From the policymakers right down to the individuals who choose EVs over ICE vehicles, the transition is being met with enthusiasm and a commitment to the difference that electrification will make.

Chapter 1

eMobility nears inflection point

Surge of support takes EVs beyond the point of no return.

In 2020, we glimpsed an alternative reality. Fewer polluting vehicles on the roads, cleaner air and a healthier natural environment came courtesy of the national lockdowns that accompanied the COVID-19 pandemic. In some cities, nitrogen oxide levels from traffic fell by as much as 70%. It sparked introspection on how we live our lives, work and travel.

At the same time as consumers’ hearts and minds were being won over to cleaner transport, new carbon dioxide (CO2) emissions standards for automakers came into effect, while COVID-19 economic recovery packages focused on carbon-neutral and renewable energy solutions. Together, they gave eMobility a very decisive push.

In fact, in Europe, in the first nine months of 2020, EV sales outstripped those in China for the first time in at least five years. In the UK, in September 2020, EV sales eclipsed diesel sales for the first time, though only just. And, in the 11 months to November 2020, a landmark one million vehicle sales were either pure electric or hybrid models – accounting for 1 in every 10 passenger cars sold in Europe.

Admittedly, we are starting from a low base. Of the 308 million motor vehicles on Europe’s roads today, just 3 million1– including cars, buses and trucks – are electric. But the future potential is vast. EY analysis puts the estimated number of EVs at 40 million by 2030.2

Of the 308 million motor vehicles on Europe’s roads today, just 3 million are electric. But the future potential is vast. EY analysis puts the estimated number of EVs at 40 million by 2030.

Chapter 2

The need for speed in the electrification of transport

Can we go fast enough to stave off the irreversible effects of pollution from transport?

How soon we decarbonize will determine climate, health and environmental outcomes for decades to come. But are we going fast enough?

