- 2019 was lackluster year for IPO activity with deals and proceeds down overall

- Technology sector dominates with 263 IPOs raising US$62.8b in 2019

- 2020 expected to see more robust IPO activity, particularly in the first half of the year

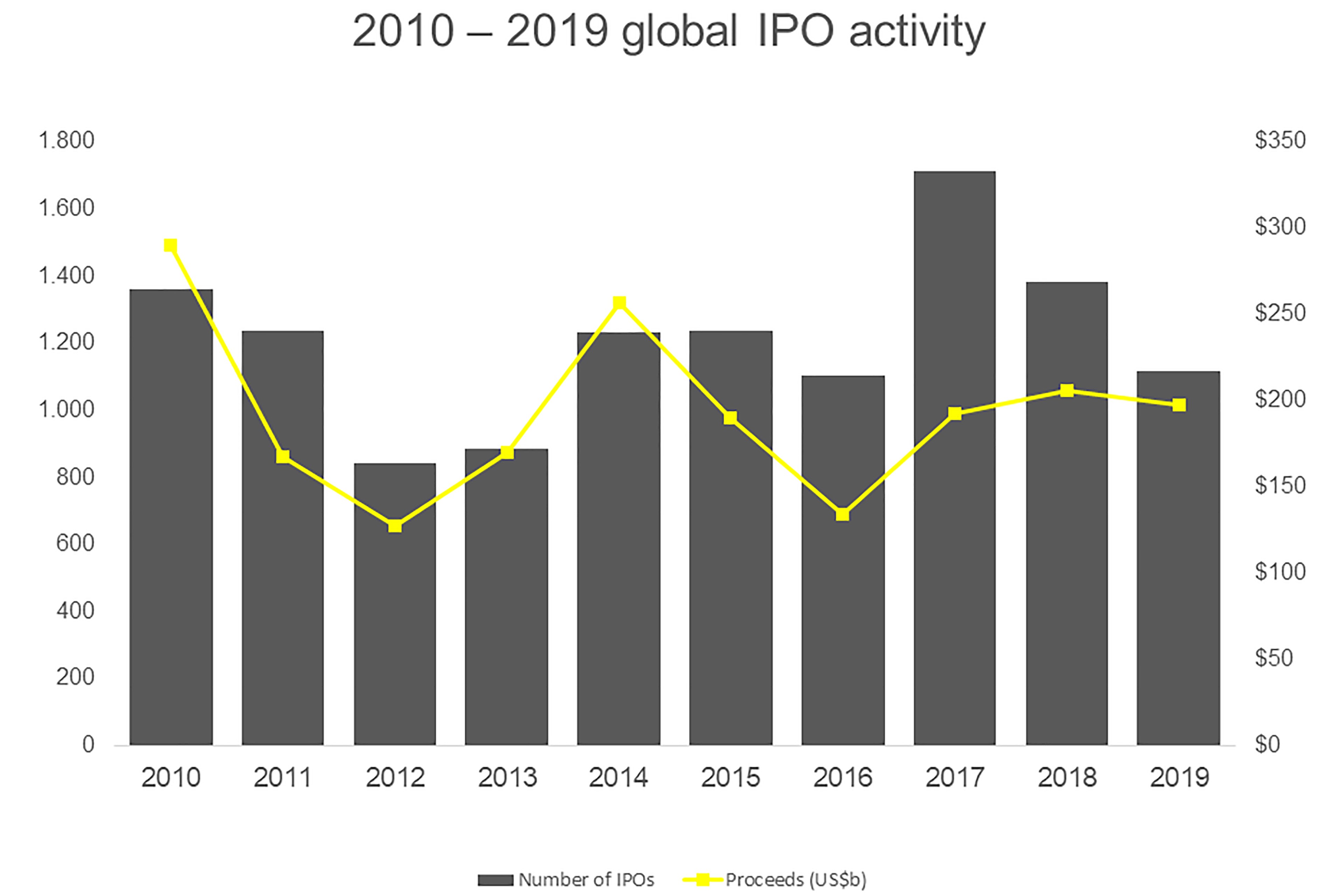

Geopolitical uncertainty and trade tensions heavily impacted the 2019 IPO landscape, pushing overall IPO activity down in terms of deals and proceeds. 2019 has registered 1,115 IPOs with proceeds of US$198b – a 19% fall in deal volume and a 4% decrease in proceeds compared with 2018. However, as US-China-EU trade tensions, concerns about economic growth and other geopolitical issues – including Brexit and social unrest in Hong Kong – subside, a healthy increase in IPO activity is expected in 2020, particularly in the first half of the year, as markets are expected to become more volatile leading up to the US Presidential elections.

While Asia-Pacific saw overall declines in deal volume (-1%) and proceeds (-8%) for 2019, it led the regions, with EMEIA second by both deal volume and proceeds and the Americas third in both measures. The technology sector continued to dominate in 2019 with 263 IPOs raising US$62.8b. By deal numbers, health care (174 deals) and industrials (147 deals) were also active in 2019, while by proceeds, energy (US$32b) and health care (US$22.5b) performed well.

Activity in Q4 2019 (353 IPOs and proceeds of US$84.5b) was 5% lower in deal volume and 53% higher by proceeds compared with Q4 2018. Two of the largest IPOs in 2019 came to the market in Q4, improving IPO activity for the quarter. These and other findings were published today in the EY quarterly report, Global IPO trends: Q4 2019 (pdf).

Paul Go, EY Global IPO Leader, says:

“Two of the largest and long-awaited IPOs came to the market in Q4 2019, improving what had otherwise been a lackluster year in terms of IPO activity. As we head into 2020, we anticipate that some of the geopolitical uncertainties and trade tensions that plagued the IPO market in 2019 will fade. Market volatility will remain, and owners with the ambition of a successful IPO in the near-term will need to be prepared to take advantage of the windows of opportunity expected in the early part of 2020.”

