Critical Gas depicts a lower-carbon energy complex, not a zero-carbon one. It’s a scenario that won’t get us to the goals of the Paris Accord, but it’s better than the status quo.

Let’s look at which figure most prominently in the Critical Gas scenario.

Coal and nuclear power

As electricity demand has grown in the developing world, coal has been the fuel of choice. It’s cheap, the technology is easy to implement, and supplies are reliable. However, if the world stands any chance of meeting its climate change goals, this cannot continue. Nuclear is a low-carbon alternative, but the cost of making it safe appears to be prohibitive. Almost every baseline forecast assumes an ongoing role for both coal and nuclear.

Electric vehicle penetration

Electric transportation is an unstoppable force. We’re close to the point where on a straight cost and performance basis, EVs will be competitive with internal combustion engine-powered vehicles as suggested in EY’s Countdown Clock model.

EV penetration is important to the Critical Gas scenario because it has the potential to drive new electricity demand and new demand for natural gas as a complement to renewables. According to the World Economic Forum, there could be as many as 2 billion vehicles on the world’s roads by 20401. We estimate that if all those cars were electric, that would increase electricity demand worldwide by just under 20%. That electricity will have to be generated somehow, and at the margin, it’s likely to be split between natural gas and renewables.

We’re optimistic about EVs, but there is still some uncertainty. We see three big questions:

When will EVs be fully adopted by the mass market? The cheapest models are still considerably more expensive than ICE-powered cars and aren’t available in volume.

How quickly will consumers become convinced of the cost and performance advantages? Interestingly, if a technology is perceived to be advancing, many consumers may defer adoption and push the curve out.

When will the infrastructure required to charge EVs be built at scale? There are as many charging technologies as there are EV manufacturers, and electric utilities may be reluctant to invest today in upgrades that may not yield immediate revenue.

The Critical Gas scenario assumes 41% marginal penetration for EVs by 2035. That’s slightly above the penetration we assume in The Long Goodbye scenario, substantially above the 22% penetration we assume in our Slow Peak scenario and well below the 100% market share we assume for EVs in our Meet Me in Paris scenario.

Speed of transition to renewable power

In our models, we measure the speed of transition to renewables by determining what proportion renewables and natural gas take, after we have accounted for demand growth, coal attrition and increases or decreases in nuclear generation. They are roughly 50/50 now. Meeting the goals of the Paris Agreement would require that the share exceed 100 percent: gas generation would need to be shut down and replaced by renewables.

In the Critical Gas scenario, we assume that renewables and gas will share the power generation market at the margin in 2035 and beyond. That’s roughly the case now, and it’s pessimistic as a forward-looking point of view. A recent study estimated that battery storage would have to fall to $20/kWh to make a 100% renewable power grid sustainable2. The current price is about $185/kWh. We’ll get there eventually, but no one knows when. We’re not necessarily predicting that outcome, but we consider it a plausible scenario.

Another question is financing. Today, power sector investment is almost entirely financed on government and corporate balance sheets. It’s a system that worked well, and power utilities (public and private) are among the best credit risks in the market. In an all-renewable world, we expect a large portion of that investment to shift to households. The numbers are substantial. The International Energy Agency contemplates about US$25t of investment in the power sector between 2018 and 2040 under its Sustainable Development Scenario.

Related article

Demand

There are many estimates of how fast natural gas demand will grow. In scenarios that are consistent with the Paris Agreement, including our Meet Me in Paris scenario, natural gas will grow very slowly for the next 25 years before peaking and declining to end in the middle of the 2040s roughly where it is now. In The Long Goodbye scenario, gas demand increases by 285 billion cubic feet (BCF) per day between now and 2050.

The Critical Gas scenario envisions a much bigger role for gas. Demand grows rapidly, increasing by more than 618 BCF per day, compared with the current demand of 370 BCF per day.

