Finance announces targeted COVID‑19 support measures

Tax Alert 2021 No. 30, 1 November 2021

The Canada Emergency Wage Subsidy (CEWS) and the Canada Emergency Rent Subsidy (CERS) (including the lockdown support) expired on 23 October 2021 (end of period 21). In their place, the government announced new targeted COVID‑19 support measures in addition to an extension of the Canada Recovery Hiring Program (CRHP).

The introduction of the new targeted COVID‑19 support measures represents a shift away from the broad-based assistance that was previously available to eligible entities affected by the pandemic, and toward an approach that focuses primarily on eligible entities that have been deeply affected since the outset of the pandemic and are continuing to face significant challenges.

Although the CEWS and the CERS expired on 23 October 2021, eligible entities can continue to make an application for these subsidies until 180 days after the end of the applicable qualifying period.

Business support measures

The following is a summary of the business support measures announced:

Tourism and Hospitality Recovery Program (THRP)

- The THRP would provide wage and rent subsidies (similar to the CEWS/CERS) to eligible entities in the tourism and hospitality industry that have experienced the most significant losses since the outset of the pandemic.

- Examples of eligible entities include hotels, restaurants, bars, festivals, travel agencies, tour operators, convention centres, and convention and trade show organizers. Additional details on the definition of qualifying businesses within this category will be forthcoming.

- The lockdown support would continue to be available to eligible entities under the THRP at the same rate of 25%, prorated based on the number of days in a qualifying period that a particular location is affected by a lockdown.

Hardest-Hit Business Recovery Program (HHBRP)

- The HHBRP would provide wage and rent subsidies (similar to the CEWS/CERS) to eligible entities that have experienced the most significant losses since the outset of the pandemic (and that do not qualify for the THRP above).

- The lockdown support would continue to be available to eligible entities under the HHBRP at the same rate of 25%, prorated based on the number of days in a qualifying period that a particular location is affected by a lockdown.

Public health lockdown support

- Entities that become subject to a qualifying public health restriction would be eligible for support at the subsidy rates applicable under the THRP above.

- An entity would be eligible for this support if it has one or more locations subject to a public health restriction that lasts for at least seven days in a qualifying period and that requires the entity to cease activities that accounted for at least 25% of its total revenue during the prior reference period.

- The entity would only need to demonstrate a current-month revenue decline (and not a revenue decline since the outset of the pandemic as under the THRP and HHBRP).

Canada Recovery Hiring Program

- The CRHP would be extended to 7 May 2022, with the possibility of a further extension to 2 July 2022.

- The subsidy rate would be increased to 50% beginning 24 October 2021 until 7 May 2022. Previously, the CRHP was set to expire on 20 November 2021, and the subsidy rate was set to decline to 20% from 24 October 2021 to 20 November 2021.

- The existing eligibility rules would continue to apply and the existing baseline period of 14 March 2021 to 10 April 2021 would continue to be used to calculate incremental remuneration.

The THRP, HHBRP and public health lockdown support would be available from 24 October 2021 to 7 May 2022, with the possibility of further extension to 2 July 2022.

