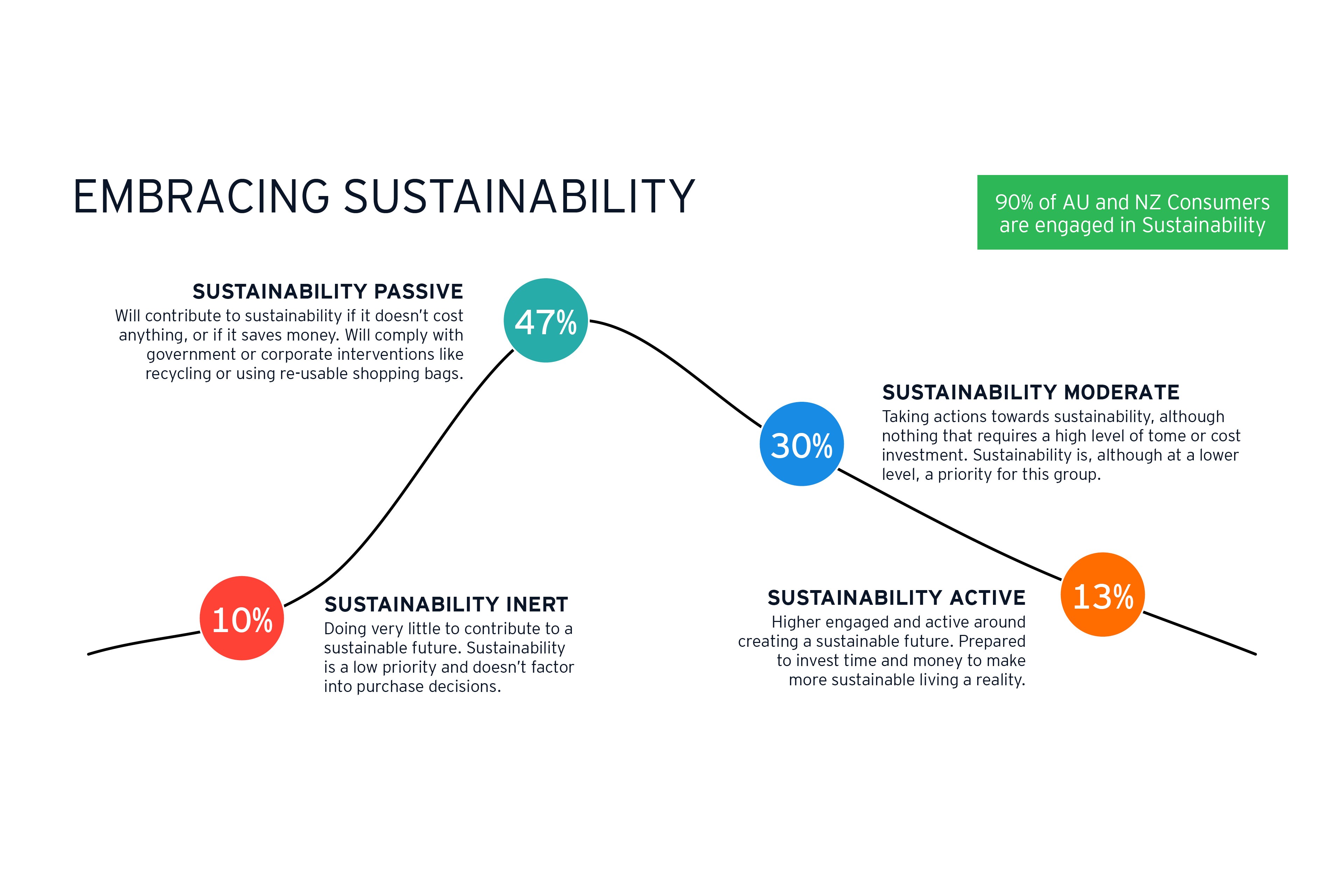

From the earliest days of the pandemic, consumers around the world have said they plan to make more sustainable choices about how they spend their time and money once the crisis feels over. Global consumer sentiment on this point remains solid and consumers in Oceania are no different. While there are differences between Australian and New Zealand consumers, the sustainable consumer is a rapidly emerging segment that has different and evolving expectations of companies.

In fact, this could be the year in which the political, social, corporate and consumer agendas on a full range of sustainability issues – from climate change to poverty and social justice – come into alignment. The 26th UN Climate Change Conference of the Parties (COP26) is due this November and we know from our work with corporations across the globe and throughout Oceania that sustainability is now a central boardroom concern.

Here, we’ll outline consumers’ changing expectations of brands and the companies behind them with regards to sustainability, and how CEOs can address them.

