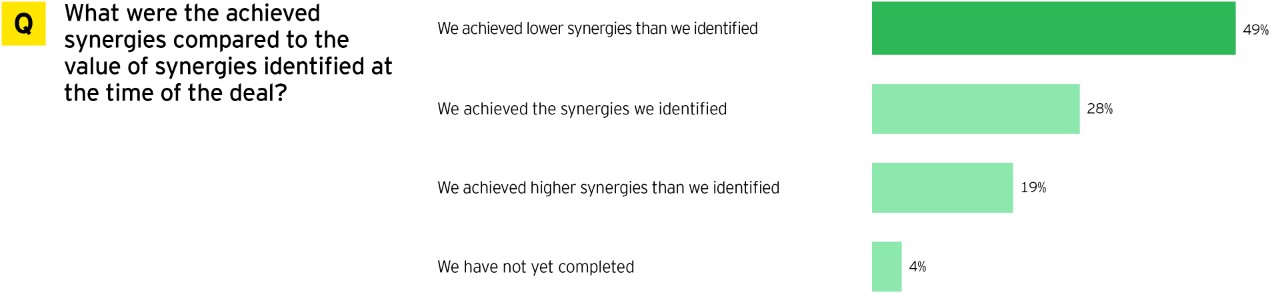

Many have failed to meet synergy goals historically, but the future looks more upbeat. The identification and realization of synergies are at the heart of M&A value creation — but this is only the start of the journey.

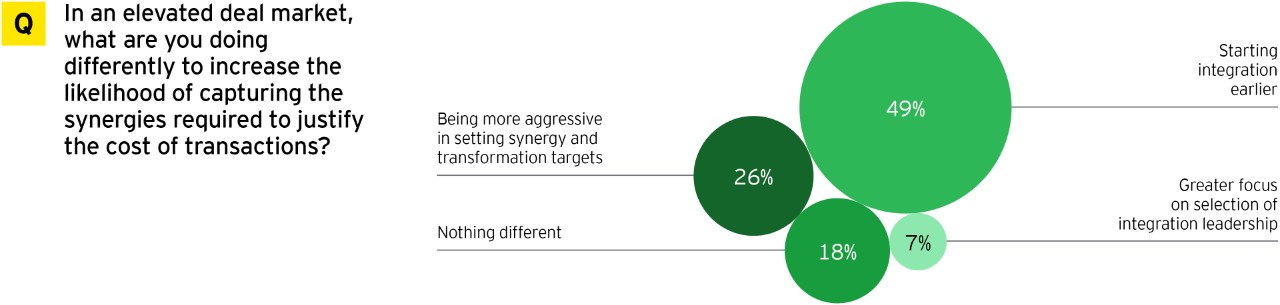

Executives are signaling that they are preparing for post-deal integration earlier in the deal life cycle than they have in the past. Acquiring companies will capture synergies effectively only if they map them out upfront and assign accountability for monitoring their progress.

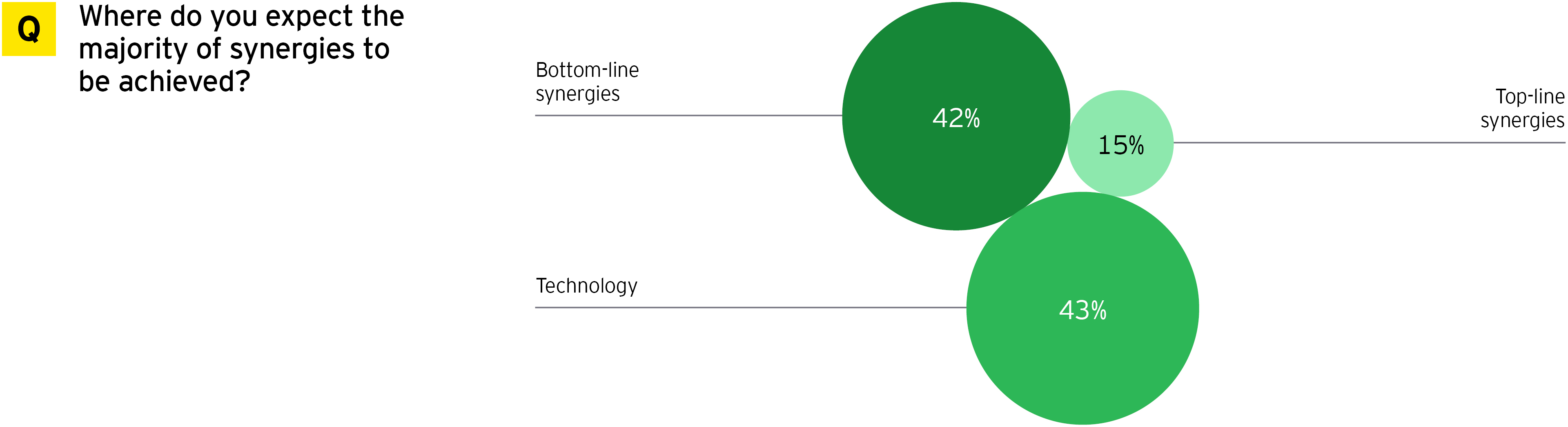

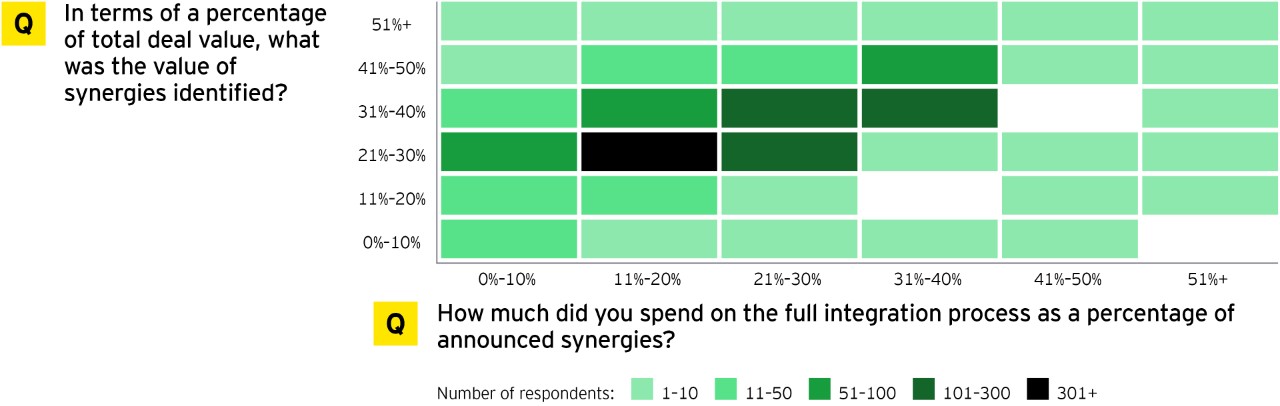

However, this requires experience of understanding and identifying where value can be created, what is proven to work and where the risks lie. To secure competitive advantage, value needs to be identified early, often with limited information.

Ideally, those responsible for achieving synergies should play a direct role in identifying and valuing specific synergies. Business units should help develop synergy assessments and promote buy-in very early in the process.