Chapter 1

Fast and furious

The stakes are high and rapid change is needed.

On a positive note, Canada is well-positioned to act. Globally, our energy transition policy puts us at the forefront of climate action over the last few decades, earning us a strong environmental record. With rich natural resources and a diverse electricity generation mix, we benefit from energy security, boasting both a reliable energy supply and resilient system. Energy equity – or the ability to provide affordable, fairly priced and abundant energy domestically and commercially – also remains strong. And with a top ten ranking on the global Energy Trilemma Index, Canada is drawing from a position of power.

The energy trilemma

Definition

The energy trilemma refers to the growing challenge of finding a balance between energy security, sustainability and equity in how we access and use energy in our daily lives.12 The three dimensions are uniquely necessary and complementary, whereby each dimension requires a careful consideration to transform and build resilience in future energy systems.

Measures a nation’s capacity to meet current and future energy demand reliably, accessibly and resiliently against systemic shocks with minimal disruption to supplies.13

Relevance: Energy security is essential for all aspects of stable economic activities. This dimension is underpinned by an ability to maintain a country’s access to a reliable energy supply and a resilient energy system, which could be compromised via systemic shocks14 such as geopolitical tensions, cybersecurity risks or extreme weather events15.

Dimension indicators

Each dimension can be evaluated based on a set of indicators that either strengthen or weaken a country’s performance in managing the energy trilemma. Below are sample indicators that are used to assess respective dimensions and countries:

- Diversity of primary energy supply

- Dependence on energy imports

- Diversity of electricity generation

- Energy storage availability

- System stability and recovery capacity

- System interconnectivity

- Reliability of the energy system

Represents the transition of a nation's energy system towards using renewable and lower carbon-intensive energy sources.16

Relevance: Environmental sustainability has been at the forefront of climate change action over the last few decades. This dimension focuses on a country’s efforts towards mitigating and avoiding potential environmental and climate change impacts.17 The current global energy crisis is becoming a key turning point in accelerating efforts towards a cleaner, more secure and affordable energy system.

Dimension indicators

Each dimension can be evaluated based on a set of indicators that either strengthen or weaken a country’s performance in managing the energy trilemma. Below are sample indicators that are used to assess respective dimensions and countries:

- GHG emission trends from energy production and application

- Renewable/low-carbon electricity generation

- Carbon intensity of energy products and carriers

- Final energy intensity

- Efficiency of power generation and transmission and distribution

Assesses a nation's ability to provide universal access to affordable and abundant energy for domestic and commercial use.18

Relevance: Energy equity analyzes a country’s ability to provide universal access to affordable, fairly priced and abundant energy for domestic and commercial use.19 Affordability is arguably the most important element to consumers, as energy equity directly affects standards of living. Hence, the cost competitiveness of energy solutions is very important in driving action towards meeting net-zero global emissions targets by 2050.

Dimension indicators

Each dimension can be evaluated based on a set of indicators that either strengthen or weaken a country's performance in managing the energy trilemma. Below are sample indicators that are used to assess respective dimensions and countries:

- Access to electricity

- Access to modern energy

- Electricity prices (e.g., coal, gas, hydro, solar, nuclear)

- Gasoline and diesel prices

- Natural gas prices

Canada’s sustainability score remains stable, but affordability is raising concerns. Instability seen with the war in the Ukraine and the impact it has had on pricing and inflation is clouding the future, making the future of energy transition difficult to predict. Questions abound on how energy transition will unfold in Canada. How will local industries support transition? How will energy transition balance sustainability, equity and security? What’s our next best move, and perhaps the most troubling question on pundits’ minds: who will pay for it all?

It’s estimated that Canada needs approximately $2 trillion to deploy new technologies and reach 2050 targets.1 COVID-19 spending has governments juggling budgets and while the federal government committed $9.1 billion as part of the 2030 Emissions Reduction Plan to tackle climate change last February, it’s a drop in the bucket in light of the modernization that will be required to decarbonize value chains.