Pandemic a catalyst for a sharpened focus

The pandemic has changed the way consumers look at the world and priorities are being recalibrated, with sustainability issues increasing in importance. Well over four in ten Australians (46%) and New Zealanders (48%) say that their values and the way they look at the life has changed since the pandemic hit. Over six in ten say they are thinking a lot about the future and what is important to them (AU 63% and NZ 65%).

Embedded in this change in perspective is a much greater emphasis on looking to organisations that benefit society and are perceived to be doing the right thing. At a global level, over 44% of consumers in the latest edition of the EY Future Consumer Index suggest they want to buy more from organisations that benefit society, even if their products or services cost more. We also saw 30% saying they were willing to pay a premium for more sustainable goods and services

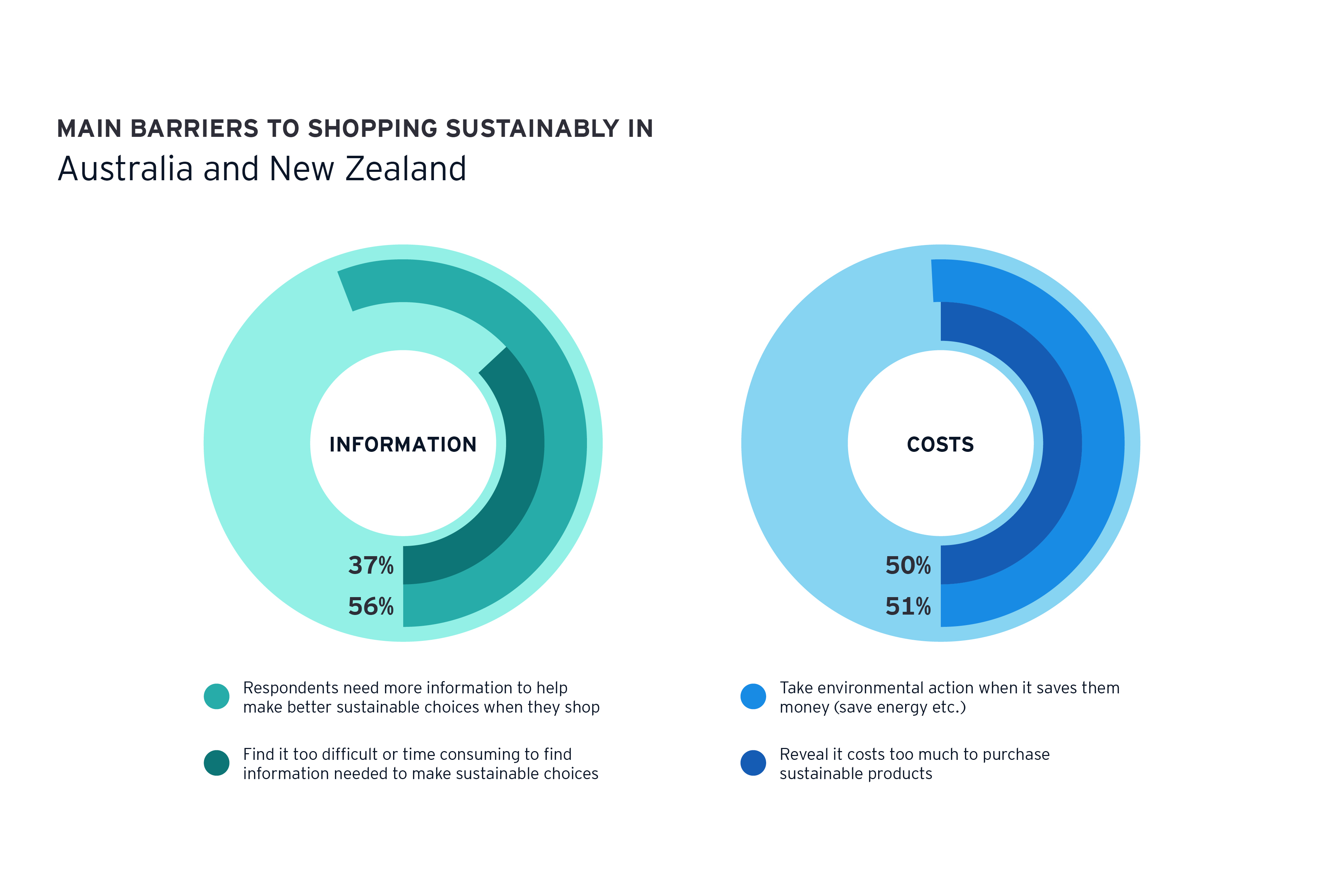

In Australia and New Zealand, the numbers are lower for both those saying they would pay a premium for brands that contribute to the community (AU 20% and NZ 27%) and those who are willing to pay a premium for more sustainable goods and services (AU 24% and NZ 35%).

