EY transaction snapshot

About the company

Established in 1981 and headquartered in Woodbridge, Ontario, Soroc serves a blue-chip customer base in the financial services, technology and retail industries across North America. Customers rely on Soroc’s proven track record of quality IT services, including onsite and help desk support, procurement and deployment, professional services, recruiting, and business continuity and disaster recovery services. CenterGate is a private equity investment firm based in Austin, Texas that focuses on investing in private middle market companies.

The Win-Win

EY used our vast experience working with entrepreneurial, mid-market businesses to help drive a superior transaction outcome and provide Soroc with a partner to help drive future success and growth. EY led all portions of the process, including the negotiation of key terms and structure of the transaction.

This partnership marks an important step in Soroc’s growth by providing the capital and strategic resources to grow its service offerings while maintaining its focus on unparalleled customer service.

We selected EY as our financial advisor due to their experience of working with Canadian private middle market companies and their dedicated Technology M&A team. Their hands-on approach and strategic advice were critical while navigating the complexities of closing a transaction with a US investor during the COVID pandemic. The M&A team at EY were great partners throughout the entire process and were instrumental in achieving a successful transaction outcome for Soroc and its shareholders.

EY’s Sector focused quarterly recaps

Illustrative Ontario transactions

The following is a snapshot of transactions that occurred in Ontario during the quarter, with a focus on mid-market, private company transactions. Companies headquartered in Ontario are noted in yellow.

- Oct 1, 2020: CCL Industries Inc. acquired Denmark-based Graphic West International ApS, a manufacturer and supplier of folding carton packaging, and rigid set-up boxes for the pharmaceutical and medical device industries, for C$36m. The transaction value implies a TEV/Revenue multiple of 0.6x. The acquisition will help CCL grow its product line and expand its footprint to meet the demand in CCL’s Healthcare & Specialty Business.

- Oct 1, 2020: GFL Environmental Inc. acquired Texas-based WCA Waste Corporation, a provider of non-hazardous solid waste collection, transfer, processing and disposal services, for US$1,212m. The transaction value implies a TEV/revenue multiple of 3x. The acquisition will help GFL expand its US footprint and will also provide a base for making further strategic acquisitions.

- Oct 1, 2020: 360insights.com acquired West-Midlands-based Corporate Rewards Ltd., a provider of sales incentive and employee recognition solutions. The acquisition will help 360insights increase its sales and return on investment by expanding its global workforce, reach and customer base. Terms of the transaction were not disclosed.

- Oct 5, 2020: Autodesk Inc. acquired Ontario-based CAMplete Solutions Inc., a provider of software solutions for computer numerical control and milling machines. The acquisition will help Autodesk expand its product offerings post migration of CAMplete’s product suite into Autodesk’s advanced manufacturing product family. Terms of the transaction were not disclosed.

- Oct 14, 2020: Simply Green Home Services Inc. acquired British Columbia-based Snap Financial Corporation, a consumer finance company engaged in providing loans, for C$511m. The acquisition will allow Simply to drive innovation and enable expansion of its customer base by providing additional products and services.

- Oct 19, 2020: Blue Ant Media Solutions Inc. acquired Ontario-based MobileSyrup.com, a content production, distribution and TV channel operating company. The acquisition will help Blue Ant to expand its digital footprint in tech space. Terms of the transaction were not disclosed.

- Oct 20, 2020: Surewerx Inc. acquired Ontario-based Geroline Inc., a manufacturer of winter traction aids. The acquisition will strengthen Surewerx’s current position in safety and productivity, and the K1 Series brand of Geroline that offers winter traction aids will be complementary to its Due North portfolio, a specialist in full-coverage ice cleats. Terms of the transaction were not disclosed.

- Oct 26, 2020: Simply Green Home Services Inc. acquired Ontario-based Dealnet Capital Corp., a provider of finance process outsourcing solutions through its portfolio, for C$243m. The acquisition will contribute to Simply’s investment strategy for growth and will benefit its customers due to combination of wide offerings.

- Oct 30, 2020: Clearspring Capital Partners acquired Quebec-based Regal Confections Inc., which is engaged in manufacturing, packaging and distributing chocolate and non-chocolate confectionery products. The acquisition will help Regal pursue its growth strategy with the capital and support of Clearspring. Terms of the transaction were not disclosed.

