Getting ahead

To overcome roadblocks that stand in the way of technology innovation, finance and reporting, teams often focus on two areas:

1. Collaboration with teams across the business

With the benefit of a broader understanding of the complex dependencies between risks and existing information risk management initiatives, an integrated approach to information governance can help tackle complex areas such as:

- Responding to regulatory requirements. Rigorous compliance requirements may include international standards, such as European Union laws or regulations issued by the U.S. Securities and Exchange Commission (SEC).

- Increasing global flows of data. As volume increases and new information systems are procured, information may shift around the globe. As this happens, organizations tend to lose understanding and control of what information is stored where. This introduces risks when they have to apply record retention policies, respond to discovery or regulatory requests, and determine compliance with privacy requirements. If companies cannot identify data and dispose of it in accordance with retention policies, then that data may be discoverable.

2. Managing the compliance challenges of new technologies

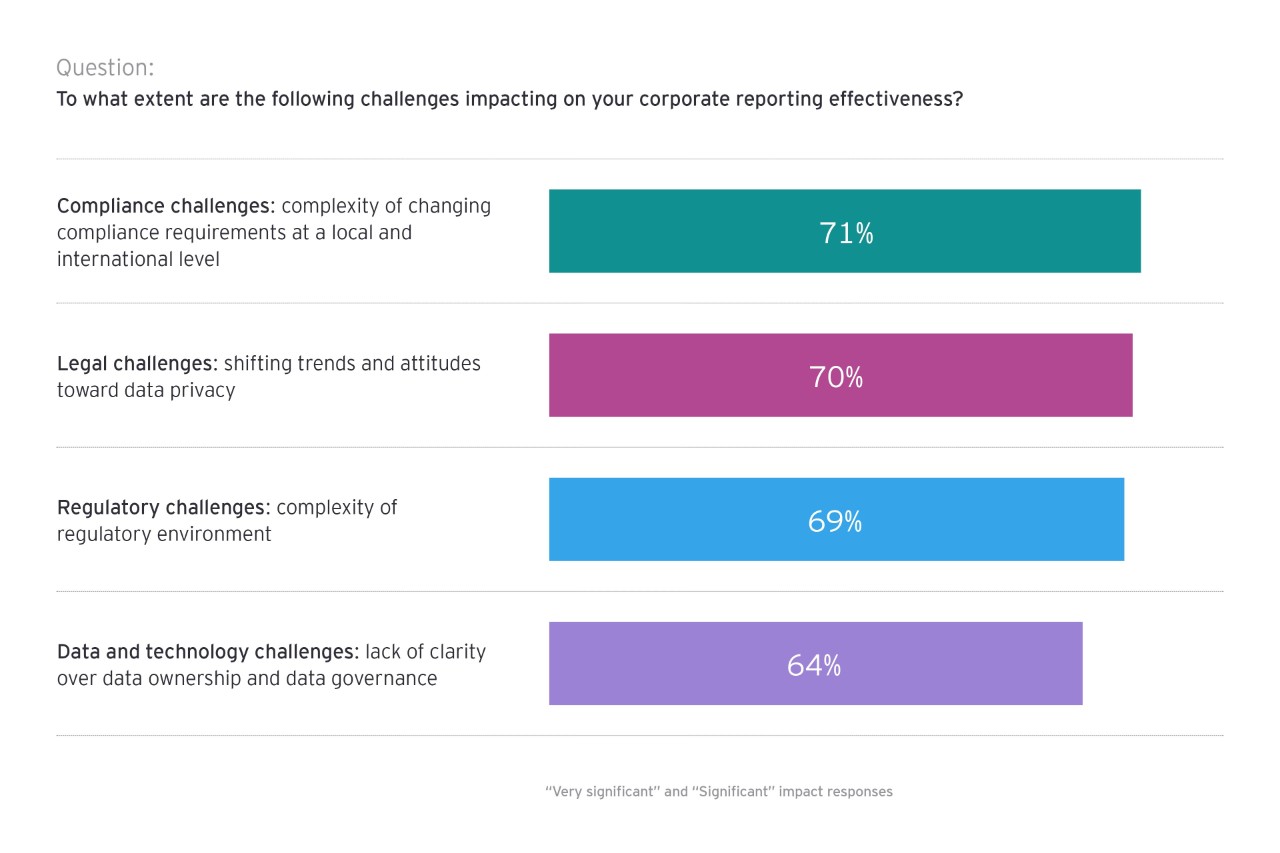

Our research finds that 87% of organizations surveyed plan to increase their investment in reporting technologies over the next two years. However, even with a strong investment commitment, organizations face significant barriers in implementing innovative new systems. In particular, concerns over cloud compliance risks are the number one barrier to technology innovation in finance, according to group CFOs.

