1

Economic outlook

Underlying fundamentals are strong

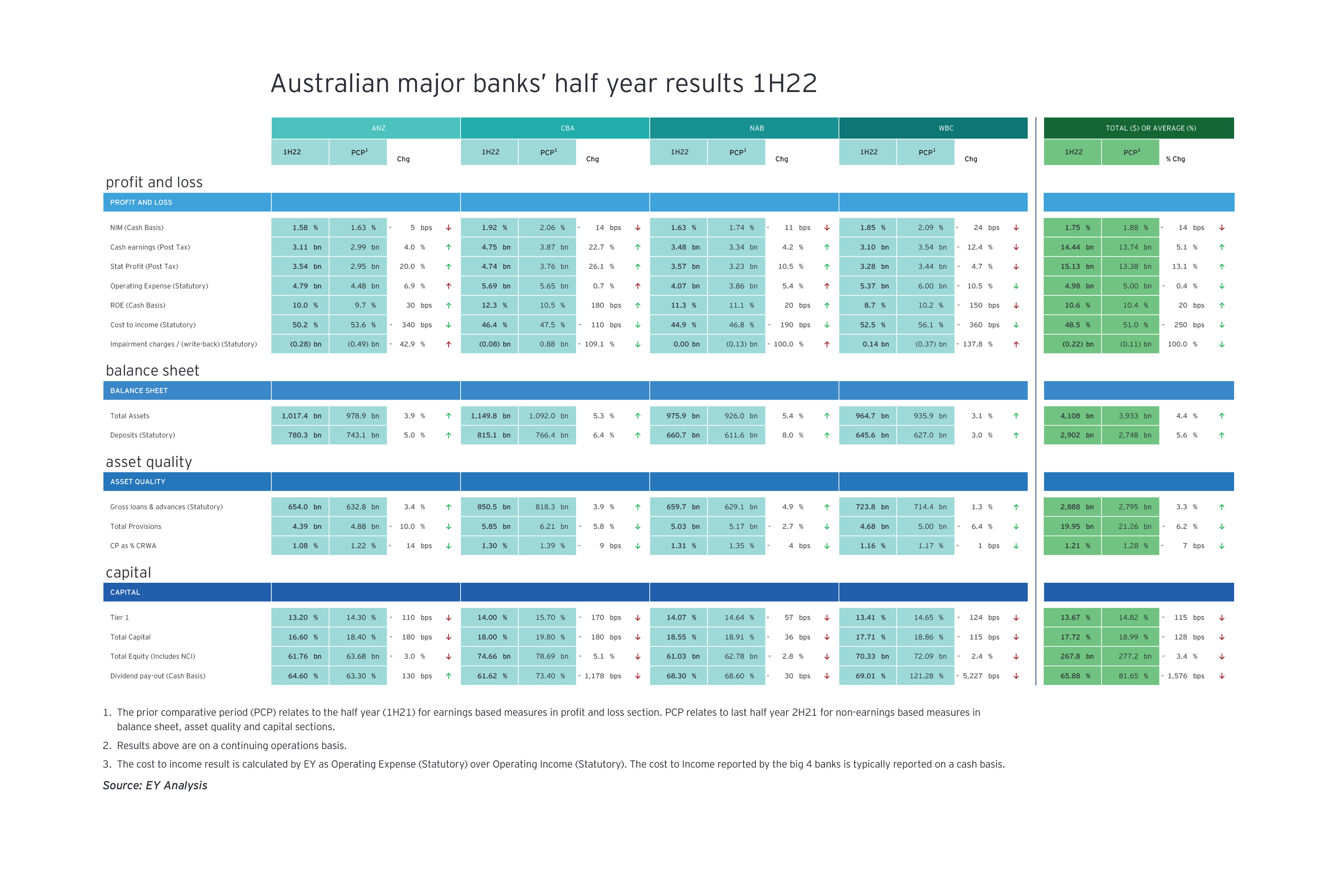

The underlying fundamentals of Australia’s economy are strong. In the December quarter of 2021, the economy expanded 3.4%. The consumer was the cornerstone of the economic recovery, with the growth baton passed from the public sector which has started to reign in emergency stimulus. This momentum has continued into 2022. Consensus forecasts as of mid-April[2] suggest the Australian economy will be 4.3% larger at the end of 2022.

