Disclosure of sustainability risks

EY has been observing the increasing demand from stakeholders and investors for greater transparency. Internal management and external stakeholders increasingly consider nonfinancial information in their decision-making. In EY’s Tomorrow’s investment rules report from 2017, involving more than 320 institutional investors around the world, nearly 86% of respondents consider CSR or sustainability reports as essential or useful when making investment decisions.

As demand for nonfinancial disclosures rapidly increases, a number of global organizations and regulators have established reporting frameworks aimed at shifting the focus on alignment to the financial and regulatory disclosure markets. While these frameworks continue to be voluntary, companies may see strategic and operational benefits from choosing to use a framework to disclose nonfinancial information.

In 2015, the Sustainability Accounting Standards Board (SASB), a nonprofit organization that develops standards for the disclosure of material sustainability-related information in SEC filings, issued provisional sustainability accounting standards for 79 industries in 10 sectors. The goal of these standards is to assist public corporations in complying with existing requirements when disclosing information material to investors in SEC filings.

In December 2015, the Financial Stability Board (FSB) established the Task Force on Climate-related Financial Disclosures (TCFD). The TCFD is globally diverse and includes private providers of capital, major issuers, accounting firms and ratings agencies, thereby presenting a unique opportunity to form a collaborative partnership between the users and preparers of financial reports. The TCFD was tasked with assessing what constitutes efficient and effective disclosure and to design a set of recommendations for voluntary company financial disclosure of climate-related risks. In June 2017, the TCFD presented its recommendations, which covered governance, strategy, risk management and metrics, and targets disclosures related to climate change.

The International Integrated Reporting Council (IIRC) has developed the Integrated Reporting Framework, which provides guidance for public companies on how to integrate sustainability into their annual financial reports. In addition, governments and stock exchanges are increasingly requesting that companies report on their nonfinancial information. Governments and stock exchanges in more than 40 countries now require or encourage some level of sustainability reporting, according to one estimate.

And yet, as the WBCSD report suggested, current state of disclosures suggests a discrepancy between what companies are reporting in their sustainability reports and their legal filings.

A way forward

There are no silver bullets to address this issue, but a well-designed ERM function is a powerful way to weave the management of sustainability risk into the fabric of an organization.

The ERM function plays a critical role in monitoring and managing the risks and opportunities that can impact a company’s profitability, success or even survival. The ERM function is often tasked with canvasing the internal and external opportunities and threats to the business and challenging these in the business strategy, sometimes leveraging an ERM framework such as COSO or International Standard of Organization (ISO), to support this.

Some of the critical elements in place at leading organizations include:

- Starting with establishing a risk management culture of consistent sustainability factors and their risk management. Encourage everyone in the company to use the same language and share risk definitions across the organization.

- Leveraging the risk management function to better map and identify emerging sustainability risks, as well as support the identification, quantification and prioritization of sustainability risks. Specific tools can be used to help quantify sustainability issues — such as the social or natural capital protocol.