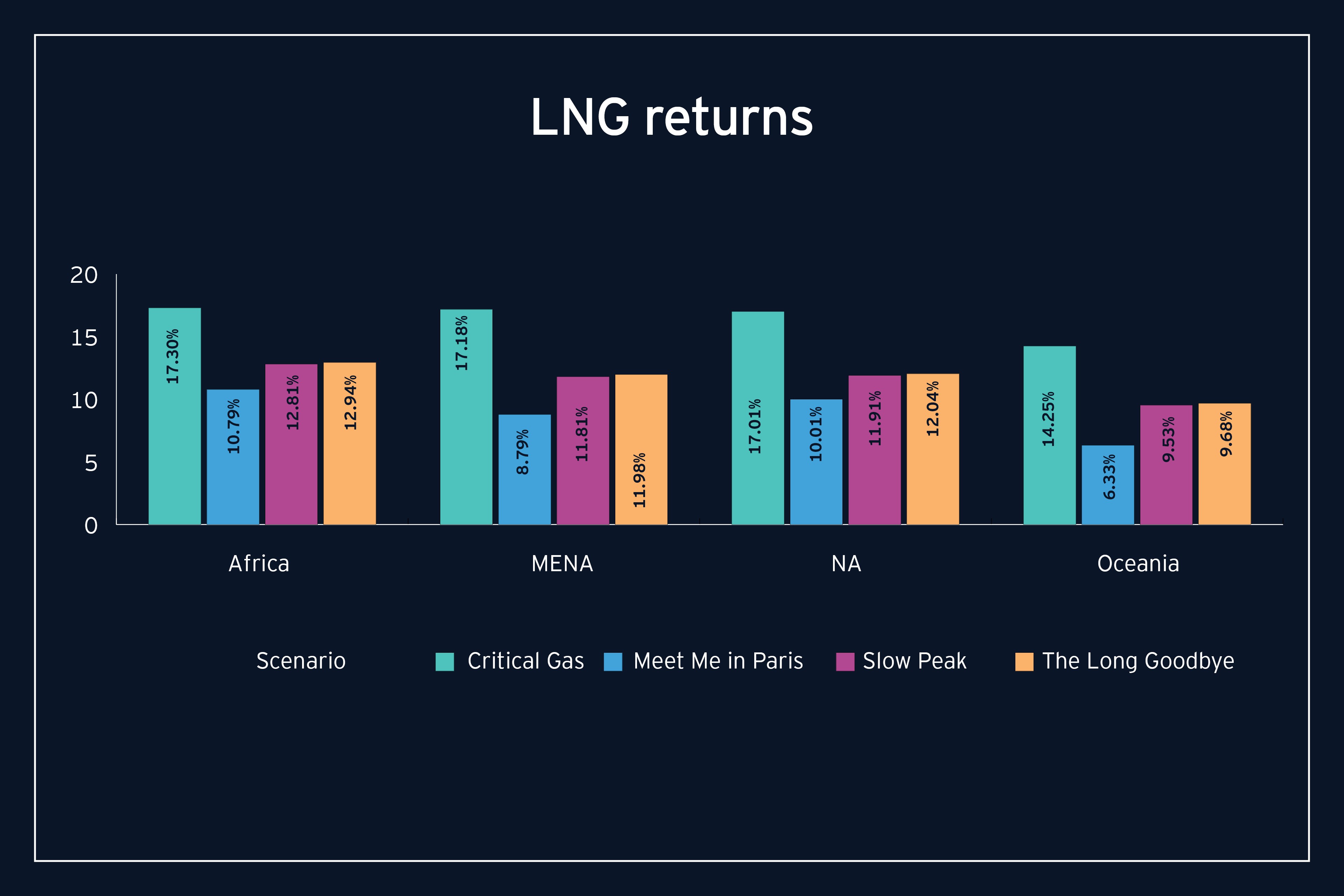

Returns

One of the major findings of our Fueling the Future project is that asset returns have a predictable pattern with respect to demand scenarios and various asset classes. The Critical Gas scenario is no exception. Investments on LNG assets, for instance, show large returns, relative to other scenarios. This scenario supports, as it needs to, substantial investments in natural gas assets all along the value chain.

Summary

We know we’re on a journey to decarbonized energy, but how long a journey is unknown. The current mix is convenient for consumers in OECD countries, has fostered increased standards of living, and is enormously profitable for the industry. However, this status quo will change. Addressing climate change while delivering reliable power is imperative. The Critical Gas scenario is a story of rapid change, just in a direction slightly different from meeting the Paris Agreement goals. While we can’t plot a path with certainty, it could be the role for natural gas will be bigger than imagined.