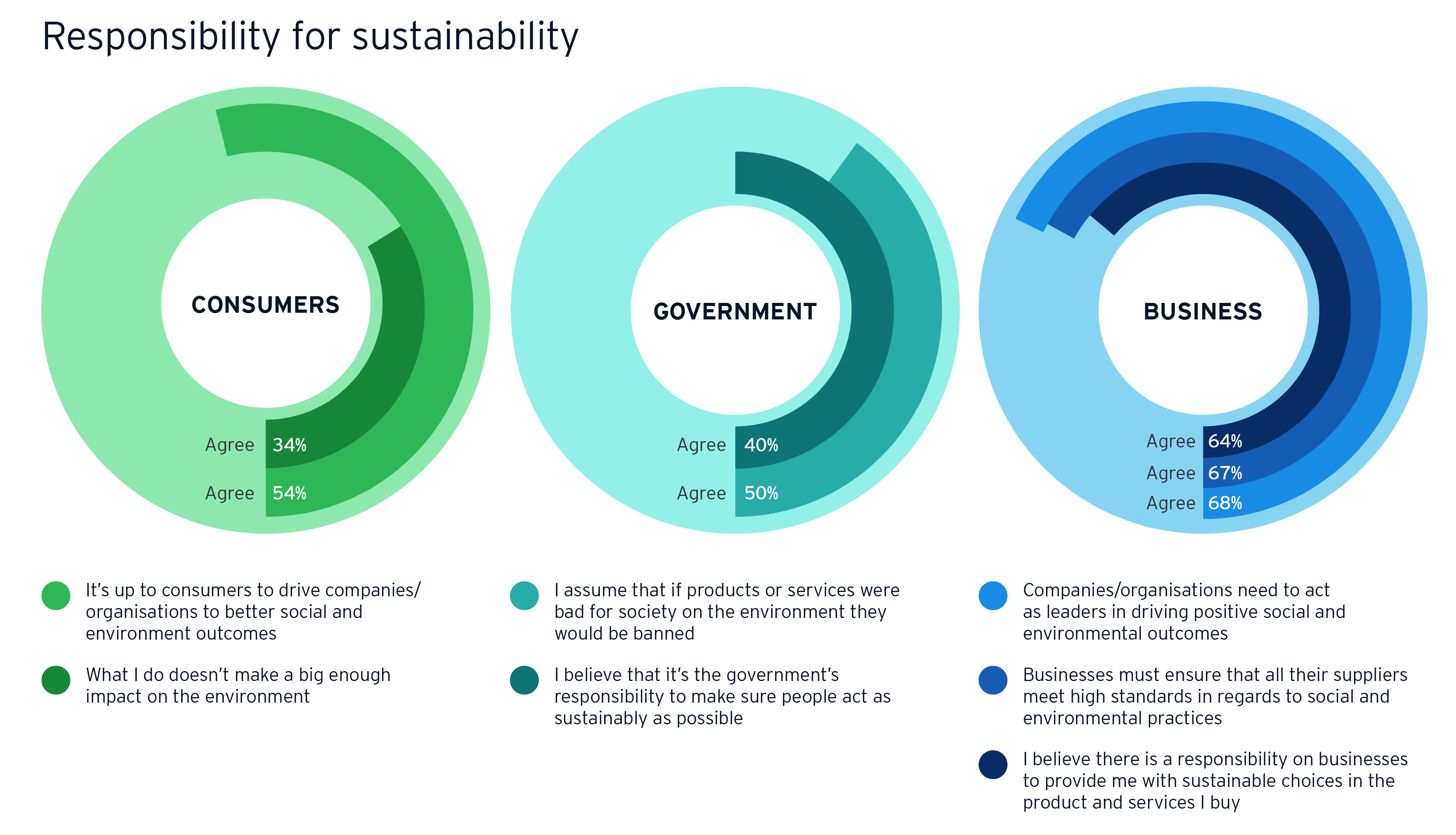

However, the lower numbers don’t mean that consumer facing organisations can afford any complacency in development and implementation of the sustainability strategy. People are reflecting on the type of world they want to live in and momentum is building. Over seven in ten Australians (71%) and New Zealanders (72%) believe brands have a responsibility to make a positive change in the world. A higher number say the behaviour of a company is as important as what it sells (AU 78% and NZ 80%).