As a net exporter of food, energy and resources, Australia is benefitting from higher commodity prices. There are also positive factors flowing from the monetary and fiscal stimulus over the last two years, opened borders and the build-up of residential and public sector construction work. Business balance sheets are also strong and business investment indications are positive.

Australia’s labour market is as strong as it has been in several decades. The unemployment rate was at a 48-year low of 4.0% in March and the participation rate was at a record high of 66.4%. Together, these facts mean more people are looking for work and they are finding it.

With the Commonwealth Treasury estimating full employment to be at 4.25%, the strength in the labour market should soon translate into higher wages growth. Consensus forecasts[3] suggest only a 2.5% increase in the March quarter. This is just above the 2.3% recorded in the December quarter, although the RBA expects wages growth to accelerate from here, to reach 3.25% by mid-2024.

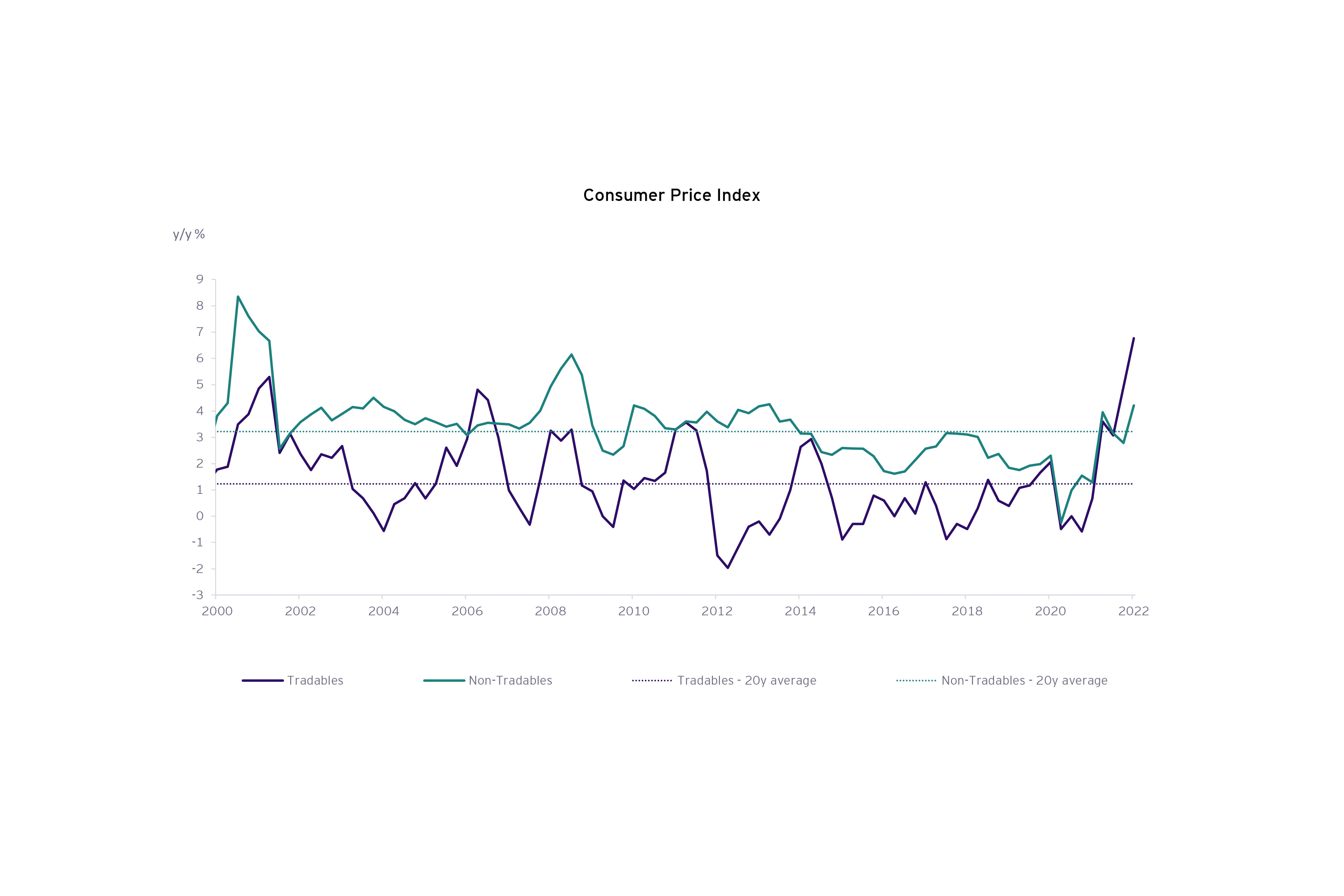

Inflation is broadening. Annual inflation jumped to 5.1% in the March quarter 2022. This was the highest rate of inflation since 2001, after the GST was introduced in mid-2000. Most importantly, inflation is broad based and does not just reflect international forces.

Strong inflation and only moderate wage growth present a challenge to the household sector, as real wages are falling. The RBA has started the rate hiking cycle to bring the cash rate back to a less stimulatory level. At its May meeting, the RBA raised the cash rate by 25 basis points to 0.35% and several more rate hikes are expected to follow. Rates futures are pricing a cash rate of 2.5% by February next year.

House price growth has started to slow down in anticipation of rising rates. Australian dwelling prices rose 2.4% in the March quarter. A year ago, values were rising at more than double that pace. While house price growth is expected to cool further, Australia’s household sector is somewhat protected from higher interest rates by mortgage buffers and stockpiled savings due to the COVID-19 pandemic and the associated Government assistance.