Americas IPO activity falls amid geopolitical and trade uncertainty

With 213 IPOs raising US$53.9b, deal volumes and proceeds of Americas IPO markets in 2019 fell compared with 2018 numbers by 20% and 10%, respectively. The US remained in the spotlight as the leading source of IPOs in 2019, accounting for 77% of Americas IPOs and 93% by proceeds, including 24 unicorn IPOs.

Canada’s Toronto Stock Exchange and Venture Exchange saw 18 IPOs, which raised US$295m, accounting for 8% of Americas IPO deals, while Brazil’s B3 exchange posted 5 IPOs over the year, with proceeds of US$2.3b, and Chile posted 2 IPOs, with total proceeds of US1.1b.

Jackie Kelley, EY Americas IPO Leader, says:

“As is typical, the bulk of Americas’ IPO activity occurred in the US for 2019. However, there was activity across a range of markets including Brazil, Chile and Canada. Coming into year end, we see momentum in all of these markets. We expect a strong environment across the Americas for business leaders who have the ambition to go public in 2020.”

Asia-Pacific IPO markets remain resilient

Asia-Pacific continued to dominate global IPO activity, accounting for seven of the top ten exchanges globally by deal number and five of the top ten exchanges by proceeds in 2019. However, 2019 deal volumes (668 deals) were down by 1% versus 2018 and proceeds (US$89.9b) were down by 8%.

Japanese exchanges posted 89 IPOs in 2019, a 9% decrease in terms of volume compared to 2018, with proceeds of US$3.6b representing an 87% drop compared with 2018 proceeds. Due to the early success of Shanghai’s STAR market, Mainland China saw an increase in IPO activity in Q4 2019, which pushed 2019 deals volumes past 2018 by 89% (197 deals) and proceeds by 69% (US$35.7b). The Hong Kong Stock Exchange saw a 25% decline by deal number (154 IPOs), but a 4% increase by proceeds (US$37.9b).