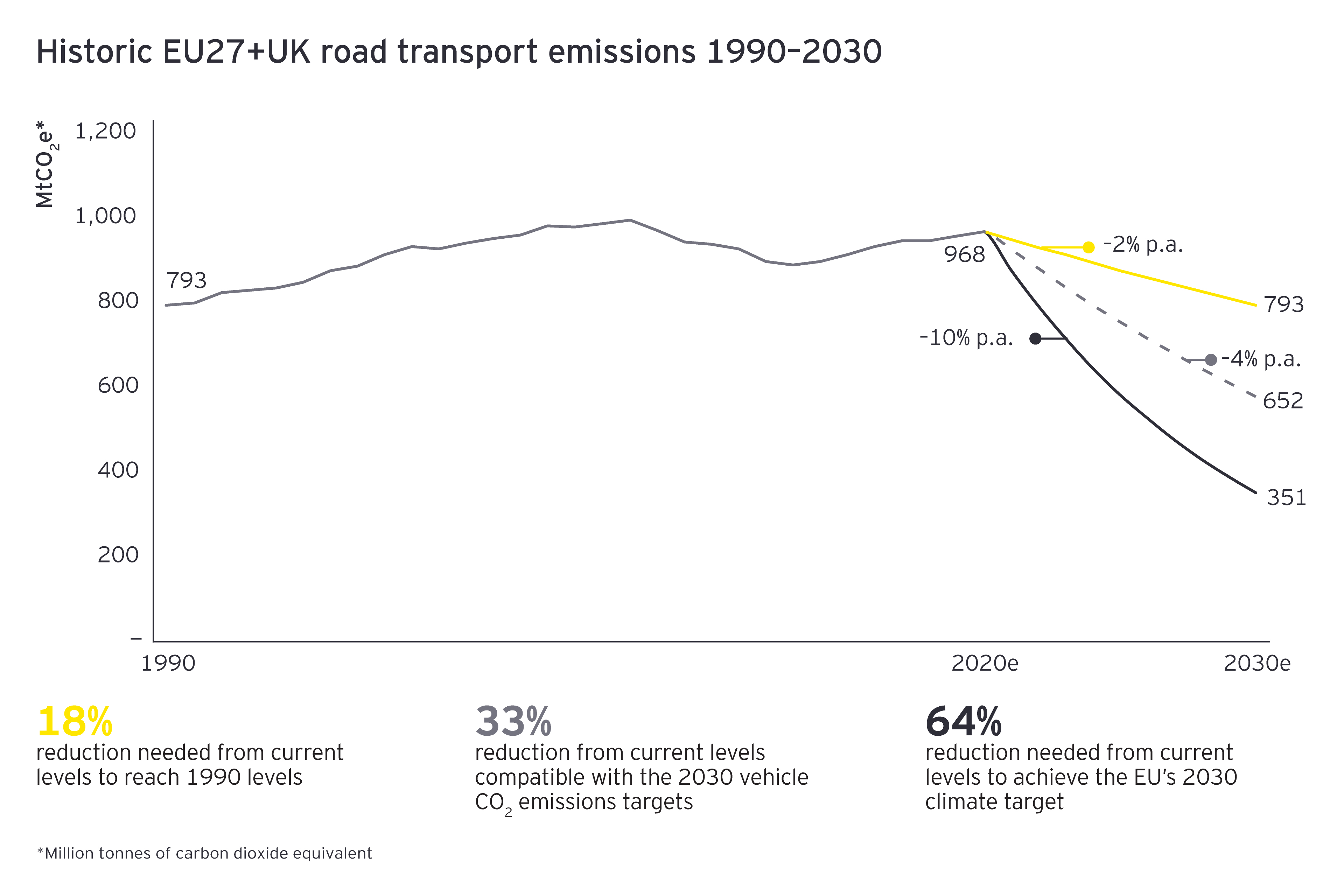

Figure 1 illustrates projected transport emissions for the EU27 members, plus the UK, to 2030. An 18% reduction, shown by the yellow line, is needed to bring emissions down to 1990 levels (equivalent to a 2% year-on-year reduction). This compares with the 4% year-on-year reduction (dashed line) expected by meeting the current post-2020 CO2 emission standards. However, a 64% reduction, or 10% year-on-year saving, shown by the black line, is actually needed to achieve Europe’s targeted 55% reduction, compared with 1990 levels.

Regulators clamp down and automakers switch up

Carbon dioxide emissions standards are, according to many observers, the single biggest accelerant of the eMobility transition. They have forced automakers down a decarbonized path and will be the fundamental driver of change.

Taking 2021 as a baseline, cars and vans must emit 15% less CO2 from 2025. Then, from 2030, cars must emit 37.5% less CO2, and vans 31% less. For every gram that every vehicle exceeds the emissions targets, a €95 fine applies.

However, it seems these regulations may not go far enough to meet the ambitions laid out in the SSMS to get 30 million zero-emission vehicles on the roads by 2030. The European Commission has already committed to review the CO2 standards (pdf) for cars and vans by June 2021, and for heavy-duty vehicles the year after.

The regulations are also designed to accelerate EV sales. They stipulated that new EV car and van sales made up more than 5% of automakers’ total sales in 2020, rising to 10% in 2021 and to 15% in 2025. From 2030, it becomes 35% for cars and 30% for vans. The reward is relaxation of the emissions cap, but there is no penalty – erroneously, we think – for non-compliance.

For automakers, the regulations mean a complete rethink of powertrains, massive investment in research and development, and disruption to long-standing supply chains in order to deliver cleaner vehicles with lower lifetime emissions.

They will bring more than 200 new electric and plug-in hybrid models to market in 2021, giving private and fleet customers greater choice and accelerating, in turn, the pace of electrification.

National and local initiatives favor electric

Several European governments plan to banish the sale of new diesel and petrol ICE vehicles by 2030. Norway, one of the most progressive economies for EVs, is aiming for 2025.

France, which plans a five-fold increase in EV sales by 2022 compared with 2017, operates an effective bonus-malus scheme that could serve other nations well. The “bonus” is an environmental reward of up to €6,000 for vehicles costing less than €45,000 that emit less than 20 grams of CO2 per kilometer. The “malus” is a tax of up to €20,000 on the biggest polluting vehicles at the point of registration, effectively funding the bonus payouts.

At a town and city level, almost 300 low-emission zones now ban polluting vehicles. So a logistics or last-mile delivery business either has to switch to EVs or pay a penalty to reach its urban customers.

However, despite inducements to electrify, EV ownership is not within everyone’s reach. The market is disjointed, and a continental divide is emerging. Economies that offer the best incentives and have the wealthiest populations account for the biggest take-up of EVs. There is a real risk that poorer nations are being squeezed out, with adverse implications for air quality and health.

