Chapter 1

Breaking with the past to reinvent the future

Distribution utilities can adapt to the unrelenting pace of multi-faceted change.

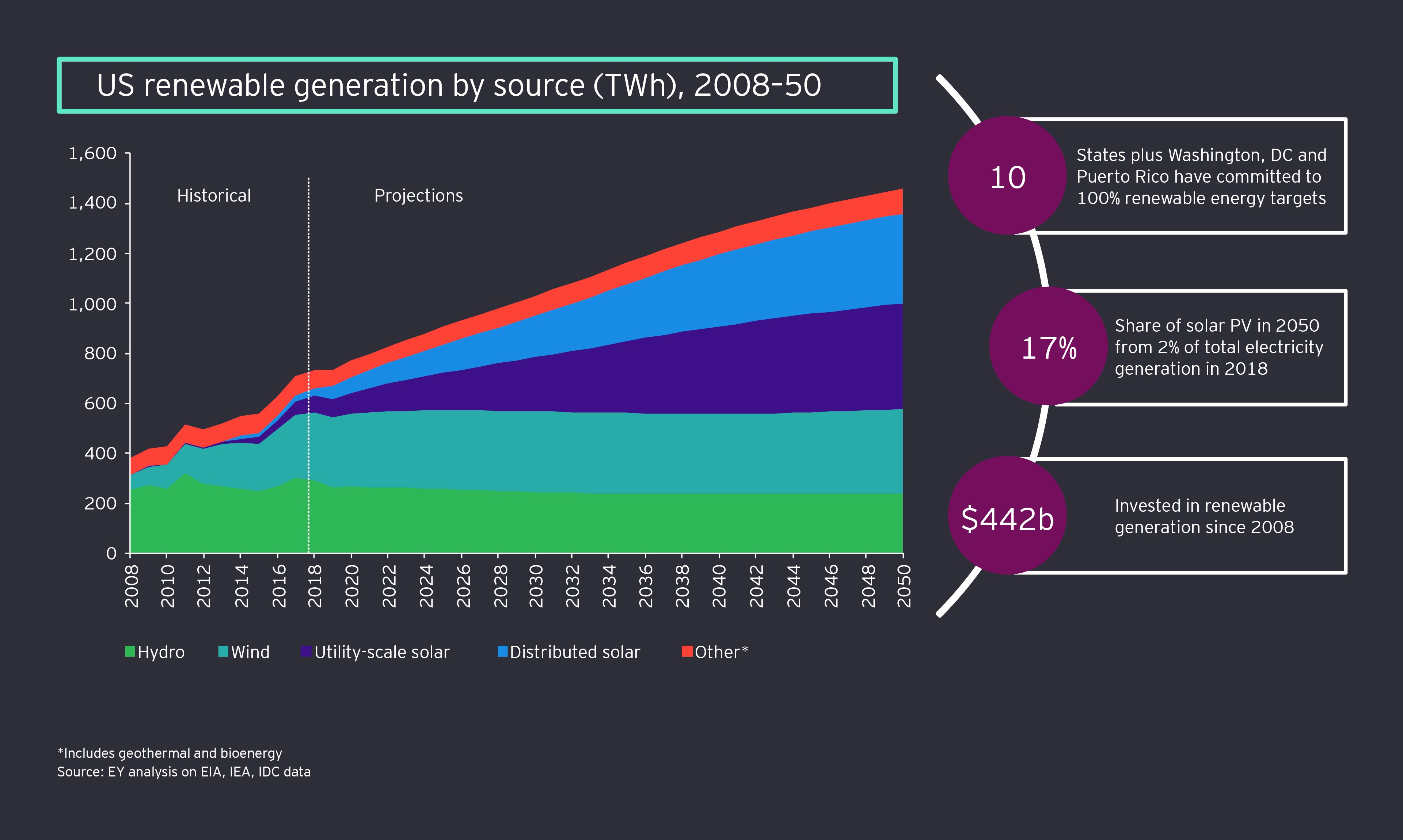

Across the US, there is growing enthusiasm for a clean energy future. Ten states2, more than 100 cities3 and several top US corporations4 have committed to 100% renewable targets since 2018.

On the generation side, utilities are making progress on transforming the electricity mix to favor renewable energy sources and natural gas. “If you don’t prepare the grid for the future, once you get to the future, it’s too late. You end up playing catch-up,” says Lee Mazzocchi, Senior Vice President, Grid Solutions, Duke Energy.

