Chapter 1

Effective communication is key to address value

Focusing on materiality and relevance of information

Best-in-class organizations can effectively translate their assets and future value chain into an integrated view for their stake- and shareholders and combine financial, human, environmental, social and governance aspects in their management and public communication.

Today, a large number of publicly available reports fail to address this requirement by not creating sufficient prerequisites for performing holistic management decisions as well as estimating a predicative picture for the future value creation of the company. A common reason for failing to meet these prerequisites is the limited attention to one of the most important regulatory financial reporting criteria: the materiality and relevance of information. Therefore, it is not uncommon that, as an outcome, the foundation for internal and external measurements usually represents an unreflected hodgepodge of annual, social and sustainability reports of large volume but incoherent content.

To prevent this, a continuous process set-up supports and enables a materiality analysis in correlation with the overall strategy and the value chain of an organization, combining them effectively to an integrated view for internal and external reporting.

Chapter 2

Continuous process builds foundation

Prioritizing consistency and relevance of information

The implementation of a continuous process aims to increase information exchange and, as a result, enhances the level of end-to-end measurement systems. This also further facilitates the predictability of future value creation capabilities. Therefore, it is inevitable to first define the tangible and intangible company’s core assets and finally combine them with quantifiable key performance indicators and their ecosystem impacts. Hence, the focus is less on quantity and more on the consistency and relevance of the information, which builds the prerequisite for the successful integration into the organizational strategy. The gain lies in the alignment of the operating model and its processes in a way that transparently defines the segregation of duties and responsibilities at all departments levels. This enables a process governance according to financial, non-financial, social, environmental or human perspectives in order to address all significant stakeholder interests in an integrated model.

Chapter 3

Technology is the backbone

Aiming for harmonization and automation of data

For every organization, adequate data quality and availability is the essential backbone in order to empower the foundation for a continuous process and grow an integrated ecosystem. Nowadays, heterogenic system landscapes with multiple reporting tools, manual workarounds and complexity in interfacing data prevent companies from implementing sustainable changes. However, recent technology developments and increasing intuitive finance functionalities in software offer the possibility of enriching data within one integrated environment. As a result, siloed reporting data is centralized in a so-called “Single Source of Truth” within one data mart and allows it to be integrated into one finance data model and process. To unleash such capabilities, multiple individual company parameters like data granularity, status standardization or harmonization, automation target or complexity of the business model should be considered to determine the effort of a transformation. Therefore, examples of leading practices aim to streamline the IT system landscapes and interfaces, thereby also lowering operating and maintenance costs. In addition to the merge in systems, costs and effort, organizations use the related data enrichment and new granularity for combining information and using it across the entire reporting value chain in an automated way.

Chapter 4

Organizational change management as opportunity

Striving for development and transformation of knowledge

With the development towards integrated measurements and incentives, it is essential to enable a consistent expansion and transformation of specialist knowledge into value-creating skills for the entire organization. Therefore, the employee’s competence profile should empower integrated roles to connect the specialist area and different departments within one end-to-end view. This requires sophisticated change management to encourage the people in charge to gain a deep understanding of the organizational value chain, continuously enhance the corporate measurement and act as sparring partners for the management. Ergo, this increases the acceptance of the internal stakeholders, accelerates the operational performance and supports the development of new technical and process capabilities.

