Federal government delivers its Fall Economic Statement 2020

Tax Alert No. 56, 30 November 2020

“Our strategy is clear: We will do whatever it takes to help Canadians through this crisis. We will invest in every necessary public health measure. We will support Canadians and Canadian businesses, in a deliberate, prudent and thoughtful way. And we will ensure the Canadian economy that emerges from this pandemic is more robust, inclusive and sustainable than the one that preceded it, with a stronger, more resilient middle class.”

Deputy Prime Minister and Finance Minister Chrystia Freeland

2020 Fall Economic Statement

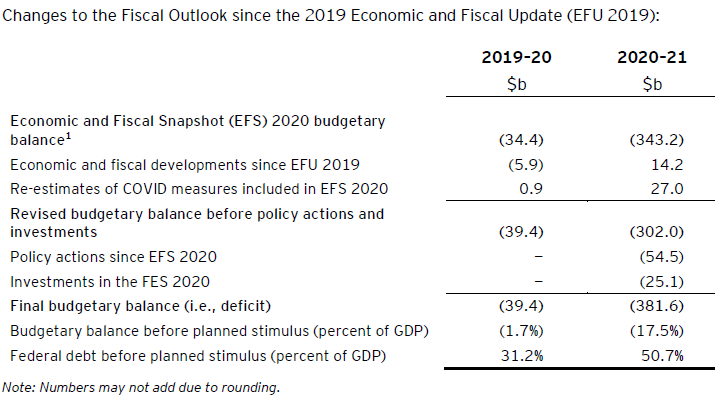

On 30 November 2020, federal Deputy Prime Minister and Finance Minister Chrystia Freeland tabled Supporting Canadians and Fighting COVID-19: Fall Economic Statement 2020. The Fall Economic Statement (FES) contains several tax measures affecting individuals and corporations. As set out in Table A, the minister anticipates a deficit of $381.6b for 2020–21 and projects deficits for each of the next five years.

Table A: Projections of federal budgetary deficit

1 The EFS was delivered on 8 July 2020. See EY Tax Alert 2020 No. 41.

Several income tax measures, and the accompanying legislative amendments, are proposed in the FES, including measures with respect to:

- Amendments to the Canada Emergency Wage Subsidy and the Canada Emergency Rent Subsidy (including the related lockdown support);

- Employee stock options;

- The Canada Child Benefit;

- Registered disability savings plans; and

- Patronage dividends paid in shares in respect of agricultural cooperatives.

Also, several sales tax measures, and the accompanying legislative amendments, are proposed in the FES, including measures with respect to:

- GST/HST application in relation to e-commerce supplies;

- GST/HST on cross-border digital products and services;

- GST/HST on goods supplied through fulfilment warehouses;

- GST/HST on platform-based short-term accommodations; and

- GST/HST relief on face masks and face shields.

The government also outlined other measures to improve tax fairness and strengthen compliance by:

- Introducing a domestic unilateral tax on corporations providing digital services, which would apply from 1 January 2022, until a coordinated multilateral approach (developed by international partners and led by the Organisation for Economic Co-operation and Development) is introduced;

- Targeting the unproductive use of Canadian housing by foreign non-resident owners;

- Funding new initiatives and extending existing programs targeting international tax evasion;

- Initiating consultations to modernize Canada’s anti-avoidance rules; and

- Simplifying the home office expense deduction.

Additional information and insight with respect to these proposals will be discussed shortly in greater detail in upcoming EY Tax Alerts.

For more information on these measures, see Supporting Canadians and Fighting COVID-19.

Learn more

For more information, please contact your EY advisor.

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.