- Nov 1, 2020: WELL Health Technologies Corp. acquired Ontario-based DoctorCare Inc., a provider of billing and optimization software for doctors, for C$11m. DoctorCare will serve as a new business unit of WELL, focused on the North American medical billing and back-office marketplace.

- Nov 6, 2020: The Descartes Systems Group Inc. acquired Ontario-based ShipTrack Inc., a provider of cloud-based mobile resource management and shipment tracking solutions, for C$50m. The acquisition will help Descartes make timely deliveries to clientele and fulfil its distribution obligations.

- Nov 9, 2020: Algonquin Power & Utilities Corp. acquired Bermuda-based Ascendant Group Limited,a provider of electrical generation, transmission and distribution services, for US$433m. The acquisition will allow APUC to continue its growth program through further international expansion of its regulated utility business.

- Nov 11, 2020: WELL Health Technologies Corp. acquired Ontario-based Insig Corporation, a provider of SaaS-enabled virtual platforms for healthcare professionals and patients, for C$31m. The acquisition will enable WELL to enhance its virtual platform expertise and product offering and utilize Insig’s resources and operational capabilities.

- Nov 18, 2020: CloudMD Software & Services Inc. acquired Ontario-based iMD Health Global Corp., an e-health software development company that provides digital patient engagement platforms, for C$10m. The acquisition will provide iMD with increased resources and capital for further acquisitions of complementary solutions. The acquisition will also enable iMD to provide healthcare professionals direct access to additional educational resources for delivery to their patients from one platform.

- Nov 24, 2020: Tulip Retail Inc. acquired California-based Timekit Inc., a provider of an API-first appointment scheduling system. The acquisition will enable Tulip to drive digital transformation, enhance connected customer experience and drive revenue growth. Terms of the transaction were not disclosed.

- Nov 25, 2020: Ace Hill Beer Company Inc. acquired Ontario-based Iconic Brewing Company Inc., a provider of ready-to-drink alcoholic beverages. Terms of the transaction were not disclosed.

- Nov 26, 2020: Green Shield Benefits Association acquired Ontario-based Benecaid Health Benefit Solutions Inc., a provider of employee benefits solutions for Canadian small and medium-sized businesses. The acquisition will allow Green Shield and Benecaid to leverage synergies across platforms, distribution channels and human re-sources to collaboratively provide customers advanced solutions. Terms of the transaction were not disclosed.

- Nov 30, 2020: Cemtrex Inc. acquired Ontario-based MasterpieceVR, a developer of professional desktop application that offers a suite of 3D content creation products for virtual reality. The acquisition will allow Cemtrex to further expand its virtual reality portfolio. Terms of the transaction were not disclosed.

- Dec 21, 2020: CenterGate Capital made an investment in Ontario-based Soroc Technology Inc., a company that specializes in IT infrastructure services for large enterprises. This partnership marks an important step in Soroc’s growth by providing capital and strategic resources.*

- Dec 22, 2020: Converge Technology Solutions Corp. acquired Saskatchewan-based Vivvo Application Studios Ltd., a company that designs and develops identity-management-as-a-service platform software, for C$7m. The transaction value implies a TEV/revenue multiple of 3.8x. The integration is expected to better position Converge in the next generation digital identity product market.

- Dec 30, 2020: PointClickCare Corp. acquired Utah-based Collective Medical Technologies, a network-enabled real-time cross-continuum care coordination platform for the healthcare industry, for US$650m. The acquisition will help PointClick position itself as a high-growth, cloud-based healthcare software provider to the healthcare industry.

- Dec 30, 2020: Enghouse Systems Limited acquired Lisbon-based Altitude Software Inc., a provider of omnichannel contact centre solutions for small and large organizations. The acquisition will help Enghouse expand its presence in Latin American countries. Terms of the transaction were not disclosed.

- Dec 30, 2020: Dye & Durham Limited acquired Ontario-based Courthouse Solutions Inc., a provider of workflow management software. The acquisition will help Dye & Durham accelerate the adoption of cloud-based software dockets within Canadian courts. Terms of the transaction were not disclosed.

* EY acted as financial advisor.