Maintaining economic prosperity will be critical. The environmental and clean technology sector contributed $67.5 billion to the Canadian GDP in 2020, and there is significant room for growth. Doing so will demand national alignment, with consideration of the country’s diverse interregional resources and policy frameworks. In addition, cooperation and funds will have to be shared amongst both private and public sectors. While solutions will be complex, opportunities will be significant.

Chapter 2

Resource rich, sustainably savvy

The energy and resources sector is critical to achieving Canada’s decarbonization goals.

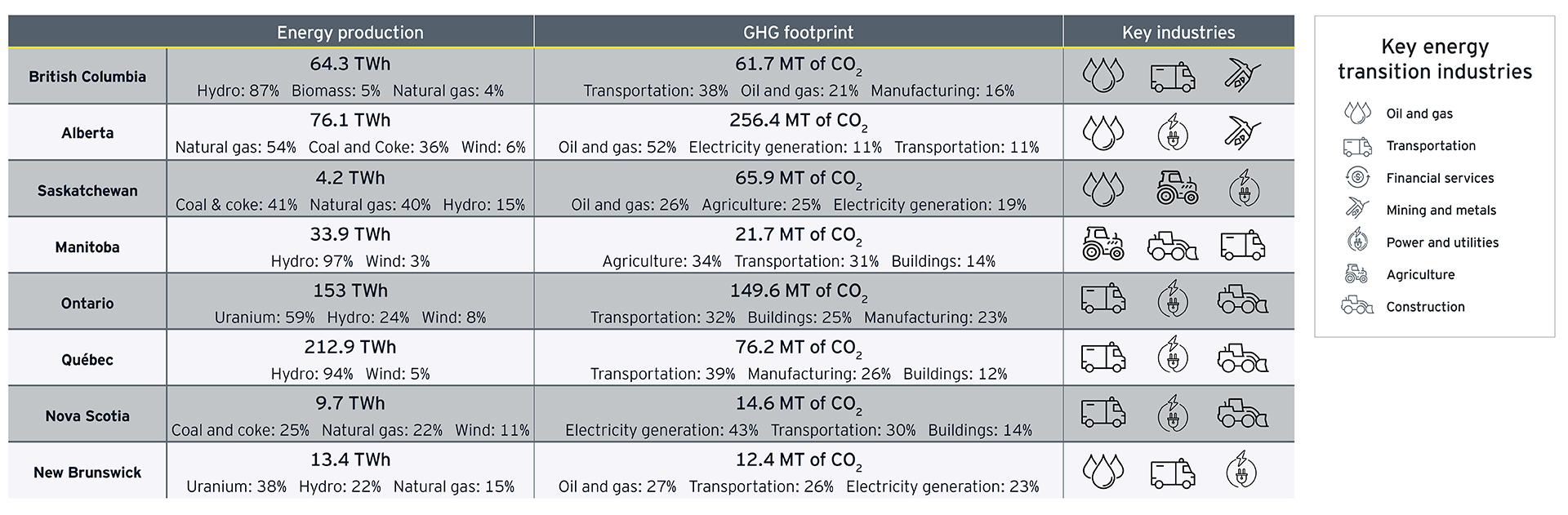

Canada had a natural resource wealth of $550 billion in 20202 and ranked first for ESG practices among the world’s top oil reserve holders. Energy accounted for approximately 9.7% of the country’s GDP in 2021, with $154.3 billion worth of exports sent to 142 countries.3

Often in the spotlight of energy transition discussions due to its carbon intensive operations, oil and gas opportunities including the generation of carbon credits or renewable electricity can help reduce cost gaps to international competition. Climate action in the form of sustainable investments to protect land and water could show climate leadership and return environmental value.

Similarly, the power and utilities sector has a significant opportunity to decarbonize, favouring alternate sources of power, including hydrogen and electrification, and investing in technology innovations and infrastructure updates.

The mining industry is set up to benefit from such innovations, with increased demand for minerals to supply renewable technologies like clean-tech batteries and wind turbines expected to quadruple by 2040. There is also, however, a significant opportunity this uptick in operations will provide – to electrify and automate, for example, or show important goodwill through water, land and resource stewardship and working with Indigenous communities in decision-making.

