Chapter 1

Identifying distress

For the commercial aerospace sector, 2021 could be even worse than 2020, so the threat of supplier failures remains elevated.

During early stages of the pandemic, suppliers were thrust into survival mode. And, by and large, survive they did. As a return to normalcy draws closer, though, sub-tier suppliers will be challenged to shift to “revive” mode, especially if these companies are dealing with distressed suppliers or have fallen into their own distressed situation.

Despite volume recovery, instances of supplier failures are expected to rise as bills come due from ramp-up in volume and lenders seek to protect liquid collateral. Suppliers will need to restaff operations to meet increasing production levels, adding hefty payroll requirements and depleting cash reserves. Of specific concern is the ability of suppliers to fund the inventory and working capital requirements necessary for ramp-up, especially as they struggle to raise rates with a severely trimmed workforce.

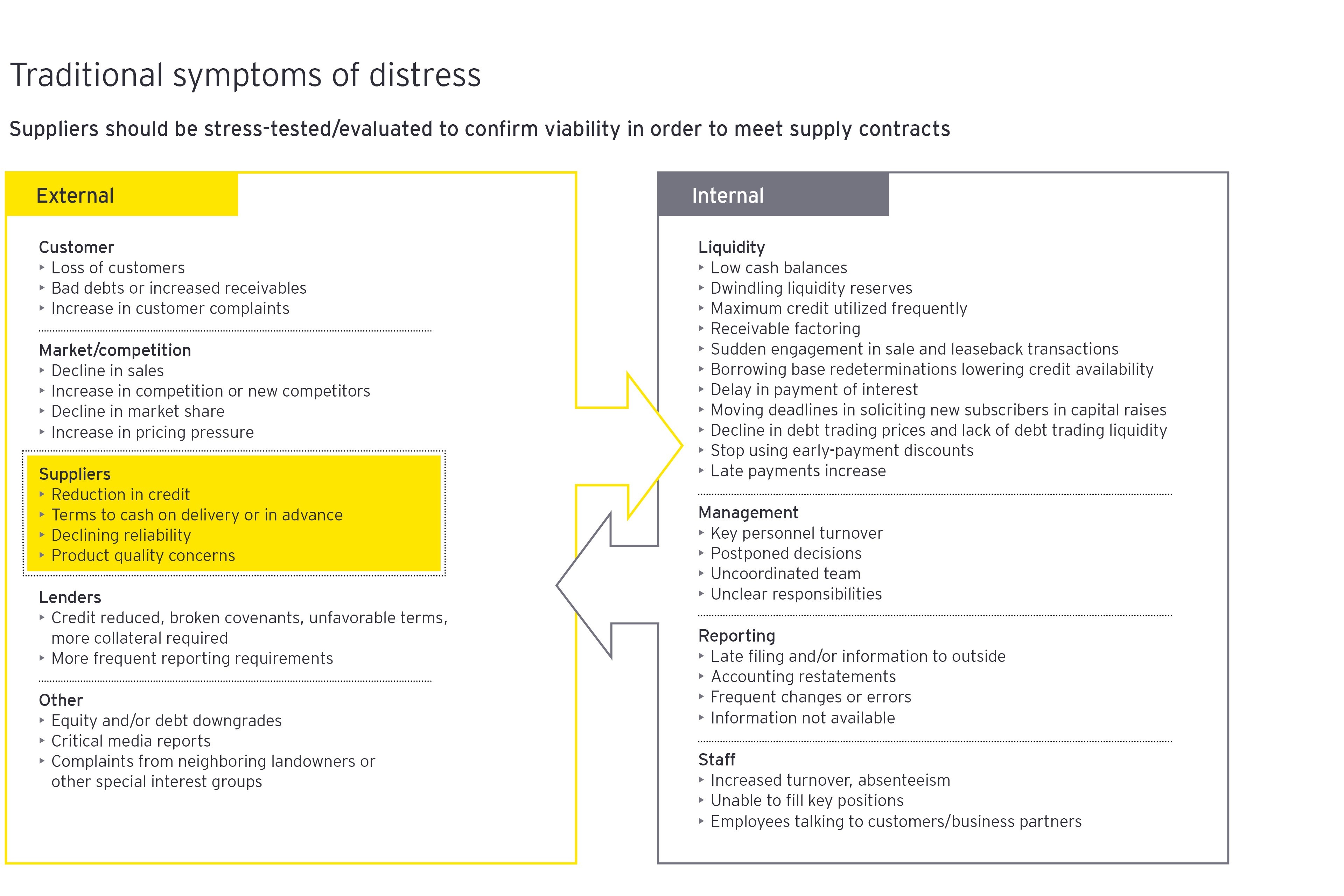

Distress is not only caused by external forces, though. Self-inflicted distress, whether it be poor management decisions, financial irresponsibility or weak quality programs, is also pervasive throughout the industry and, in many instances, is much more severe than any outside market force.

