The rush to develop tight oil, oil sands and other unconventionals has increased North American liquids supply to levels not seen since the 1980s, and the trend is expected to continue well into the future. But while innovation and technology advances have spurred a new “energy renaissance,” many companies are now struggling to manage growth.

There is a very real need for sustained cost reduction and system scalability to accommodate this increasing activity. A key challenge for energy companies today is to identify structural, long-term organizational changes that can strengthen their ability to compete in a low-margin/high-capital capital growth market.

What needs to change

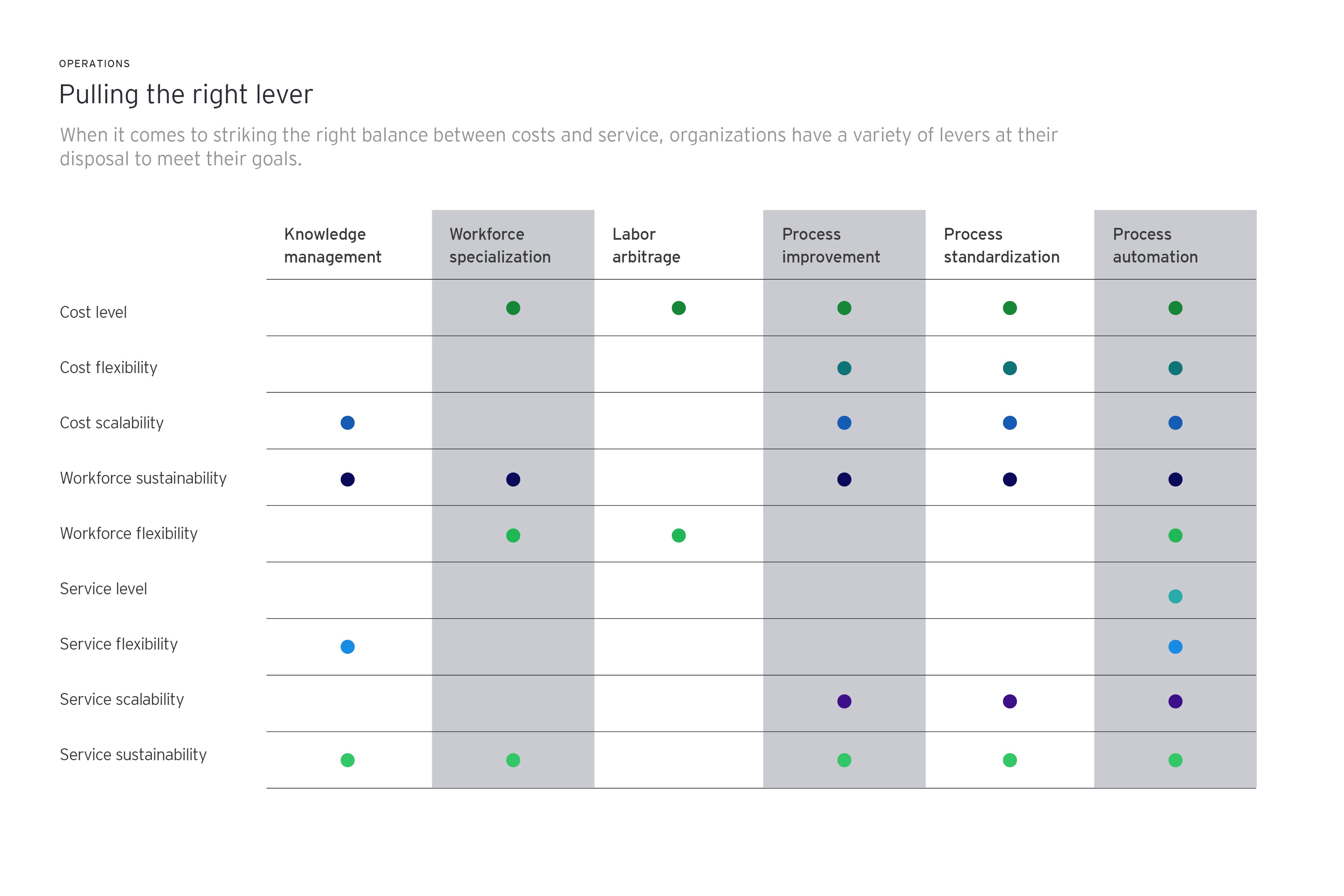

To remain competitive, energy companies need to maximize cash from operations. They can achieve this in large part by lowering back-office costs, but this must be done without negatively impacting service. In other words, companies must find a workable balance between staffing, costs and a high level of service for back-office operations.

