Toilet paper. Bleach. Now packet cakes are being stripped off supermarket shelves. But what happens when your company relies on a critical widget or spare part that is now unavailable because of COVID-19 shutdowns? It's driving companies to reassess how, and why they offshore their supply chains.

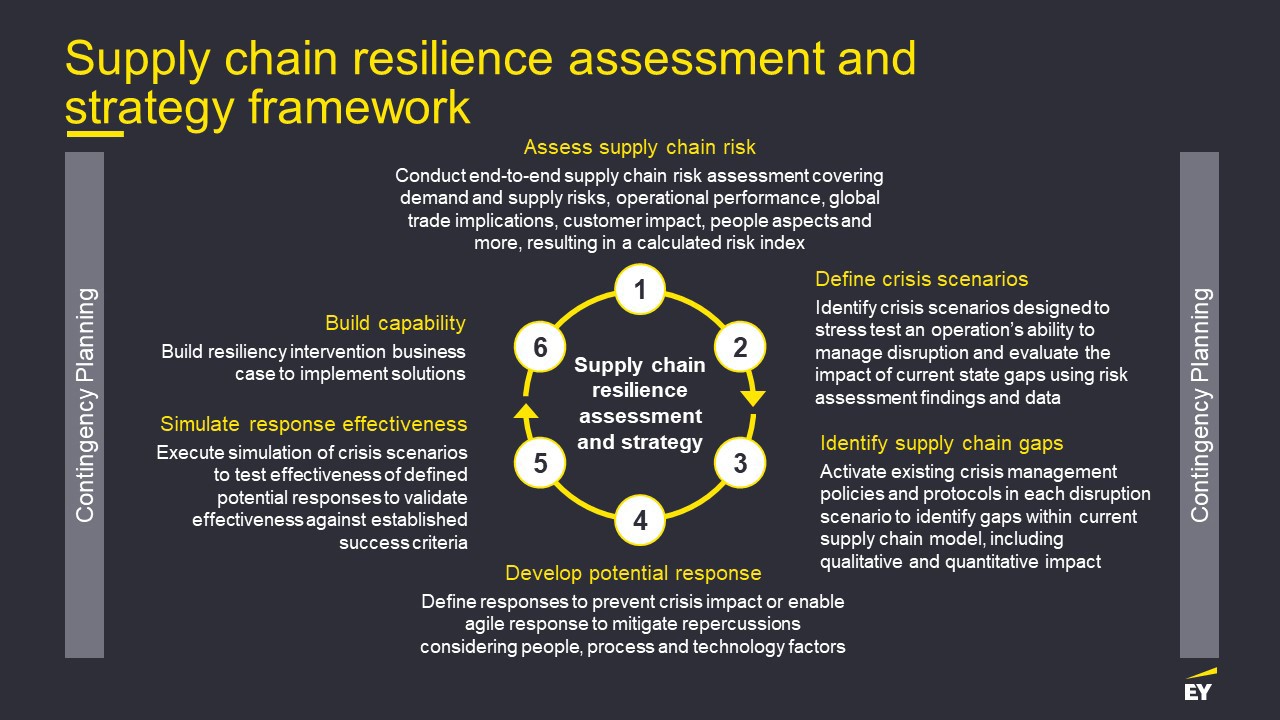

Supply chain disruption is nothing new. But this crisis is testing the opaque relationships, network interdependencies and global sourcing in supply chains in a whole new way. Whether its palm oil for food and consumables, rare earths for mobile devices or spare tyres for mining trucks, the pace and geographic scale of the disruption is enormous.

“A month ago, businesses were really concerned about disruption in North Asia,” EY Oceania Partner and Supply Chain expert, Nathan Roost, says, “Now the concerns are in the EU and the US.”

Nev Power, the handpicked head of the National COVID-19 Coordination Commission, sees a silver lining in the crisis. He told The Australian Financial Review that disrupted supply chains represented an opportunity for rekindling Australian manufacturing. “But [the manufacturing] needs to be modern, efficient, high-tech and focused on the things we need,” he said, “A lot of the manufacturing in Australia is very old fashioned, it hasn’t had new investment.”

It’s a long-term proposition, but for some companies that have seen key input supply disrupted to the extent it threatens their own viability, it is one they’re starting to consider. What no-one knows for sure is will supply chains simply weather the shock and return to normal, or will the advances happen in time to support more local production? China is already showing signs of recovery: PMI data, which measures manufacturing, shows a rebound to pre-COVID-19 levels between February and March.

If onshoring and near-shoring is to be a long-term solution, the availability of and capabilities in technology such as advanced manufacturing, will be crucial. In the interim, Roost says organisations including mining companies are looking at whether 3D metal printers might work to print critical parts as a short-term solution. Manufacturing at a scale any larger than that, however, will have a much different ROI.

“As a small and relatively expensive market globally, we will need to think carefully about what we bring back,” says Roost, “There might be nation-critical parts in defence, some chemicals or critical spares for power and utility companies that we start to manufacture ourselves.