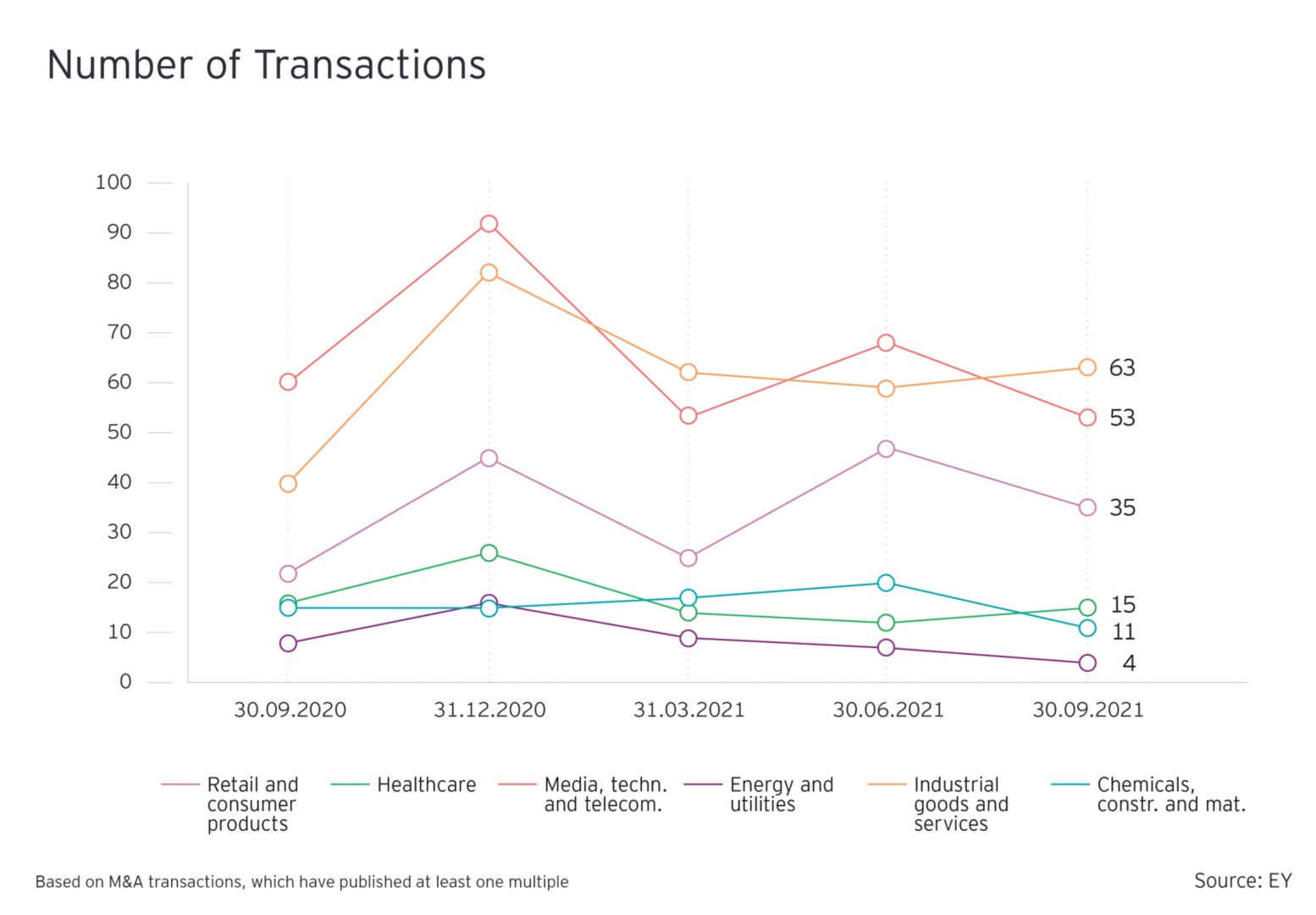

As opposed to Q2 2021 of the current publication, the number of deals in the European M&A activity declined in Q3 2021 by 15%. The total number of transactions (M&A deals, which were announced or announced & closed and have published at least one of the Revenue, EBITDA or EBIT multiples) across the six sectors shrunk from 213 to 181 during Q3 2021.

At the same time, in Q3 2021, the market observed 12% more transactions than in same quarter last year.

The overall decline in the number of transactions was primarily driven by the following four sectors: CC&M (45%), E&U (43%), R&CP (26%) as well as MT&T (22%).

In terms of sector specific performance, CC&M sector had a 45% decline to 11 deals after having witnessed a moderate growth in the last two quarters, while reaching 22 deals in Q2 2021.

E&U sector continued its declining trend from the last two quarters and saw the number of transactions decrease from 7 to 4 in Q3 2021.

R&CP sector, which had experienced an 88% growth in the number of transactions in the previous quarter, observed a slowdown from 47 to 35 transactions in Q3 2021.

MT&T sector also saw a decline of 22% to 53 transactions, which is also the lowest number on a quarterly basis since Q3 2020.

On the other hand, the number of transactions in the Healthcare sector increased by 25% to 15 transactions and in the IG&S sector by 7% to 63 transactions, after having experienced a decrease over the last two quarters.

The average deal volume (total deals value/number of deals) increased significantly by 135% during Q3 2021, which was primarily attributable to a substantial increase in deal sizes in four out of six sectors including CC&M, Healthcare, MT&T and R&CP.

Since the last 3 quarters, UK has retained the top spot among countries in terms of number of deals and location of the target company. In Q3 2021 the number of deals in UK contributed 25 % of total transactions, followed by Germany (12%) and France (10%).