A wide array of companies today are working toward digitalization of their core businesses and support functions such as finance and taxation. Meanwhile, tax authorities themselves are becoming more automated — with a fast-growing number of jurisdictions moving toward digital, real-time filing of basic value-added tax (VAT) or good and services tax (GST) transactions will eventually shift toward e-filing and e-audits.

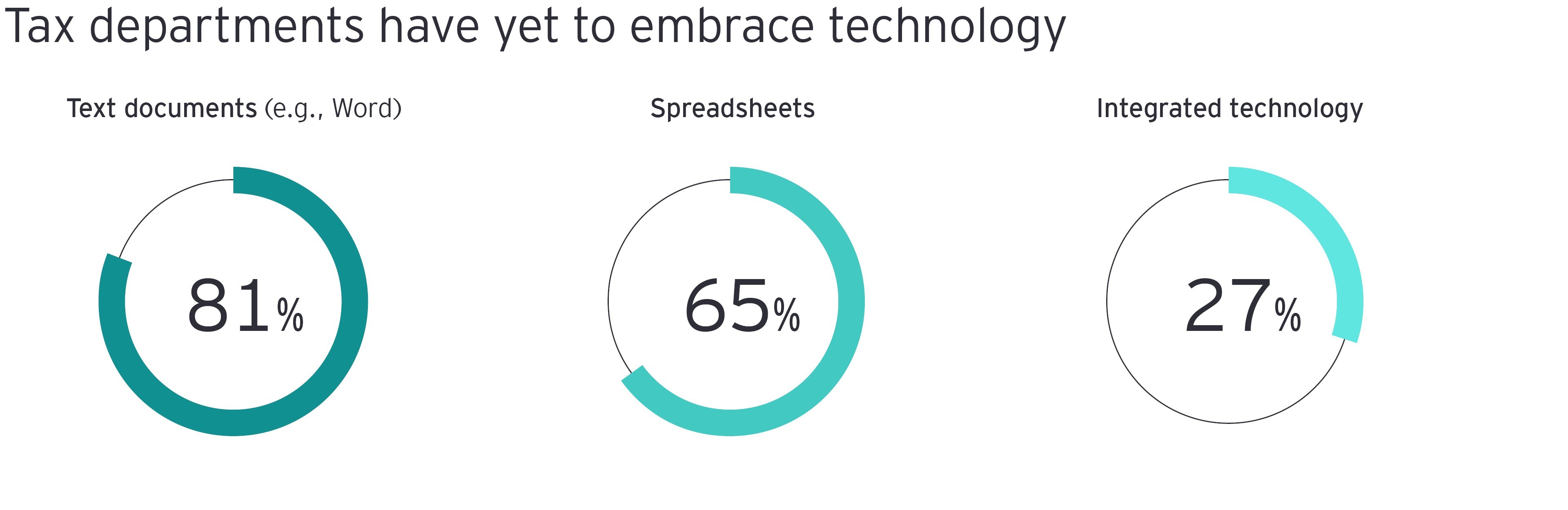

Tax departments themselves, says Fultz, “will find it worthwhile” to embrace new technologies. Software today, she explains, “can be used for purposes such as monitoring transfer pricing margins or keeping track of services charges.” Tools, such as robotic process automation (RPA), can be employed to lighten workloads, reduce errors and free greater resources for more value-added pursuits. Armed with more digital tools, “tax departments will be in a much better position for managing and documenting their transfer pricing.”

The adoption of a more centralized, shared services approach to global tax management goes hand in glove with technology. The model to embrace, says Fultz, “is one that is standardized to the full extent possible — where expertise is concentrated, and there is a data lake and the data is captured for a single-time use where and when needed.” Local finance and tax teams can of course respond to local needs and nuance, but adjustments and changes to processes and reports take place only where necessary.

Opportunity number five: obtain more help

Both van den Brekel and Coronado say that given the degree of change in today’s transfer pricing and general tax environment, businesses need to take a close look at tax department resources. “Do all you can with automation, with RPA and the like,” says van den Brekel. “But ultimately, your tax function is likely under-resourced; there is simply too much change and too many growing demands. Companies always want to do more with less, but here, the risks are growing.”

