Chapter 1

New expectations for CEOs to personally lead on global challenges

CEOs no longer need permission to act on global challenges, although alignment and collaboration are key.

Investors and boards strongly endorse a greater CEO role in the corporate response to global challenges. However, CEOs, considering their personal roles and their perceptions of these stakeholders, are more conservative. Chief executives must engage with their investors and boards to understand the new expectations and come to a consensus with these stakeholders on how to move forward on global challenges.

CEOs must take a more active role and lead on global challenges

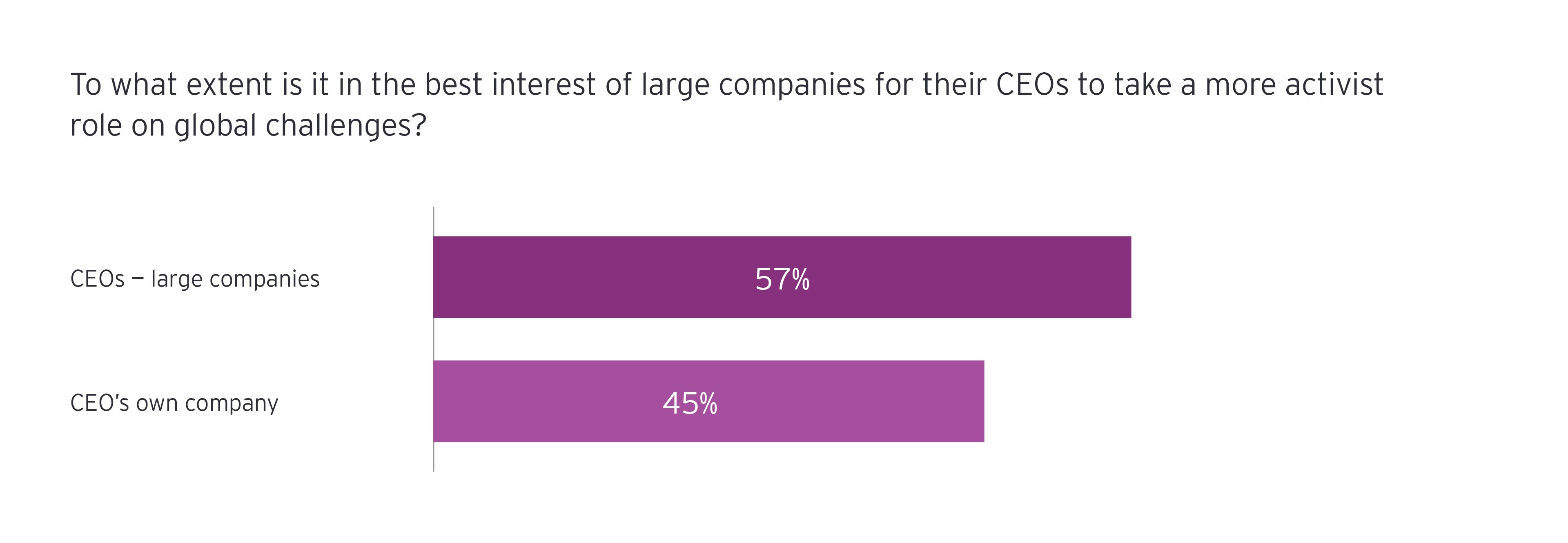

While 57% of chief executives agree with the general proposition that large company CEOs should take a more active role on global challenges, only 45% of respondents say this when it comes to their own company. This difference of 12 percentage points underscores how action on global challenges draws CEOs out of their traditional comfort zone.

