How do you optimize working capital management?

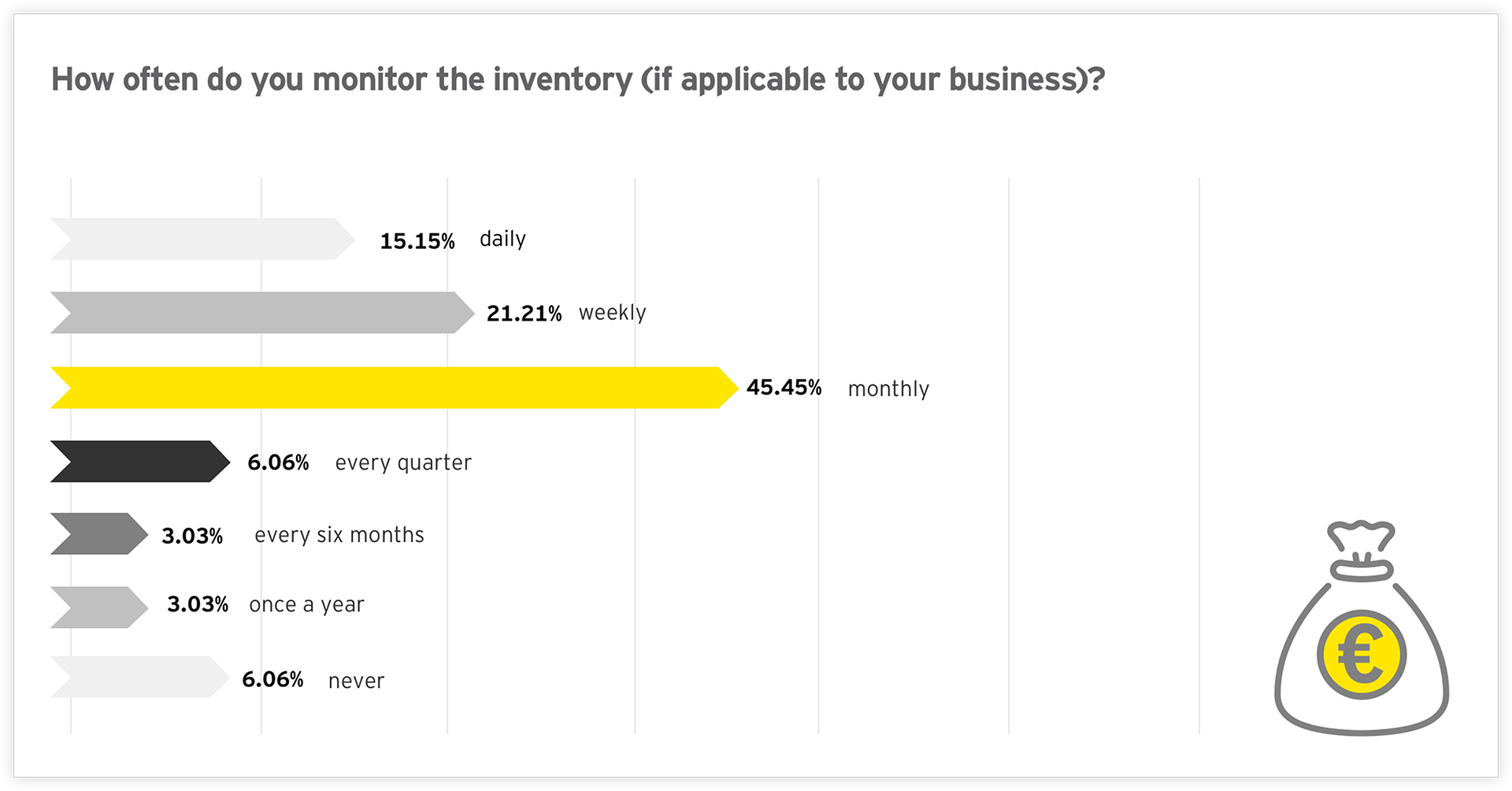

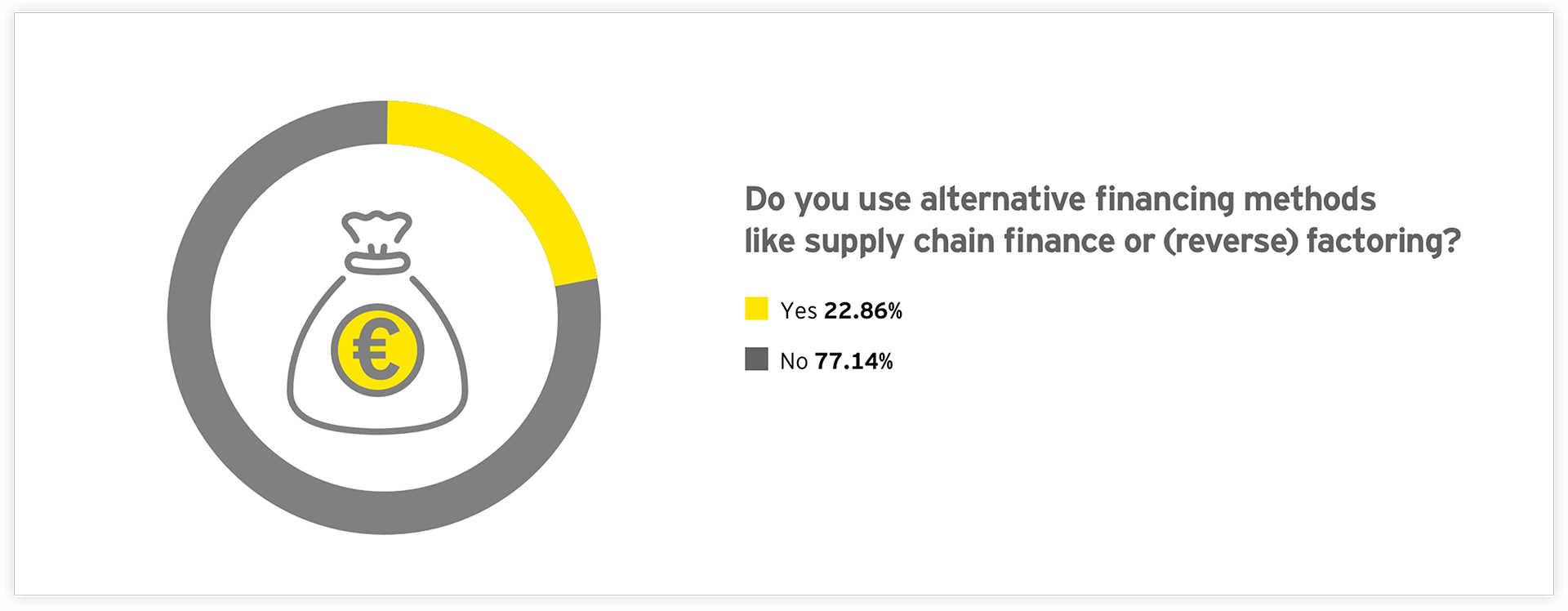

Dries Telen: “When talking about optimizing working capital management, we have three things to take into account: customers, distributors and inventory. The task is to find a balance between them by making sure that customers pay more quickly, ensuring that incoming invoices are not paid too quickly and guaranteeing that the inventory is sent out as soon as possible. That is not an easy balance to keep in its own right. But that task is even more difficult when you have to try and maintain good relationships with customers and distributors. This focus on maintaining good relationships has become more important than ever before.”

How should CFOs monitor the cash position?