Choosing the right operating model

There are pros and cons to the various models for delivering back-office services — outsourcing, captive shared services or hybrid structures.

Many organizations have learned that in order for outsourcing to be an effective solution, a highly functional internal governance model is required. But once that mature model is in place, companies could enjoy the benefits of outsourcing — cost and efficiency — while using a captive shared services approach that also enables flexibility.

There has been a trend toward insourcing among energy companies, allowing organizations to save the margins they previously passed on to their outsourcing partners. Both established super-majors and start-ups alike should take a fresh look at shared services to help them realize their cost management goals.

Maximizing the potential of shared services

Historically, shared service organizations have underperformed for many oil and gas companies. Thus, discussion of expanding these operations into new geographies and new, more complex functions — such as budgeting, planning and analysis — is often met with skepticism.

But there is a great deal of value to be gained by fixing and optimizing existing shared service operations, and then transitioning to new functions. Doing so, of course, requires understanding what is currently not working, and then designing and implementing corrective actions. Issues that companies need to consider and address include:

Leadership support

If executive leadership does not mandate shared services and allows an “opt-in” approach, many predictable events negatively impacting performance often follow. Functional leaders may agree to migrate certain activities to shared services but may only agree to do so as long as they can maintain control and exclusively determine the definition of success of shared services.

A better formula for success is to agree upon which activities will be migrated, based on leading-practice criteria, and agreeing on a standard delivery model, along with a cross-functional RACI (who’s responsible, accountable, consulted and informed for each management activity) agreement. The minute functional leaders are allowed to negotiate changes to the standard model, future success is compromised.

Branding

Typically, the biggest branding mistake when it comes to shared services is not branding. Without effective branding, stakeholders are free to rely on their preconceived notions of what shared services is or should be. Proactively branding the organization as a leader in global collaboration or as an innovation center can have a positive effect. Brand drives culture and culture drives performance.

Governance

Allowing your shared services governance organization to be structured as a one-way, top-down oversight organization specifically focused on shared services improvements is a very common mistake that can result in missed improvement opportunities, negativity, and morale and retention problems.

Frequently, performance problems originate within the shared services ecosystem but outside of the shared services organization’s control.

Effective governance takes an arm’s-length view of the entire shared service ecosystem, including the enabling organizations that provide service to the shared service organization as well as their customers.

Expectations management

Shared service organizations are often burdened with unrealistic expectations. Internal customers do not want to accept a drop-off in performance during the migration period, specifically when knowledge transfer and new employee training is taking place, and where an infrastructure may not be mature.

Also, customers commonly demand a performance level that has never been measured or achieved in the legacy organization. An outsourcing company would never agree to delivery on an unproven, unrealistic performance baseline, nor should a captive shared services organization.

Performance measures

It is common for shared services organizations to agree to performance measures that cannot easily be achieved or in which they have no control over. Performance measures are never perfect, but they can be developed in a manner that is fair and that serves the best interests of the service organization and its customers.

We have found that five types of performance measures cover most situations and should be considered for each function delivered by a shared service organization:

- Net cycle time — This measures the time that a work product is within the control of the center. This does not include time that the work product is sent back out for approvals, clarification, additional information or other matters.

- Net quality — This measures controllable quality by considering both the defects of each work request coming into a work cell and measuring the errors created in that work cell.

- Cost or efficiency — Shared service organizations often strive to be market-competitive. In order to measure their relative competitiveness, calculating cost per work unit — for example, the cost to produce an invoice — should be considered.

- Strategic alignment — Process owners often make decisions that they expect shared service centers to execute. It is insightful to understand how effectively a shared service center is carrying out the strategy, as it can have a significant impact on overall performance.

- Value contribution — Measuring the value of back-office functions will help ensure the focus of these groups does not shift completely to other considerations, such as efficiency, at the expense of their purpose.

Cultural alignment

Declaring that “we are all one culture” and that the shared service centers are treated no differently than other internal groups may not be enough to make it so. Many things are different when work is moved to a remote location, often performed by people with much different backgrounds than their predecessors. Not achieving “cultural alignment” may adversely result in an underperforming shared service organization in the form of low morale, productivity and employee retention.

There is a real business need to understand and address these differences. Then plans should be adopted with the ultimate goal being to attract, retain and motivate all of the people in the shared service organization.

Cross-functional tools and enablers

Back-office operations need infrastructure – a way to accept and route work. They need ways to manage the quality of the requests coming in, and a defined process for handling nonstandard requests. Shared services centers need to be able to collect information that helps them continuously improve, and they need to be efficient and effective with the way they handle data.

