Chapter 1

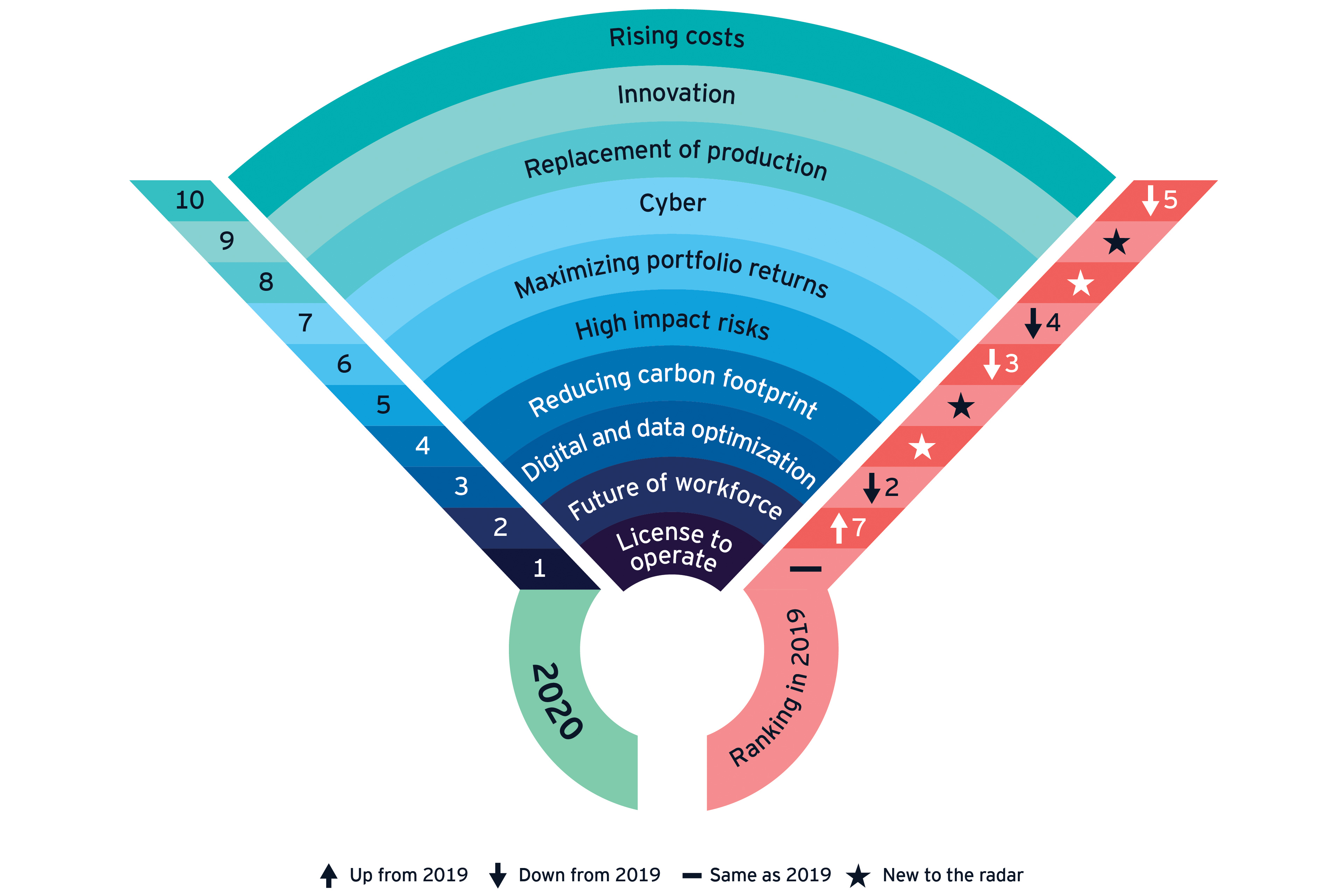

License to operate (LTO) is the No. 1 risk for the second year in a row

License to operate and disruption run through this year’s risks, as social responsibility and broader stakeholder demands intensify.

