EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Although the Global Anti-Base Erosion (GloBE) Rules and domestic minimum top-up tax (DMTT) will provide an investment fund exemption, an analysis will be required to assess whether an investment fund with a Hong Kong connection falls within the scope of these rules and can benefit from the investment fund exemption.

During the latest Budget Speech on 22 February 2023, the Hong Kong Secretary for Financial Services and the Treasury (SFST) announced that the Hong Kong government plans to implement the OECD’s Global Anti-Base Erosion (GloBE) Rules1 – i.e., the Income Inclusion Rule (IIR) and Undertaxed Profits Rule (UTPR) – and a domestic minimum top-up tax (DMTT) starting from 2025 onwards. Investment funds with a Hong Kong connection (e.g., constituted in Hong Kong or using special purpose vehicles established in Hong Kong to hold and administer investments) may, as a result, become liable to top-up tax in Hong Kong where their local or foreign profits are not subject to a 15% effective tax rate (ETR). This top-up tax could significantly impact the returns of fund investors.2

Since the GloBE Rules and DMTT will only apply to multinational enterprise (MNE) groups with a consolidated revenue of €750 million or more in two of the last four fiscal years, some investment funds may not be affected by these rules. Generally, investment funds are not required to consolidate their portfolio investments under financial reporting standards such as the Hong Kong Financial Reporting Standards (HKFRS).3 In these instances, investments funds may therefore fall short of the specified revenue threshold.

Further, fund managers should be aware that certain entities will be excluded from the application of the GloBE Rules and DMTT – including government entities, international organisations, non-profit organisations, pension funds, and investment funds4 and real estate investment vehicles that are ultimate parent entities (UPEs).5 An entity may also be excluded if it is owned (directly or through a chain of excluded entities) by one or more excluded entities, provided certain ownership thresholds and activity conditions are met. Such entities are typically holding companies of an investment fund that are used to hold and administer the portfolio investments.

Despite the above, some investment funds may still be subject to the GloBE Rules and DMTT owing to their unique facts and circumstances. Further, the applicability of the GloBE Rules and DMTT should be considered both at the fund level as well as at a portfolio level. Fund managers should therefore start reviewing the applicability of the GloBE Rules and DMTT immediately and assess their potential impact on investor returns.

It should also be noted that the fund managers themselves may be captured by the GloBE Rules if the management entities group (i.e., fund house) has consolidated revenue of €750 million or more in two of the last four fiscal years.

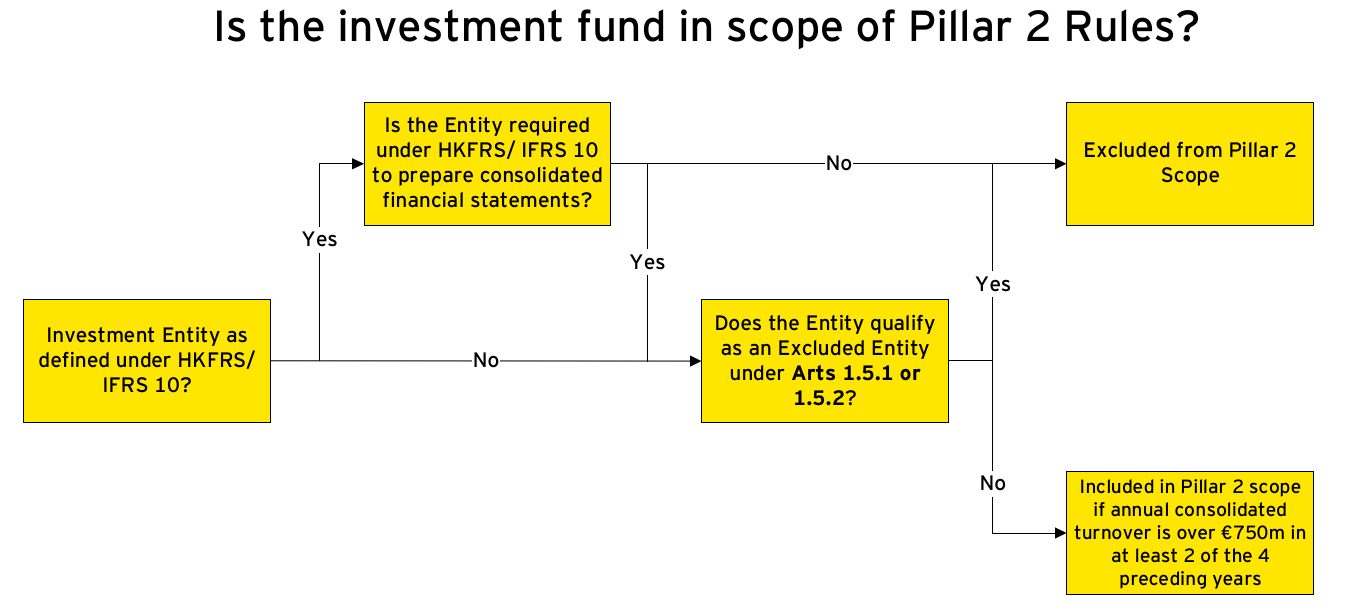

In this regard, we have prepared a simplified flowchart below to guide fund managers conducting a rapid assessment and ascertain whether a quick call with their tax advisor is required to take the BEPS 2.0 Pillar 2 discussion further.

The International Accounting Standards Board (IASB) issued amendments to IAS 12 to clarify the application of IAS 12 Income Taxes to income taxes arising from tax law enacted or substantively enacted to implement Pillar 2. The Amendments introduce:

- A mandatory temporary exception to the accounting for deferred taxes arising from the jurisdictional implementation of the Pillar Two model rules; and

- Disclosure requirements for affected entities to help users of the financial statements better understand an entity’s exposure to Pillar Two income taxes arising from that legislation, particularly before its effective date.

The mandatory temporary exception – the use of which is required to be disclosed – applies immediately. The remaining disclosure requirements apply for annual reporting periods beginning on or after 1 January 2023, but not for any interim periods ending on or before 31 December 2023. Entities need to monitor the developments around the implementation and (substantive) enactment of the Pillar Two model rules in the relevant jurisdictions, get ready to provide the disclosures required by the amendments to IAS 12 and endorsement of IAS 12 amendments with the local accounting standards board.

Summary

Fund managers should monitor Pillar 2 implementation and development in Hong Kong.