The effective visualization and quantification of indirect tax projects towards finance leaders.

Let’s talk Finance!

Bridging the gap between the language of indirect tax and finance is vital to clearly demonstrate both the need to invest in the organization’s Indirect tax function and, more importantly, the return on investment that can be expected by finance leadership.

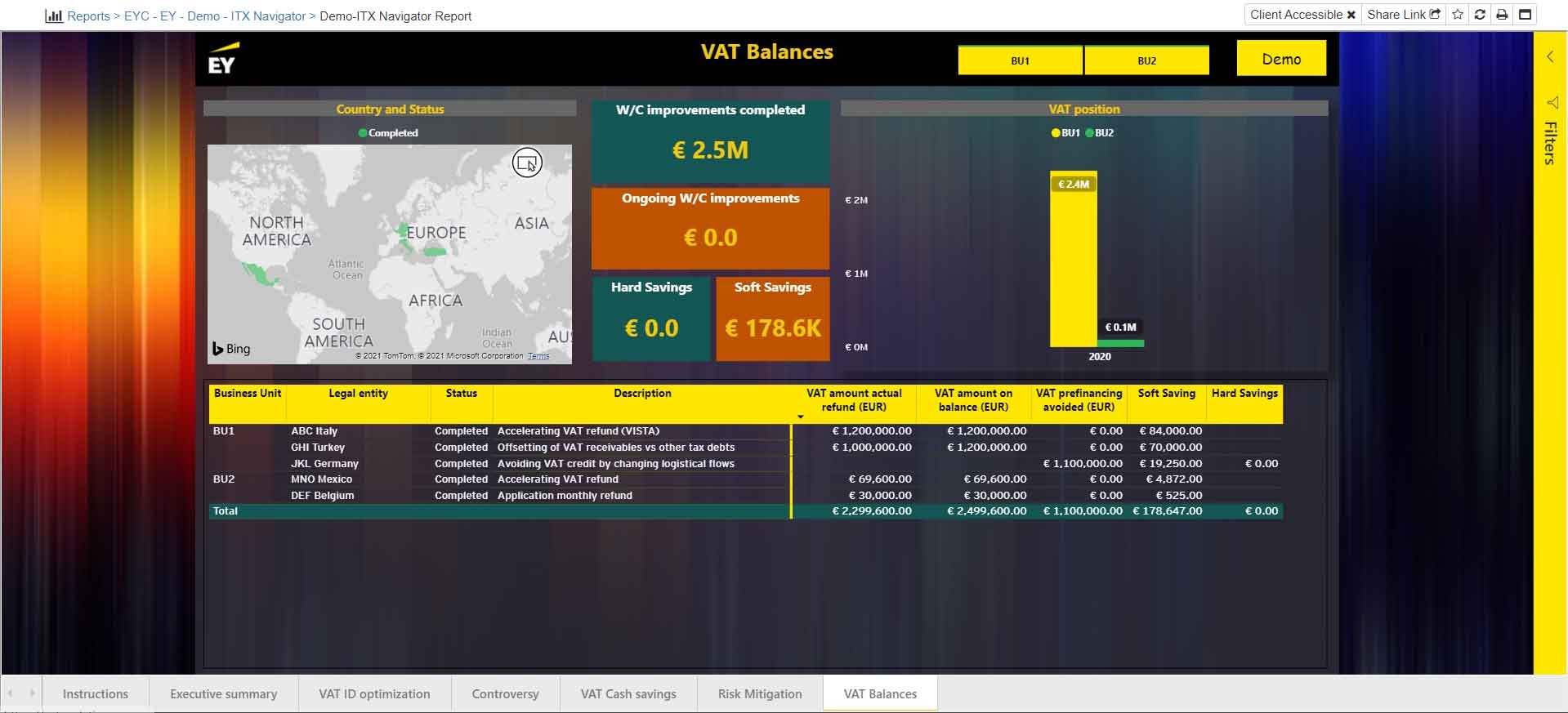

In times of high uncertainty and potential high pressure on the organization’s working capital, it is important that the finance leadership understands that VAT is not always ‘neutral’ and that indirect tax planning, aligned with the organization’s overall strategy, is vital in order to optimize the indirect tax cash flow and overall P&L impact for the organization.