2

Institutional build-to-rent can help fill housing gaps

Institutional build-to-rent is gaining traction

Across several states, housing shortages are looming. As borders reopen, we have started to see significant pressure on housing, due to factors such as the reintroduction of skilled migrants into the workforce, the return of international students, and the migration back to the cities from the regions as the office environment reopens. However, with construction material and labour costs escalating, geopolitical stresses exacerbating supply chain challenges, and labour shortages due to historically low unemployment numbers, the anticipated demand for housing is not expected to be met in the short to medium term.

One option to address this imminent housing crunch is the emergence of the institutional build-to-rent sector in Australia, currently sitting at 48 projects with approximately 13,000 apartments across 18 institutional platforms[4]. State governments are implementing incentives (land tax reduction and planning concessions) to attract investors, with institutional build-to-rent expected to outperform over the next five to ten years. This could be accelerated if the Federal Government provides further incentives such as managed investment trust and GST relief similar to that received by other institutional asset classes (e.g., purpose-built student accommodation, office and retail). Institutional build-to-rent is a particularly attractive option for institutions, like large superannuation funds and property investment companies, seeking reliable, steady returns.

Financiers will need to better understand the dynamics of this asset class to compete with the overseas financial institutions that currently dominate the financing of these projects. While institutional build-to-rent will only ever represent around $125 to $250 billion of a $9.8 trillion residential asset class, the sector will be dominated by institutional platforms which will be an important source of lending growth for all the major banks in Australia.

