Ninety-two percent of European companies say that changes in the technology landscape, and therefore the competitive landscape, are directly influencing their divestment plans — up from 55% pre-pandemic. They are increasingly recognizing the need to divest businesses that are not technology-driven, or at least relocate them to more conducive parts of their enterprise.

ESG grows in importance when assessing divestments

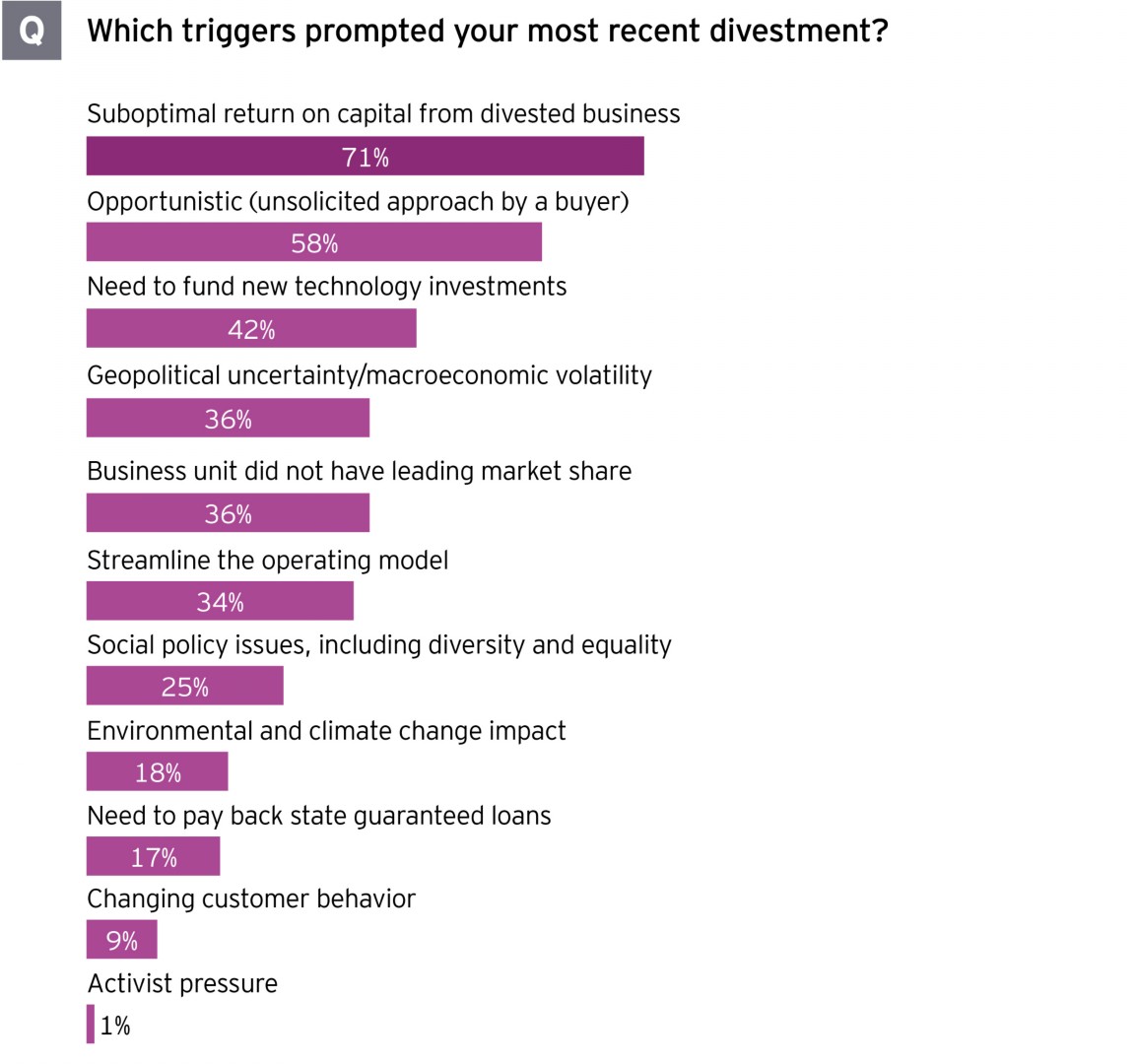

While not yet a main driver for divestments, environmental, social and governance (ESG) considerations are increasingly of focus in Europe. Evidence of this significant shift in priorities in recent years includes larger corporates with compliance programs embedding a carbon footprint KPI in senior management’s balanced scorecards.

Forty-three percent of European companies say that ESG and sustainability challenges, as well as other social issues and policies, are directly influencing their divestment plans — compared to only 14% of companies in the Americas and 84% in Asia-Pacific.

Companies will increasingly need to assess the impact of their carbon footprint and embed related performance metrics into their reviews and planning. This will give them visibility of how their carbon footprint is improving after they have sold an asset.

ESG is such an important consideration for C-suite, shareholders and other stakeholders alike. Compromising on the sales price can be worth it, if it means achieving environment and social balance by improving the company’s carbon footprint and social policies, including diversity and inclusion.

Steps to enhance value ahead of a transaction

For sectors not under pressure from the pandemic, equity valuations remain at peak levels with significant liquidity (PE “dry powder,” for example) still available in the market to pursue corporate carve-outs. For companies that are not forced sellers, this creates an appealing opportunity to pursue value-creation strategies ahead of divestments.

This is reinforced by the relatively narrow gap between buyers’ and sellers’ price expectations. European companies see this gap as no greater than 20%, while a majority put it as low as from 1% to 10%.

