26 March 2020 - 6:25am

Have you got your work laptop in isolation?

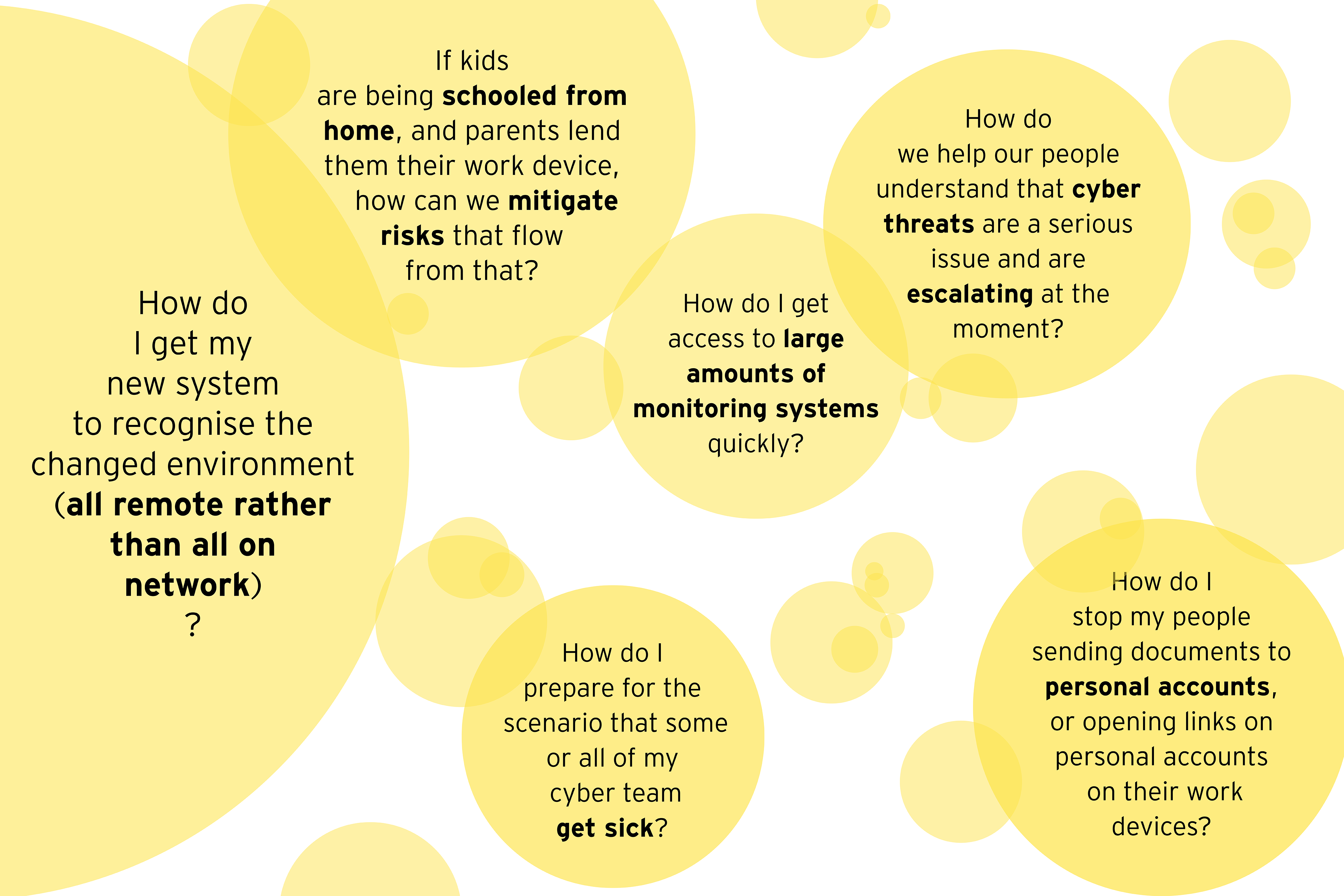

Protecting your secure documents and environment is as much about how you communicate with your people, as it is about the tech capabilities you have. Covid-19 has triggered a ripple effect of anxiety on a global scale. It means people are hungry for information, and more prone to falling prey to malware and ransomware attacks masquerading as legitimate news and information.

