Service providers are good to get started, but you need to own your own model. Digitalization at the end of the day will become a top-line priority.

Chapter 1

How do you extract insight from a hydrocarbon?

A majority of respondents are eager to invest more in digital, with urgency to contain costs and deliver a bigger return on capital.

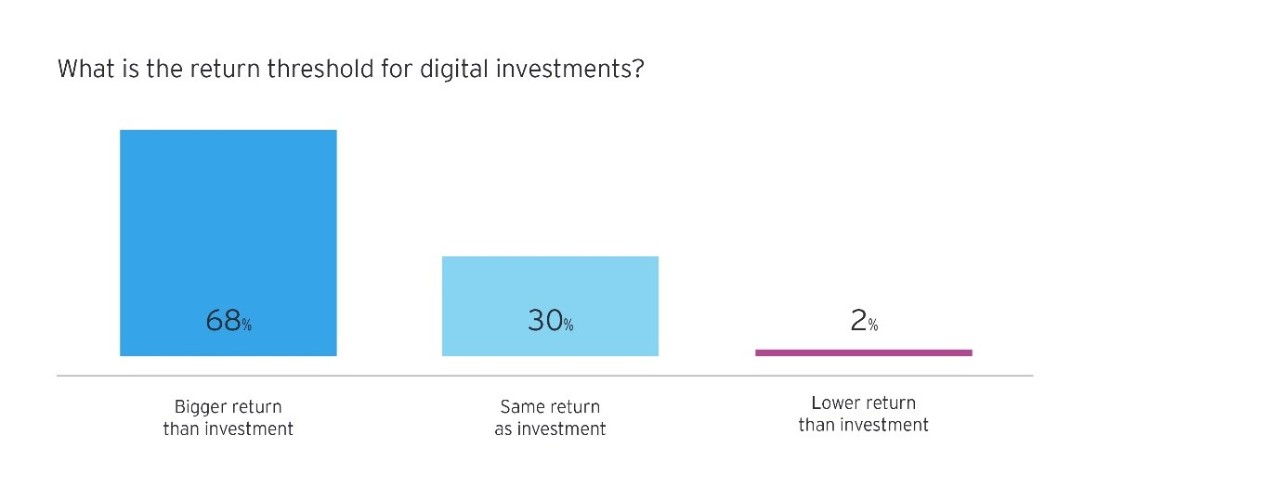

One of the keys to the oil and gas industry’s growth ambitions lies in unleashing capital expenditures on technology. And our survey results reflect this – a majority of our respondents are eager to invest more in digital, with an urgent need to contain costs and deliver a bigger return on capital.

Nearly nine in 10 respondents to our survey (89%) expect their investment in digital tools to increase over the next two years, with a quarter (25%) foreseeing a significant jump. Just 11% see investment staying flat and, significantly, none see it declining.

“It’s not surprising that the bottom line is about becoming more efficient,” says Ioana-Andreea Ene, a Norway-based partner at EY. “Efficiency is the top priority because that gives you access to investments and to the market.”

Digital tool investments

89%Nearly nine in ten respondents expect their investment in digital tools to increase over the next two years, with a quarter foreseeing a significant increase.

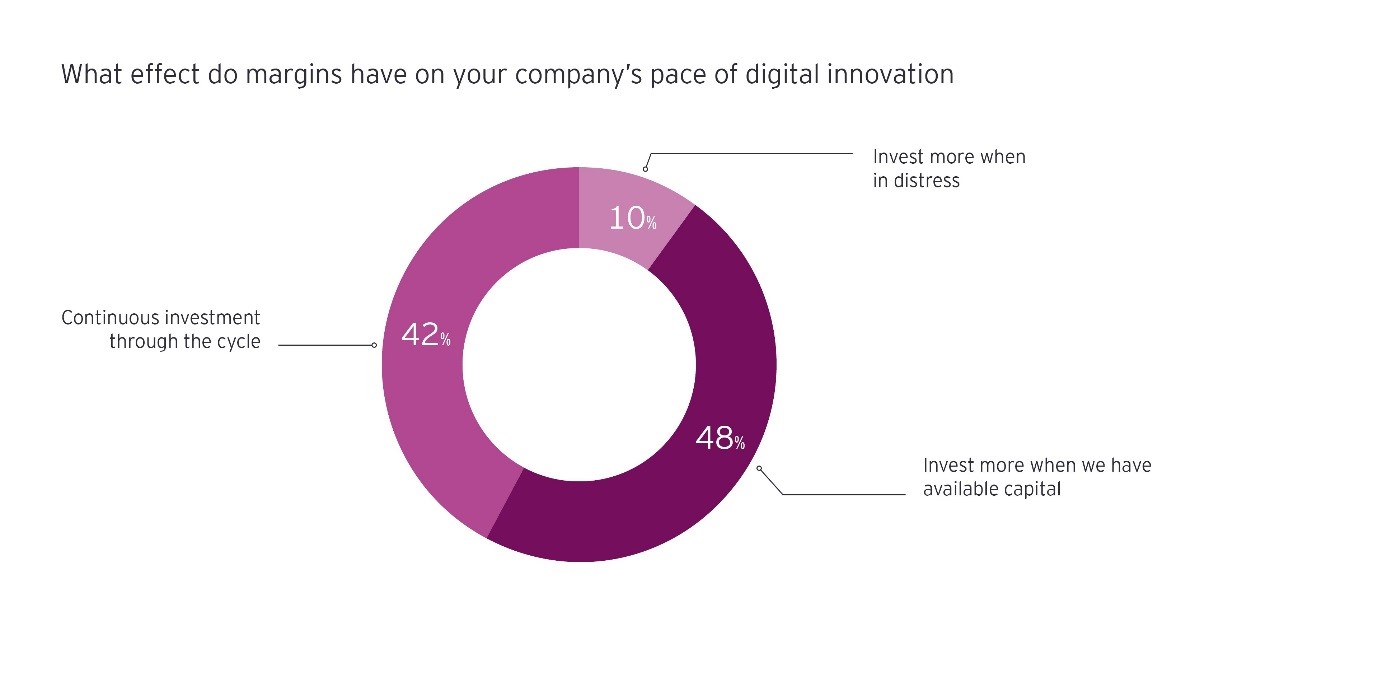

In addition, a plurality of respondents (48%) said their companies invest more in digital innovation when they have available capital. Given the recent period of higher energy prices, this may help explain respondents’ stated intention to boost investmentin the coming years.