Audit committees and supervisory boards: seeking new competencies and data-driven insights

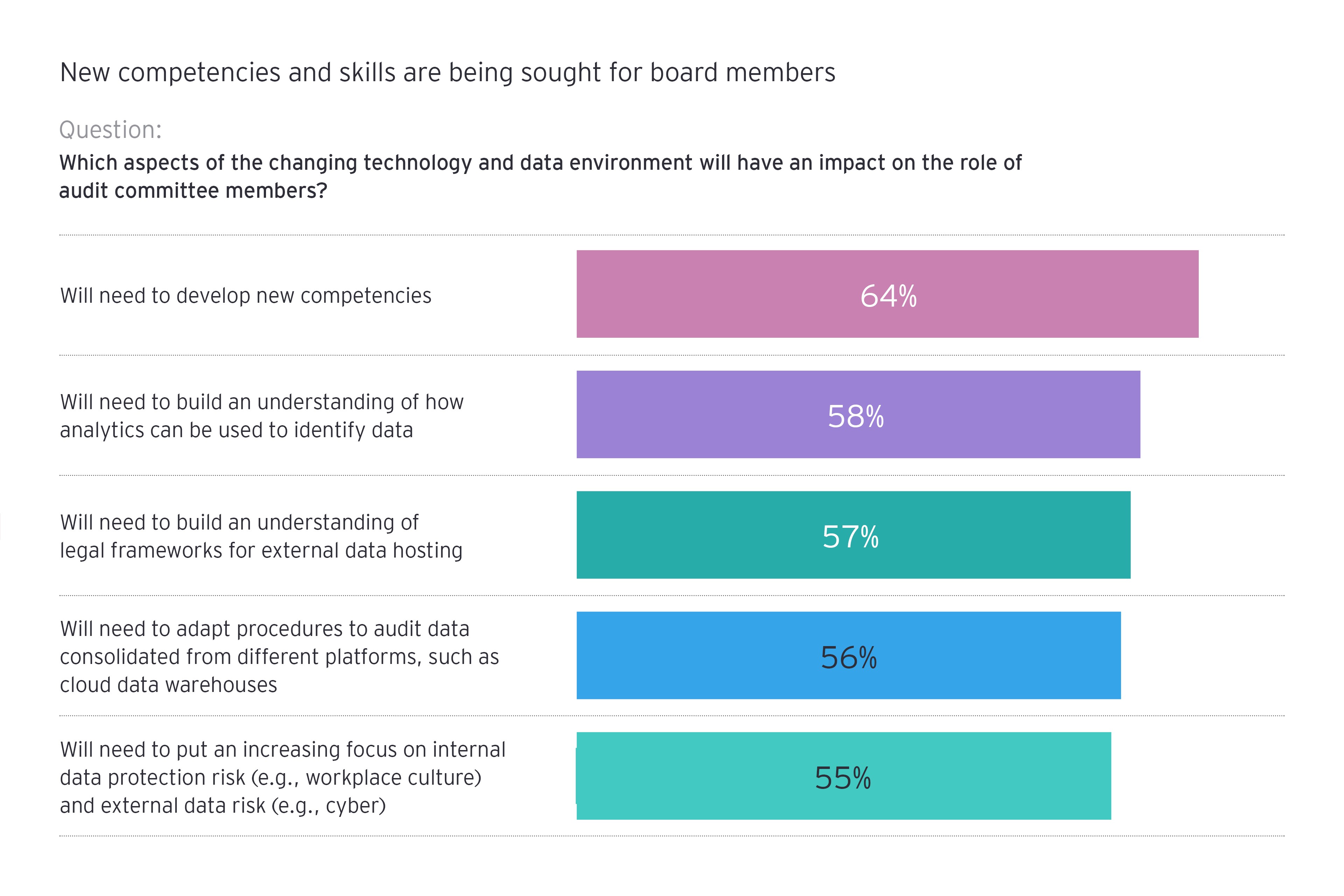

The reporting requirements of audit committees and boards are changing in two ways: what they do in terms of where they are focusing their attentions and the competencies they need for effective oversight, and how they provide oversight, with boards requiring more regular, real-time and relevant information to perform their role effectively.

What audit committees do

Today’s volatile and fast-changing environment is making areas such as internal controls, compliance and culture, and fraud prevention increasingly important. When we asked respondents to select the main priorities of their audit committee and board in terms of their oversight role, we found that implementation of new accounting standards is the top priority for public companies. For private companies, the top priority is fraud prevention.

Board and committee members face increasing expectations from the public and media in managing key risks such as lapses in individual behavior. With an increasing focus on technology and data challenges, finance leaders believe that audit committee members will need new competencies to fulfill their oversight roles effectively.