Enterprise resource planning (ERP) integration

The most common mistake is not building the necessary infrastructure. Many organizations learn about their infrastructure needs as they march along the maturity curve, implementing point solutions as they go. The result is limited integration with their ERP.

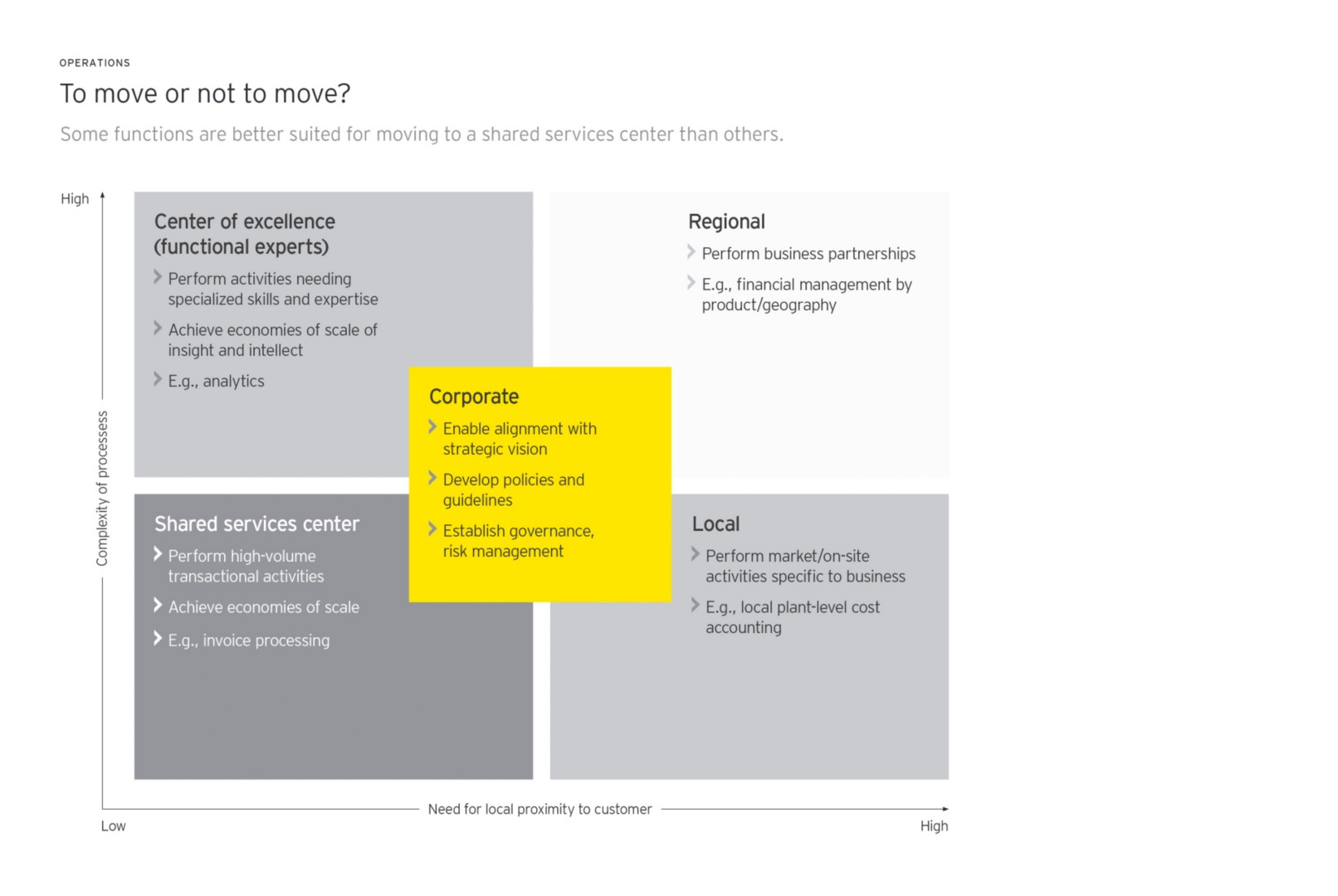

Expanding shared services into new areas

Many companies have expanded their shared services organizations beyond transactional activities, often called “business services,” into more analytical or certification-based functions known as “centers of excellence.” Some companies have even offshored or outsourced large parts of strategic functions such as research and development.

A trend with energy companies today is to move a majority of the activities in functions such as budgeting, planning and analytics or supply chain analytics to a shared services center.

In order to determine which functions or activities to move, the criteria of the work should be analyzed. In general, leadership, entrepreneurial, judgment-based and strategic activities that require significant industry or company-specific skills are not good candidates for centralization.