Amendments to the General Healthcare System Law, Settlement of Overdue Social Contribution Law and VAT Law

Is your entity ready to react to COVID-19 fiscal measures?

Following our alert issued on 17 of March 2020, we note that the Parliament voted today amending laws with regard to the General Healthcare System Law, Settlement of Overdue Social Contribution Law and VAT Law.

It is noted that these amending laws will be effective as of the date of their publication in the official Gazette of the Republic.

General Healthcare System Law (“GHS” Law)

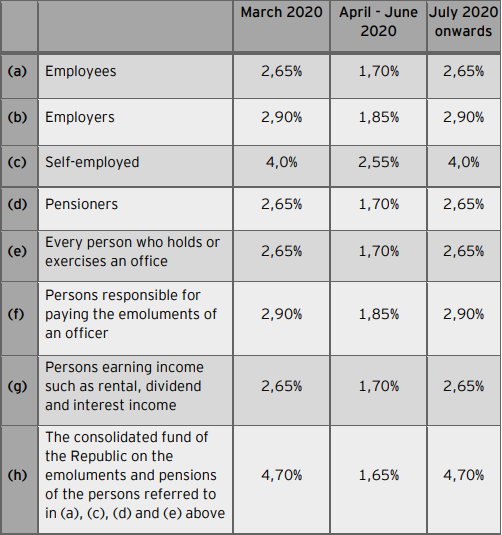

The purpose of the amending GHS Law is to enact one of the measures in the Government Support Program to tackle the effects of COVID-19.Given the amending law, the reduced contributions rates to the General Healthcare System (“GHS”) that were applicable during Phase A of GHS will apply, for all the categories set out in the below table, also for the months of April, May and June 2020. It is noted that the increased contribution rates applicable for Phase B of GHS will apply for the months of March 2020 and as of July 2020 (inclusive) onwards. Consequently, the GHS contribution rates are as follows:

Settlement of Overdue Social Contribution Law (SOSC Law) The purpose of the amending Settlement of Overdue Social Contribution Law is to amend Article 7(3) of the SOSC Law so that individuals and companies who have regulated the payment of their overdue social contributions in instalments, can defer relevant payments that are due for the months of March and April 2020 by extending the agreed repayment period by two months.

VAT Law

Subsequent to the initial announcement of various VAT measures, the final shape of amending VAT legislation provides for temporary VAT payment deferral to 10 November 2020 applicable for:

- The majority of entities (except from the list of sectors that have been expressly excluded in the amending law) regardless of turnover volume, total outputs or their respective decreases;

- VAT quarters December 2019 – 29 February 2020, January – March 2020 and February – April 2020;

- As long as those entities timely submit their VAT returns for the above quarters i.e. by 10 April, 10 May and 10 June 2020 accordingly.

The aforesaid deferral suspends additional 10% tax penalty, interest and criminal sanctions on VAT payable for taxable persons promptly submitting their VAT returns and arrange settlement by 10 November 2020.

Major Excluded Sectors (see accompanying economic activity coding found in VAT Registration Certificate for confirmation) from VAT payment deferral:

• Electricity Production & Water Distribution (35111 & 36001)

• Groceries – Food supermarkets & Kiosks – Mini-market (47111 & 47112)

• Pharmacies (47731)

• Retail multi-stores where food, drink, smoking items not predominant (47191)

• Internet & Satellite & telecommunications Services (61201,61301,61901)

• Retail Computing, peripheral and software trading (47411)

• Retail Fuel trading (47301)

All Excluded Economic Activity codes from VAT payment deferral:

35111, 36001, 47111, 47112, 47191, 47211, 47221, 47231, 47241, 47242, 47301, 47411, 47611, 47621, 47651, 47731, 61101, 61201, 61301, 61901. Proposed legislation on VAT rates reduction was withdrawn

How EY Cyprus can assist

Our Specialist Teams are at your disposal to examine entity specifics and provide assistance with:

✓ Impact Assessment of the measures and facilitation with Tax - VAT implementation.

✓ Supporting Tax - VAT treatment in software platforms, contractual employment agreements – terms, internal policies and accounting records.

✓ Structuring your entity Tax – VAT affairs in an efficient and compliant manner escaping from unnecessary leakages.

EY Cyprus will host a webcast analysing the COVID-19 fiscal measures. In case of interest, feel free to register here.

For additional information with respect to this Alert, please contact the following:

Petros Liassides

Partner, Tax Services

Tel: +357 22 209 797

George Liasis

Partner, Indirect Tax Services

Tel: +357 22 209 759

Herodotos Hadjipavlou

Assistant Manager, Direct Tax Services

Tel: +357 22 209 788

Herodotos.Hadjipavlou@cy.ey.com

Simos Simou

Manager, Indirect Tax (VAT) Services

Tel: +357 22 209 894

EY | Assurance | Tax | Transactions | Advisory

About EY

EY is a global leader in assurance,tax,transaction and advisory services.The insights and quality services we deliver help build trust and confidence in thecapital markets and in economies the world over. We develop outstanding leaders who team to deliver on ourpromises to all of our stakeholders.In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

For more information about our organization,please visit ey.com © 2020Ernst&YoungCyprusLtd All rights reserved. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to youradvisors forspecificadvice. ey.com/cy