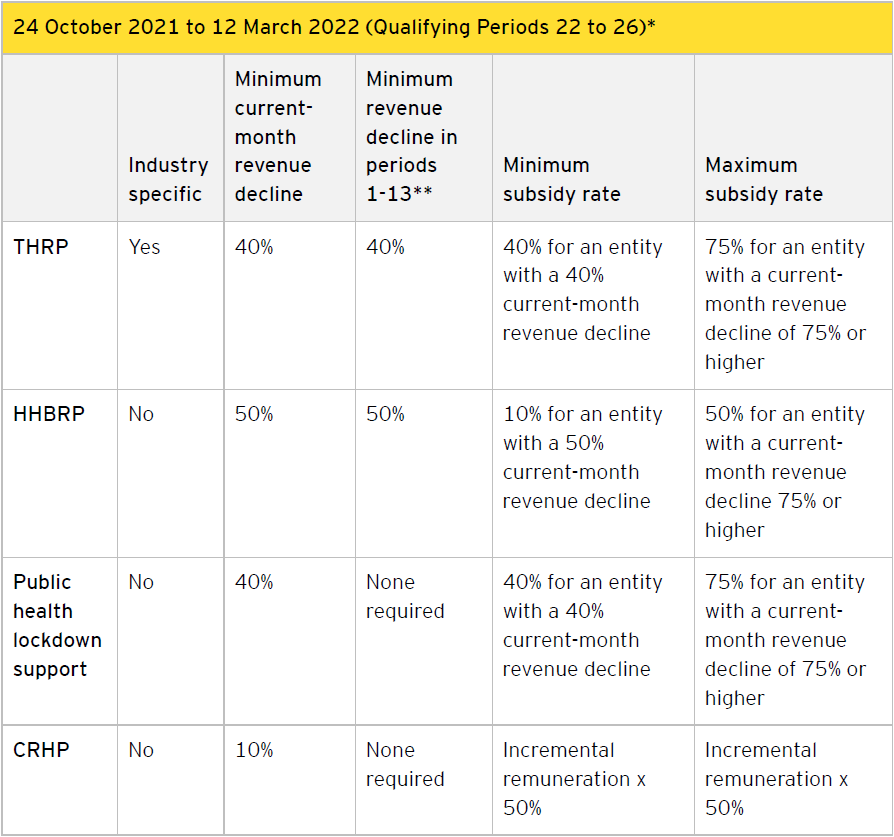

The table below provides a high-level comparison of the business support measures summarized above, based on the Minister’s announcement:

*The subsidy rates for the THRP, the HHBRP and the public health lockdown support would be reduced by half for qualifying periods from 13 March 2022 to 7 May 2022 (periods 27 and 28).

**Calculated as the average of all revenue decline percentages from March 2020 to February 2021 (periods 1 to 13, excluding period 10 or 11), and excluding any periods in which the entity was not carrying on its ordinary operations for reasons other than a public health restriction, such as in the case of seasonal operations.

The THRP and the HHBRP will function differently than the CEWS, in that eligibility for the CEWS was determined on a period-by-period basis even though the eligible entity might not have experienced a revenue decline when a longer measurement period is used.

While it remains to be seen, it is likely reasonable to anticipate that the executive remuneration repayment rule that applied to certain entities under the CEWS for qualifying periods 17 to 21 will be extended to the THRP, the HHBRP and possibly the public health lockdown support, as the same policy rationale would be applicable under these new targeted support measures.

No update on Minister’s report on the CEWS

Enacted Bill C-30, Budget Implementation Act, 2021, No. 1, contains a provision that requires the Minister of Finance to prepare a report on proposed measures to:

- Prevent publicly traded companies and their subsidiaries from paying dividends or repurchasing their own shares while receiving the CEWS after the tabling of the report; and

- Recover wage subsidy amounts from publicly traded companies and their subsidiaries that have paid dividends or repurchased their own shares while receiving the CEWS prior to the tabling of the report.

It is important to recognize that this requirement does not necessarily equate to or guarantee any future changes to the CEWS provisions of the Income Tax Act. Parliament would have to decide based on the report whether to implement the proposed measures.

This report is required to be presented within 15 days of when the House of Commons next sits (i.e., by 10 December 2021).

Notably, the Minister’s announcement did not provide an update on the status of the Minister’s report, including the date the report will be presented and what proposed measures the report might include.

Next steps

Although the government is proposing to use the authority given under Bill C-30 to provide hard-hit organizations with support under the THRP and the HHBRP until 20 November 2021, it indicated that legislation will be introduced in Parliament after it reconvenes on 22 November 2021 for the extensions and support after 20 November 2021.

For further information on the announcement, refer to the Department of Finance news release, Government announces targeted COVID-19 support measures to create jobs and growth, and the accompanying backgrounders.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Toronto

Uros Karadzic

+1 416 943 2087 | uros.karadzic@ca.ey.com

Tom Di Emanuele

+1 416 932 5889 | tom.diemanuele@ca.ey.com

Lawrence Levin

+1 416 943 3364 | lawrence.levin@ca.ey.com

Caitlin Morin

+1 416 943 3133 | caitlin.morin@ca.ey.com

Edward Rajaratnam

+1 416 943 2612 | edward.rajaratnam@ca.ey.com

David Robertson

+1 403 206 5474 | david.d.robertson@ca.ey.com

Montréal

Stéphane Leblanc

+1 514 879 2660 | stephane.leblanc@ca.ey.com

Philippe-Antoine Morin

+1 514 874 4635 | philippe-antoine.morin@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.