According to Keith Strier, EY’s global and Americas consulting leader for artificial intelligence, digital technology has the potential to offer much more than better efficiency. And to achieve more ambitious targets, companies must be willing to aim higher. “If the goal is just to extract efficiency, the sun is going to set on that objective,” he said. “If you ask the wrong question at the beginning of your journey, then you’re going to be aiming for the wrong target.”

Some companies are beginning to acknowledge that the argument for adding capabilities via digital tools is compelling. One executive at a US E&P company said the ability to obtain more detailed information than ever before represents a definite competitive advantage. Along with gaining the power for unprecedented and granular views into operations, digital technology provides access to better supporting information for strategic decision-making.

Aligning all parts of the business machine

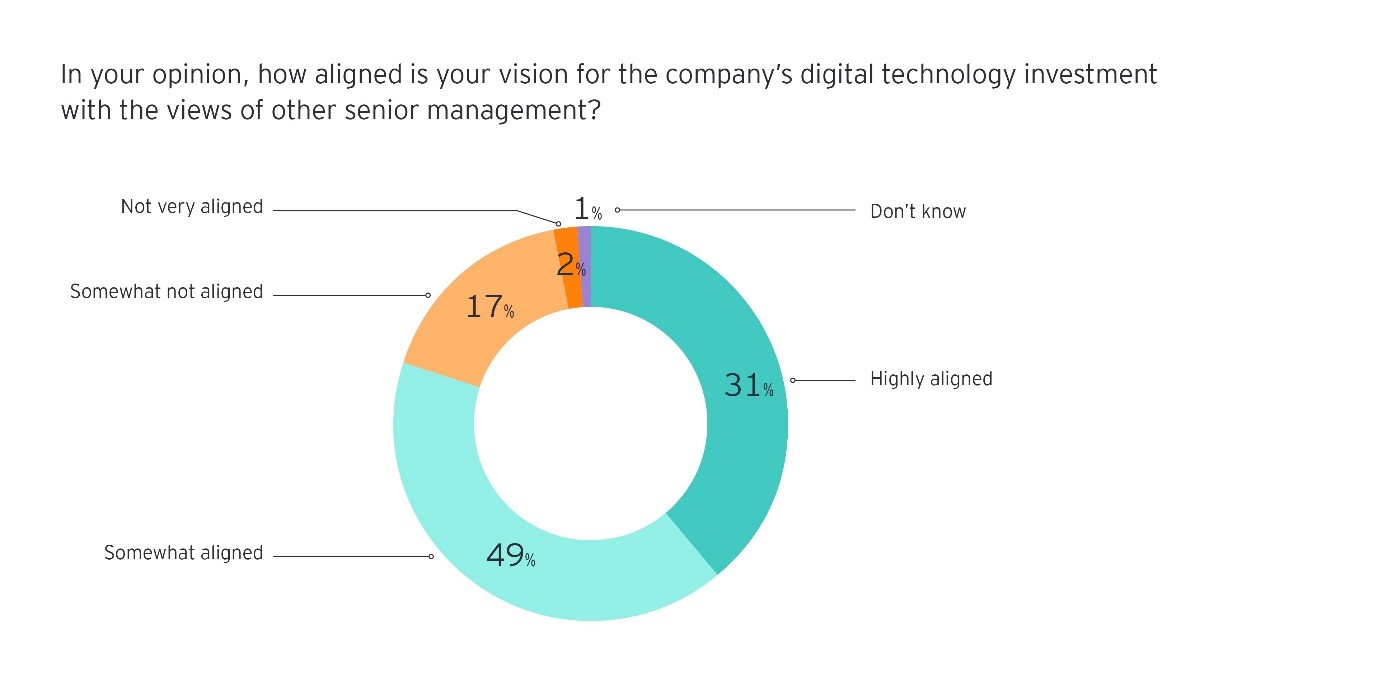

For many firms, however, rising to new heights will require resolving internal conflicts regarding digital strategy. This suggests that more often than not, there is some measure of disagreement among senior officials regarding digital strategy.

According to EY senior manager Kanishka Banerji, a major part of leveraging digital from a C-suite perspective is to introduce capabilities and unlock value in a way that may have not been possible in the past. “Digital typically allows you to unlock upwards of 30% of value within only a few years. When done right, a company is going to leapfrog what others are doing because of digital,” he says. “It introduces new capabilities and allows you to work in new ways, unlocking significantly more value than you would get through traditional operational excellence or continuous improvement initiatives.”

Thankfully, the benefits of new technologies often extend beyond the balance sheet. Safety improvements, for instance, tend to make a positive financial impact as well, whether from reduced workers compensation payouts thanks to a lower accident rate or from avoiding the cost of refinery repairs due to better monitoring of equipment, among other measures.

Chapter 2

Is technology your strategy or starting point?