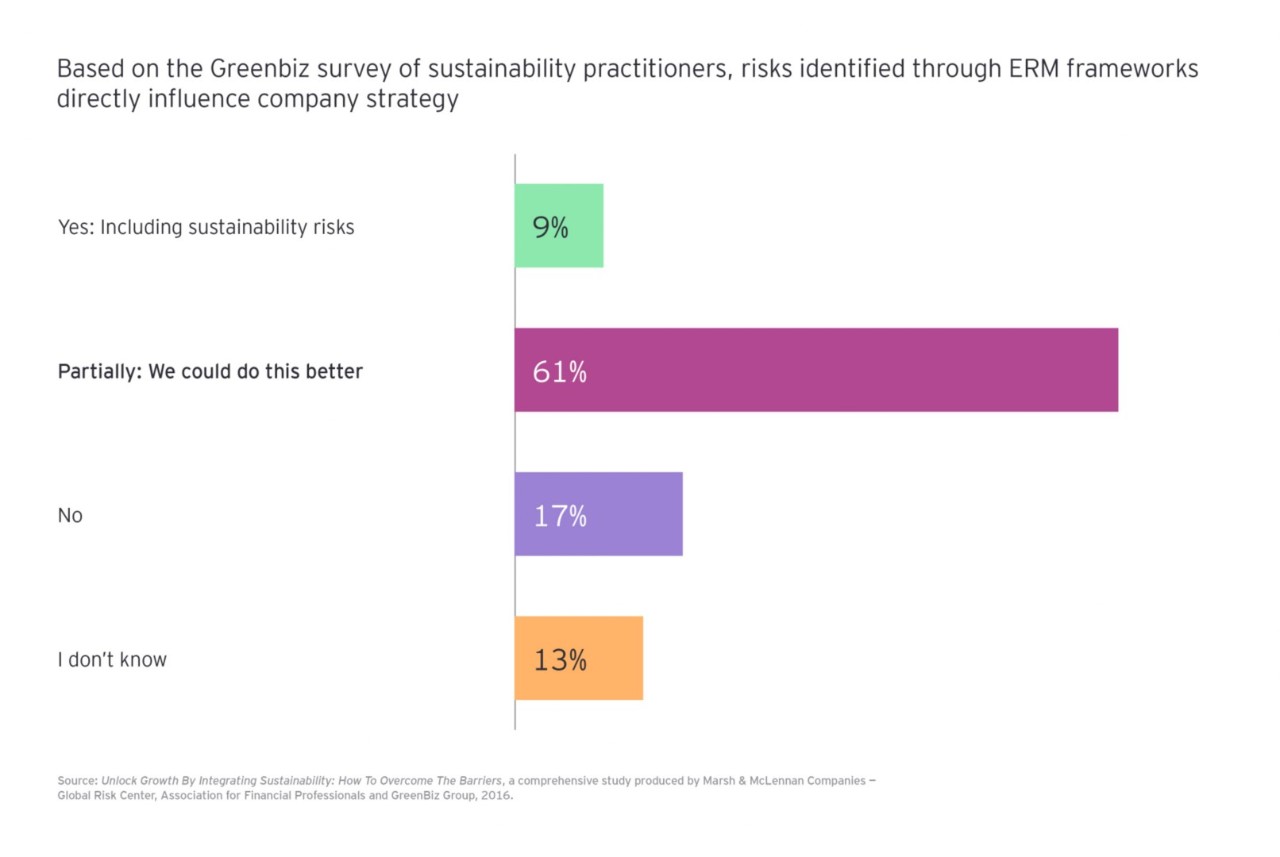

- Leveraging the risk management function to support links into the business strategy and support better decision-making.