Chapter 3

Challenges accepted

A coordinated approach will be needed.

There will be varying degrees of disruption across most businesses. An integrated, multi-sector approach, including infrastructure updates, will be needed to ensure national alignment and to help accelerate decarbonization.

A coordinated approach to a cohesive Energy System for 2050 has proven elusive. Given Canada’s geographic size and scope, the vastly different political and social perspectives across provinces have prevented consensus. Siloed action by government and business has been fragmented and often led to new concerns once implemented, and financing has been a stumbling block, with stakeholders scrambling to source funding.

Lacking leadership oversight and accountability, and in the absence of an actionable strategy, results have been underwhelming. Gaining the traction needed to drive momentum forward and achieve energy transition will demand the collaborative efforts of all players – government, industry, business and consumers. With strong leadership, policies and regulations in place to guide action, clearly defined accountabilities and communities continuing their energy transition pursuits, Canada can get back on track in the three decades we have left.

Chapter 4

Where to start?

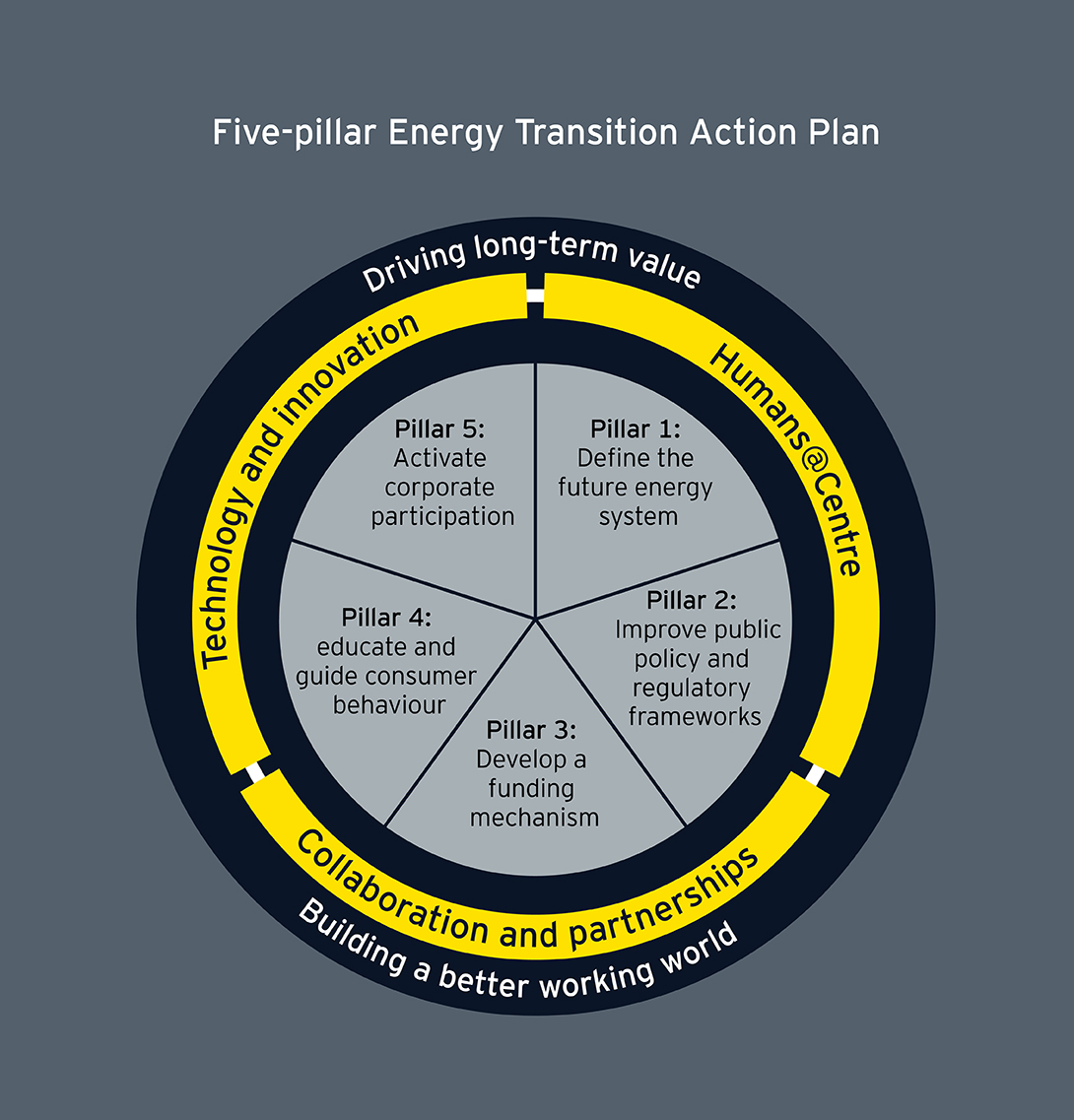

EY’s five-pillar action plan

EY has identified an action plan to accelerate net-zero aspirations and help Canada build an energy system aligned for 2050. Focusing on the following five pillars can help get the country back on track with its net-zero commitments.

1. Defining the future energy system – A hybrid of old and new, the energy system will need to capitalize and build on existing sources of energy, interwoven with innovative solutions including electrification, clean hydrogen and renewables. An optimized mix combined with a central, national vision and action plan will help ease the transition and position us as leaders in sustainability for the future.

2. Improving public policy and regulatory frameworks – Having a national plan, with clear accountabilities and policies to ensure traction and forward progress and strategies to support capital allocation will be critical. Carbon levies, emissions caps and carbon offsetting capabilities can go a long way towards ensuring compliance and incentivizing progress.

3. Developing a funding mechanism – Investors have a way of unlocking potential. Public and private, blended financing and innovative ESG investment frameworks for energy transition enterprises will provide much-needed access to the capital needed to feed decarbonization agendas.