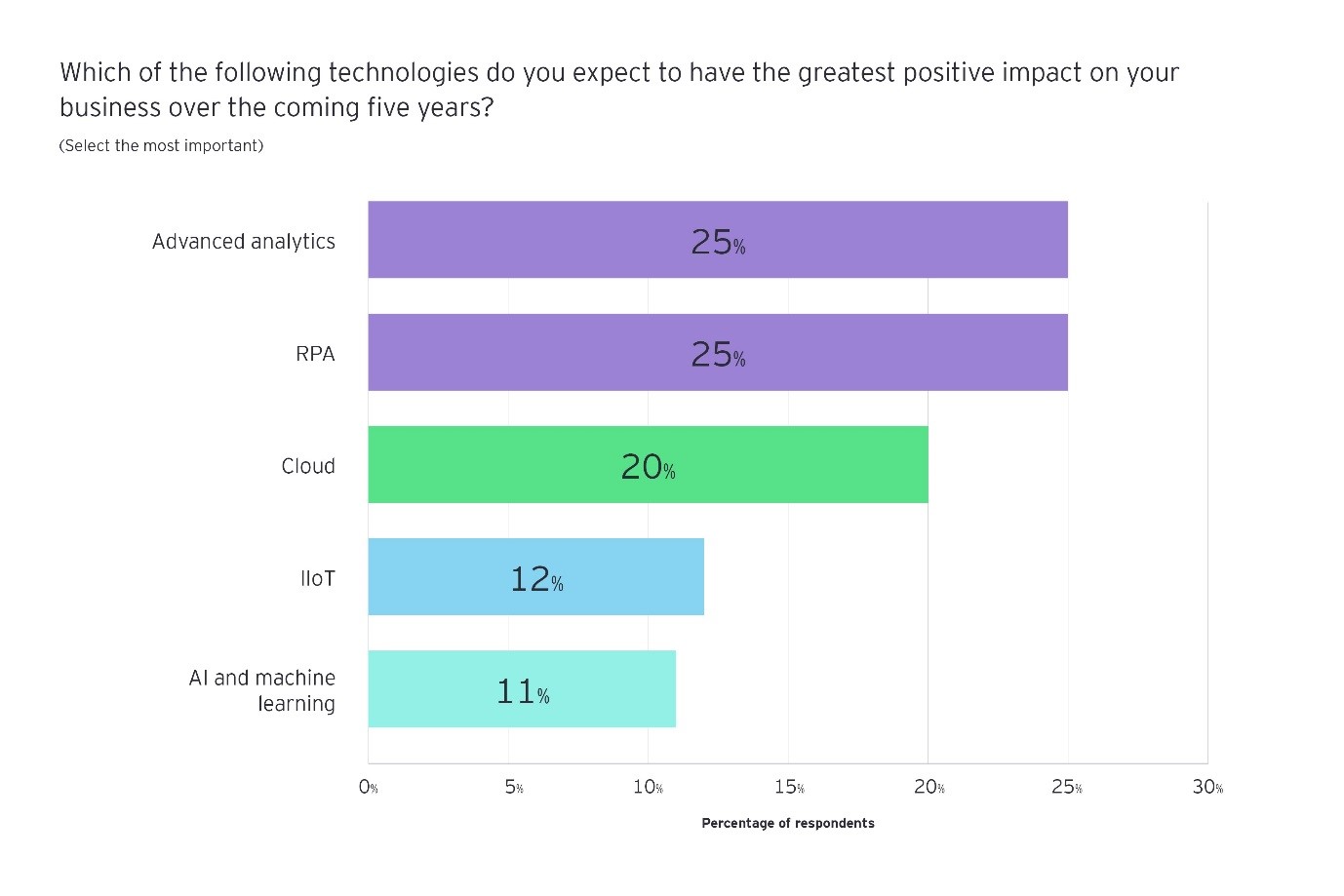

See which digital technologies are expected to have the greatest positive impact on respondents’ businesses.

