Four steps to accelerate digital transformation

1. Capitalize on digital spend

- Build IT and data infrastructure with both the business and customer needs in mind and not for the sake of technology

- Start with agile sprints to test impact and drive value while establishing a digital governance to measure results and secure funding

- Build a sustainable analytics foundation that meets current and future needs and enables data availability to all, rather than individual silos

Digital solutions in action: A $3b mid-tier mining company in Australia invested in AI and machine learning capabilities to build digital twins for its milling operations. EY helped the company develop the “twin” to run in parallel to the legacy system to predict optimal operational setpoints, identify ways to increase throughput, improve uptime and increase yield quality – all leading to a $50m+ business value improvement.

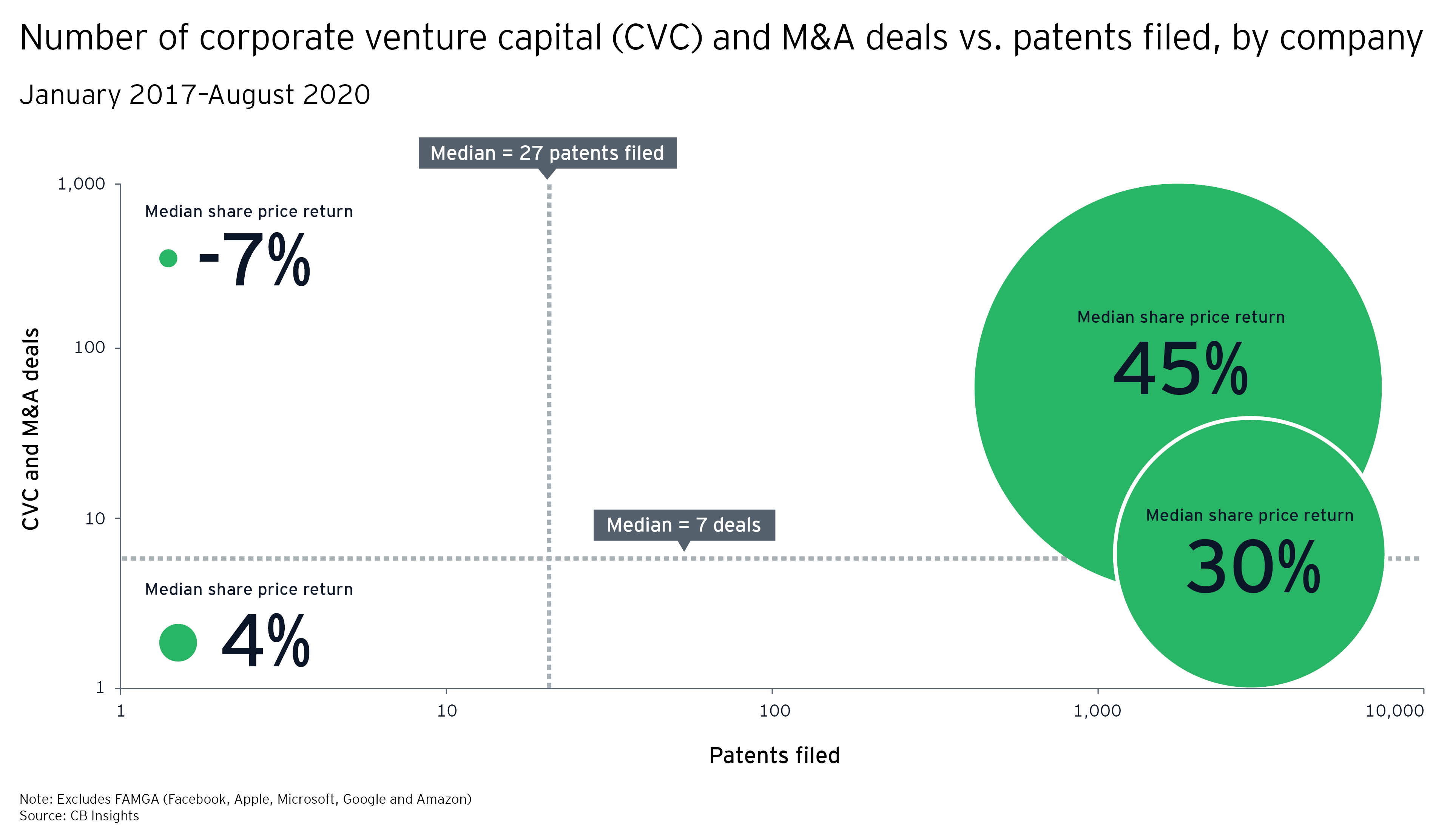

2. Align on investment strategy and leverage M&A

- Align on proper investment mix of buy, build or partner

- Avoid a siloed approach – the CEO should own the investment approach and strategic direction, and establish collaboration incentives and a governing body to provide oversight

- Assign clear execution accountability for each investment vehicle based on CXO roles and strengths

- Drive M&A value by recognizing differences in start-up vs. traditional M&A

Digital solutions in action: A leading US-based retail pharmacy player was facing questions on operational performance and its retail business model. EY advised the company to acquire technology capabilities critical to drive both operational gains, offer platform-based technology solutions to regional retail pharmacies and build new business models to compete in the emerging e-commerce pharmacy segment. Result: The company’s $100m+ investments in various companies during the last three years are reaping double-digit returns.

3. Remove barriers to scale

Digital solutions in action: One government needed scalable rapid identification, containment and treatment of the COVID-19 virus. With the help of EY, one country’s government rapidly deployed a digital care platform and care accelerator embedded with intelligence and analytics to eliminate barriers to patient outreach, monitor risk groups, understand citizen behavior and manage demand spikes. EY worked with another country on a similar scaled roll-out that resulted in a 28% reduction in emergency visits in the initial stage of the virus outbreak.

4. Establish strong governance procedures and proper metrics

- Align on digital goals, funding mechanisms and metrics connected to the digital strategy

- Regularly review use case portfolio and focus on strategic solutions to drive revenue, reduce costs and increase cash flow

- Establish an effective governance model to manage incubation funnel in an agile way

- Upgrade skills, data and tools to measure financial impact and return on digital investment

Digital solutions in action: A local government tried to increase connectivity among citizens and public services by adapting new digital technologies. EY diagnosis revealed that implementation failed because of unclear digital governance, breakdown in coordination across departments and failure to monitor critical priorities. EY designed an implementation strategy in which a central figurehead was accountable for communication and performance. A new KPI framework also monitored performance, implementation pace and coordination. Result: The governance framework enabled the city to regain the control of the digital agenda.