By applying accounting quantification methodologies, the indirect tax function can translate and visualize the impact of the various indirect tax projects from a P&L and working capital perspective. This will help finance leaders understand the importance of supporting the indirect tax function and securing the required budget and resources to successfully reach the working capital improvements and P&L savings.

Harvesting the power of data analytics and clear management reporting

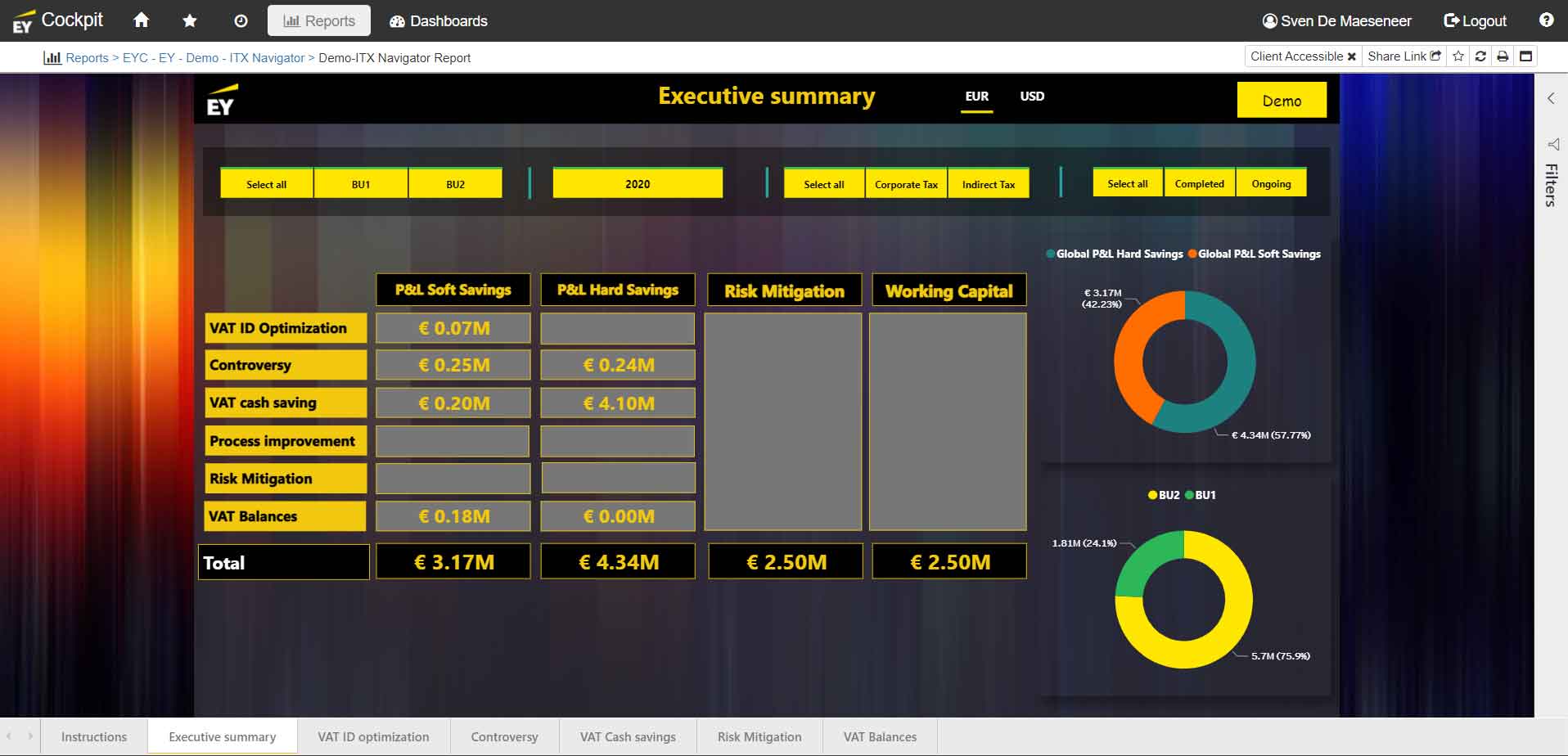