4. Educating and guiding consumer behaviour – According to EY’s Future Consumer Index Survey, 61% of Canadians say they will pay more attention to the environmental impact of purchases, and 69% expect companies to solve sustainability issues. Making consumers aware of their impact can help them to make better choices and apply pressure with their spending dollars.

5. Activating corporate participation – Organizations should be invited to continue contributing to decarbonization efforts internally. Increased capital allocation and the introduction of disclosure and reporting standards may help encourage organizations to adopt new technologies and be more accountable for their own impact.

Engaging diverse stakeholders and delivering on decarbonization targets will be near-impossible without three key enablers. Technology and innovation, while not solutions to the energy transition, will be critical tools and early and proactive investment in new and creative tools and processes will enable efficiencies and expedite industry’s path to net-zero.

Having humans at the centre of change with transformative leadership and tangible value delivered to stakeholders each step along the way will help sustain progress. And partnering through collaboration and sponsorships like Pathways Alliance – Canada's oil sands producers working together to address climate change – will help build awareness, distribute knowledge, invite participation and perhaps most importantly, ensure resources are available to see change through.

Decarbonizing to avert climate crisis is a massive undertaking. While there are certainly gaps to overcome, Canada’s role in energy transition holds significant promise. Our work with disclosures and clean technologies have us off to a good start. We’ll need decisive action and the dedicated attention of government, industry, investors and citizens if we are to realize our decarbonization goals and move forward together for a more sustainable future.

Download the Energy Transition in Canada – Pathway to the 2050 Energy System Report.

Summary

A successful energy transition is crucial to achieving Canada's climate change objectives and unlocking its economic potential. While the energy transition is already underway, Canada is still at the beginning of its energy transition journey. To succeed, Canada will need widespread stakeholder support, including federal, provincial and municipal governments. Efforts must be made to find a balance and a path forward while working together to solve the energy trilemma.

In Canada, the energy transition future holds many opportunities to decarbonize value chains, innovate, and introduce new products and solutions. EY presents a five-pillar energy transition pathway to achieve a decarbonized economy.