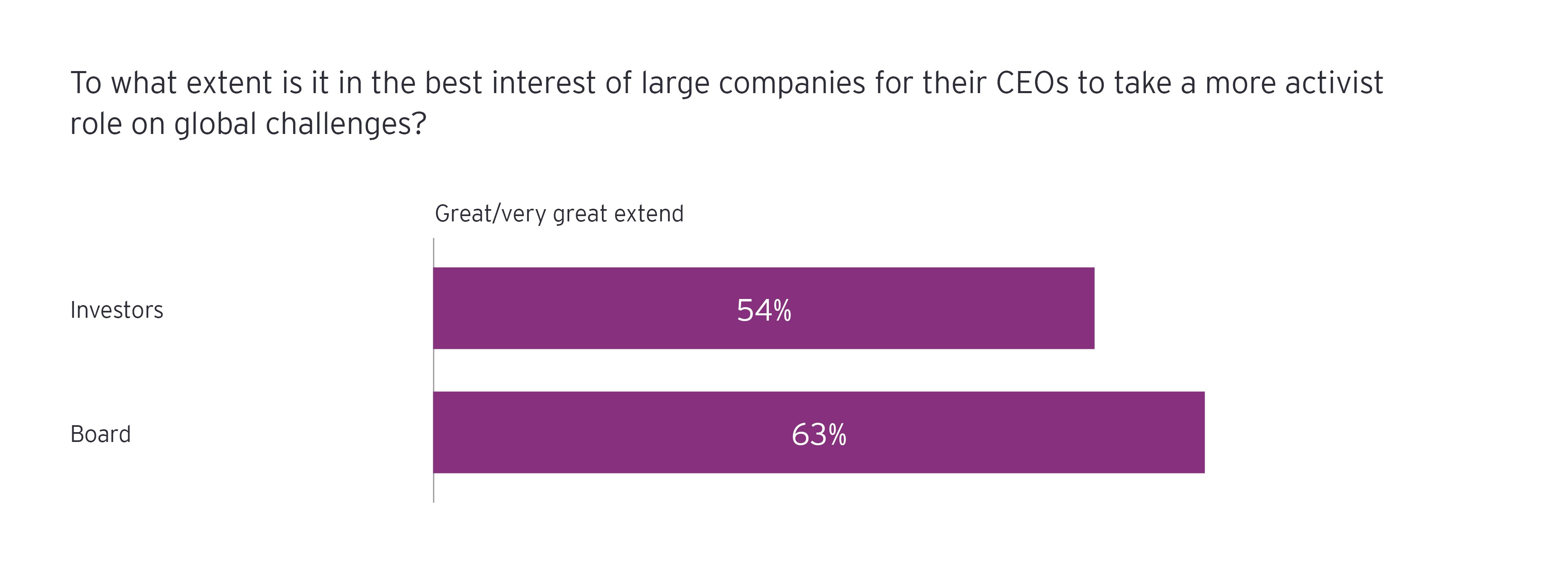

Part of the discomfort could stem from concern over investor and board perspectives on CEO involvement in global challenges. Chief executives might be surprised to learn that well over half of board members and investors believe that it is in best interest of large companies for their CEOs to take a more activist role on global challenges.

Investors and boards are more supportive than CEOs think they are

Investors and boards are also more supportive of CEOs taking public stances on big issues than CEOs themselves.