The first step to improving an at-risk company is identifying the specific signs of distress. While these signs would be seemingly obvious and easy to recognize, many companies don’t have the appropriate level of resources committed to properly and continuously track the true pulse of their suppliers or their entire supply chain. Other symptoms of distress will likely become more prevalent, including reduction in credit options, declining reliability, product quality concerns, and contract terms that require cash in advance or on delivery.

In addition, there are other, less visible signals of distress:

There are several consequences to a company as a result of supplier failure, including negative impacts to costs, reputation and revenue. This can lead to value leakage, unforeseen costs and lack of operational control.

As important it is to improve the ability to identify distress, of equal importance is asking for help or risk having help imposed on your company.

Chapter 2

Take a proactive measure to prevent supply chain disruption

While often unavoidable, supply disruptions can be minimized through some proactive evaluation and due diligence best practices.

Companies can pursue various strategies.

Evaluate the existing supplier base

It is important to identify those suppliers that serve as key strategic partners — the single-source providers of key components, for example, that are most critical to keeping your operations online and uninterrupted. Working closely with each of these supplier partners to support your detailed financial assessment to determine risk of distress or insolvency is critical to inform your development of any potential necessary mitigation strategies.

Perform an up-front financial assessment of future suppliers

When preparing to engage with future suppliers, complete a detailed financial projection of the supplier’s business and evaluate the tolerance of the business to absorb the impact of any proposed work statements. Scenario planning is a beneficial tool in these instances, as it allows for stress-test projections under downside or upside circumstances.

Expand number of caveats/mitigations prior to awarding work

It is important to protect the supply chain operations beyond healthy supplier financial assessments and tolerance evaluations. Incorporate and maintain key performance indicators and financial metrics, and confirm all contracts include access rights; continuously monitoring supplier financials is a key distress mitigation practice. Pre-negotiating lender, legal and customer consent considerations under the terms of the contract is also an important best practice for the most critical suppliers. Proactive communication across supplier management, quality, operations and credit/risk management functions can help to uncover the financial risks of key suppliers and then to disseminate those risks across the organization.

