Chapter 1

Reshaping the business model

Clients expect simplicity, transparency, and swiftness

Digital transformation essentially means reshaping and enhancing the underlying business model. And this is exactly what clients expect.

Insurers have always known that private clients have a limited desire to look at insurance solutions in detail. Insurance products have rarely managed to trigger interest or even raise an intense desire to own the product. On the contrary, what clients want most are simplicity, transparency and speed. This attitude has become more pronounced, especially in recent years, due to the influence of other industries that have transformed or re-created their business models. This has led to a general shift in client expectations that insurers must also meet. Not an easy task given that insurance products require a higher level of advice and are traditionally sold personally, especially as this is likely to remain the case for some time.

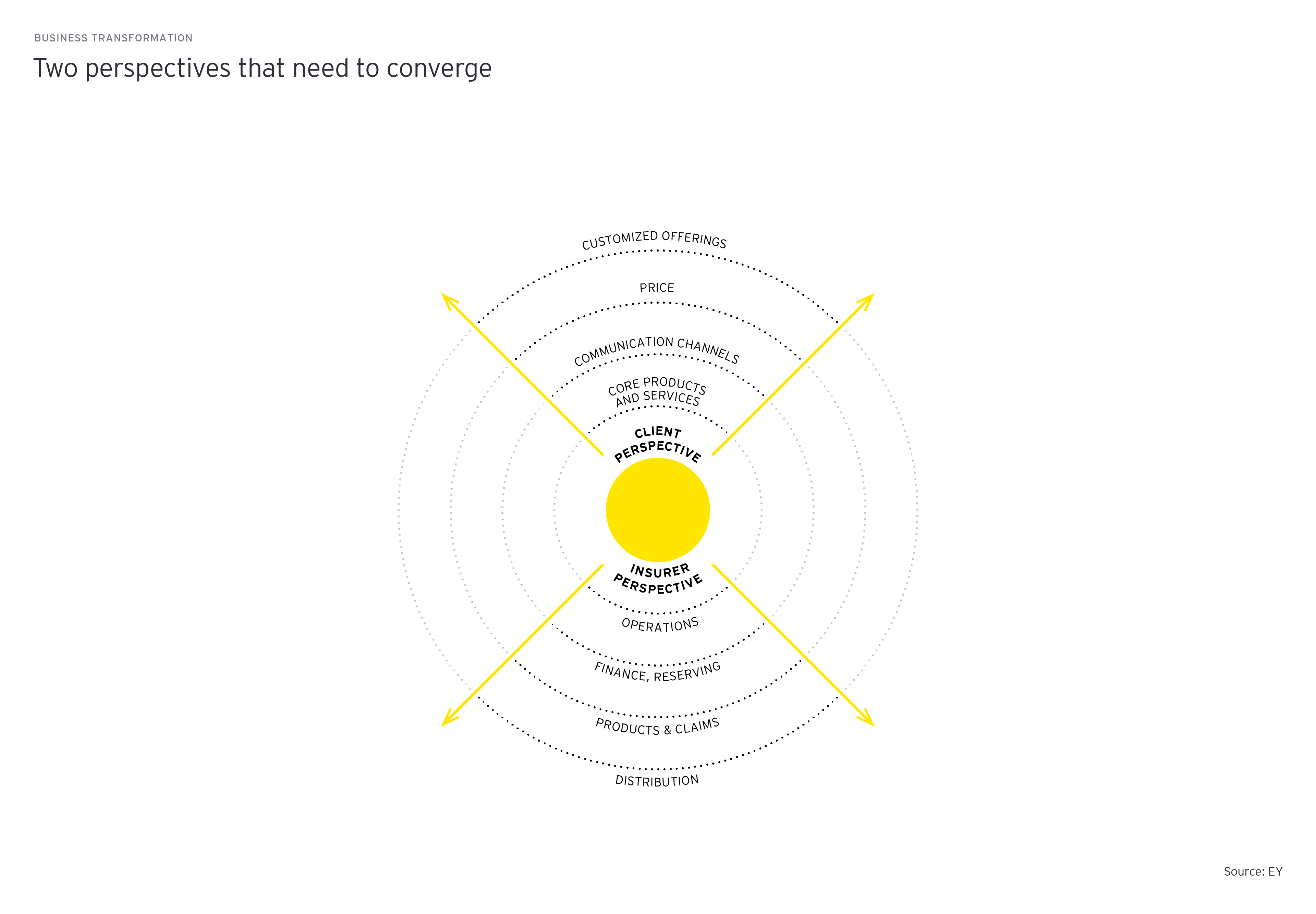

Essentially, then, we are dealing with two very different points of view – that of the client (policyholder, outside-in) and that of the insurance company (insurer, inside-out).