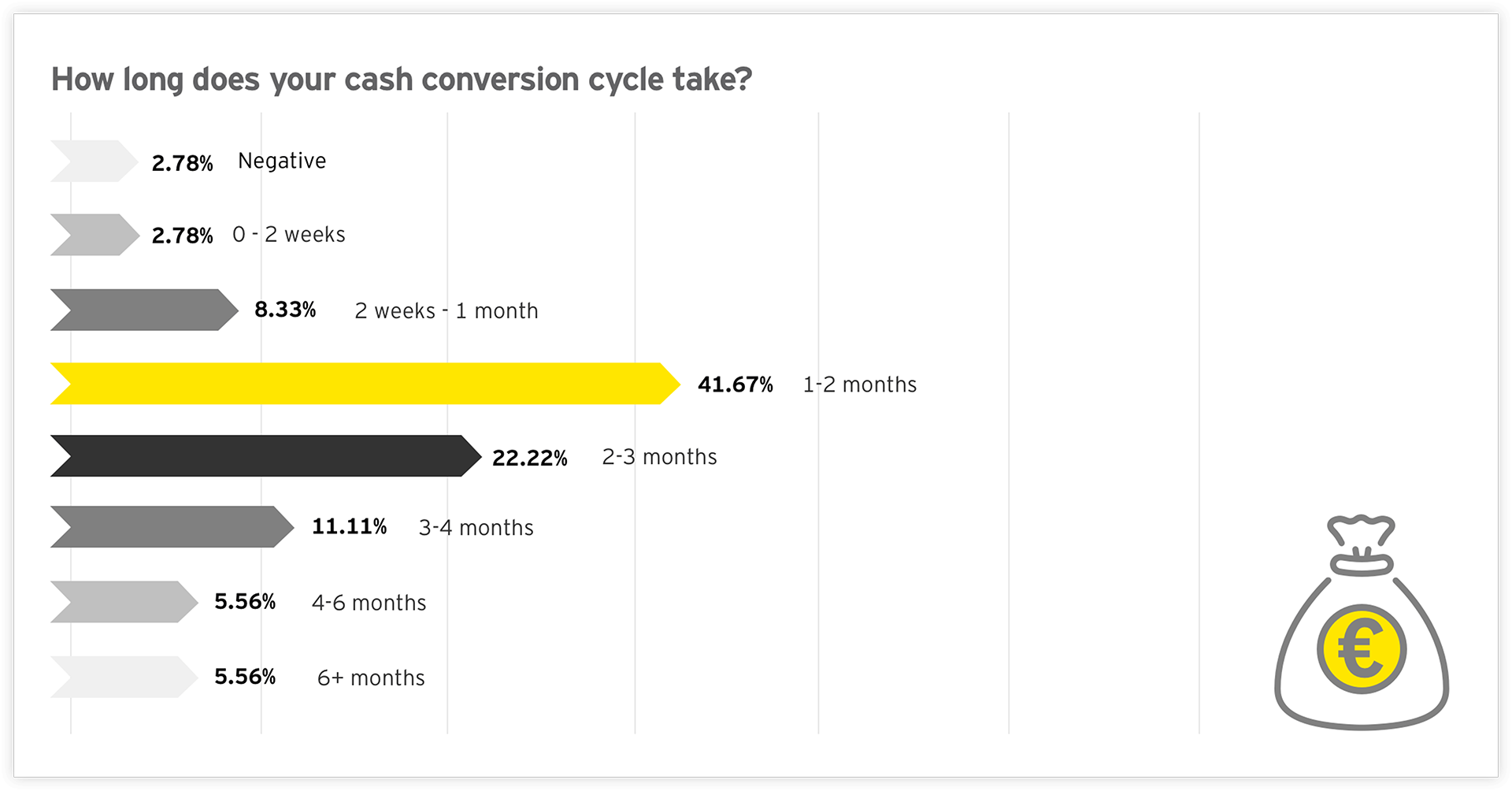

Dries Telen: “Many CFOs have started to follow up the cash position more frequently. A good forecast is essential to know where a cash shortage might arise. A CFO can only negotiate with a bank to solve a shortage when he or she has gained the necessary insights in advance. Especially with companies where the cash conversion cycle is relatively long.”

Mark Sheikh: “The cash swing, the highest and lowest cash position during a certain period, is important to monitor as well.”

Jean Gieskens: “And it is also vital to solve dead working capital, like inventory that remains in-house for too long and invoices that remain unpaid. The shorter the cash conversion cycle, the better. Naturally, this is not possible for all companies, but in some sectors, it should be possible to significantly shorten or negate the cycle by aligning processes and flows better.”