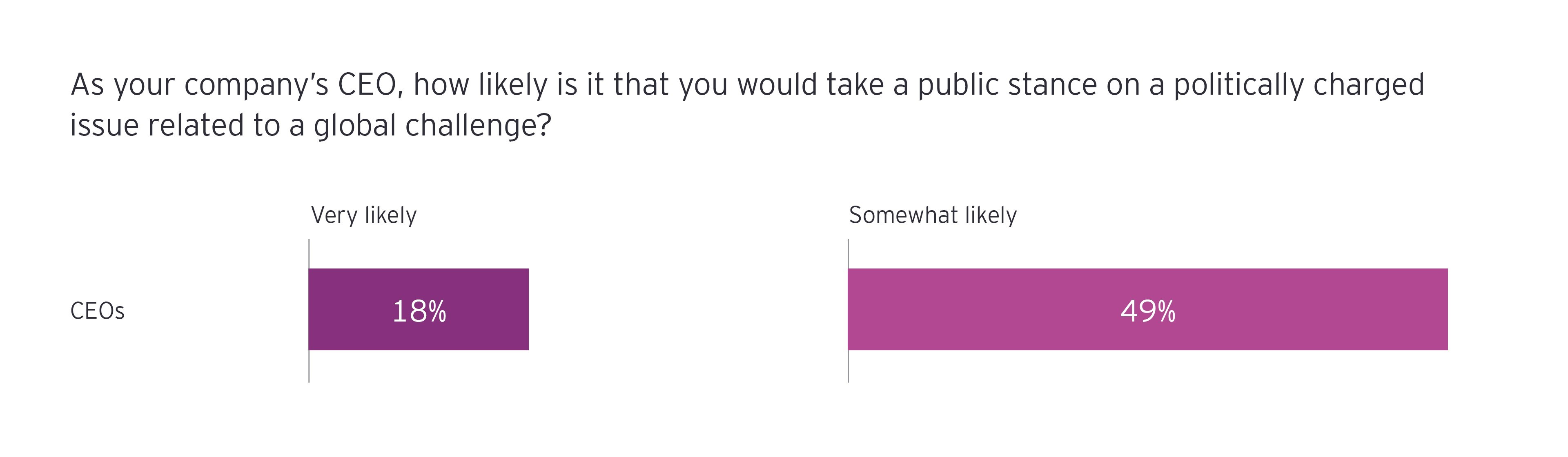

While 67% of CEOs think that they are somewhat or very likely to take a public position on a politically-charged issue in the future, boards and investors are even more prepared to support CEOs taking that stance, with over three-quarters of board members (76%) and investors (79%) saying that they will likely be supportive.

While this suggests that CEOs may no longer need explicit permission from these stakeholder groups to speak out or take an action, it doesn’t rule out the importance of alignment and collaboration. For example, some point to the importance of a strong CEO and board partnership in promoting enhanced CEO engagement on global issues.

Maggie Wilderotter, former CEO of Frontier Communications, and an independent director at Costco Wholesale Enterprises, Hewlett Packard Enterprises, and Chair at DocuSign, contends that CEOs and boards should work hand in hand: “The board has to work with the CEO so that the CEO knows there is an expectation that he or she will evaluate issues that come up, and decide whether he or she thinks the Board should be involved more actively or make a statement. Then the CEO should discuss these expectations with their board, or at least their nominating and governance committee, and make a call on it. It should be a process, not a knee jerk reaction to a specific issue.”

Others noted the importance of CEO alignment with employee concerns. Ron Mock, CEO of the Ontario Teachers’ Pension Plan, explains: “It’s also critically important that it’s not just the CEO and the executive team that come up with the issues that are important to the company. Employees also have a high level of engagement around global challenges. It is important that we acknowledge that stakeholder group.”

CEOs must resolve disconnections between investors, boards and management

Why aren’t CEOs already more active on global challenges despite the broad agreement that it is a new imperative? In fact, CEOs, boards and investors aren’t always on the same page when it comes to perceptions of the systemic factors that may constrain chief executives:

- CEOs (57%), boards (46%) and investors (46%) identify boards' attitudes, skills, composition and leadership as a top constraint. Given the governance role that boards play, this is not a big surprise.

- Both CEOs (42%) and boards (50%) point to the linkage between executive compensation and short-term performance, which is fundamentally investor-driven. This is underscored by the fact that boards (52%) and investors (44%) alike identify short-term earnings pressure from investors as one of the top constraints.

- CEOs (47%) and investors (54%) also put regulatory requirements high on the list of constraints. For CEOs, this may be closely tied to quarterly financial performance reporting requirements. For investors, this could relate to the importance of client fiduciary responsibility and the need for positive economic performance from the companies in which they invest.