The split is evident. Slightly more than 75% (pdf) of all EV charging stations are located in Germany, France, the Netherlands and the UK, while more than three-quarters (pdf) of all EVs are sold in those same countries, plus Norway. If decarbonization is Europe’s ambition, ways to harmonize EV adoption and to reverse the polarization of poorer economies must be found.

If decarbonization is Europe’s ambition, ways to harmonize EV adoption and reverse the polarization of poorer economies must be found.

Infrastructure lags behind EV rollout

Though an estimated 80% of EVs (pdf) will charge at home or at the workplace, drivers cannot travel further afield without public charging infrastructure.

The European Commission is calling for 3 million public charge points by 2030 (pdf), a 13-fold increase within the next 10 years. European non-profit organization Transport & Environment estimates that we need 1.3 million public charge points by 2025 and close to 3 million by 2030. This calls for investment of around €20bn, based on an assumed uptake (pdf) of between 33 million and 44 million EVs on Europe’s roads. Further investment of around €25bn is needed in power distribution grids to support charging infrastructure rollout, according to industry body Eurelectric.

But appetite is lacking for what is often perceived as a high-risk and low-return investment. The business case, built around revenue enhancement and cost reduction, needs to improve if it is to attract mainstream investors to meet infrastructure rollout targets.

The parallel assessment of the Alternative Fuels Infrastructure Directive (AFID), and revisions to the Trans-European Transport Network (TEN-T) guidelines, should identify ways to roll out finance-backed charging infrastructure (pdf).

Though, under state aid rules, the European Commission is required to demonstrate technology neutrality, some initiatives have been given the go-ahead where the benefits exceed potential distortion of competition. Romania won approval from European competition regulators in early 2020 for a €53mn public support scheme for charging stations. In Sweden, “charging streets” are being set up on land given to electricity companies free of charge (pdf). In Denmark, the Commission approved a €8mn scheme for investments in publicly accessible charging stations along the Danish road network.

Private sector investors also need to be convinced by the case for infrastructure. The profit margins are often deemed too small, and the lack of unified charging standards adds uncertainty. Closing the private funding gap, gaining investor confidence and giving EVs the chance to become mainstream will hinge on new and innovative ways to raise private capital for infrastructure investment.

Common protocols for communications between the EV, the charger, the central management system and the grid are also needed to standardize charging for all. Until then, the lack of interoperability between providers’ charging stations means the experience is far removed from the ease with which drivers fill up at a petrol or diesel pump.

Without uniformity and price-transparent e-roaming capabilities, as in the telecoms industry, the big risk is that customers become disincentivized by the charging experience and decarbonization goals are jeopardized.

Energy and transport sectors connect on eMobility

The acceleration of eMobility, and demand for slow- and fast-charging capabilities, will bring about greater cohesion between the European power and transport sectors. They will need to accommodate a surge in drivers charging their EVs at the end of the working day, without destabilizing the grid.

Distribution system operators (DSOs) will work alongside charge point operators to connect charging points to the grid, and:

- Identify projected load from EVs and the need for charging infrastructure in their service territories

- Consider load management and smart-charging strategies to optimize network investment and, potentially, reduce the need for grid reinforcement

- Identify the best locations for charging infrastructure, in cooperation with other players

DSOs will also provide guidance on charging infrastructure allocation at both existing and new-build developments to avoid costly retro-fitting and other capacity-related issues. And they will seek future opportunities for V2G energy exchange to leverage flexibility and keep power flows in balance.

In fact, once there are enough EVs on the roads, they will become part of a virtuous energy circle. Smart charging will shift power demand to times of the day when renewable supply is high and power prices low. V2G goes one step further and enables the charged power to be pushed back to the grid to balance variations in energy production and consumption: essentially, turning the EV into an independent renewable energy management system on wheels.

What the energy transition needs to make it go faster: five enablers of eMobility

- Cohesive regulation: a strong mandate for electrification will engage every participant in the value chain in joined-up planning and investment.

- Funding models: new funding models must deliver €80bn of investment (pdf) in public and private charging infrastructure by 2030 to accommodate 40 million EVs.

