Supporting local business lines is therefore very important. Is there sufficient IT support locally? How can the corporate culture continue to be respected? How do local employees deal with customers? Carefully answering these questions ensures that new and existing customers come and stay on board.

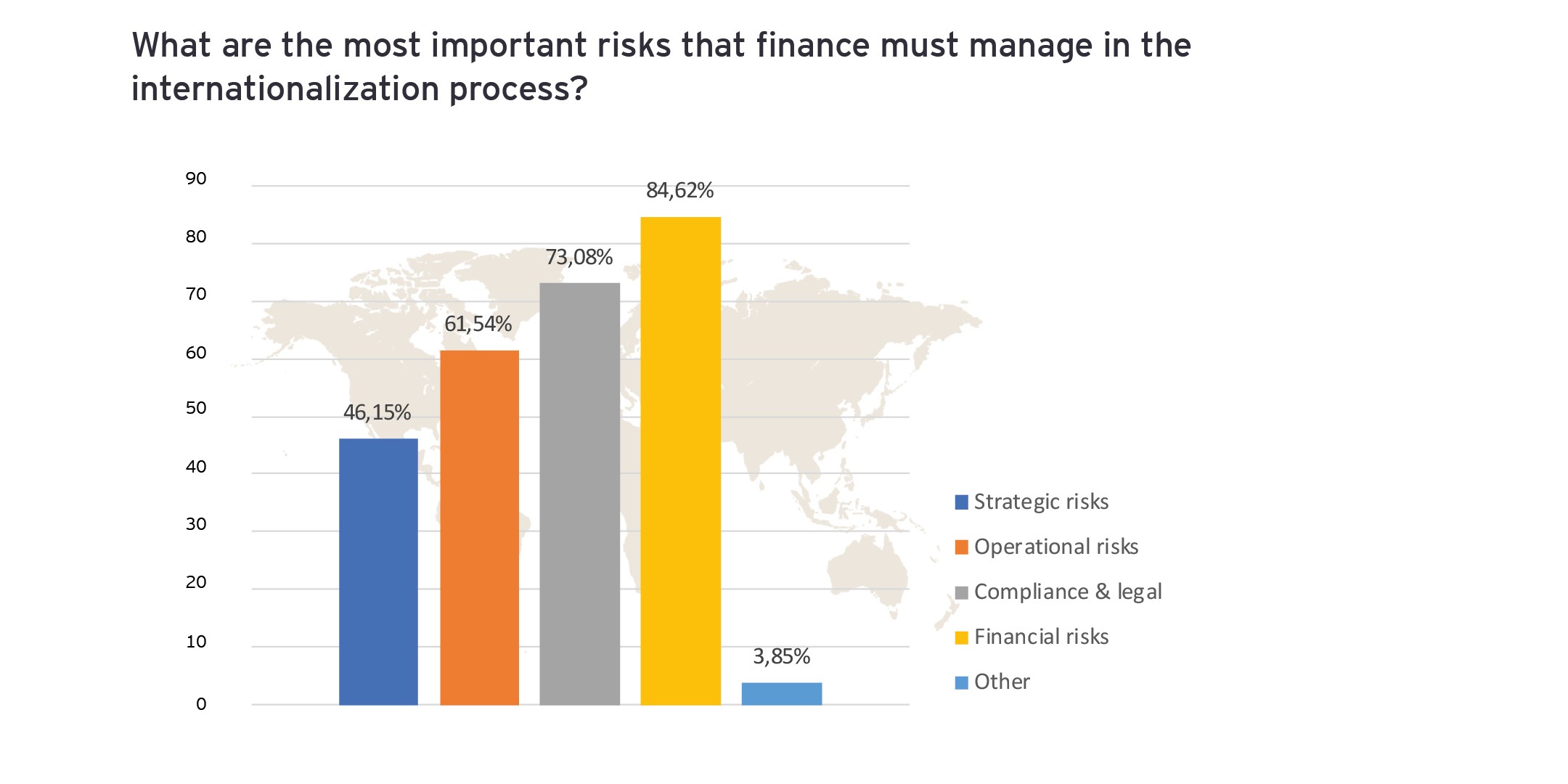

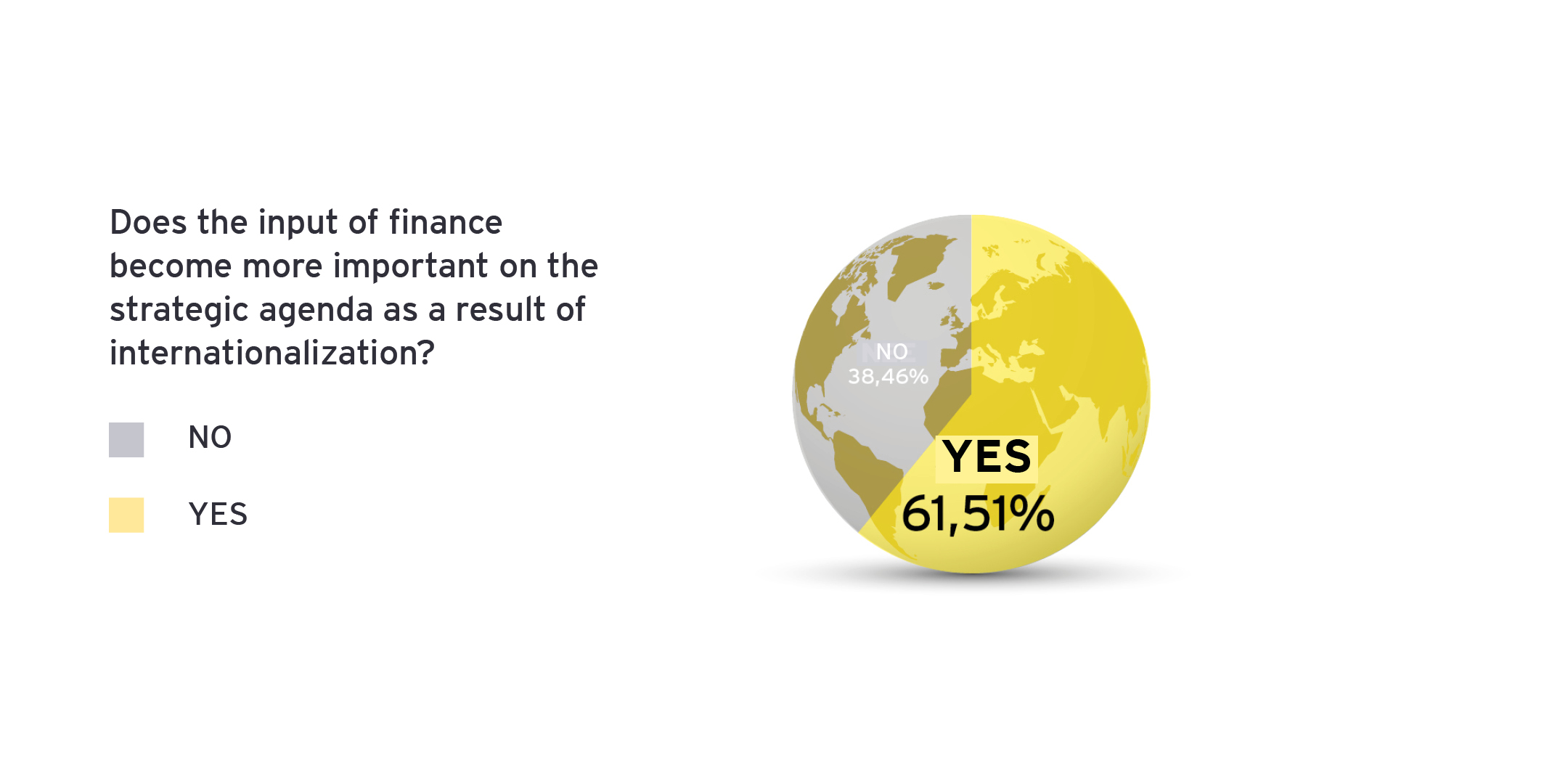

A due diligence audit in the field of finance, legal and tax ensures clear rules. Finance is and remains the link between management and the assets of the company.

Focusing on efficiency pays off, also with regard to personnel duties

After the financial crisis in 2010, many companies questioned themselves in terms of income and expenses. Products and services were evaluated. Unfortunately, redundancies took place in some departments.

Currently, ten years later, there is growth again. That means more administration, more support, serving more regions and countries. This extra work can be completed by the same number of employees if the company is fully committed to digitalisation.