Given the rising importance of global challenges resolution as a corporate growth imperative, it’s up to CEOs to resolve these differences within their own companies. The ability to align a company’s stakeholders around a specific course of action when it comes to global challenges must become part of the CEO’s new DNA.

Chapter 2

Now is the tipping point for corporate engagement

Evaluate your readiness to address global challenges through a benchmark of key actions.

Many of the world’s largest companies have already undertaken important actions to address global challenges, such as establishing external partnerships, participating in cross-industry coalitions or increasing dedicated spending.

It’s perhaps not surprising that 60% of the world’s largest companies have linked their corporate purpose to addressing global challenges—such declarations of purpose are relatively easy. Yet fewer than half of all companies have undertaken any of the other nine of 10 key actions to address global issues, and only 6% of CEOs report that their companies have initiated all of them.

Importantly, a significant percentage of companies are actively planning to take these actions if they haven’t already, indicating that we are at tipping point in corporate engagement on global challenges.

Boards and investors prioritize actions that drive internal transformation

The survey data indicate that companies to-date have more frequently taken the easier, external-oriented actions such as declarations of purpose and changes to reporting. However, boards and investors want companies to take steps that will drive internal organization transformation that aligns the organization to action global challenges. External actions will flow from the internal drivers.

As Angela Rodell, CEO of the Alaska Permanent Fund Corporation, says: “If you're a large company and you expect to be around for the next 20, 30, 50 years, and you have a long-term business plan, you have to be thinking about how your business is affected and is engaged in these global challenges. The challenge is: what does addressing these global challenges look like? What I want to see as an investor is companies addressing it from a business plan perspective.”

Board director and investor respondents prioritize two actions as the most important steps companies should be taking now in relation to global challenges:

- Integrating a plan on global challenges into corporate strategy

- Linking internal governance, performance measures and rewards to global challenge objectives

“Addressing global challenges will often mean that companies will need to adapt and transform, and as a result they will need to evolve their business strategies and governance structures to do this,” says AustralianSuper’s Mark Delaney. “The required pace of adaptation and transformation is likely to continue to accelerate. Businesses need to be agile in meeting the challenges, as acting for the long-term somewhat paradoxically also requires agility.”

Michael Kanazawa, EY Global Innovation Realized Leader notes, “Creating a future-back vision of the business where global challenges become opportunity areas ensures companies will lead innovation in their market and not be disrupted by it.” He adds that: “Not to be confused with corporate social responsibility, this new brand of CEO responsibility for leading through global challenges means innovation around the entire business value, including long-term strategy, new products and services, market growth plans and the core operations of the business.”

Only 44% of CEOs report integrating global challenges into strategy and only 40% have linked governance and metrics to global challenges, despite their prioritization by boards and investors—clearly there is work to be done.

Chapter 3

Are you a leader or a laggard?

Actions speak louder than words.

“Action separates corporate leaders from laggards on global challenges,” says Gil Forer, EY Global Markets Digital and Business Disruption Lead Partner, and EYQ leader. “The leaders have transformed strategy, operations and governance in response to global challenges. They have taken public positions, established global action ecosystems and exerted their influence through their value chains. Leaders recognize the global challenge growth imperative and are taking action to seize the upsides,” he adds.

Some 25% of our sample comprise the leader category, which we define as companies that have already taken at least seven of ten action steps, while 28% of our sample was made up of laggards, or companies that have taken two or fewer of the defined actions. At each extreme, 12 companies assert they are undertaking all 10 action steps, while four companies report taking no action steps whatsoever.

Leaders align strategy and metrics to address global challenges

When it comes to acting on global challenges, leaders outperform laggards by a significant margin. On each of the 10 specific action measures, at least three-quarters or more of leaders report they are already doing the activity; laggards only exceeded 20% on one action step—linking corporate purpose to global challenges.

Of these ten steps, leaders were far more likely to have implemented the two action steps seen by investors and boards as important to driving internal transformation and aligning the organization to progress on global challenges.