Historical M&A activity

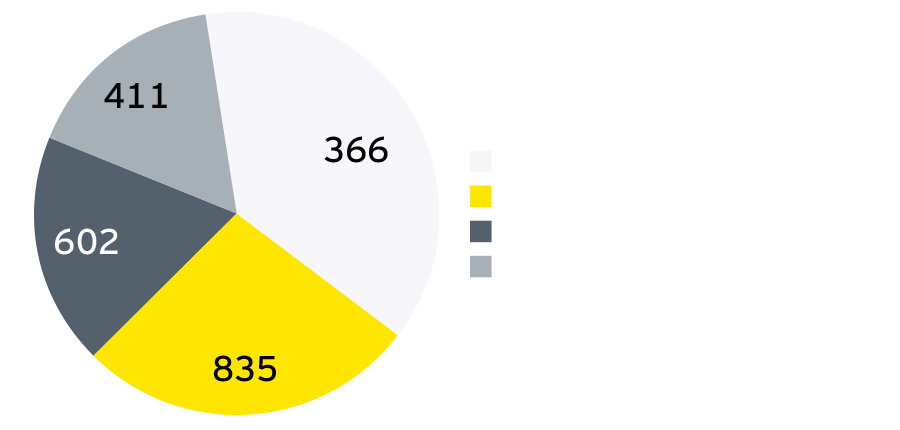

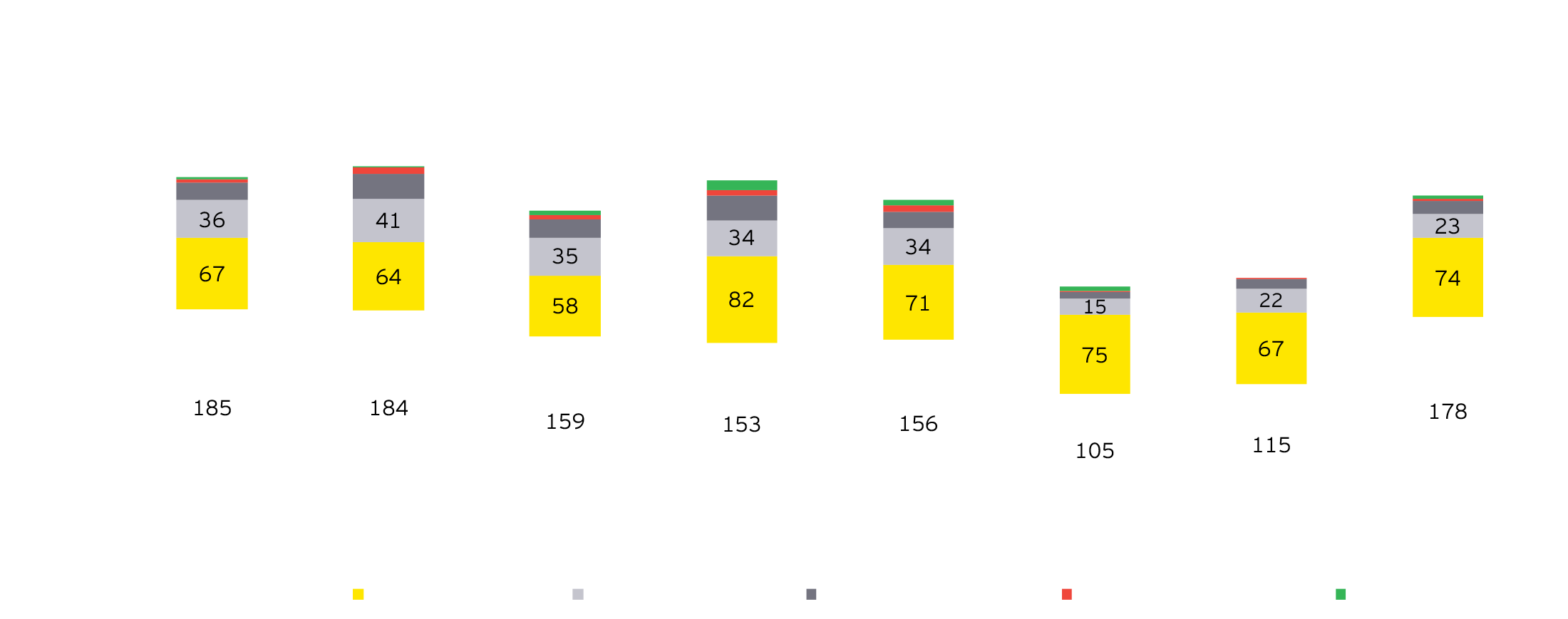

Counterparty mix over the last eight quarters

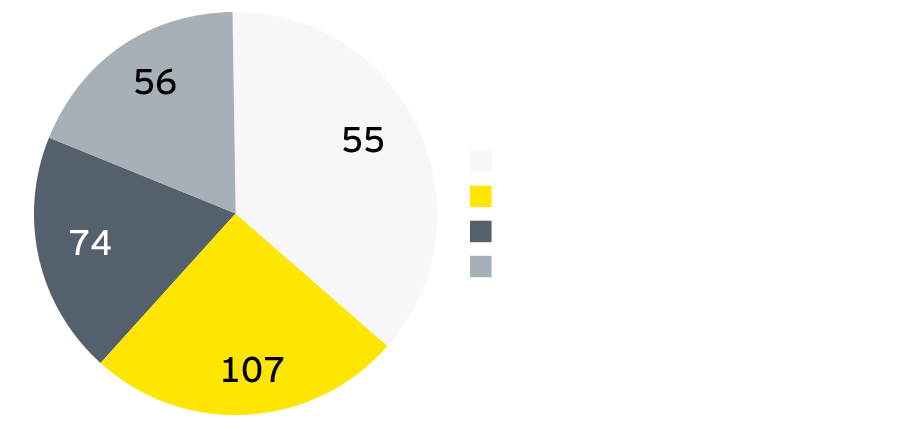

Counterparty mix over the last quarter