3

Net interest margin (NIM)

Margin pressures likely to ease as we enter a rising cash rate environment

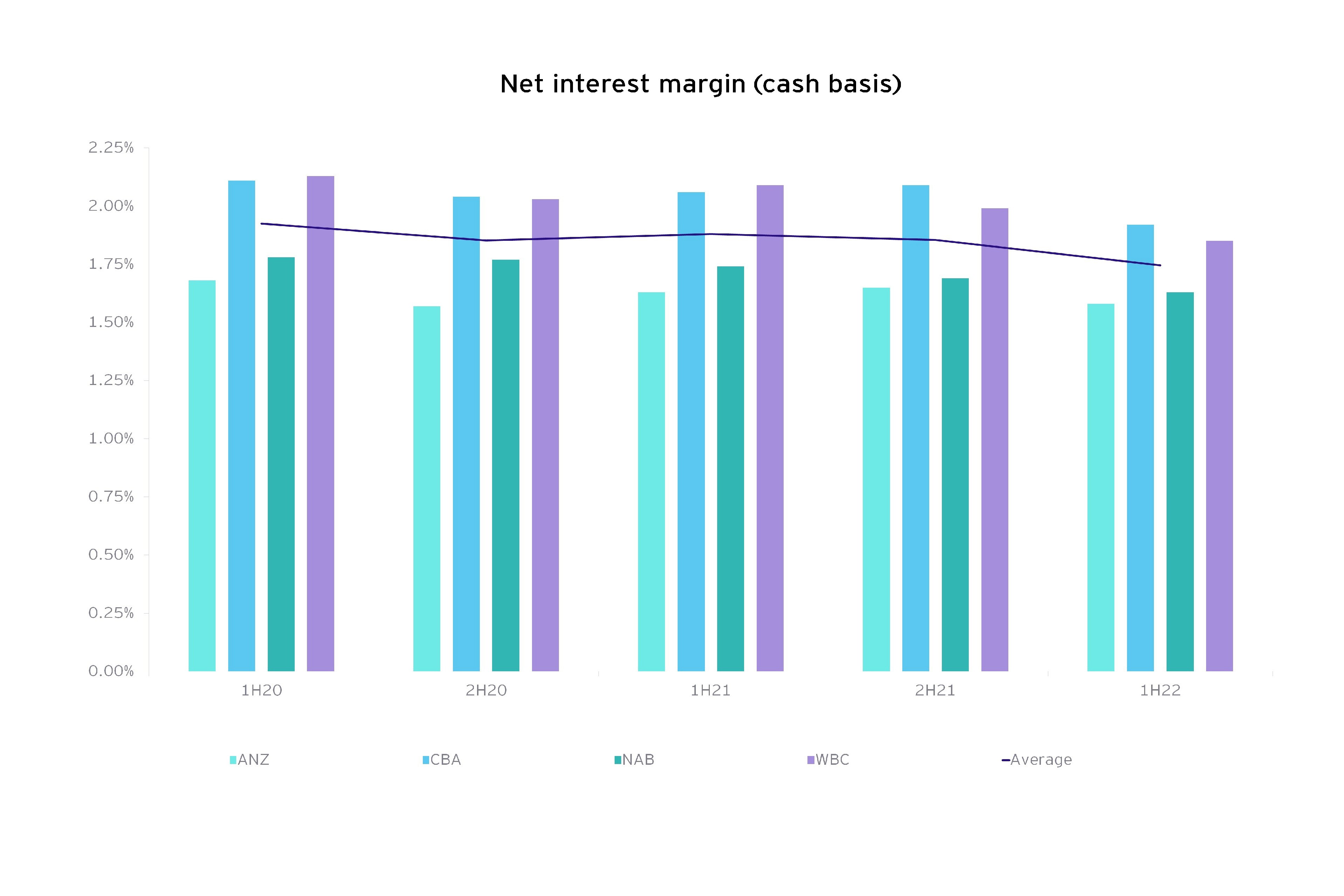

In a low interest rate environment, NIM declined for all the banks, exacerbated by intense competition and an unfavourable mix of fixed rate mortgage loans. Banks are likely to see NIM headwinds continue in the second half, with rising funding costs, and ongoing front and back book repricing pressure on both variable and fixed rate loans.