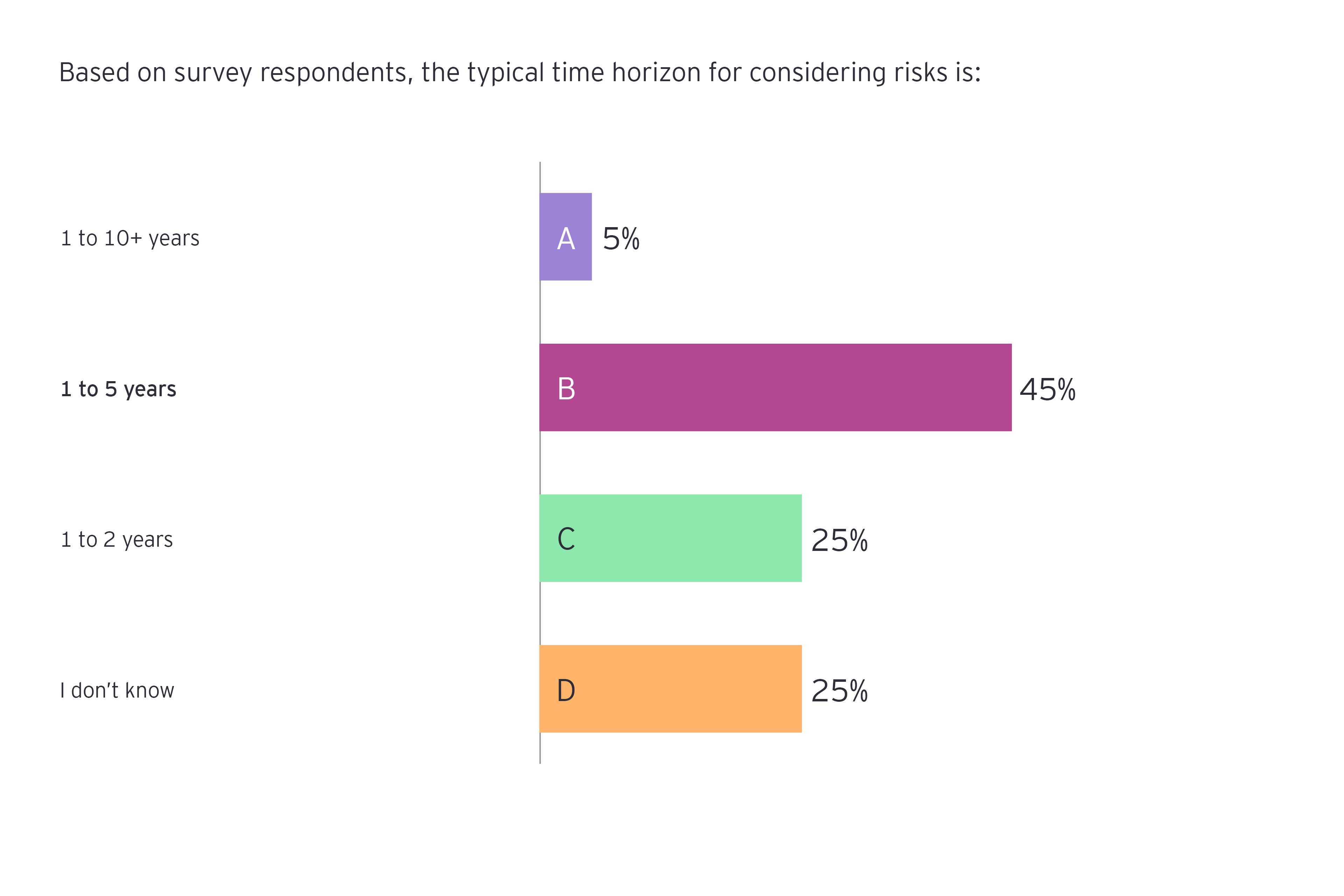

- Adopting an enterprise-wide view to prioritize and aggregate issues by likelihood and severity, along with adaptability, complexity, persistence, velocity and recovery.

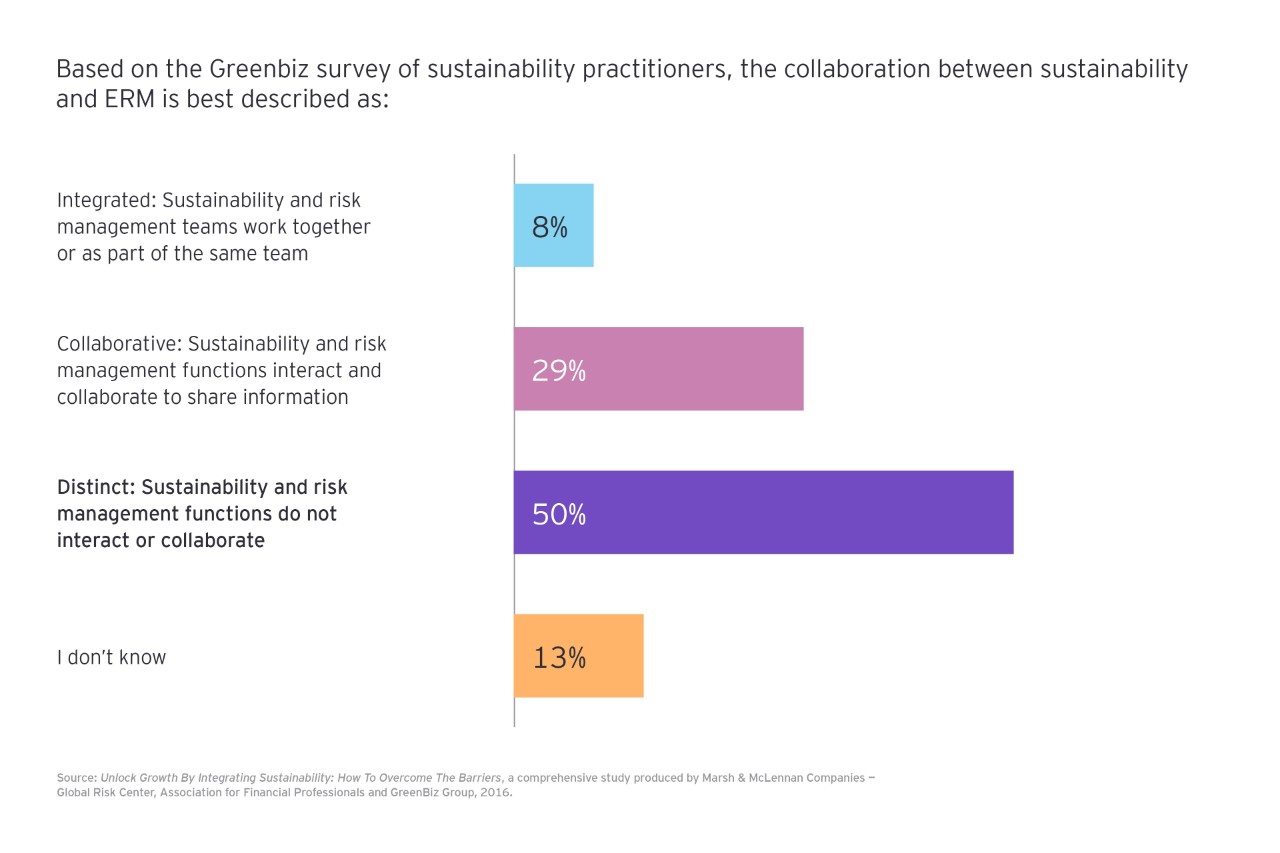

- Improving collaboration between sustainability and ERM.

- Considering how to align reporting of sustainability and risk.