Their expectations of what makes digitalization successful diverge, as do their views of activities in this area to date. These two perspectives – as noted above – appear to have little overlap. While this is a classic conflict of objectives, it is by no means an insurmountable obstacle to successful digitalization of the insurance industry. Resolving this conflict starts by separating the two perspectives, the one of the policyholder and the one of the insurer, so they can be developed separately before being realigned step by step.

There are of course other perspectives that arise from the insurer's external relationships, e.g. with the claimant and other parties involved in the claims process, and – the most important - the intermediary. As a rule, the intermediary is positioned between the policyholder and the insurer and therefore holds both points of view.

Chapter 2

Separating the perspectives

How to enable digital communication

There are of course other perspectives that arise from the insurer's external relationships, e.g. with the claimant and other parties involved in the claims process, and – the most important - the intermediary. As a rule, the intermediary is positioned between the policyholder and the insurer and therefore holds both points of view.

From the perspective of the client, as well as the intermediary and all those involved in the claims process, the goal of digitalization is to enable, but not to force, purely digital communication between the insurer and client. This starts with contacting the client and concluding the contract but continues along the processes of contract management and – crucially – claims settlement. It has been repeatedly demonstrated how important it is to allow for personal communication during the claims process in particular. Digital interaction alone is not enough, it is essential to include in-person elements and channels. The client, not the insurer, must choose preferred methods, i.e. clients should be free to choose the communication channel that suits them best.

In fact, most insurers have already made good progress in this area. Almost all market players offer a range of communication channels for many products and claim types. The principle is always: the client makes the choice and selects their preferred method.

Chapter 3

Personalizing products

Why choices start with standardization

If this kind of client centricity is elevated to a principle, then digitalization means nothing other than generally giving clients a choice, or – put another way – personalizing insurance products and services. Digital transformation is not just about technology, but it depends on a shift in the corporate mindset that also tends to affect corporate culture. Giving the client the choice means prioritizing the client perspective over the insurer perspective. It means turning client expectations into your own and – if possible – fulfilling them. This is what allows innovation to emerge – and be perceived as such by the client.

But this cannot be a one-way street. A paradigm shift like this is only possible if the other perspective, i.e. that of the insurance company, is also considered. How can this personalization be achieved while still enabling the necessary scalability? The answer is standardization and simplification from within, and this is precisely what digitalization is about from the insurer's perspective.

Successively bringing these two views together is the silver bullet.

Digitalization means personalizing products from a customer perspective and standardizing processes internally.

In concrete terms, three components need to be aligned and combined to form a successful team:

- Process management i.e., the management of all processes, primarily internally and with the help of IT

- Technical expertise, i.e. the classic know-how of product development, underwriting and claims

- Client focus, i.e. know your client (KYC)

A catalyst for the success of this project is the cultural component mentioned above: rethinking corporate culture. This is more elusive and less concrete than other aspects, but it is the most important one. It is vital for an overarching and sustainable digital strategy, but shouldn’t stand in the way of certain areas being developed separately. It is perfectly possible and sensible to develop individual competencies in line with digital requirements without creating a digital patchwork in the company.

Chapter 4

Scope for transformation

Seven focus areas for digitalizing insurance

In the remainder of this series, we will explore those components of the value chain where there is scope for digital transformation in the company. We have identified seven key areas, which we present briefly here. Content and concepts will be developed in more detail in further articles on the selected topics.

There is still a lot of scope for digitalization on the client side in claims.

This is the starting point, and we can progress either by radically driving forward complete system conversions or – more likely – by successively replacing individual subsystems.

Summary

This is the first in a series of articles highlighting what digital transformation could achieve in the insurance sector, and where Swiss companies currently stand. We start by focusing on primary insurers and identify seven elements of their value chain where digital transformation of the business model can – and must – take place to give clients the convenience they know from other sectors and hence expect from their insurer. At the same time, however, we fully acknowledge that most clients continue to value personal contact with their insurer and expect a seamless digitalization of all insurance related processes.