Source: EY analysis

However, the NIM outlook is brighter given a rising cash rate. This should ease the pressure on margins and boost profitability. All the major banks have passed on the recent cash rate increase in full to mortgage borrowers – but they have also announced rate increases for selected deposits, which will dampen loan repricing benefits.

If housing credit growth moderates in response to interest rate increases, we may see banks prioritise margin preservation to drive revenue growth.

4

Credit growth

Recent strong growth may moderate in response to interest rate increases

Housing credit remained strong, supported by low rates, and business lending rose as the economy opened up. System housing and business credit grew by 7.9% and 9.4% respectively over the 12 months to March 2022, compared with 4.1% and -2.6% in the preceding 12 months[5].

Mortgage competition remains a significant headwind, which will limit margin upside for revenue growth as banks chase low-risk customers. To some extent, banks with greater business lending exposure may be protected.

Housing credit

In recent years, the share of lower-margin fixed rate loans has increased as the banks experienced high levels of churn, with many borrowers refinancing from variable to fixed-rate loans.

Previously, higher volumes of fixed rate housing loans have been a major drag on NIM, with fixed rates failing to keep pace with rising swap rates. But, now, fixed rates have moved sharply higher as the banks look to manage margins, while the more profitable variable rates have remained low. In the next few months, the drag from the shift to fixed rate lending should start to ease as home buyers opt for variable rate loans, enticed by incentives on new loans.

Business credit

Despite disruptions from Omicron restrictions, business credit has lifted as businesses took advantage of low interest rates, borders re-opening, government incentives such as the instant asset write-off (extended for a further year until mid-2023) and a resurgent economy following two years of the pandemic. However, potential headwinds now include geopolitical risk, macro uncertainty, inflationary pressures, and supply shortages and bottlenecks.

Unlike the increasingly commoditised mortgage segment, business banking offers opportunities for the banks to differentiate. The banks are investing in resources to sustain business and SME banking against fast-growing challengers with seamless digital capabilities. To retain market share, the banks need to focus on operational and service excellence, while preparing to participate in industry disruption. The banks will be increasingly challenged by new entrants with data-backed operating models that offer fast, accurate unsecured lending, specialised digital platforms and SME banking ecosystems that capture users for the long-term.

5

Expenses

Automation and digitisation of banking operations is key to lowering the cost base

A strong focus on expense management helped the banks offset the impacts of margin compression, and investment and compliance spend demands, resulting in positive jaws for the first half of the year. But increasing inflationary pressures are a headwind that threatens the banks’ cost base reduction efforts.

The banks are looking to automate back-office functions and digitise banking systems to deliver measurable cost out and reduce operational risk. They are concentrating technology investment in digitising customer-facing processes and infrastructure initiatives, such as consolidating their networks, transitioning to the cloud and building out platforms to support future growth. A major need is to leverage data and analytics to inform risk management and, perhaps most importantly, enable the banks to form a forward-looking view of risks and opportunities.

However, reducing the cost base remains a challenging task, given banks’ traditional operations silos, complex legacy systems and the need to respond to ever-evolving regulatory requirements. This is contributing to the banks’ struggle to drive integrated, holistic operations transformation.

Tackling financial crime risk

Financial crime risk, in particular, would benefit from an integrated approach. The banks are being challenged, both internally and externally, to keep up with the onerous demands of mitigating financial crime risks. The answer lies in using advanced data and analytics techniques, leveraging artificial intelligence, machine learning, natural language processing and cognitive automation, to accelerate or automate a significant portion of otherwise labour-intensive compliance monitoring. This will improve inefficiencies in existing investigative processes and reduce operational costs.

Compliance teams can also leverage advanced analytics in a range of preventative financial crime use cases. These include enriching the KYC process, enhancing sanctions screening performance and monitoring transactional activity – helping to proactively identify risks and opportunities.