- Supply chain: beyond getting the right products to the right markets at the right time, the supply chain must satisfy battery and vehicle demand, and enable end-of-life battery recycling and the acquisition or transition of skills and resources.

- Physical infrastructure: optimally sited public charging points (a mix of fast and slow chargers), aligned with EV take-up and grid capabilities, will engage customer confidence.

- Digital interface: the open exchange of data from vehicle to charge point to grid is critical, along with a simplified and seamless customer experience, irrespective of vehicle, payment and contract type.

Related article

Chapter 3

Why fleet must electrify first

Fleet is the low-hanging fruit able to deliver the biggest and fastest environmental rewards.

Fleet will make the biggest and fastest contribution to the decarbonization of road transport. We have established that the fleet sector, though relatively small at 63 million vehicles (20% of Europe’s total vehicle parc) is disproportionately damaging (pdf) to the environment. It accounts for more than 40% of total kilometers traveled and for half of total emissions from road transport.3 It makes, therefore, the biggest and most impactful test case. Additionally:

- Fleets will have to switch to alternative vehicle types over time as CO2 emissions standards restrict non-EV sales.

- Polluting fleet vehicles are banned from more than 300 major European cities and towns that operate low-emission zones. The alternative is to pay a penalty or switch to EVs.

- Fleet vehicles tend to travel regular routes and clock up fairly consistent daily kilometers. They have fixed destinations and stopovers, which can be combined with charging.

- EVs total cost of ownership (TCO) is fast reaching par with ICE vehicles. Incentives and grants bridge the gap, while reduced servicing and maintenance, as well as significant fuel savings, make the economic case for fleet electrification.

EY analysts calculate that the number of fleet vehicles – both EVs and ICE – will grow by around 15% by 2030, to 73 million vehicles. A 24-fold increase in total electrified fleet will bring actual numbers to 10.5 million by 2030, up from 420,000 vehicles today. Company cars, last-mile delivery vehicles, pool cars, and work-related light commercial vehicles will electrify fastest. Within the same time frame, around 2% of heavy goods vehicles, including refuse-collection trucks, will go electric.4

The lessons learned from electrifying fleet first will cascade across the transport sector. Meanwhile, turnover in company cars, which are a major component of the fleet sector, will see a second-hand market develop, extending EV ownership to a new audience.

Chapter 4

An emerging eMobility ecosystem

Electrification of transport opens up a new landscape of commercial opportunity.