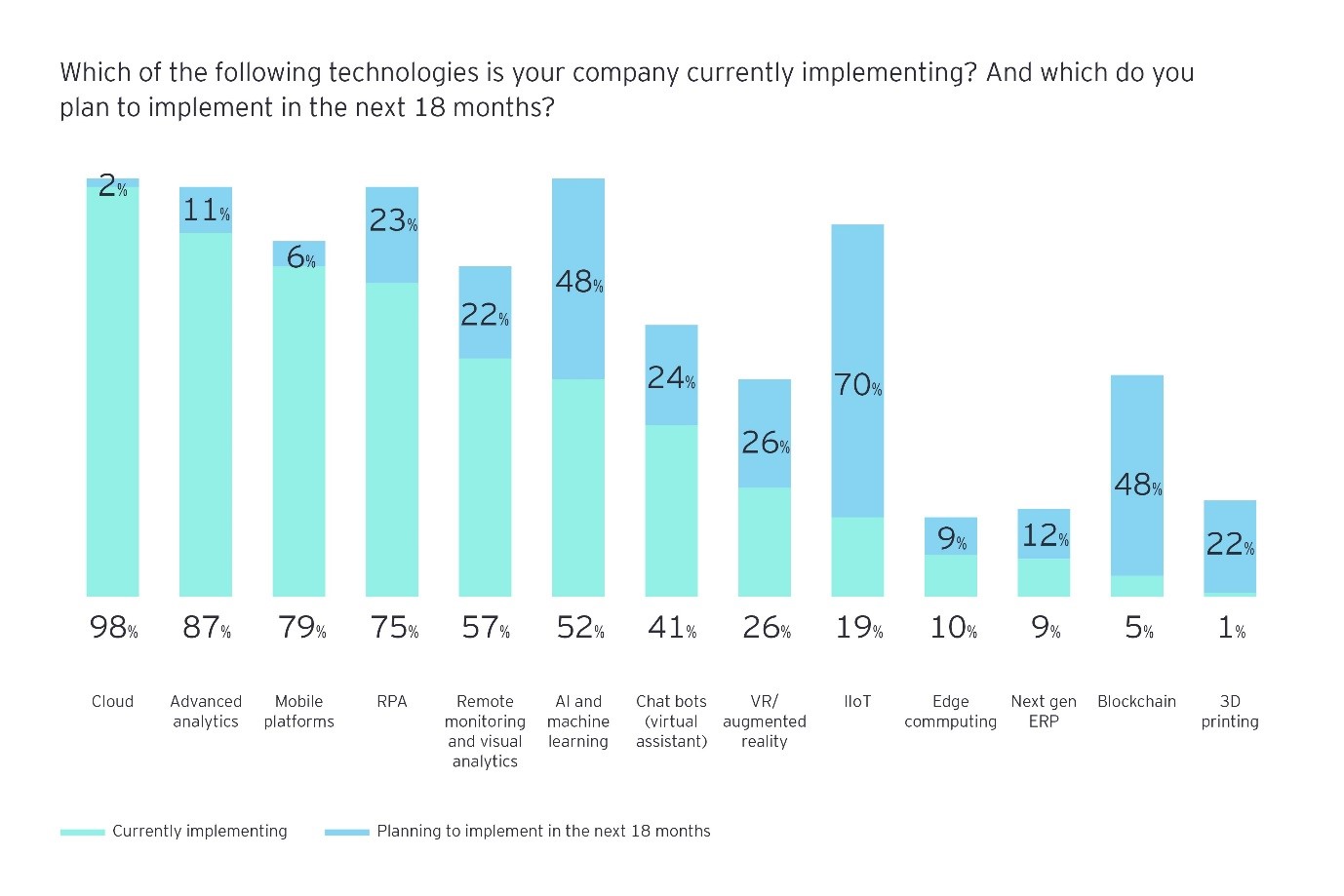

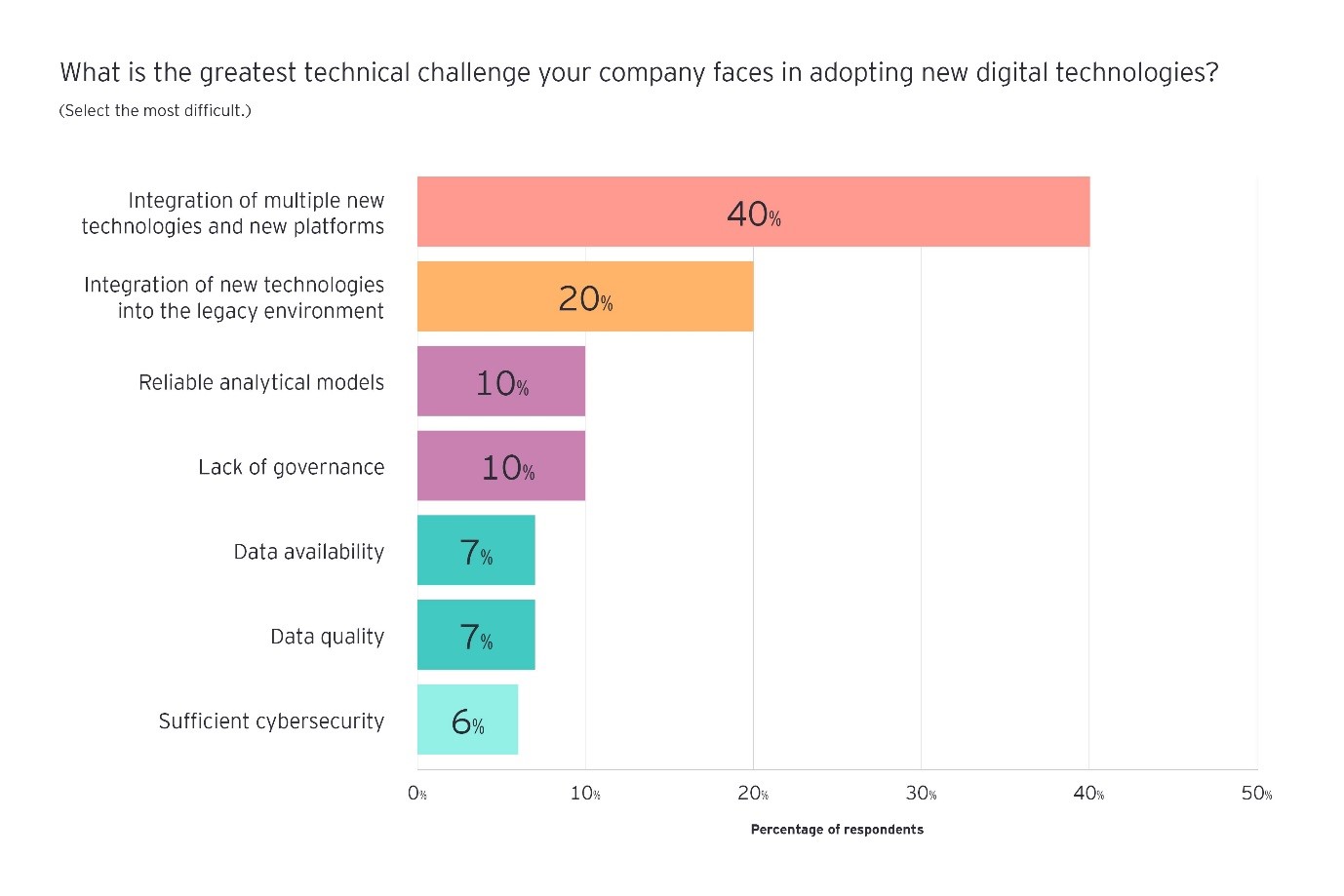

Oil and gas players are increasingly looking to digital technology as a means of boosting productivity and gaining competitive advantages. In order to gain a fuller picture of companies’ strategies regarding these technologies, we asked them which ones they are in the process of implementing, as well as which they will implement in the near future. We also polled companies as to the perceived positive impacts and negative risks surrounding these tools.

The future will be automated

When it comes to the digital technologies expected to have the greatest positive impact on respondents’ businesses over the next five years, robotics process automation (RPA) tied for the highest. In addition, 75% of those polled regarding which technologies they are in the midst of implementing cited RPA.

EY’s Strier attributes the relatively high adoption score for robotics technology to management’s pre-existing familiarity with it. Among the many companies already making use of robotics, oilfield services giant Schlumberger is testing a robotic drilling rig it believes will cut man-hours by 30% and reduce the amount of time required to complete a land well by the same percentage.3

However, Strier emphasized that the complexity can grow exponentially as the tasks become more challenging. “When you start layering on more advanced forms of automation using AI, computer vision and natural language processing, then you're not using rules – you're aiming for human-like cognition. And that follows a completely different path than the traditional enterprise IT,” he said.

Value is attained by stitching tools together to solve specific business problems. Inevitably, the right answer is not going to be a robot or an algorithm, it's going to be a combination of the two.

Connected systems to bring rewards—and risks

A significant plurality of respondents named the IIoT—which allows companies to transform their management of assets using predictive solutions deploying big data—as the riskiest of any technology. According to EY’s Ene, it is viewed in some quarters as a potential “Pandora’s Box,” due to the fact that it connects systems dating back to the 1980s and 1990s with newer ones.

While the older systems may have been initially secure because they were operating autonomously, Ene says tapping into that data now requires opening a data pipe that could raise cybersecurity issues. “When it was working in splendid isolation it was fine, but how are you going to build a wall around it so you’re not jeopardizing the entire platform?” she said.

The sky-high potential of cloud

Among respondents, 20% predicted the cloud would have the greatest impact on their business over the next five years. Cloud also figures most strongly among all technology types that companies are currently implementing, with 98% citing it as a tool they already use.