Chapter 5

Sustainability as accelerator to enable transformation into predictive reporting

Moving from reactive to predictive reporting

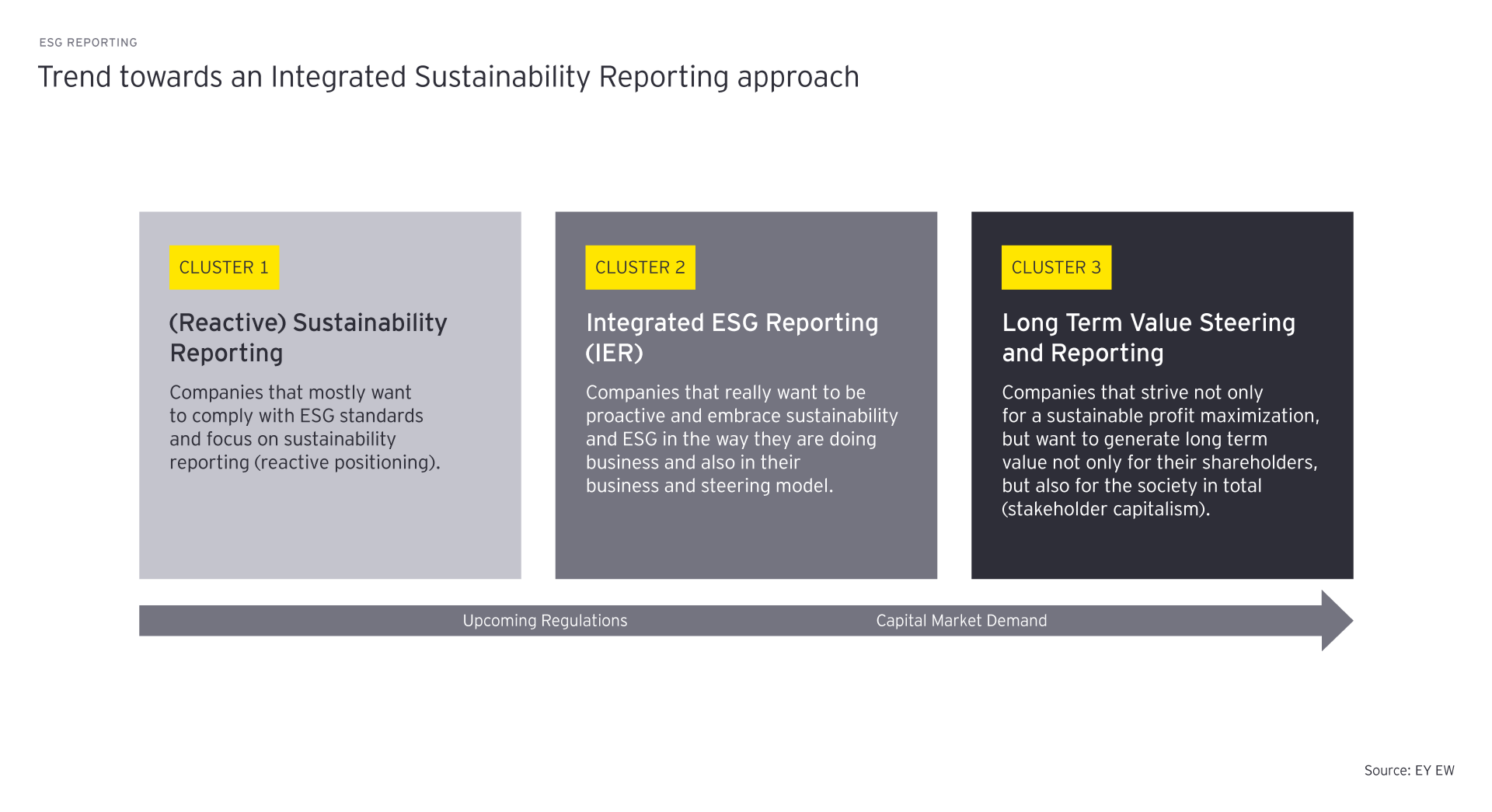

Leading practice organizations are using the upcoming ESG legal regulations for sustainability to change their reactive reporting (Cluster 1 ESG) into an integrated approach (Cluster 2 ESG) or even leverage the momentum to go a step ahead into a predictive long-term value steering and reporting model (Cluster 3 ESG), which then covers all layers from data and technology to process and organization. The reason for considering Cluster 3 is the key role steering and reporting activities as well as the closely related sustainability aspects take in influencing most of the company’s departments and processes and their importance in connecting the whole organization.