Following in the footsteps of Xcel Energy, the first major US utility to commit to 100% carbon-free electricity by 2050, others are pledging stronger action on climate goals.5

If you don’t prepare the grid for the future, once you get to the future, it’s too late. You end up playing catch-up.

The direction of travel is encouraging. US carbon dioxide emissions from electricity generation fell 26%6 between 2008 and 2018. It is mostly a consequence of the shale-gas revolution and switch from coal-fired to cleaner natural gas-fired generation. But natural gas now ranks as the number one source of electricity generation in the US and is expected to retain that status through 2030.

The real shake-up, however, will come from non-hydro renewables. By 2050, solar and wind energy will account for one-quarter of the US generation mix, up from 9% today.7

And growing numbers of customers are getting on board with increasingly affordable renewable energy technologies, such as rooftop solar plus storage. For them, “saving money in the long run,” rather than reducing their carbon footprints, is the big motivator, found a 2019 EY study.8

Now is the time for distribution utilities to take action. Over the next decade, a massive acceleration in DER take-up is expected, which will have an inexorable impact on the way energy is generated, consumed and traded in the US. In fact, by 2030, at a compound annual growth rate (CAGR) of over 10%, distributed solar will produce 165 terawatt hours (TWh) of electricity.9 Battery storage, microgrids and EVs will also experience double-digit CAGRs over this period.

Evolving and digitizing the grid to channel these growing volumes of DERs warrants some serious investment. Aging infrastructure needs to be replaced, maintained and upgraded. The energy system must be hardened against more frequent and intense US weather events and made more resilient to the probability of cyber attacks.

The priority remains to provide safe, affordable and reliable electricity supply. But there are growing challenges around peak capacity planning and matching power supply from variable energy resources, such as solar and wind generation, to changing load profiles.

And the challenges become exacerbated with disruption behind the meter. For instance, simultaneous EV charging will create unpredictable loads on the system that could lead to demand surges and supply shortages in some neighborhoods.

Clarity is what delegates at the Denver workshop most want. They asked us: “How do we know what connections are going to be added; or when EVs are going to charge; or when rooftop solar will be generating so that we can just get on with balancing our electricity flows at the local level?”

Tackling all of these challenges, and the complexities they create, coincides with:

- A looming depression in utilities’ top-line revenues

- Loss of load from growth in distributed generation

- Slow regulatory progress, in some states, on participation in behind-the-meter (BTM) activities that could deliver alternative revenue streams

- Energy-efficiency programs — in 2017, utility programs saved enough electricity to power 22 million US homes for a year10 — which conflict with distribution utilities’ commercial objective of selling more electricity

There will be rewards, of course, not least from the electrification of transport, buildings and heating. The National Renewable Energy Laboratory (NREL) estimates that electricity consumption in the US will increase between 21% and 41% by 2050.11 This promises to offset, to some extent, revenue losses from energy-efficiency programs and distributed generation. Future success, however, will not be found in traditional activities but in pursuit of greater responsibilities and alternative revenue streams.

Related article

Chapter 2

Finding the right fit in the energy future

Distribution utilities will take on new responsibilities and explore alternative revenue streams.

Bidirectional flows on an aging one-directional network, rapid DER participation in the wholesale electric markets and congestion, peak load and power quality issues at a local level — all risk destabilizing the electricity system.

We see massive change coming. The last frontier is optimization — being the entity that knows where energy is needed and becoming the connector with the people who have that energy.

Equally, however, they create opportunities for distribution utilities to assume more significant responsibilities. “We see massive change coming. The last frontier is optimization — being the entity that knows where energy is needed and becoming the connector with the people who have that energy,” says Chris Kelly, Chef Operating Officer, National Grid.

This is their chance to drive future value. They can:

- Reduce the burden on independent system operators (ISOs) and regional transmission organizations (RTOs) that are currently tasked with ensuring DERs’ compliance with state-level regulations and local reliability needs

- Maneuver themselves to enable greater interconnectedness between the bulk and local electric systems

- Balance supply and demand by optimizing the downstream impact of DERs on the network

- Seek to reduce operational complexity and participate in BTM services, products and new innovations that will improve the customer experience

But they cannot achieve all this without acquiring new and enhanced capabilities to enable a data-driven, more timely, informed and responsive future electricity distribution system. Capabilities include:

- Integrated planning, to better identify and predict DER capacity and the likely impact on the distribution and transmission grids