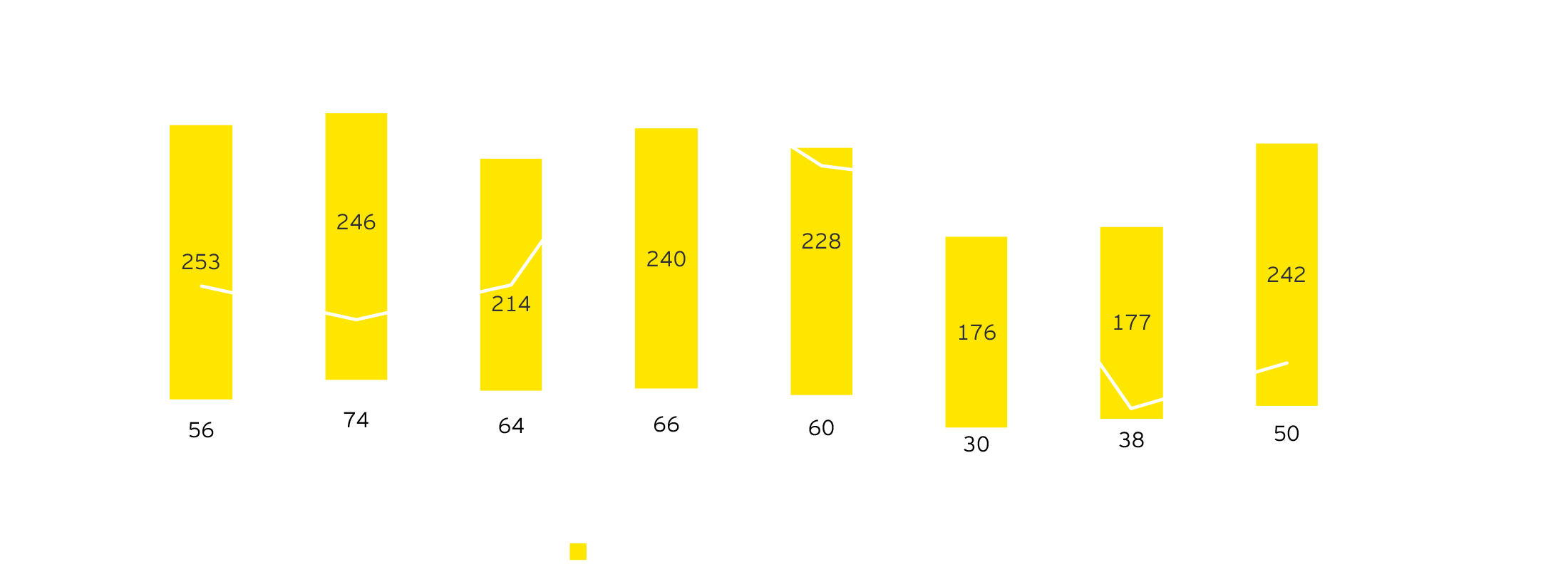

Transactions involving Ontario-based companies over the last eight quarters

Transactions involving Ontario-based companies over the last eight quarters by deal size (in C$) millions)

