Prince Edward Island budget 2022‑23

Tax Alert 2022 No. 10, 25 February 2022

“[W]e are living in a period of unprecedented challenges and unprecedented opportunities. It is essential that government address these challenges and seize these opportunities. This budget strives to achieve those goals.”

“Government’s agenda must also be more than a “political agenda.” It must be the People’s Agenda, not based on what is expedient for the current election cycle, but what is right for the future.”

“[T]hese plans are extensive, many expensive, but all are achievable and will contribute to a better society. Working together and using our collective skills I am confident our efforts will ensure a fair and more prosperous future for every citizen of this Province.”

Prince Edward Island Finance Minister Darlene Compton

2022–23 budget speech

On 24 February 2022, Prince Edward Island Finance Minister Darlene Compton tabled the province’s fiscal 2022–23 budget. The budget contains tax measures affecting individuals and corporations.

The minister anticipates a deficit of $26.5m for 2021–22 and projects a deficit of $92.9m for 2022–23, followed by further reduced deficits for each of the next two fiscal years ($51.9m for 2023–24 and $32.1m for 2024–25).

Following is a brief summary of the key tax measures.

Business tax measures

Corporate income tax rates

No changes are proposed to the corporate income tax rates or the $500,000 small-business limit.

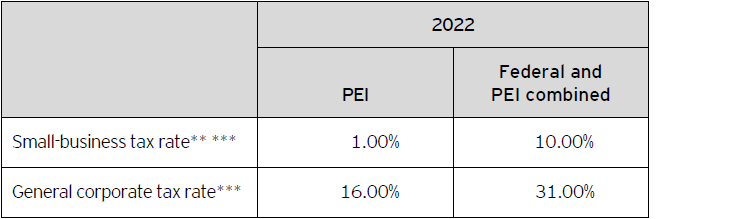

Prince Edward Island’s 2022 corporate income tax rates are summarized in Table A.

Table A – 2022 corporate income tax rates*

* Rates represent calendar-year rates.

** Prince Edward Island reduced its small-business tax rate from 2.00% to 1.00% effective 1 January 2022.

*** The 2021 federal budget proposed to temporarily reduce the federal corporate income tax rate for qualifying zero-emission technology manufacturers by 50% (i.e., to 7.5% for eligible income otherwise subject to the 15% general corporate income tax rate or 4.5% for eligible income otherwise subject to the 9% small-business corporate income tax rate), applicable for taxation years beginning after 2021. The reduced tax rates are proposed to be gradually phased out for taxation years beginning in 2029 and fully phased out for taxation years beginning after 2031.

Personal tax

Personal income tax rates

The budget does not include any changes to personal income tax rates.

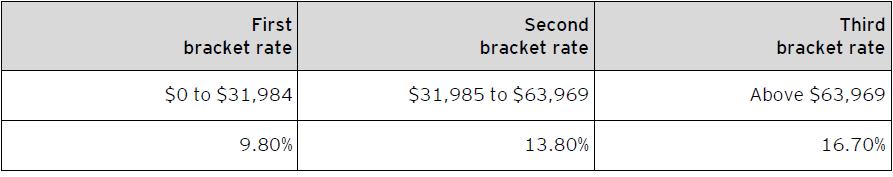

The 2022 Prince Edward Island personal income tax rates are summarized in Table B.

Table B – 2022 Prince Edward Island personal income tax rates

In addition, there is a 10% surtax on provincial income tax in excess of $12,500.

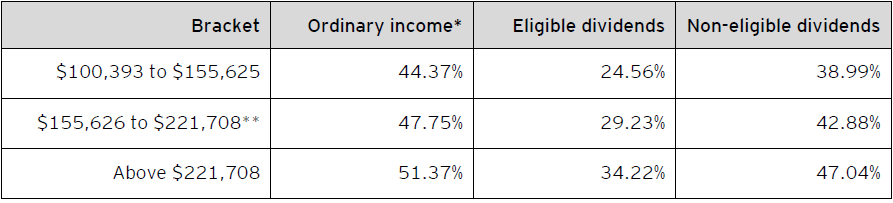

For taxable income in excess of $100,392, the 2022 combined federal-Prince Edward Island personal income tax rates are outlined in Table C.

Table C – Combined 2022 federal and Prince Edward Island personal income tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with net income in excess of $155,625 and is fully eliminated for individuals with net income in excess of $221,708. Consequently, the additional amount is clawed back on net income in excess of $155,625 until the additional tax credit of $252 is eliminated; this results in additional federal income tax (e.g., 0.38% on ordinary income) on net income between $155,626 and $221,708.

Personal tax credits

The budget proposes to increase the basic personal income tax exemption to $12,000 from $11,250 as of 1 January 2023.

Harmonized Sales Tax

The budget proposes to increase the rate of the rebate of the provincial component of the Harmonized Sales Tax for charities and non-profit organizations to 50% from 35% as of 1 January 2023.

Other tax measures

Tax on vaping products

The budget proposes the introduction of a new tax on vaping products, but no details were provided in the budget documents.

Tobacco tax

The budget also proposes an increase on tobacco taxes, but no details were provided in the budget documents.

Carbon levy

Lastly, the budget proposes an increase, effective 31 March 2022, in the carbon levy on the carbon-based fuels that are currently taxed, but no details were provided.

Learn more

For more information, please contact your EY or EY Law advisor.

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.