Here's what we're being asked:

EY Asia-Pacific Cyber Security Leader Richard Watson says many organisations, even at the top end of town, are unprepared for remote working at scale in this new environment, meaning seemingly small things such as updating policy and procedures for the new normal, can be overlooked. He works through some of the top issues, here.

The last thing you need is data going home with your employees if they are forced to be home based to comply with isolation requirements. How securely they treat that information and their devices when they end up at home, comes back to how well you’ve helped them understand the importance of your cyber protocols.

25 March 2020 - 7:00am

Team singing? Pet stories? How the world of remote working is the new normal

As organisations rapidly shift their workforce from office blocks to suburban living areas and spare bedrooms, having the right tech infrastructure is just one piece of the puzzle. Maintaining the wellbeing of your employees is just as important, as we outline here.

Taking ourselves as an example, EY implemented mandatory work from home arrangements in mid-March and have deployed cluster-based models and extended use of Microsoft Teams. In some projects, we have extreme teaming where the commute time is used to connect on a daily basis. There have also been shared team singing and other light-hearted initiatives, including round-ups of how ill-behaved various pets have been. We know that this connectivity is really important, especially during periods of self-isolation.

The disruption to the workforce is also a time to look at your organisation with fresh eyes. What skills will be needed for the 'new normal'?

“A key to future success is now protecting your best, critical people,” says EY Oceania Partner Matt Lovegrove. “This may be counterintuitive, but there is a window and a time here to consider how you will adjust some roles, the critical roles, in terms of rewarding remuneration and how you will measure performance of all your employees in the future.”

24 March 2020 - 6:30am

Need to shift your workforce to a virtual office in the next fortnight? It is possible.

As the prospect of stronger lock-down provisions loom in the fight to flatten the curve of COVID-19, private and govenment organisations are starting to consider how they can continue to provide critical services consistently and securely, as we detail in full here.

“This is rapidly evolving to being not just about the tech, but about the models of work. How do you work in a virtual world? How do you maintain service continuity and productivity in a virtual world? And how do you meet the anxiousness of staff around the changes?”, EY’s Government Digital and Technology Leader Andrew Garner says.

- Does everyone have a laptop or a desktop at home that can be remotely connected?

- Have you mapped what your critical services are and who performs them?

- What happens if those critical service staff, eg payment processing staff, cant be in the office?

- Do you have core software that doesnt have to be on the VPN, eg email?

- How much spillover capacity do you have for your licenses and can you increase these quickly?

“Almost every organisation has the ability to connect virtually to key systems and processes," Garner says. "The risk is if an organisation is faced with having to move their entire workforce virtually, can they scale it up quickly?"

In mid-March, EY moved its workforce of more than 8,000 to remote working, with a 24 hour dry run to test the capability of the VPN and network systems. "The question wasn't whether we had the technology capability, it was what would happen to the system when 6000 people logged on simultaneously," EY Oceania IT Leader Chris Huey, who oversees the remote work capabilities, says.

He implemented practical steps to reduce the burden of having so many people remotely connected, including changing the idle period timeout on the VPN from eight hours to two hours, and increasing the licence for the EY remote connect software.

"The biggest delay is not so much getting the licence, it’s getting priority with the vendors to get the increase, because everyone around the world is asking for the same thing."

23 March 2020 - 7:00 am

Government support packages and conserving cash in a rapid downturn: live panel discussion today

Prime Minister Scott Morrison has announced the second stimulus package in less than a week, bringing the total Federal Government support to just under $85 billion, or $189 bn including the RBA measures (about 10 per cent of GDP). New provisions to alleviate cashflow issues for small and medium sized businesses include an expansion of relief on wage bills through the tax system as well as the introduction of the Coronavirus SME Guarantee Scheme, which will see the Government provide a guarantee on some lending. Credit to SMEs will also be supported by the RBA’s term funding facility and the measures announced by the banks around supporting interest payments.

"While the economy is still likely to suffer a recession, the co-ordinated policy response is aimed at cushioning the impact as much as possible," EY Chief Economist Jo Masters said on Sunday. "Pushing the stimulus spending into the economy as quickly as possible must be a focus."