Banks that innovate and adopt new technologies and techniques to address these regulatory compliance demands will be industry leaders in the years to come.

Talent challenges

Acquiring and retaining talent remains a significant challenge. In-demand critical skills, such as data and engineering, are particularly hard to find, with retention exacerbating the challenge for the banks.

In the war for talent, salaries aren’t the only factor. Employees also want a quality work experience and a job that offers meaning and purpose. Rather than the Great Resignation, we are observing something more akin to the Great Reshuffle, as employees choose to move to more personally satisfying roles.

To compete for and retain the best talent, banks must:

- Boost employee engagement by focusing on purpose, including embedding an environmental, social and governance (ESG) agenda in mainstream strategy.

- Proactively redesign an employee value proposition (EVP) centred on employee experience. Banks must also be able to translate their purpose into an EVP that resonates with an increasingly diverse workforce – without becoming so diluted that it loses all meaning. This includes providing meaningful tailored rewards, tangible career pathing and training, and flexible work arrangements.

- Design the organisation to perform, scale and adapt. Determine what work elements are needed to achieve the bank’s goals and redesign work outputs to increase effectiveness and efficiency.

6

Asset quality

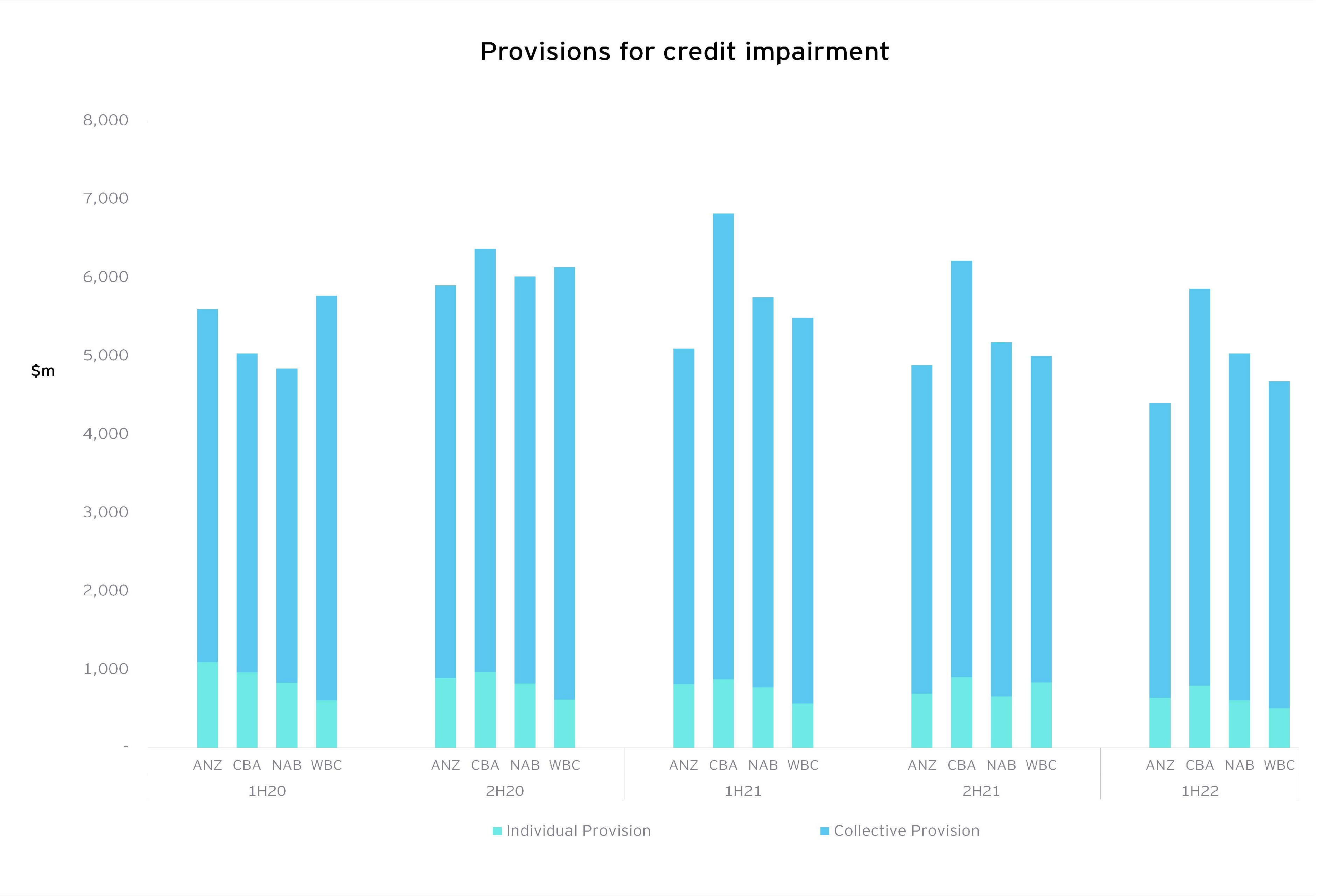

Out of cycle adjustments and pandemic overlays are declining as we move to ‘COVID-normal’

