SR&ED and Business Incentives

Unlock scientific research and experimental development (SR&ED), capital recoveries and other incentives to drive growth.

We’re on a mission to help Canadian companies navigate SR&ED tax credits, capital deductions and credits and other incentives quickly, efficiently and predictably. Whether you’re a complex multinational organization or an owner-operated startup, we pair leading professionals with unique digital tools to optimize the various credits and incentives available to you. We cover the innovation, business expansion, hiring and sustainability-related landscapes.

Our services

![[R&D Incentives] [R&D Incentives]](https://assets.ey.com/content/dam/ey-sites/ey-com/en_ca/topics/sr-ed-and-business-incentives/img/ey-r-and-d-incentives-text.png)

Identification of eligible activities and costs, preparation of claims, assistance with government reviews and process improvement recommendations for:

- Canadian SR&ED claims

- US R&D claims

- Global R&D claims

![[Capital Deductions and Credits] [Capital Deductions and Credits]](https://assets.ey.com/content/dam/ey-sites/ey-com/en_ca/topics/sr-ed-and-business-incentives/img/ey-capital-deductions-and-credits-text.png)

Detailed analysis of costs using engineering, construction and valuation techniques to optimize:

- Capital Cost Allowance

- Current tax deductions

- Investment tax credits

![[Other Incentives] [Other Incentives]](https://assets.ey.com/content/dam/ey-sites/ey-com/en_ca/topics/sr-ed-and-business-incentives/img/ey-other-incentives-text.png)

Identification and preparation assistance with applications for incentives related to:

- Technology adoption / expansion

- Environmental sustainability

- Innovation development

- People development

- Location selection

Solutions to meet your needs

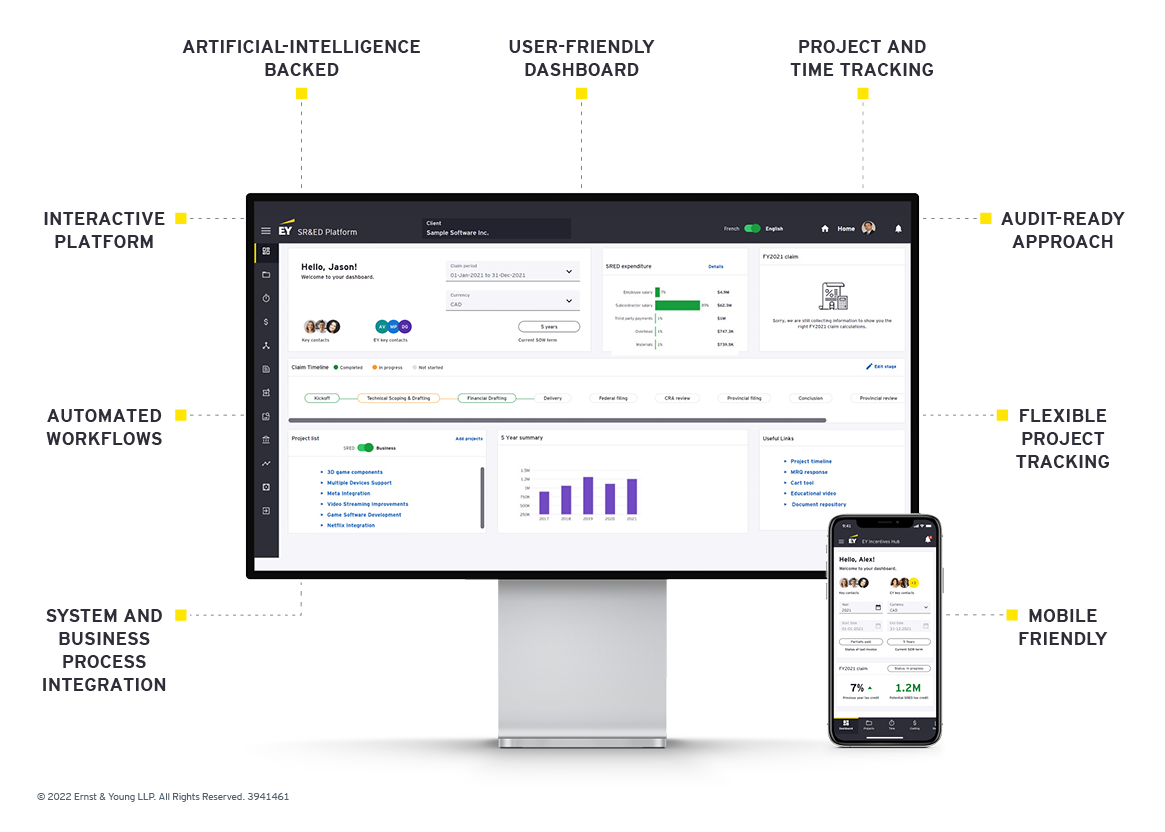

Rethinking your approach to SR&ED and incentives frees up cash and time for innovation. Innovative companies translate disruption into meaningful new solutions, products and services. The EY Business Tax Incentives Hub can help you manage SR&ED, tax credits for e-business, capital cost recovery and other programs holistically. This reduces inefficiencies, expedites the process and liberates funds, empowering you to be competitive and agile.

EY's Business Tax Incentives Hub

EY is continually investing in the development of innovative technology tools that can help to modernize your SR&ED process. Our digital SR&ED platform enhances client communications and helps optimize the claim size, while making the process less onerous on your team.

The SR&ED and business incentives team

At EY, we’re on a mission to enable Canadian innovation at every stage of the growth journey. Whether you’re a start-up, scale-up, or a multinational business, our team of professionals are here to support you at every phase.