Directors have also been granted temporary relief from personal liability for insolvent trading. Safe Harbour is another pre-existing option for directors to trigger, which provides protection from civil liabilities relating to insolvent trading, as we detail here.

The broader insolvency measures will provide greater flexibility to company directors to remain in control of their companies and to execute on their plans, EY Oceania Head of Restructuring Services Adam Nikitins says.

"We are mindful of the possible unintended consequences of these relief measures, mainly the impact on credit markets, the possible shift in credit risk from the company to its supply chain and the possibility of a material debt overhang in six month’s time, when the temporary relief measures are currently due to be lifted," Nikitins says, but stresses that times of unprecedented challenges make a strong and decisive response necessary.

Live panel discussion: Click here to watch the replay, which is available on demand.

Adam and Jo will be joining Growth Markets Leader Justin Howse and supply Chain and Operations Leader Wayne Boulton to discuss this week's announcements from the RBA and Federal Government, and how they will impact organisations looking to conserve cash in a rapid downturn.

21 March 2020 - 8:30am

Workforce is the number one concern, but cash flow and liquidity is the number one priority

Conserving cash and shoring up liquidity is critical to getting through the next few weeks and months. Survival is the ultimate objective. While fearmongering is not helpful, organisations should be investigating what crisis measures are available and which ones to activate.

Adam Nikitins, EY Oceania Head of Restructuring Services, says time is the real threat in these situations, so organisations need to exercise common sense and take stock of their downside risks, liquidity runway and options around capital raising.

“Most people won’t be able to demonstrate whether their business can make it through a crisis or not because they haven’t prepared for it. But catastrophising doesn’t help.

Plan, don't panic. Make informed decisions and show strong leadership – don’t let ‘perfect’ get in the way of ‘good’

"Employees are the number one concern, liquidity should be the number one priority. To recover strongly from this crisis you have to make it through to the other side.

"Contingency plans need to be practical, capabile of execution and contain board pre-approved conditions, so if triggers are hit, plans can be quickly put in place. In acute circumstances, directors are rightly concerned about their own exposures – so they should determine whether safe harbour is available to them.

"The only way you can get certainty around liquidity is by testing it with scenario analysis. Scenarios need to focus on financial and operational vulnerabilities, be assumptions based and quickly be able to flex assumptions and scenarios. The environment is rapidly changing and boards together with their management teams need to be able to react at pace.

"Early, clear, genuine communication with stakeholders is critical as part of any mitigation plan. Too frequently organisations turn inwards in a crisis. But no-one likes surprises, so clients who hold stakeholders at arms length more often have more difficulties than those who are proactive, open and clear with their asks.

20 March 2020 - 3:30pm

Five ways to move towards continuity and business resilience, fast

Our APAC team have put together a list of critical ideas to help companies be predictive and proactive in their current decision-making. Some of these priorities are based on perspectives and experiences from the regions where COVID-19 first impacted.

It includes steps leaders can take to not only react to severe business shocks now but also reshape their business and plan for recovery. "Organisations that operate with transparency and open communication have inherent advantages when events require quick actions to react and reshape," Christopher Mack EY Asia-Pacific Partner and EY Japan Restructuring Leader says.

The five key points include: prioritising people safety and continuous engagement; reshaping strategy for business continuity; communicating with relevant stakeholders; maximising the use of government support policies; and building resilience in preparation for the new normal.

You'll find the full article here.

19 March 2020 - 10:49am

Don't confuse a crisis response with a business continuity plan

We know that organisations and boards that respond to the current crisis calmly and with measures that are based on evidence and careful consideration of the underlying health of their business, stand a greater chance of emerging intact

In a rapidly evolving situation such as COVID-19, there’s a clear delineation that businesses need to make between their crisis responses and their business continuity.

Our EY APAC Leader, Claims & Dispute, Forensic & Integrity Services, Campbell Jackson, says that the best thing companies can do is to take a step back and apply a risk and opportunity lens to the situation. Each business will find strengths and weaknesses in the scenario. They then need to test where their risks and opportunities lie in three key areas: finance and cashflow; operations; and communications and reputation.

Businesses then need to interrogate each of those areas, carefully model the scenarios and determine what measures need to be taken in the short and medium-long term.