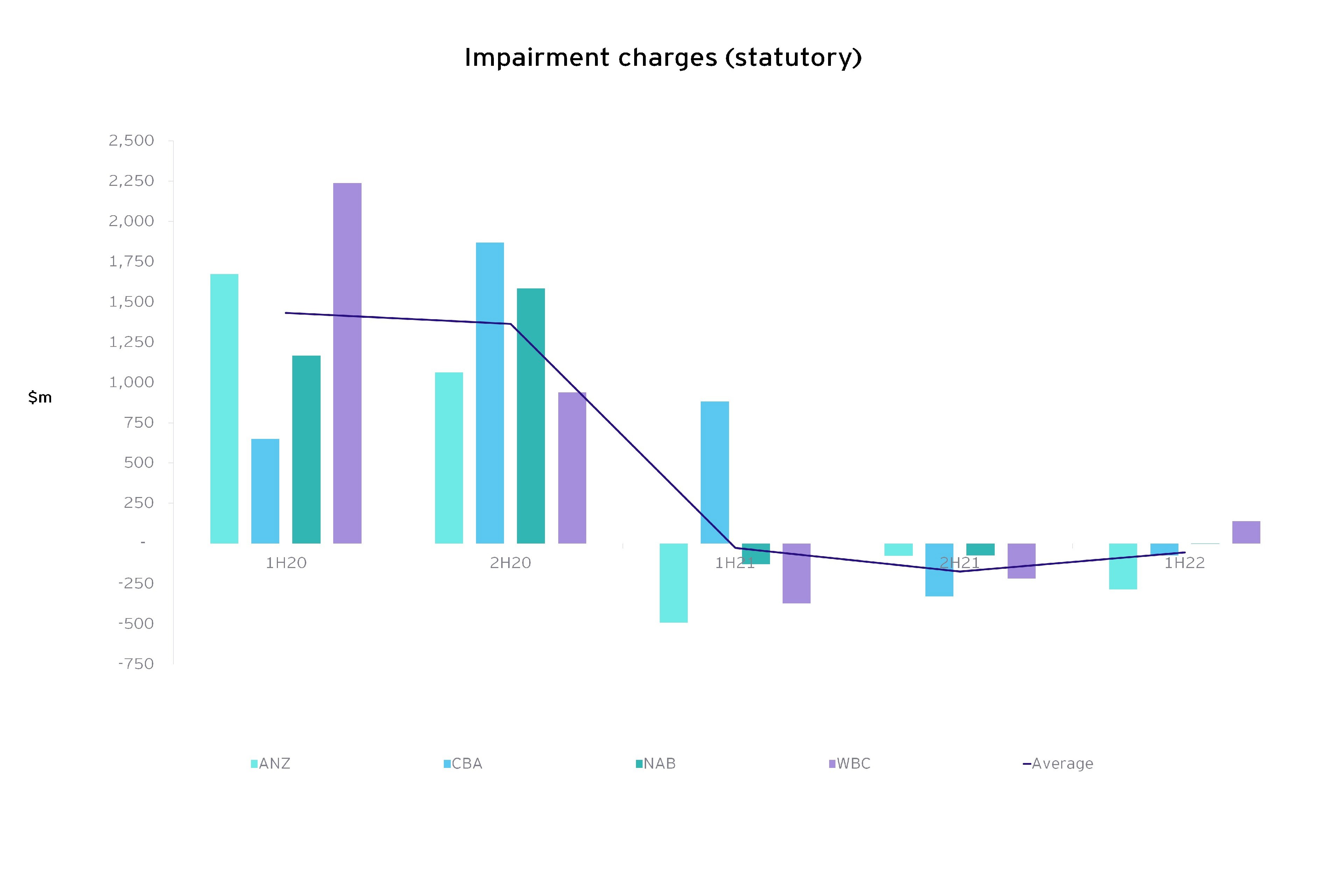

Key measures of asset quality remain resilient. Net bad debt charges were a benefit, supported by lower collective and individual provisions, and impaired and past-due loans generally improved.

Source: EY analysis

Source: EY analysis

While banks have been unwinding provisioning allocated to cover anticipated losses from the impact of the pandemic, the sector remains highly cautious in the face of continued macroeconomic uncertainty. Among the risks are:

- COVID-related impacts. Surging cases of the virus may slow business activity and disrupt supply chains. Already, we’ve seen the collapse of medium and smaller sized construction firms due to COVID-fuelled supply chain crunches and increased construction costs. Builders and constructors are also struggling to attract and retain skilled staff.

- The impact on households of sharp increases in interest rates. However, the RBA[6] has noted that household balance sheets remain generally strong, underpinned by high savings, the strong labour market and elevated housing prices. That said, this strong position may be tempered by the current inflationary pressures.

- High debt-to-income ratio (DTI≥6) mortgage lending. This has increased significantly since March 2020, representing around one-quarter of new loans by authorised deposit-taking institutions in the December 2021 quarter[7]. Borrowers in this category are at higher risk of mortgage default. However, with collections capabilities strengthened during the pandemic, banks are better placed to work with borrowers on customised payment strategies and solutions.

7

Capital

Strong balance sheets support growth and deliver improved shareholder returns

During the first half, all the banks completed previously announced share buybacks in response to recent strong earnings – and some announced additional buybacks.

Given their strong capital positions, the banks should not need to raise additional capital to meet APRA’s capital reforms, which take effect from January 2023. Lower risk weights for some SME loans will benefit banks with business banking divisions, while increased risk weights for certain mortgages (investor, interest-only and highly leveraged loans) may result in further mortgage concentration in the major banks.

Returns continue to trend upwards, reflecting the improvement in earnings.

Source: EY analysis

Conclusion

Solid credit growth looks set to continue if the economic recovery is sustained and, while margin compression may continue in the short term, rising interest rates offer the opportunity for improved profitability for the banks in the medium term.

However, the ongoing economic risks underscore the need for the banks to keep their foot on the accelerator in strategic cost management and continue to forge ahead with transforming banking operations to enable a more forward-looking view of risks and opportunities. Together with a continued focus on customer-centricity, this will be essential to help the banks thrive in an increasingly challenging market.

Summary

Robust asset growth and quality, capital returns and continued close management of expenses contributed to a solid first half result for the banks. While margin compression is likely to continue in the short term, rising interest rates should ease NIM pressures. However, ongoing economic uncertainties point to downside risk for the banking sector outlook.