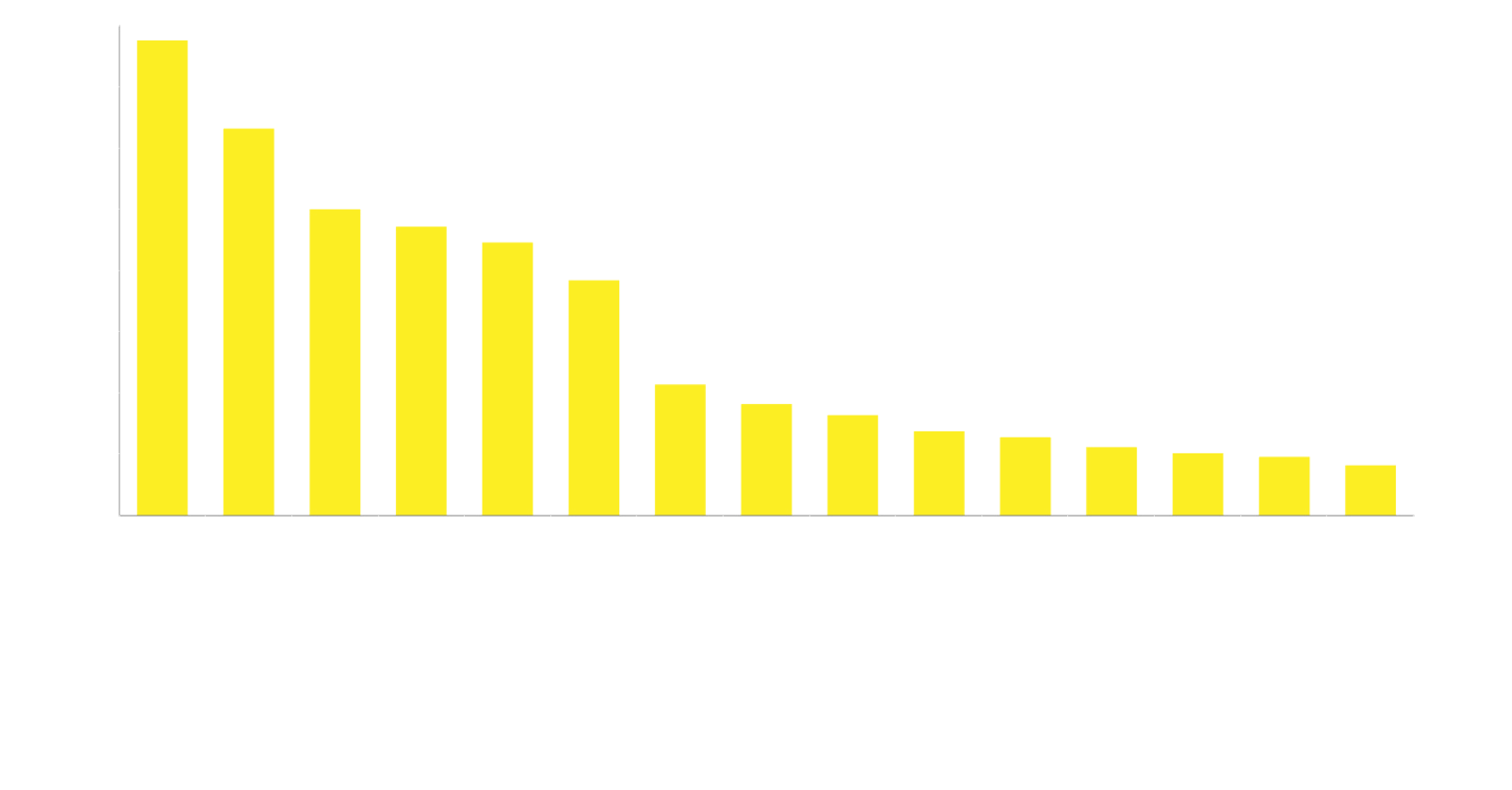

Number of Ontario transactions by industry over the last eight quarters

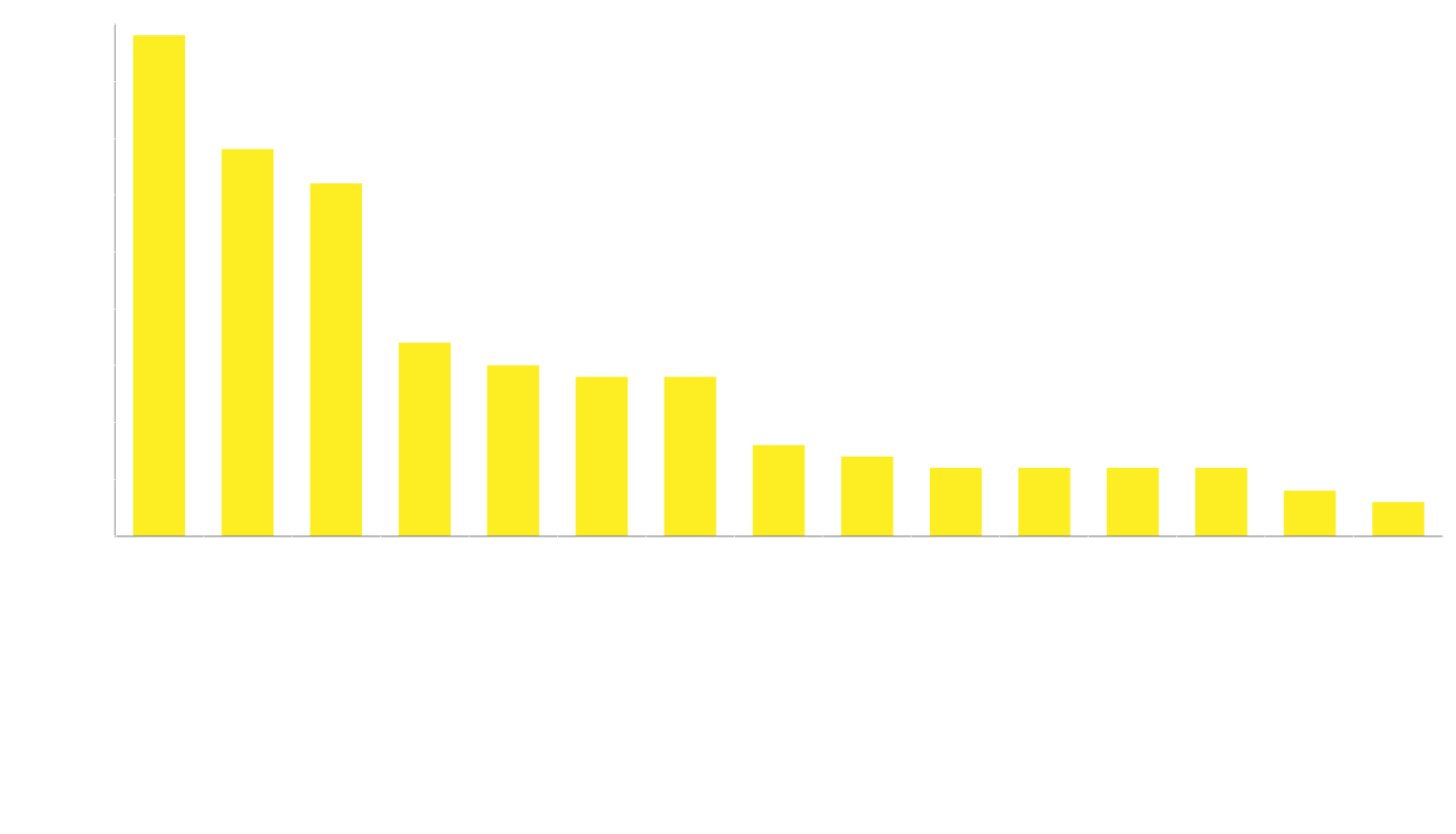

Number of Ontario transactions by industry over the last quarter

Summary

Deal volume involving Ontario-based companies in Q4 2020 was up 35% over the previous quarter, and deal volumes were similar to Q4 2019, suggesting a movement back to pre-COVID-19 levels. While total transaction deal value is still below the pre-COVID period, it appears that this is mostly due to fewer deals over $500m and more deals with undisclosed value.