“Remember: There is no playbook. A crisis is unique. And your response to the crisis is often more scrutinised than the event itself.”

You can access the rest of Campbell's insights here.

19 March 2020 - 5:00pm

Jo Masters on the RBA rate cut, QE and the new economic framework for COVID-19

EY Oceania Chief Economist Jo Masters spoke to ABC television today about what the RBA announcement means and why it’s more useful to think about how developments flow through to the real economy, rather than trying to model and predict numbers around what the pandemic will do to the global economy.

Watch Jo Masters' update below, or click here for her full analysis with charts.

17 March 2020 - 8:00am

Want to know why this pandemic isnt like any other crisis?

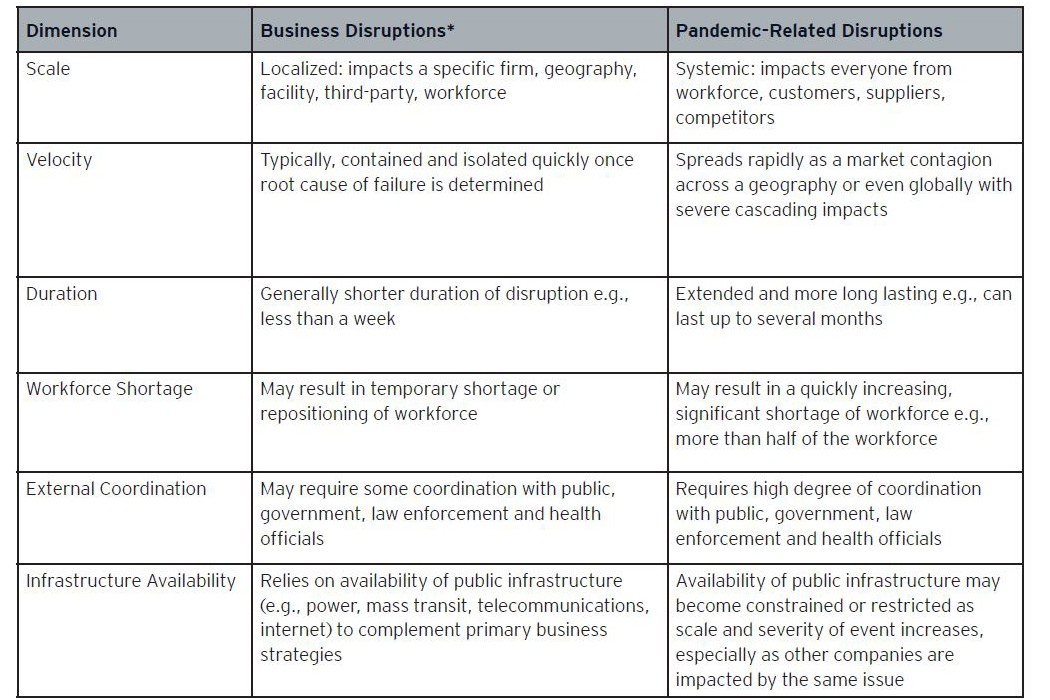

We've put together this table highlighting the differences between business disruptions caused by natural, human-made, technological or operation failures, to those caused by pandemics. Organisations need to expand beyond traditional resilience planning strategies. Click here for the full PDF.

16 March 2020 - 2:24pm

Organisations that weathered previous pandemics and financial crisis were able to quickly answer and act on four issues:

- How will a sudden economic slowdown impact your cashflow? Manage high value and high risk recievables on a case by case basis, use supply chain financing to either accelerate cash from customers or manage your supplier payments, pay suppliers on the due date rather than early and delay purchases to take adavantage of payment terms

- When will you run out of critical materials, finished goods or spare parts? Define your business rules to ration constrained inventory

- Reduce, defer or eliminate costs – but be careful to not permanently destroy capability or capacity

- Are you dependent on a supplier or customer that may not be able to survive a sudden economic slow-down? Talk to your CFO about agreeing early payments to at-risk or critical suppliers. Remember to check for aggregate exposure to one business across different subsidiaries, use cash on delivery or seven day terms where necessary. Crucially manage your risk but remember too that customers may decide to take their business elsewhere