Cloud applications have attracted considerable interest, with tech giants such as Google and Microsoft partnering with oil companies over the past year to deliver cloud solutions to the oil and gas industry. For instance, Norwegian oil company Equinor, formerly known as Statoil, announced a tie-up with Microsoft in June 2018 with the aim of accelerating the development of “fit for purpose” IT services.4

Above all, companies should be thinking about technologies holistically, according to EY’s Strier. “Value is attained by stitching tools together to solve specific business problems,” he said. “Inevitably, the right answer is not going to be a robot or an algorithm, it's going to be a combination of the two. You're going to have a few bots, some machine learning algorithms, some data models, some machines, and they're all going to be working together.”

“The narrative is beyond the tool,” Strier continued. “It's really about the integration of the full spectrum of technology.”

EY's Canada’s National Oil & Gas Strategy Services Leader, Lance Mortlock agrees: "The question is less about which technology to use and more about how technology enables the business process and the people capabilities”

Upgrading key links in the value chain

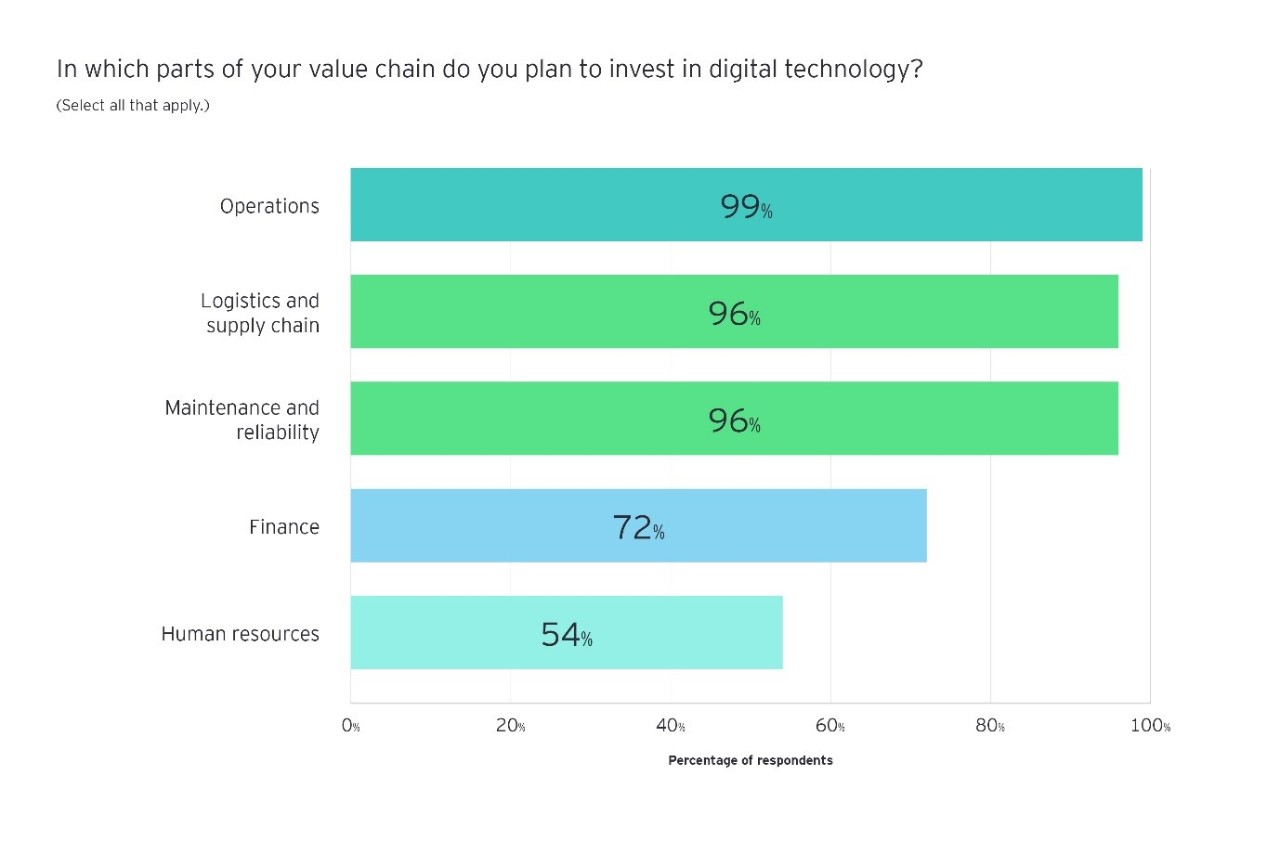

For a majority (55%) of our survey respondents, the key priority for investment in the value chain is operations. It should come as little surprise that operations are the main focus for companies in the industry – they represent the biggest cost center, and therefore a prime target for seeking efficiencies. Indeed, the key attraction of digital technology for many oil and gas firms is the opportunity to scale back their reliance on costly and time-consuming manual operations.

Take the unconventional oil sector. In traditional land-based operations in the US, operators spend an enormous number of man-hours at the well site. The time and expense associated with this manual activity has led some operators to use remote operation centers (ROCs), which utilize sensors to provide data about the operation of wells. Operational risk is also substantially reduced by ROCs, which can continuously monitor all of the locations to ensure that wells and facilities are operating smoothly without production problems or leaks.

Norwegian producer Equinor has launched a number of ROCs in recent years, and in November 2017 it opened its first control room for complete remote operation of an offshore rig, the Valemon platform in the North Sea. “In new field developments, oil and gas production will, to an increasing extent, be carried out from unmanned, robotized, standardized and remote-controlled installations,” said Equinor COO Jannicke Nilsson in announcing the opening of an integrated operations support center in Bergen in March 2018.5

Ultimately, a strategic approach is usually best when considering investment strategy in the value chain, since efforts at change often impact multiple areas of the business. For instance, those same ROCs can afford opportunities for oil and gas companies to improve their human resource development, given the reduced use of on-site labor. Fewer crews manning rigs equates to a better use of human resources to focus on value-added optimization activities.

Moving beyond operations

Secondary priorities in the value chain are maintenance and reliability (25%) and logistics and supply chain (19%) – but 96% of respondents are planning to invest in these two areas as well. Less attention is being paid to finance and human resources, though a majority said they would devote at least some capital to these areas.