Ringo Choi, EY Asia-Pacific IPO Leader, says:

“Despite the geopolitical and trade uncertainty that prevailed throughout much of the year, Asia-Pacific markets performed reasonably well in 2019. However, as we move into 2020, we expect ongoing geopolitical headwinds and rising investor skepticism to slow IPO activity, particularly in the second half of the year.”

EMEIA IPO market buoyed by strong Q4 activity

In EMEIA, deal volumes (234) were down 47% in 2019; however, proceeds (US$54.2b) were up 14% — the only region to see a rise in proceeds in 2019. EMEIA exchanges also remained strong, accounting for three of the top ten exchanges globally by proceeds in 2019 (Saudi Arabia, UK and Germany) and four of global top ten IPOs by proceeds.

EMEIA IPO proceeds picked up strongly in Q4 2019 due to four mega IPOs, including Saudi Aramco, with a rise of 174% by proceeds but a decline of 45% by deal number compared with Q4 2018.

Dr. Martin Steinbach, EY EMEIA IPO Leader, says:

“EMEIA welcomed the largest-ever IPO with Saudi Aramco, which helped drive an increase of 14% in IPO proceeds for the year. As the disruptive headwinds that dampened IPO activity subside, we anticipate a positive impact on investors’ sentiment for IPOs and a modest upturn of IPO activity in EMEIA in 2020. Overall, we expect investors to be more selective in their choice of high-quality equity stories. In addition, owners and the C-suite of IPO bound companies continue to face volatile markets. They will need to prepare early and have a holistic approach to be IPO-ready in order to act quickly when narrow IPO windows open.”

2020 outlook: more robust IPO activity, particularly in the first half of the year

Looking ahead, several uncertainties will subside in 2020. Trade tensions between the US, China and the EU; the outcome of Brexit; and uncertainty with respect to the stability some European economies will fade in early 2020 and will positively impact overall IPO sentiment.

A healthy pipeline of IPO candidates means that within the right transaction window, IPO activity will pick up across all regions, particularly in the Americas where a number of large unicorns are expected to launch their IPOs in the US in the first half of 2020. This should see 2020 deal numbers exceed 2019 levels.

-ends-

Notes to Editors

About EY

EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data and a description of the rights individuals have under data protection legislation is available via ey.com/privacy. For more information about our organization, please visit ey.com.

This news release has been issued by EYGM Limited, a member of the global EY organization that also does not provide any services to clients.

About EY’s Growth Markets

EY Growth Markets professionals connected across the globe are trusted business advisors to CEOs, owners and entrepreneurs leading private and family enterprises, including those managing increasing flows of private capital worldwide. We have a long legacy advising these ambitious leaders in realizing their ambitions, faster. With private entities making up more than 90% of EY clients, our professionals appreciate the owner mindset and possess the know-how needed to think differently about delivering business results, practically and sustainably. ey.com/private

About EY’s Initial Public Offering Services

EY is a leader in helping companies go public worldwide. With decades of experience, our global network is dedicated to serving market leaders and helping businesses evaluate the pros and cons of an initial public offering (IPO). We demystify the process by offering IPO readiness assessments, IPO preparation, project management and execution services, all of which help prepare you for life in the public spotlight. Our Global IPO Center of Excellence is a virtual hub, which provides access to our IPO knowledge, tools, thought leadership and contacts from around the world in one easy-to-use source. ey.com/ipocenter

About the data

The data presented in the Global IPO trends: Q4 2019 report and press release is from Dealogic and EY teams. Q4 2019 (i.e., October-December) and 2019 (January-December) is based on priced IPOs as of 4 December 2019 and expected IPOs in December. Data is up to 5 December 2019, 9 a.m. UK time. All data contained in this document is sourced to Dealogic, CB Insights, Crunchbase and EY unless otherwise noted.