Ideally, companies would be taking action 12 to 24 months before the divestment to achieve the best possible price. But even for divestments already in the pipeline and due in 6 to 12 months, they can seek to harness several value-creation opportunities. Examples include working capital improvements through measures such as altering inventory thresholds.

This kind of thinking reflects a change in European companies’ approach to value creation. While the corporate context may restrict freedom of action in some areas compared to financial investors, companies are increasingly looking to replicate the PE playbook by working to enhance value before they put businesses into the market.

Three-quarters of European companies report that focusing on the quality of DivestCo’s management (78%) and optimizing its working capital (74%) were sources of value in their last divestment. These areas, as well as reorganizing the supply chain, also stand out as priorities where companies will place greater focus in their next divestment.

Progress on these points should reduce the number of companies who report disappointment in divestment prices achieved (78% say these did not meet expectations) and the impact on RemainCo’s valuation multiple after divesting businesses (61% say this did not meet expectations).

Activist campaigns build momentum

While their capacity to influence European boards and management teams depends largely on shareholder structure, activist investors are exerting notable pressure for change in some European companies. Such campaigns are triggering more discussion around portfolio management and optimization.

Of the European companies surveyed, 38% report that activism in their sector has prompted them to review strategic alternatives in the past 12 months.

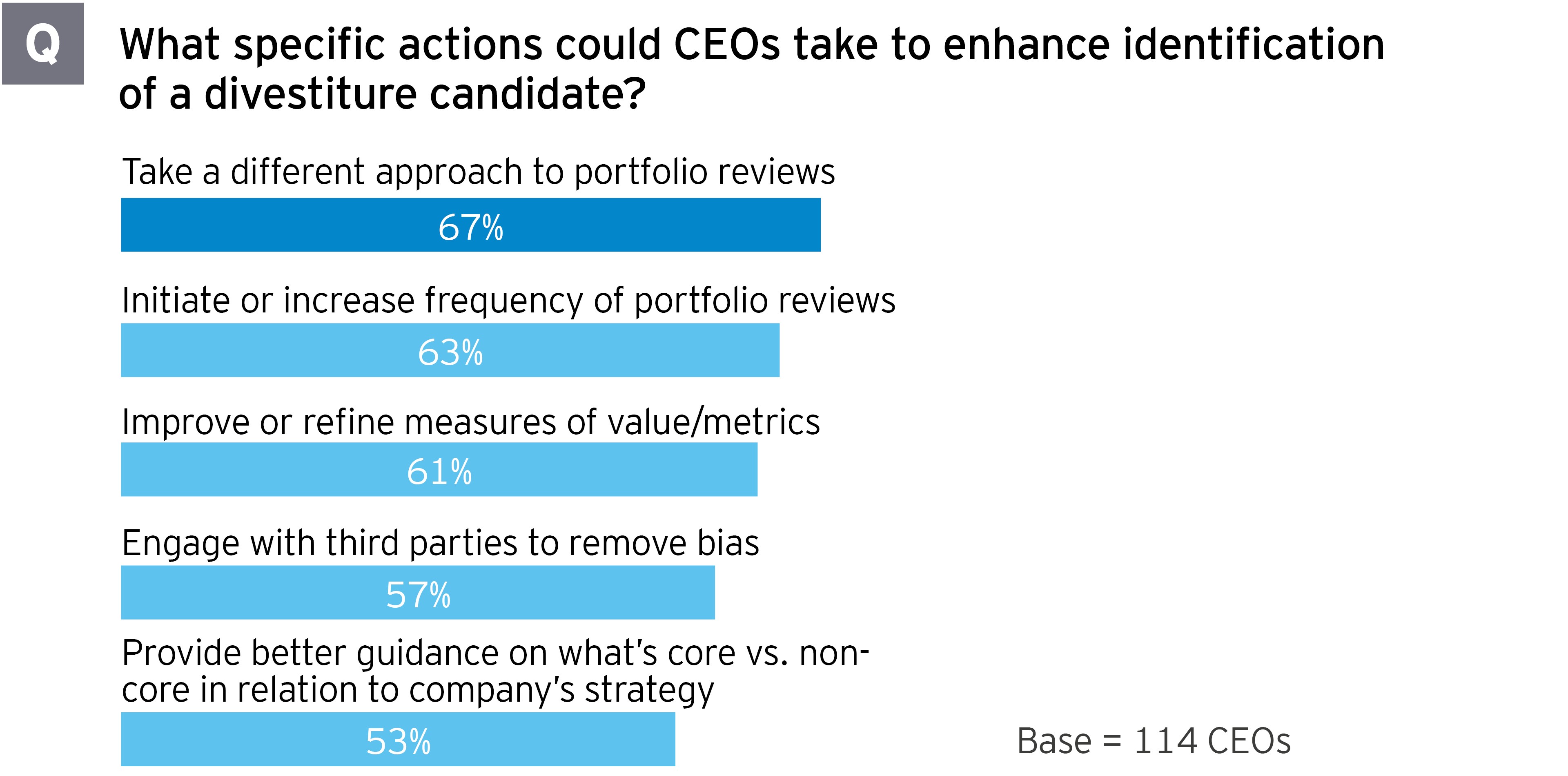

CEOs, even those who do not feel pressured by investor demands, will factor this growing activist momentum into their own approaches. One way they can do this is by bringing greater rigor to their portfolio review process, where a majority of European CEOs see scope to do better in all areas.