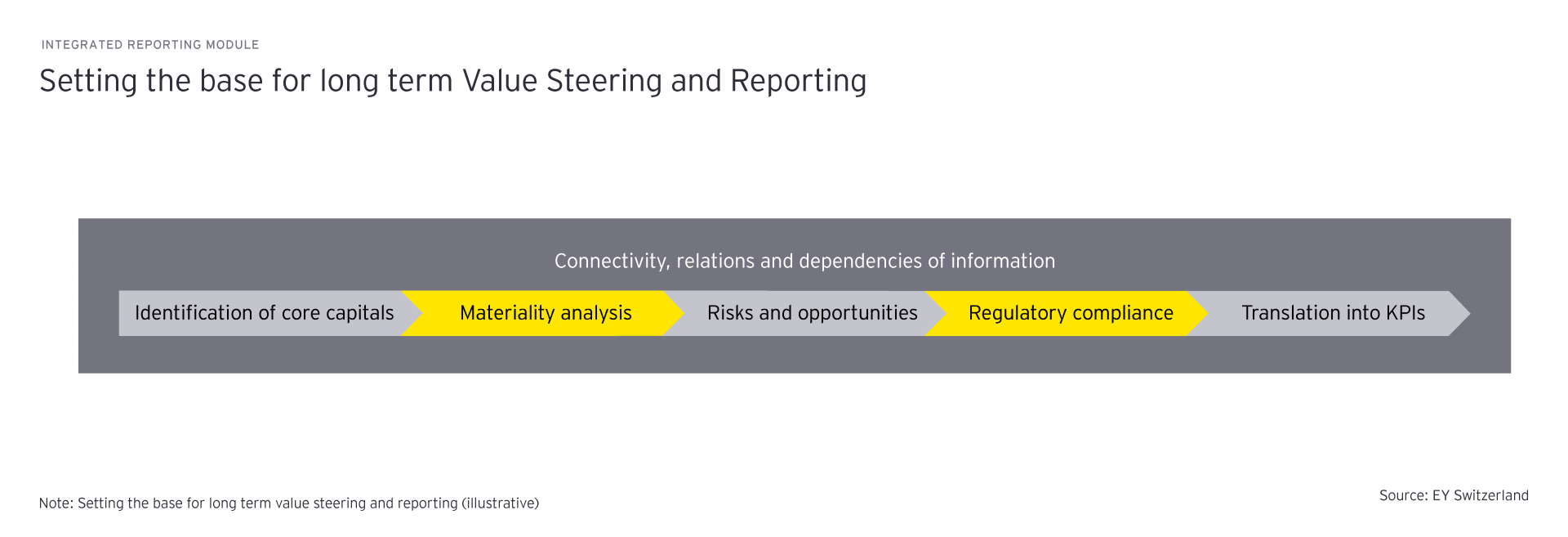

In order to implement this predictive long-term model, organizations focus on understanding as well as assessing the core of their strategic decisions and management approaches – known as “integrated thinking”. This means achieving connectivity of information and showing relations and illustration dependencies of organizational activities, not only within the company but also with society and its natural environment. Leading practices suggest starting from defining the stock of values (financial and non-financial assets) the organization operates with on a day-to-day basis, which is then transformed through organizational activities to create valuable output for share- and stakeholders. With this in place, the next vital step is to gain a qualitative understanding of the value-creation process, not only by analyzing internal and external material matters which influence the company’s activities but also by assessing related future risks and opportunities. Additionally, this further accelerates the alignment of the strategic and business model with existing and upcoming sustainability / reporting regulations. Once this holistic, connected and future-oriented thinking is in place, the ground is set for defining relevant measurements and KPIs reflecting the ability of generating economic, social and environmental value and successfully communicating the same to internal and external stakeholders. However, predefined progress goals, communication, clear employee roles and responsibilities have shown to be ongoing activities which need to be set right at the start and recurrently reviewed, as they are fundamental for a smooth reporting process.

Summary

Nowadays, many companies face the issue of setting sustainability-related targets before knowing what information is exactly available and how it can be used for steering the business. This ends up being a significant problem as non-financial disclosures, its underlying parameters, and targets have become strategically important across all industries. To address this, managed processes underpinned with targeted solutions to avoid material risks are highly required. Therefore, transforming towards Predictive Sustainability Reporting based on in-depth analysis of the business enables companies to tailor their sustainability/ESG data to their strategic and operational needs, ending up with valuable insights for the entire organization.