Click through to see the five key themes that distinguish leaders from laggards.

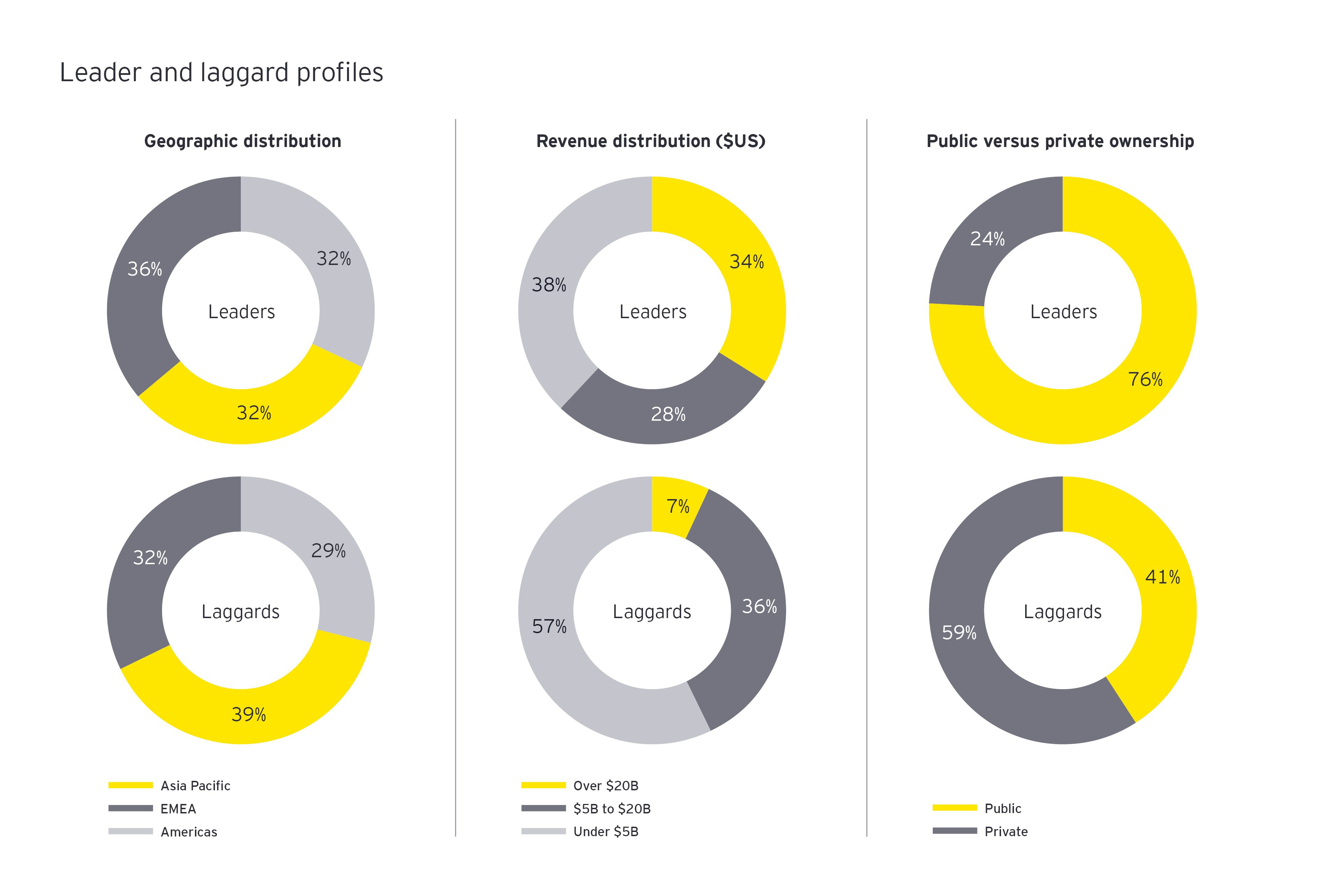

So, what do leaders and laggards look like? Geographically, they’re similar: 68% of leaders and 61% of laggards are headquartered in Europe, the Middle East and Africa, and the Americas. Some 39% of laggards and 32% of leaders are from the Asia Pacific.