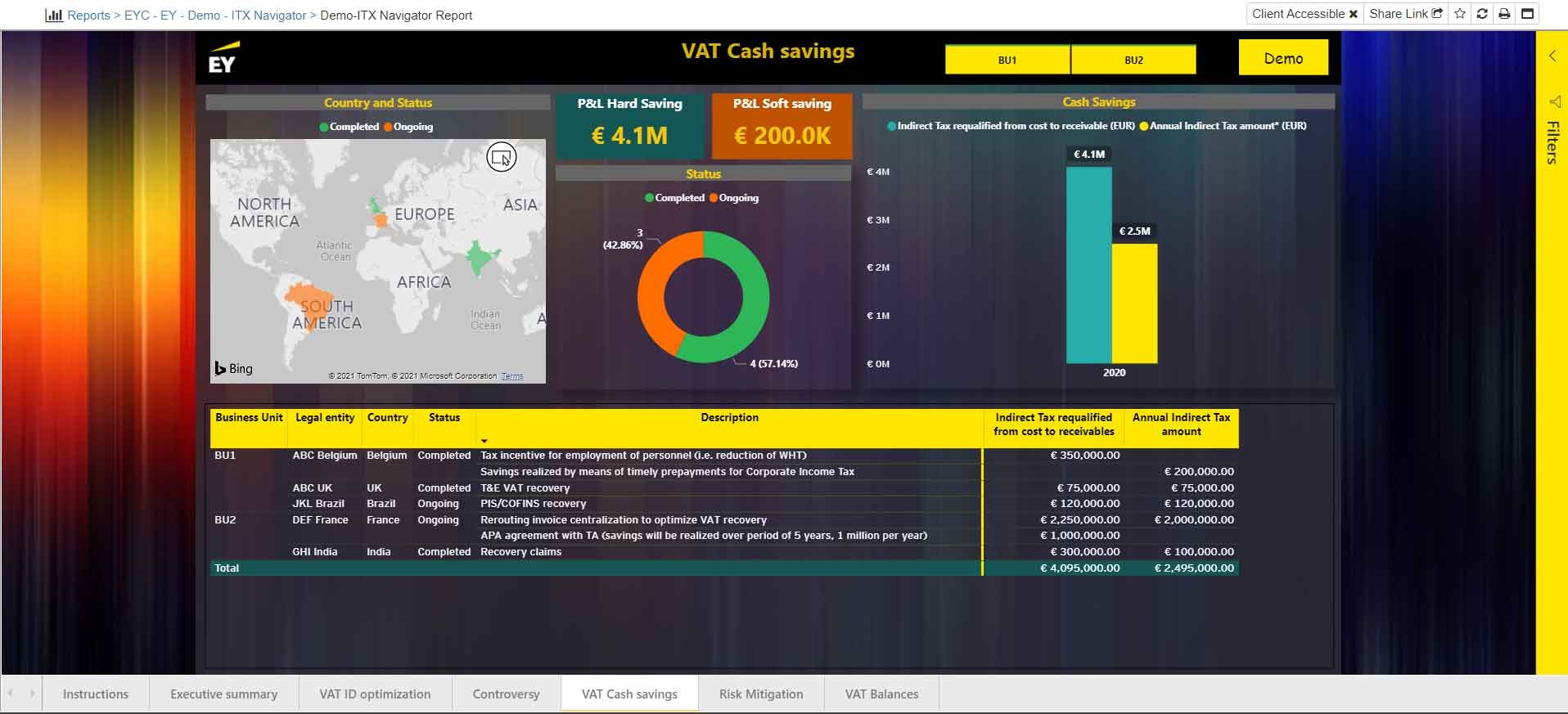

The Indirect Tax Navigation dashboard allows clients to clearly visualize and quantify all indirect tax projects from a financial point of view. EY’s indirect tax experts help clients to gather the required project data elements and to determine the financial qualification and quantification for every single project.

The outcome is visualized in Microsoft Power BI dashboards with a clear and pragmatic executive summary as well as detailed underlying overviews covering the various projects identified.