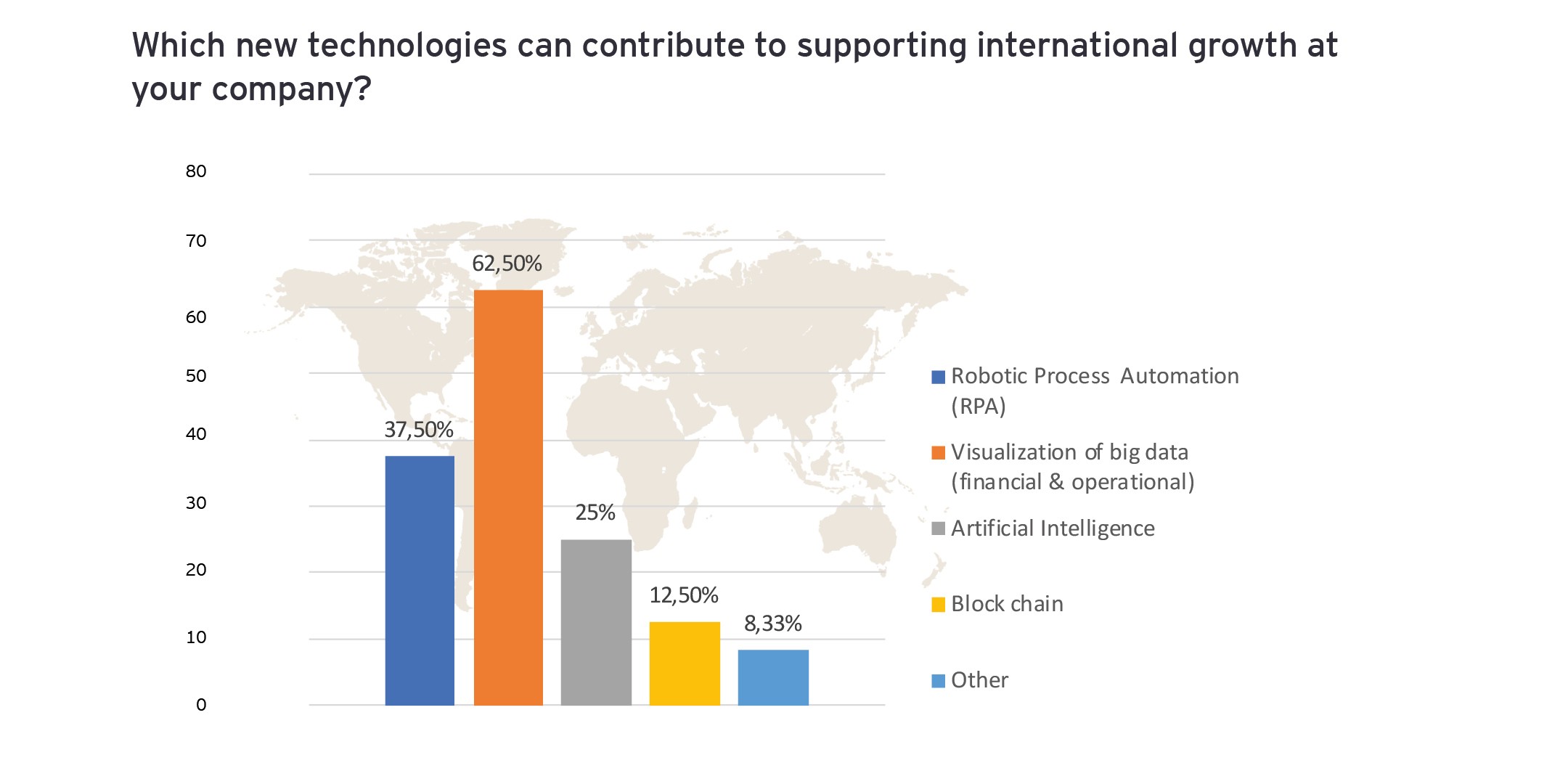

With growth, it is not always necessary to attract new employees. Work tasks can be redistributed or replaced by Robotics Process Automation (RPA). The fear of the term robotics (computers that take over processes) is unjustified. RPAs are standard tasks that code the entire flow. People assume that work will disappear, but new technologies make things easier and create new work opportunities.

Adapted and centralized IT systems, with big data as the core component

65% of the CFOs interviewed confirm that the IT infrastructure grows along with the growth of their company. However, we note that many companies are not yet working on digitalisation. The implementation of a new IT system often leads to half a year of shadow work, meaning people have to work simultaneously with the old and new systems.

In the centralization of services, accounting and controlling generally score best. Recruiting and the payment of wages can perfectly be done centrally because it involves the same process. Taxes and co are determined locally.