A vigorous debate about how to use revived cash flows is sure to ensue as companies face the choice between returning cash to shareholders, investing in the core hydrocarbon business and growing emerging alternative energy ventures.

Several analysts questioned companies’ plans to split the capital return between dividends and buybacks. Some pointed out that the market recognizes more value through dividends than buybacks and inquired if companies were willing to align their shareholder return strategy with that observation. Recognizing that most companies were able to bring down their net debt levels significantly over the past two quarters, analysts wanted to get a view of how low debt levels might go before companies begin to see themselves as under-levered and begin to return even more cash to shareholders. As companies grapple with low unlevered returns on renewable energy investments relative to oil and gas projects, the matter of gearing is likely to re-emerge.

Macro considerations

On capital spending, analysts were interested in companies’ response to the improving macro-environment, specifically whether they were considering mobilizing additional upstream investment with commodity prices returning to pre-COVID levels. Supply chain interruptions, labor market shortages and inflation concerns have begun to take center stage in economic news, and oil and gas industry analysts checked for signs of pricing pressure in the market for materials and services upstream and indications of how companies plan to offset the impact. In the wake of consecutive quarters of disappointing downstream results, analysts were looking for confidence in an improving refined product demand outlook and recovery in refining margins. In the companies’ emerging renewables businesses, analysts shared a desire for more insight into financial results, capital investment and financial structure. Clearly, skepticism remains regarding the ability of oil and gas companies to compete in a field where they have never played.

The decarbonization issue

From a strategic standpoint, decarbonization and the pipeline of renewable projects across different geographies and technologies were in focus. Analysts recognized that different policy frameworks across geographies could act as a deterrent to growing the renewables business and probed companies to understand how they plan to overcome those challenges. The companies were also questioned on how they intend to balance economic returns of new oil and gas projects with their carbon emission profile.

Analysts recognized that different policy frameworks across geographies could act as a deterrent to growing the renewables business and probed companies to understand how they plan to overcome those challenges.

Analysts were also keen to understand how companies felt about the recently announced EU Fit for 55 program and its potential impact on their business. Analysts were also keen to understand how IOCs and NOCs were responding to programs (like EU Fit for 55 program and Shareek program in Saudi Arabia) to encourage diversification. On portfolio optimization, analysts checked to see if companies were interested in pursuing mergers and acquisitions or reconsidering their upstream asset divestment plans. Apparently, renewed strength in oil and gas prices has triggered a re-examination of petroleum’s place in these companies’ portfolios.

Operational questions

Operational questions were guided by analyst curiosity around companies’ production outlook in the medium to long run, and the contrast between IOCs and NOCs upstream capital commitments was apparent. In other matters, analysts showed a typical interest in the pipeline of projects, and several companies were asked about their level of activity in the Gulf of Mexico and their long-term plans for the US shale plays.

Looking forward

Demand recovery remains a question mark, but OPEC+ discipline continues to hold, oil prices are expected to remain firm and excess supply in global gas markets is a low risk. Refining margins will face offsetting pressures as an improved demand outlook is offset by growth in refining capacity.

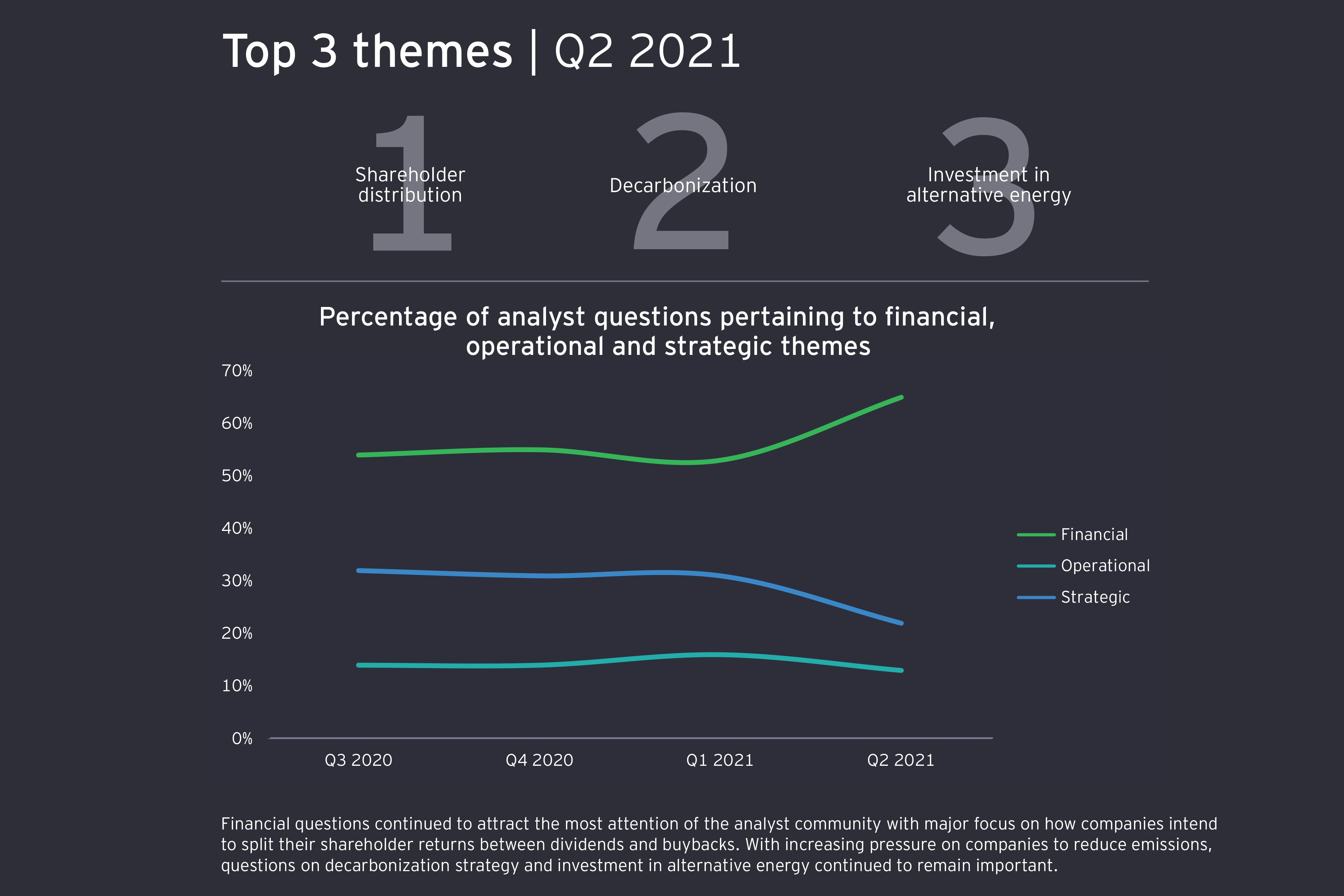

Cash distribution, decarbonization strategy, the performance of renewable projects and the lifespan of the core business will continue to remain focus areas for investors.

Summary

Oil and gas commodity markets continued to recover in the second quarter of 2021, but questions remain about what companies will do with their improved cash flows.