- Asset management, supported by analytics, to achieve better visibility over network assets and enable timely interventions

- System operations, for enhanced situational awareness of DERs within the system

- System management, using real-time information for better scheduling and maintenance

- Flexibility management, to balance volatility in load and supply and enable a step-up in the future role of distribution utilities as neutral facilitators of markets and platform providers for innovation

- Commercial operations and customer management, to enable utility participation in alternative revenue-generating activities, such as EV charging, connected home and energy services, vehicle-to-grid services or peer-to-peer trading

Harnessing these capabilities and rebuilding business models — effectively enabling them to do more with stable revenues — will require distribution utilities to leverage long-standing relationships with stakeholders and earn their backing.

Chapter 3

A new energy world built on trust

Why earning trust and keeping it will determine industry outcomes.

Distribution utilities have one big advantage over other market contenders — decades of trust built with regulators, customers, investors, employees, vendors, partners and peers. Trust does not have a purchase price. “Public trust is with utilities, by and large, and that is something that can be leveraged for the future,” says a delegate at the Denver workshop.

Public trust is with utilities, by and large, and that is something that can be leveraged for the future.

Sustaining stakeholder trust in times of transition will earn support for, and investment in, those new and enhanced capabilities that are critical to deliver the clean energy vision.

Retaining customers’ trust might mean providing cleaner energy choices, more interactive experiences and safeguarding their data in the digital age. In return, distribution utilities can hope to earn customer approval as they transition to the new role of neutral market facilitators.

For regulators, it will mean demonstrating that innovations are designed in customers’ best interests, if they are to earn compensation through the rate base or other incentive mechanisms. One delegate at the workshop in Denver illustrates why trust is so critical: “At least three public utility commission rulings on grid modernization have been declined simply because they do not generate sufficient consumer-related benefits.”

Among business partners, investors and peers, trust will help inspire confidence in early-stage innovations and enable open and transparent sharing of data and ideas.

With existing and incoming employees, the concept of trust, particularly when endorsed at the board level and monitored and measured, can inspire security in the evolving direction of the business. It helps all employees to understand the value they contribute individually and the rewards they can anticipate, which generates, in turn, greater productivity.

By continually strengthening, maintaining and monitoring stakeholder trust, distribution utilities have a platform from which to launch the core principles that will underpin their evolving role and enable the future distribution system.

Trust sits at the heart of a successful growth strategy.

From today to tomorrow in three steps

How distribution utilities can transition to their future value-added state.