Size matters

Yet that’s where the similarities end. Larger companies appear to be held more accountable to help solve global challenges: companies with annual revenue of $20 billion or more are almost five times more likely to be leaders than laggards (34% versus 7%, respectively). Among companies with annual revenue of less than $5 billion, laggards outweigh leaders by 57% to 38%).

Public companies lead the way

Similarly, public companies are three times more likely to be leaders than laggards (76% versus 24%, respectively). Laggards (59%) comprise a greater share of privately-held companies than leaders (41%), suggesting that private companies may not feel as much pressure from their external stakeholders as publicly-held entities.

From an industry perspective, laggards are concentrated in banking and capital markets; consumer products and retail, and healthcare. Leaders are more concentrated in asset management, manufacturing and industrial products and automotive. Both categories have large concentrations in the technology industry. Given recent criticism of technology’s role in exacerbating social problems such as inequality and job loss, it’s perhaps not surprising that technology firms are divided when it comes to understanding their role and approach to these problems.

Chapter 4

The DNA of an engaged CEO

A new set of capabilities and instincts will be required.

For CEOs, leadership is today about much more than simply generating shareholder value. In fact, avoiding politically-charged issues or holding non-committal stances is no longer sustainable. And we found boards and investors are far more supportive of CEO engagement on global challenges than CEOs think. But for leaders to truly lead on these issues, a new set of capabilities and instincts is required. Here are four critical items that should be on the CEO’s action agenda:

1. Define your criteria for becoming engaged on specific global challenges

- Which global challenges are relevant to the long-term success of our organization and the markets we serve?

- Which global challenges are a topic that our organization has relevant position and resources within ourselves and our larger business ecosystem to influence needed change?

- Which global challenges am I personally passionate about helping to solve and would be relevant to take on given the company’s purpose or mission?

- How well do I understand board, investor and other stakeholder support for the global challenges on which I want to make a difference?

- What are the “rules of engagement” for addressing a potentially politically-sensitive issues?

2. Define how the CEO role will change

- What new types of activities and responsibilities will you have to undertake in your CEO role?

- What skills and attributes will be required of an engaged CEO?

- How does your succession planning need to change, given the new requirements of the CEO role?

- How will you garner support for your new roles and activities from your stakeholders?

3. Embed global challenges in your purpose, strategy, operations and success metrics

- How well does your company’s articulated purpose embody the global challenges you’ve identified for deeper engagement?

- Does your corporate strategy process and mindset include future-back planning that embeds global challenges, megatrends, and disruptive innovation potential into the approach?

- How are your strategies and investments aligned to include and activate the global challenge objectives you’ve identified for deeper engagement?

- Have you embedded non-traditional concepts of value (e.g., triple bottom line, shared value, long-term value, UN SDGs) into your corporate reporting framework?

- How will you express commitment to solving global challenges from an operational standpoint (e.g., innovation investments, products and services, brand positions, supply chain, workforce practices and composition, etc.)?

- What new competencies and skills might you need in your C-suite to address global challenges?

4. Work within larger ecosystems to devise and execute on meaningful solutions

- How can you work more with governments and non-governmental bodies to solve global challenges?

- How can the industry and cross-industry coalitions to which you belong do more to address global challenges?

- How can you embed your commitment to addressing global challenges throughout your larger value chain (e.g., customers, suppliers and partners)?

Summary

CEOs need to become leading actors on global challenges, and be at the forefront of advocating solutions, even if it means taking themselves out of their personal comfort zone. The longevity of their organizations depends on it.