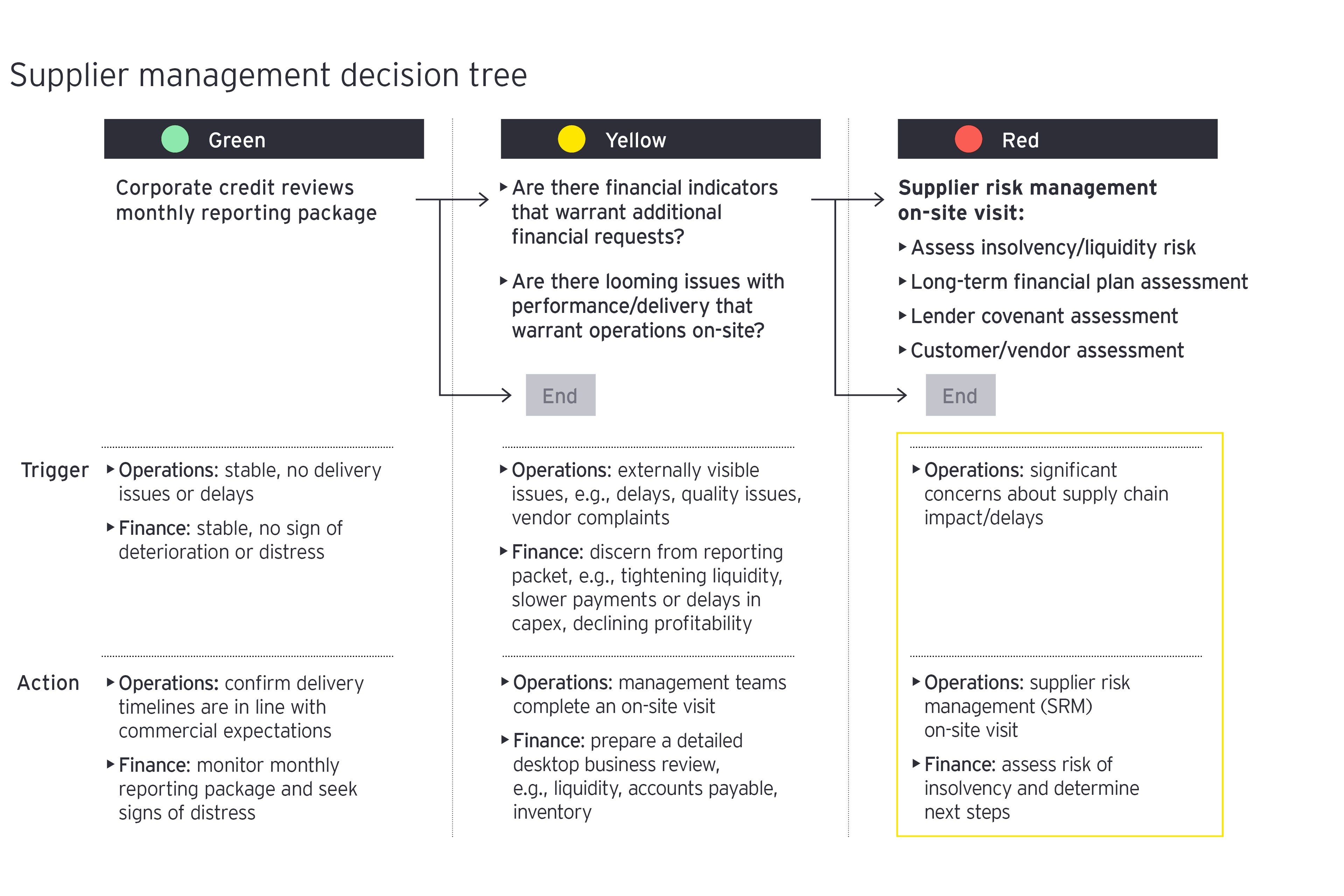

Supplier management decision tree

Early-warning screening measures provide a heightened level of visibility into the operational and financial well-being of a supplier. When monitoring the status of supplier partners, it’s helpful to keep an ongoing assessment of trigger events that require differing responses depending on the severity of the trigger event. Something as simple as a supplier management decision tree facilitates a troubled supplier response mechanism.

Chapter 3

Recommended actions and implications for troubled suppliers

Financial and operational analyses are crucial, but emergency measures should also be weighed carefully and proactively.

An initial assessment confirms that a supplier may be troubled, and now a plan must be put in place to mitigate the risks. What are the response options and recommended initiatives?

First steps should include financial and operational analysis of selected information to assess key business and financial risks for the troubled supplier’s ability to meet customer requirements:

- Analyze supplier’s organizational structure, including, but not limited to, its business units, operating plants and customers/programs

- Analyze supplier’s historical and forecast level of profitability and cash flow

- Understand capital structure, including analysis of collateral to understand changes in borrowing capacity/availability (if applicable)

- Understand supplier’s forecast of free cash flow relative to its working capital, capital spending and debt service requirements

Transparency and liquidity measures are key; establish a crisis management team

Having confirmed the level of risk through the assessment exercise, quick and decisive action is required to understand and stabilize the level of risk to your production system due to a distressed supplier. Understanding the liquidity status helps to identify available cash and determine what payments are due and when. It’s important to expand liquidity forecasts for at least 13 weeks (more ideally, 6 months) and develop cash scenarios that identify cash burn drivers and appropriate cash measure responses that facilitate worst-case scenario preparedness. And, if circumstances are dire, proactively assess the risks and benefits to the supplier’s use of bankruptcy protection options.

The immediate objective is to stop the bleeding and improve short-term results. Some quick response actions include identifying cost-cutting potentials, both direct (especially temps/labor) as well as in indirect areas and short-term contract cancellation options. Working capital optimization is another response tactic that provides immediate relief and stability through fast invoicing, receivables management, inventory reduction, modified payment terms and deferred purchases.

When facing a distressed situation, growth is not the priority; survival is. Capital expenditure initiatives must be scrutinized and followed by appropriate actions, including deferring non-critical investments, considering sale and leaseback, and divesting non-core assets.

Setting up a structured response framework is another critical action. Establish a dedicated crisis task force to carry out proactive communications with key stakeholders, both internal and external. This team will help mitigate a longer-term crisis by upholding response processes and initiatives, identifying staff risks, and considering regulatory and legal changes.

Three overall action items to consider

As the world continues its fight against the pandemic and pockets of the global economy show signs of resurgence, it’s clear that the commercial aerospace supply chain will face ongoing disruption in the near term. This will perhaps not be to the extent initially expected, yet enough to hamper an accelerated recovery for OEMs and larger suppliers, and threaten the survival of lower-tier companies. Consider these three action items:

1. Proactive supplier screening

Distress, whether market driven or self-inflicted, remains an ongoing risk for aerospace suppliers. It is imperative to invest in resources that facilitate early distress detection, proactive evaluation and due diligence best practices.

2. Rapid response

When at-risk scenarios are identified, act fast. Execute financial and operational analyses to evaluate the troubled supplier’s ability to meet customer requirements. Improve transparency and liquidity measures. Develop risk scenarios and plan for the worst case. Implement cost reduction programs and scrutinize capex initiatives.

3. Crisis management team

Manage the response with a dedicated crisis task force. A structured response will help avoid a longer-term crisis. Communication with stakeholders, both internal and external, is key.

Despite these challenges, it is the response and pace of that response to distress that will determine the ultimate outcome.

Summary

The COVID-19 pandemic upended the future of air travel, with the ripple effects shaking up the commercial aerospace sector. At a time when supplier failures are expected to increase, it’s more important than ever to proactively identify distress and plan how your organization will confront it. Analyses are a good first step, but through scenario planning, you may pinpoint a need for a crisis management team and emergency measures.