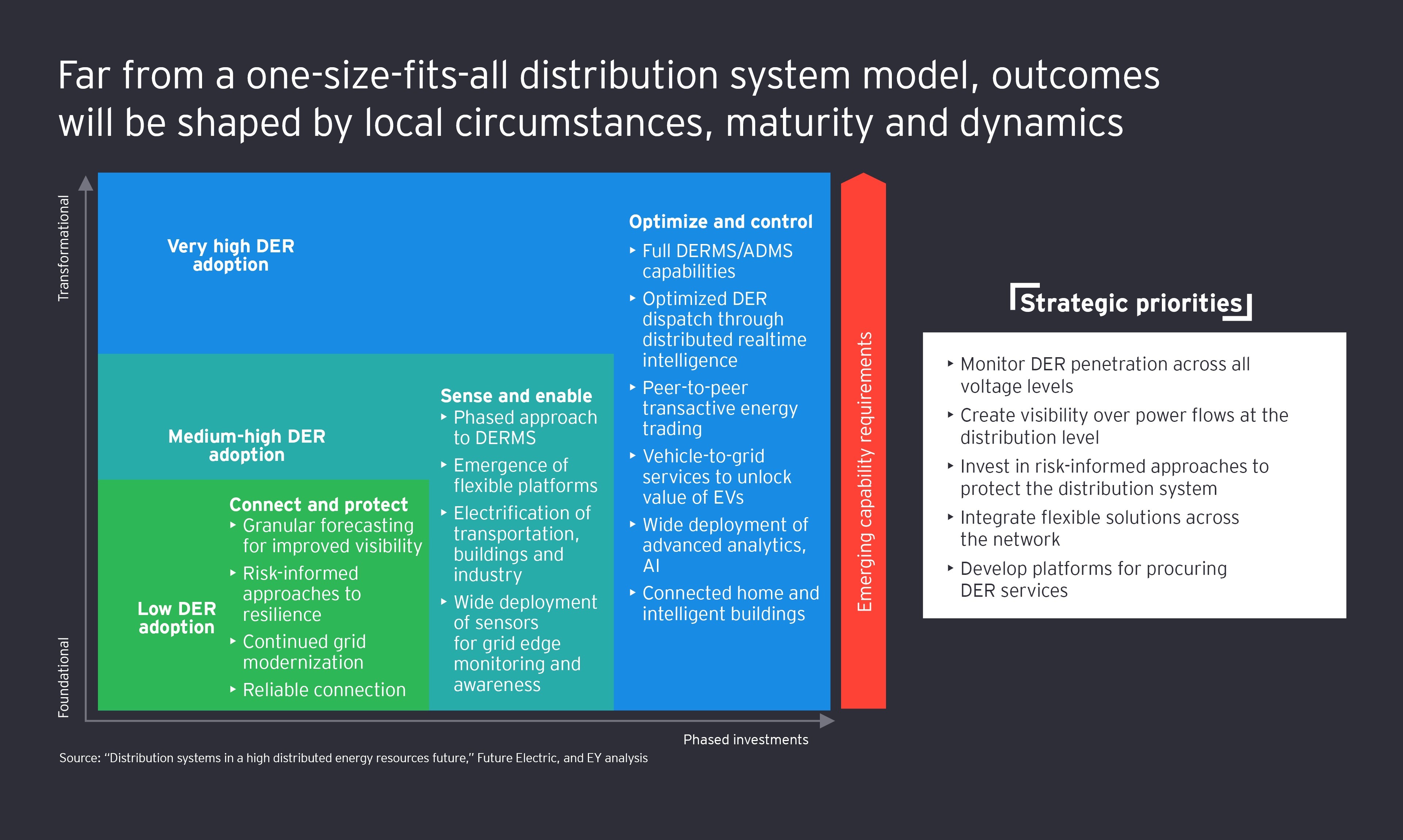

To deliver a more flexible, resilient and efficient grid, which grows with the evolving needs of tomorrow’s customer base, distribution utilities must embark on a three-phase investment and implementation journey. It will reflect the growing maturity and penetration of DERs in the US energy system.

Phase 1: Connect and protect

Utilities will need to begin investing in grid modernization and cybersecurity to integrate growing numbers of DERs without compromising local power reliability. In this phase, DERs will begin to provide essential backup during extreme weather events, with additional capacity coming from investment in grid-scale storage.

Phase 2: Sense and enable

Utilities also will need to begin investing in sensors to automate and control the network and to deliver situational awareness at the grid edge. As DER uptake accelerates, distribution utilities will invest in DER management systems (DERMS), either as stand-alone implementations or phased in to a broader advanced distribution management system (ADMS) strategy.

With situational awareness and real-time visibility over power flows, distribution utilities can prepare for their future role as neutral market facilitators and platform providers of flexible energy resources.

Phase 3: Optimize and control

As the US energy model grows in maturity and sophistication, and as DER penetration escalates, distribution utilities’ responsibilities will increase.

They will invest in advanced, real-time management and control of local DERs. They will operate a platform for transactions in energy-related commodities and innovative products and services. And, by streamlining and securing reliable power supply, utilities will become trusted orchestrators of the electricity distribution system.

This three-phase journey may be concurrent and will be continuous, with most distribution utilities fully engaged in phase one, some contending with phase two, and a few testing some of the capabilities that will be needed in phase three. However, there is no definitive template for distribution utilities to follow across the patchwork of 50 states, each characterized by distinct levels of energy resource maturity, regulation and income disparity.

The disruption and transformation in energy is significant and irreversible. There is no time for distribution utilities to wait and see how things go. Renewables, EVs, DERs, digital platforms and technologies are already entering the mainstream; traditional resources are being retired; and business models are being tested. Now is the time for distribution utilities to take action and accelerate their future.

Those that discover the upside and drive the transition agenda will emerge as orchestrators of a distribution system that is fit for an evolved, digitized and clean energy world.

Summary

A seismic shift toward a clean energy future is underway in the US. Distribution utilities are undergoing a corresponding upheaval of their own. They are being tested by the opportunity to become orchestrators of an intelligent and interconnected electricity system. As they take on more significant roles and responsibilities, distribution utilities must acquire the capabilities to accommodate the hastening pace and magnitude of the energy transition. And for that, they must leverage their long-standing reputations and stakeholder trust. But they cannot delay.