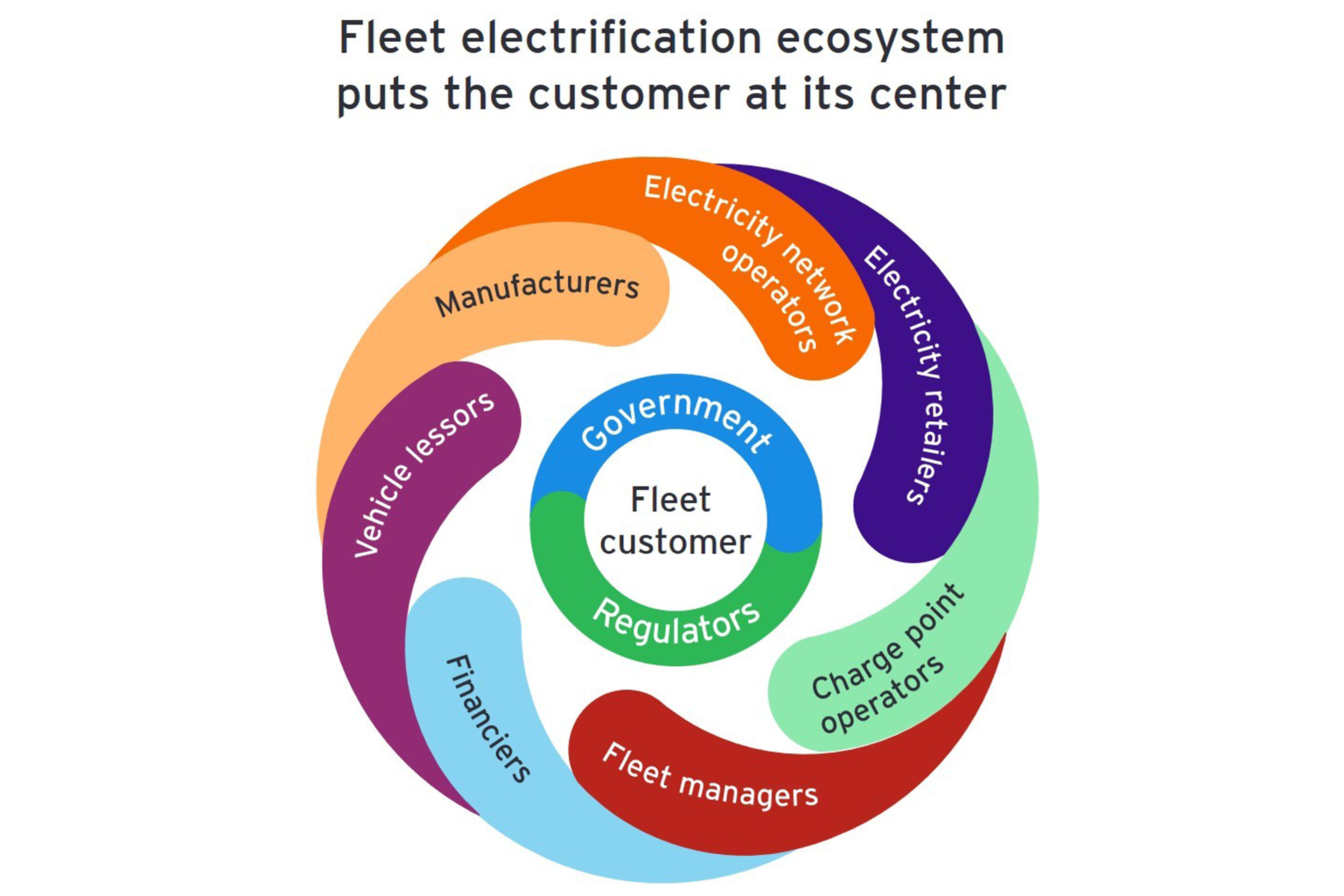

As with other sectors in transition, a supporting ecosystem has begun to develop. It includes innovative customer solutions and value-added propositions to propel eMobility into mainstream adoption.

Already, energy providers are forming partnerships with charge point operators and leasing companies. Automakers are teaming up with utilities and setting up their own captive leasing businesses. Combinations of new and established players are looking to the future and working collaboratively to earn customers’ trust and enhance their overall experience of eMobility.

Combinations of new and established players are working collaboratively to earn customers’ trust and enhance their overall experience of eMobility.

Industry players that move fastest will reap the biggest commercial rewards from increased sales, growth in market share and enhanced customer satisfaction.

Opportunity exists in:

- Electricity network management: minimizing grid infrastructure investment and accommodating new EV load, courtesy of flexibility services from aggregated EV batteries.

- EV power and charging solutions: providing tailored, smart and scalable charging infrastructure and charging management software for EVs.

- Fleet management: a one-stop shop or platform-provider model allows customers to purchase EVs, select a charge-point operator, pick an electricity supplier and a tariff as a bundled package.

- Vehicle and battery management: as EV prices come down and reach TCO parity with ICE vehicles, and as lease vehicles rotate, a second-hand EV market will emerge.

- End-of-life solutions: a market for repurposing used EV batteries, up to three or four times, will optimize costs and salvage scarce raw materials.

- Financing: cumulative investment in public and private charging infrastructure is estimated to be €80bn by 2030. Several private players have committed substantial investment, but public-private partnerships continue to be an important route to market. Given uncertain EV residual values, and the influx of new models, lease-vehicle finance will remain in demand.

- Data and platforms: ecosystem players will find ways to share data within secure architectures that maintain the trust of all stakeholders.

For now, the electrification journey has led us to a tipping point that will define the future direction of transport.

Looking ahead, the transition will not only deliver environmental, societal and health benefits from reduced emissions and improved air quality but also realize significant commercial value by putting 40 million EVs on Europe’s roads by 2030.

The upheaval that comes with reinventing the wheel and moving the world to a completely new transport state will be surely worth it.

Summary

There is massive momentum, at a country, city, business and individual level, behind the electrification of transport. Environmental benefits are, of course, the biggest prize. But there are also significant commercial rewards for the first and fastest movers in the ecosystem that underpins eMobility.