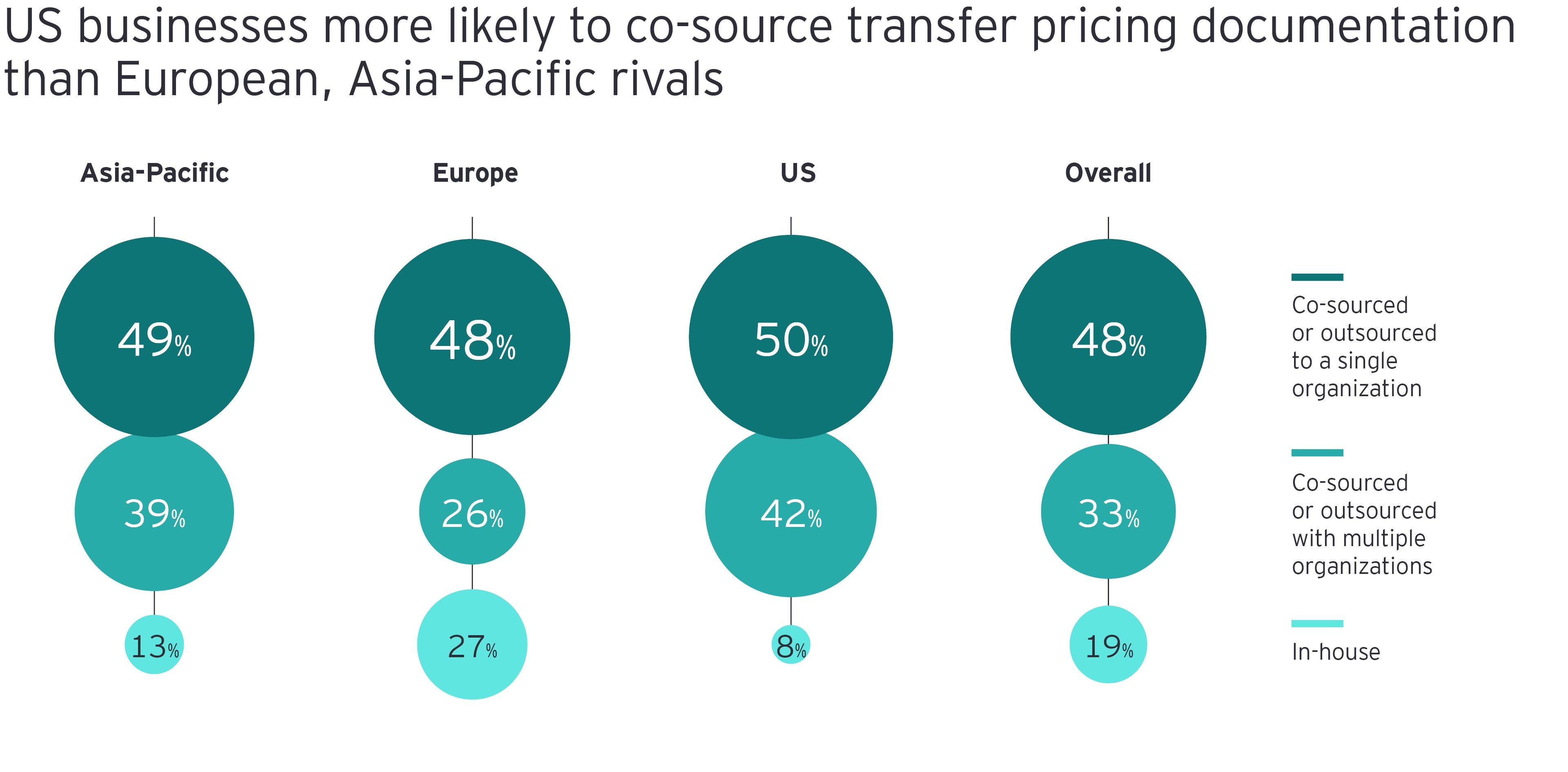

One means to address any resource gap is to pursue greater outsourcing or co-sourcing. Consistently, about half of all companies, regardless of geography, outsource significant portions of their transfer pricing documentation activities to outside providers. Meanwhile, 27% of European companies say they prefer keeping things in-house, which is twice the figure for Asia-Pacific (13%) and three times that of the US (8%). A final note: US firms are significantly more likely than others to pursue a co-sourced model.