According to EY’s Ene, blockchain could give national oil companies (NOCs) genuine traceability of their goods. “NOCs want to develop their own countries, so local content is important. And by using blockchain, everything is visible to everybody,” she said.

From production down to refining

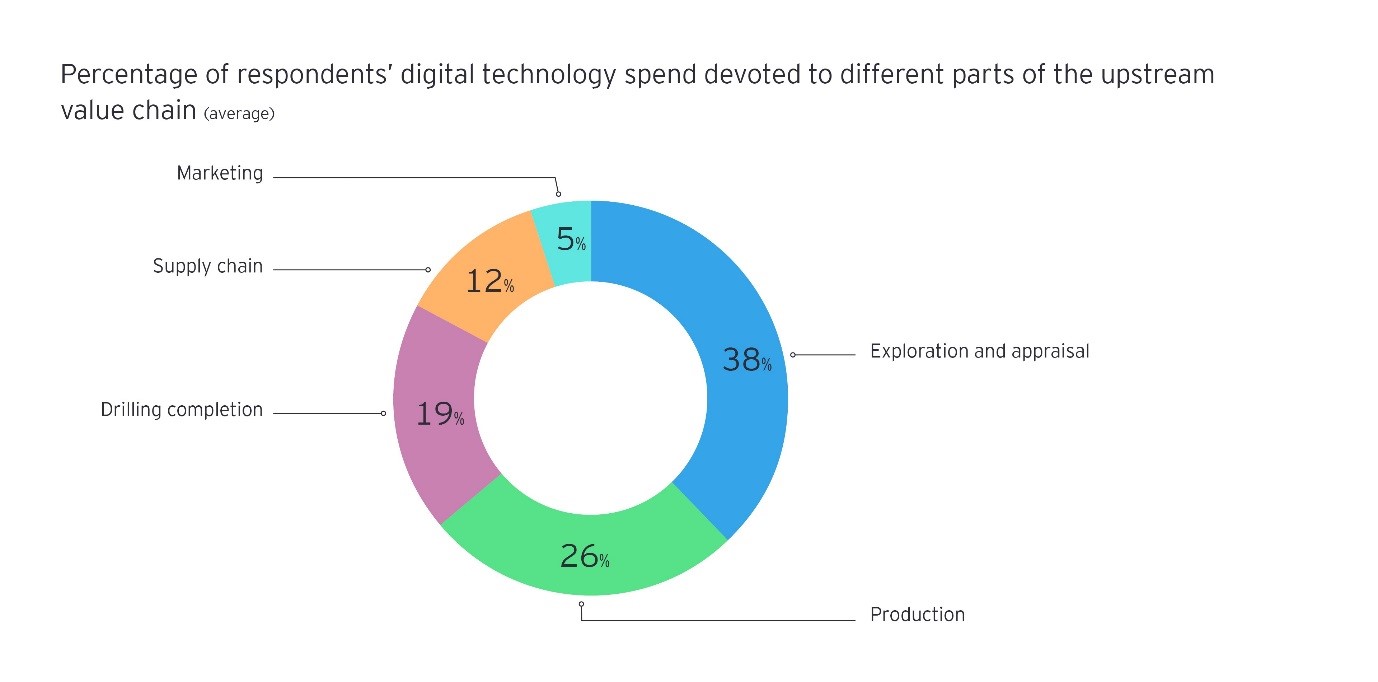

Within the upstream value chain, the highest average proportion of respondents’ spending on digital technology goes to exploration and appraisal (38%). Production was next highest at an average of 26% of respondents’ total expenditures, followed by drilling completion at 19%.

One executive at a Canadian integrated oil company said they were focused on upgrading areas that had received less capital historically. “Activities like trading, marketing and retail are already supported by digital tools, such as automated data analytics. Now we need to prioritize investments for refining, processing, storage and transport activities, where the coming crop of technologies can address key issues.”

Chapter 3

Will projects be measured in bot-hours or man-hours?

Explore the methods respondents are using to access new technologies.

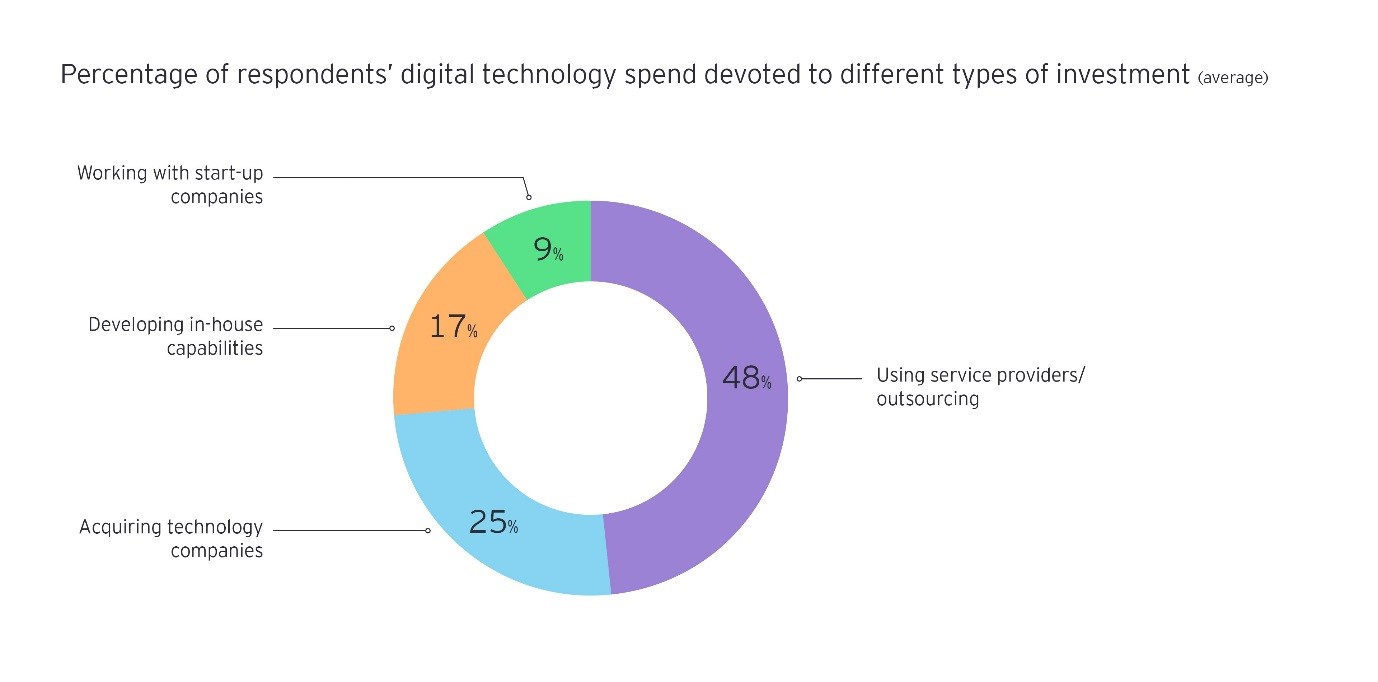

One crucial part of creating a digital roadmap in oil and gas is choosing the means of transport – that is, how exactly you will travel the path to an advanced future. The types of investment chosen by companies play an important role in navigating this path.

