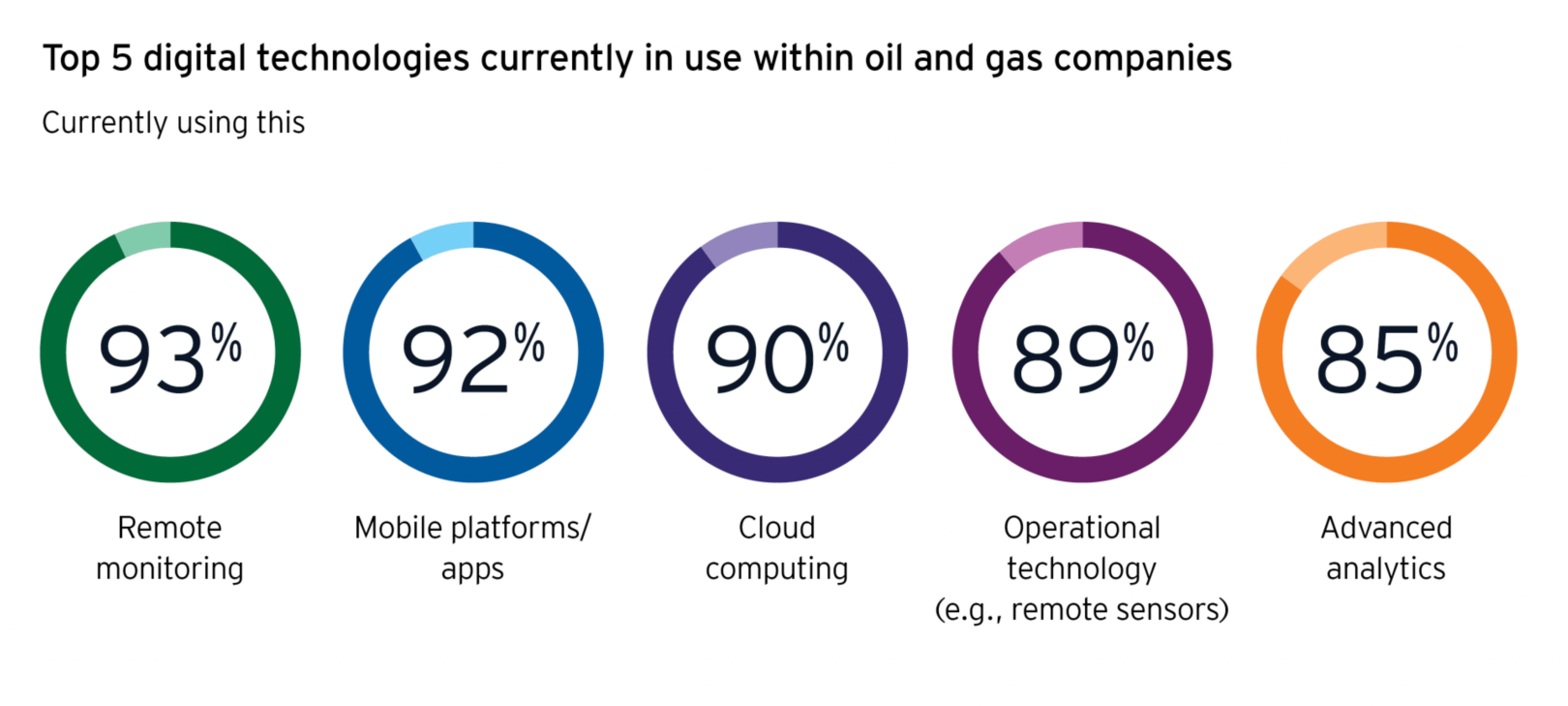

Finally, although oil and gas companies are embracing digital, they do not always have the workforce or skills necessary to capture the full value of that investment. For example, 85% of our survey respondents are currently using advanced data analytics in their organization, but only 55% of those say they have the skills necessary to realize the investment value. While companies are great at creating data around capital projects, the time and experience required to analyze and mine that data have been difficult to come by.

In an environment where digital adoption will drive competitive differentiation, companies need to remember that technology investments must be matched with a skilled workforce for maximum value.

Despite these challenges, most oil and gas companies are on the right path and recognize the value and ability for digital to drive better and faster information, improved collaboration, and more efficient decision-making. A clearly defined digital strategy enables organizations to bring teams together and deliver the power of artificial intelligence, machine learning, robotics and other digital skills to support and enhance their workforce. This is what underpins the vision for a holistic and value-driven approach to capital deployment and execution. And ultimately, this is what creates return on capital investment with a focus on creating long-term value.

Summary

Capital projects are necessary for the delivery of oil and gas but are costly and complex. An agile and technologically transformed gas industry can survive the pitfalls created by the COVID-19 crisis and long-term pressures of the energy transition, and address the ingrained inefficiencies native to capital projects.