“I believe it’s a healthy sign that companies recognize they don't need to develop everything in-house,” said EY’s Ene. “The beauty of the new digital wave is that nobody is going to lose their job because they tried a certain technology for a project. The tools are much, much cheaper than they used to be, so it's okay to try something and have it fail. You just move on to the next big project.”

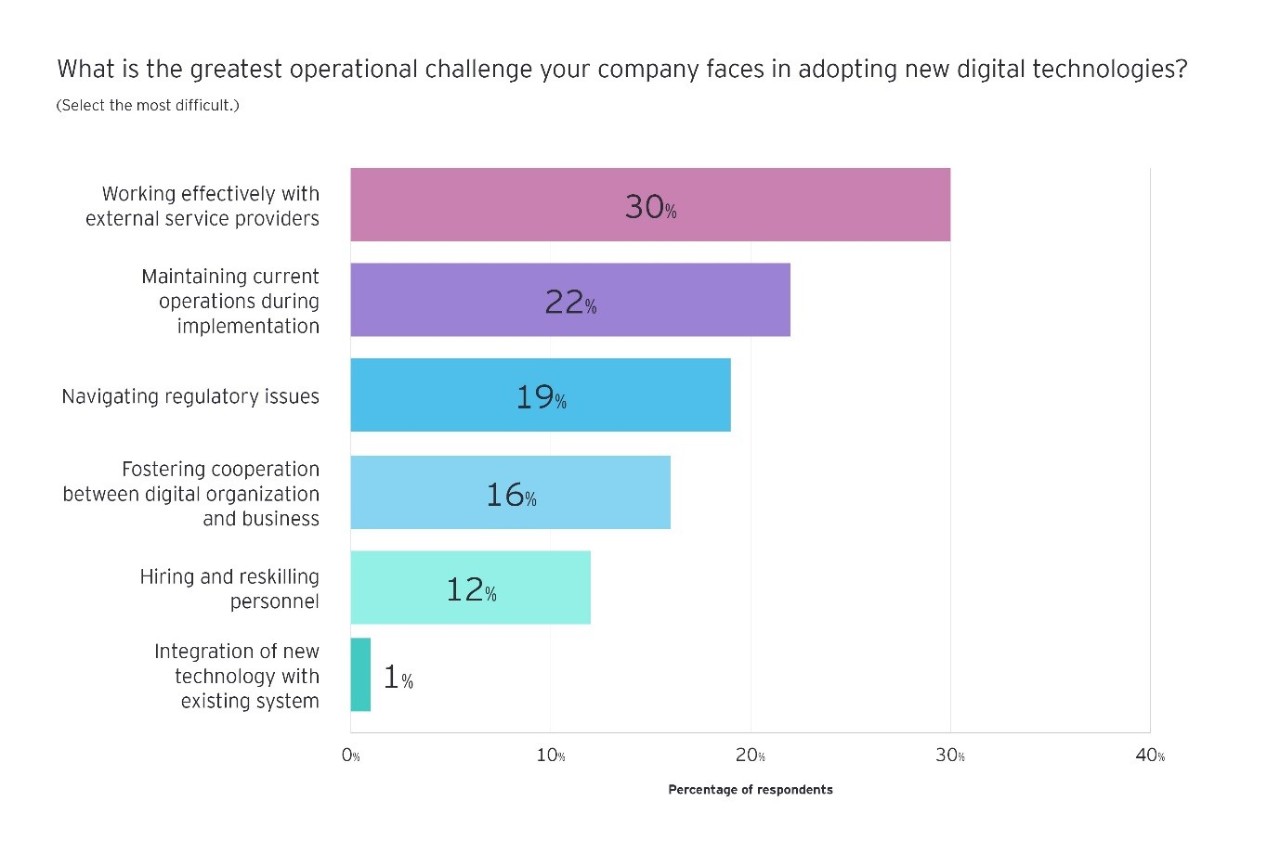

In this new environment, one of the bigger challenges becomes deciding when to make a more significant investment in a given area. Among our survey respondents, 41% said obtaining alignment on the digital roadmap from the executive team and the board of directors was another key strategic problem they faced.

“I think there is still a lack of confidence at various senior executive levels about which technologies deserve the most attention,” said EY’s Strier. "Early adopters that like to be out front will take the plunge, but if you're a more cautious company and you've been in the business for decades, management wants to make sure they will achieve value with a given investment.”

Outsourcing can work in the beginning, but, ultimately, companies need to build in-house capabilities. Service providers are good to get started, but you need to own your own model. Digitalization at the end of the day will become a top-line priority.

Barriers to integration

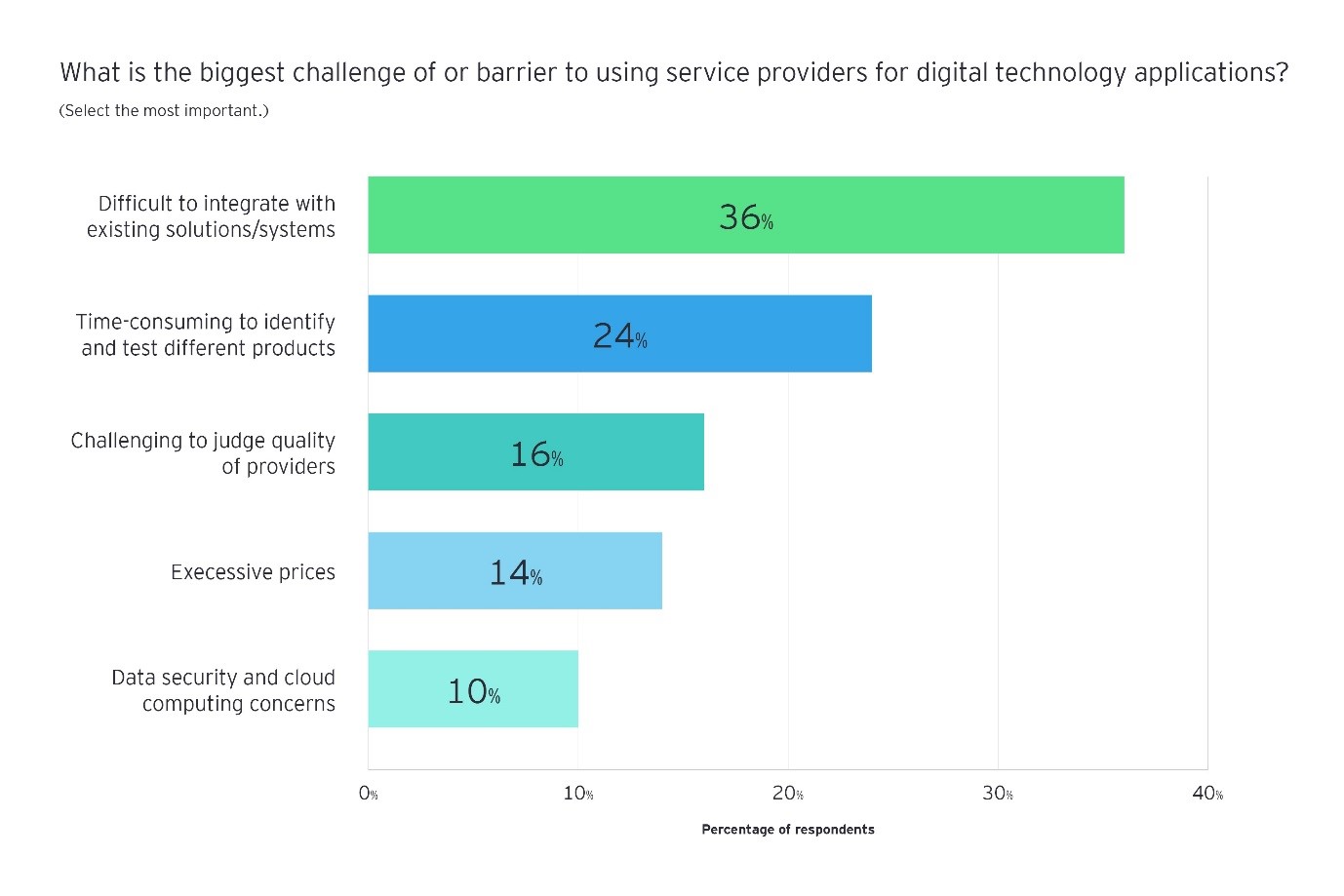

36%According to our survey, the biggest barrier is the difficulty in integrating new tools with existing solutions and systems, cited by 36% of respondents.

Maintaining speed on a steep learning curve

There are also significant hurdles to bringing in outside providers. According to our survey, the biggest barrier is the difficulty in integrating new tools with existing solutions and systems, cited by 36% of respondents.

The ‘aggregators’ of new technology

Service providers are not the whole story when it comes to adopting new technology, however – and splitting up the investment pie is no easy task. A plurality of our respondents (50%) said that finding the right balance between different types of investment represented one of the top two strategic challenges they face in adopting new technologies.

On average, our survey participants said they devote 25% of their technology investment to acquisitions, and some companies – especially the majors – certainly are using M&A to expand their capabilities. Oilfield services and industrial giants such as Halliburton, Schlumberger and ABB Group in particular have been determined buyers, acting as “aggregators” of emerging technology.

In one recent deal, Schlumberger acquired Norway-based Wellbarrier, a privately owned software company that uses a patented tool to create illustrations of well barriers, for an undisclosed sum in July 2018. Integrated oil and gas companies are making transactions as well – for instance, French major Total announced in June 2018 its acquisition of WayKonect, a French developer of fleet management software.

For the majors, developing in-house capabilities is also a realistic endeavor, and can pay serious dividends. The greatest advantage our respondents cited in developing in-house technology is fostering an internal culture of innovation (39%).

For example, Anglo-Dutch major Shell sees innovation and technology as vital to providing a wider, more sustainable mix of energy resources for the world’s growing population. Shell currently spends around US$1bn a year in R&D to turn ideas into commercially viable technologies. The majority of Shell’s research focuses on the near term, to help their existing businesses to reduce capital and operating costs, to enhance customer products and services, and to commercialize technologies for the transition to a low-carbon energy future. Shell operates a global network of technology centers, with major hubs in Houston, Amsterdam and Bangalore.6

In some cases, however, the costs of creating new tools in-house outweigh the potential benefits. Specifically, our survey respondents cited downsides such as long delivery timelines (24%) and a prohibitive cost of investment (22%).

The all-important human factor

Whether a company focuses on building relationships with service providers or creating technologies from the ground up, human resource issues are key.

“For all these brilliant technologies, it’s really about how you engage your existing employees and how you make yourself attractive for the newer generations coming in,” said EY’s Ene. “In plain words, how are you going to make oil and gas attractive for recent graduates? How are you engaged in recruiting the young population?”

EY’s Williams agrees. “A digital company starts with the people. They have to not only be digital, but they have to work digitally.”

This reinforces the fact that despite the rise of automation, the human factor remains crucial to digitization in the industry.

Conclusion

The oil and gas industry’s ardent pursuit of efficiency is not about to recede in tandem with the strengthening of the commodity price climate. The focus on cost is hard-wired into corporate DNA after more than three years of low prices forced executives to take a scalpel to spending commitments. The efficiency agenda is shaping how the industry views technology investment and what potential application it should have.

Summary

Digital is about improved, more effective, faster decision-making. To get there you need to leverage technology, connectivity and data in an effective way. Breaking silos across the value chain is a useful way to make those integrated, better informed, value-adding decisions.