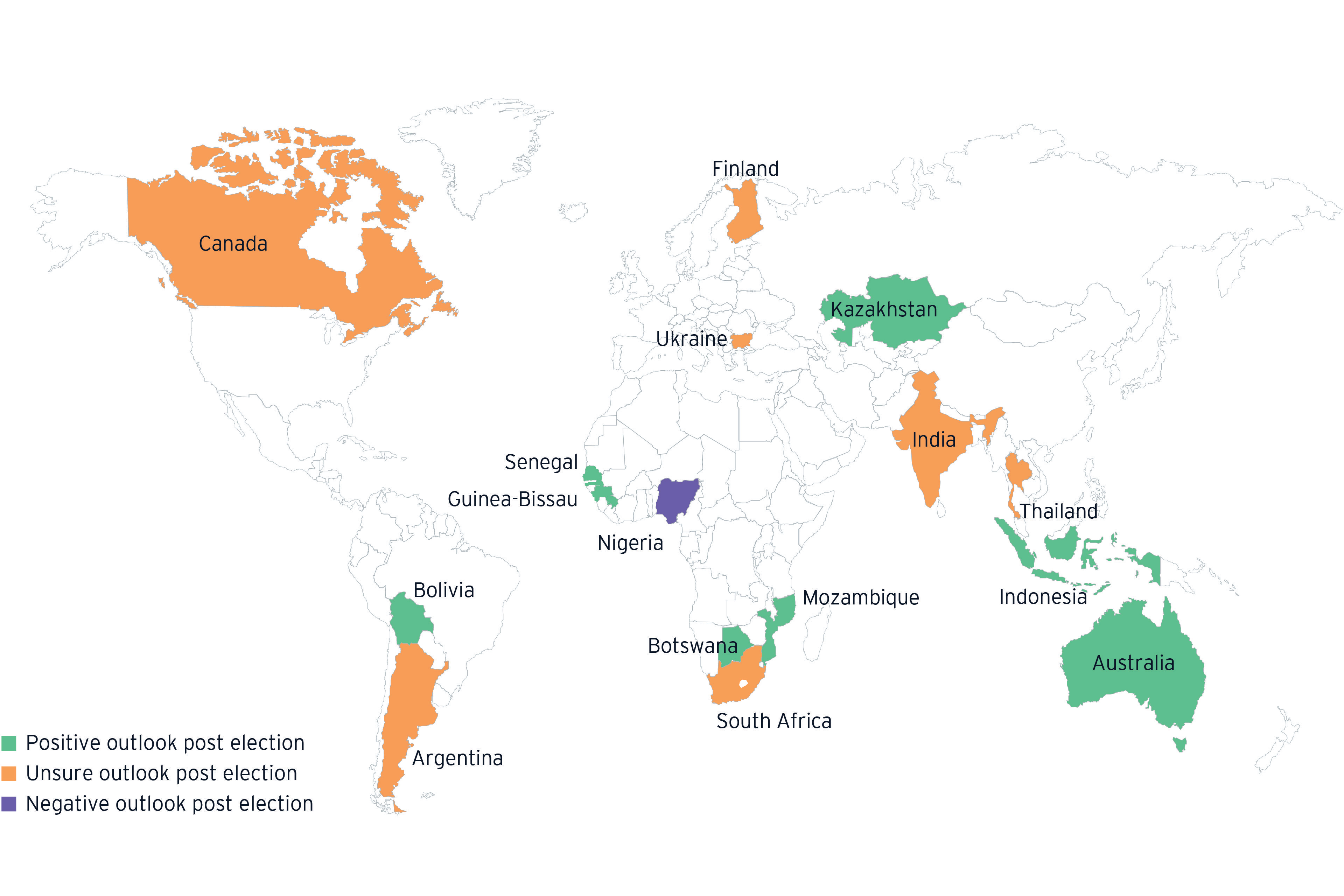

License to operate remains in the No. 1 slot, with 44% of our business risks survey respondents1 putting it at the top of the list. The extended period of elections and resultant government changes has brought uncertainty to the political environment which has created volatility in the commodity markets. In addition, the sector is facing greater scrutiny from end consumers, demanding a transparent ethical supply chain as well as a lower carbon footprint. Shareholder activists are also driving many miners, particularly those with coal assets, to reshape their portfolios by either reconfiguring existing operations or executing divestments.

Chapter 2

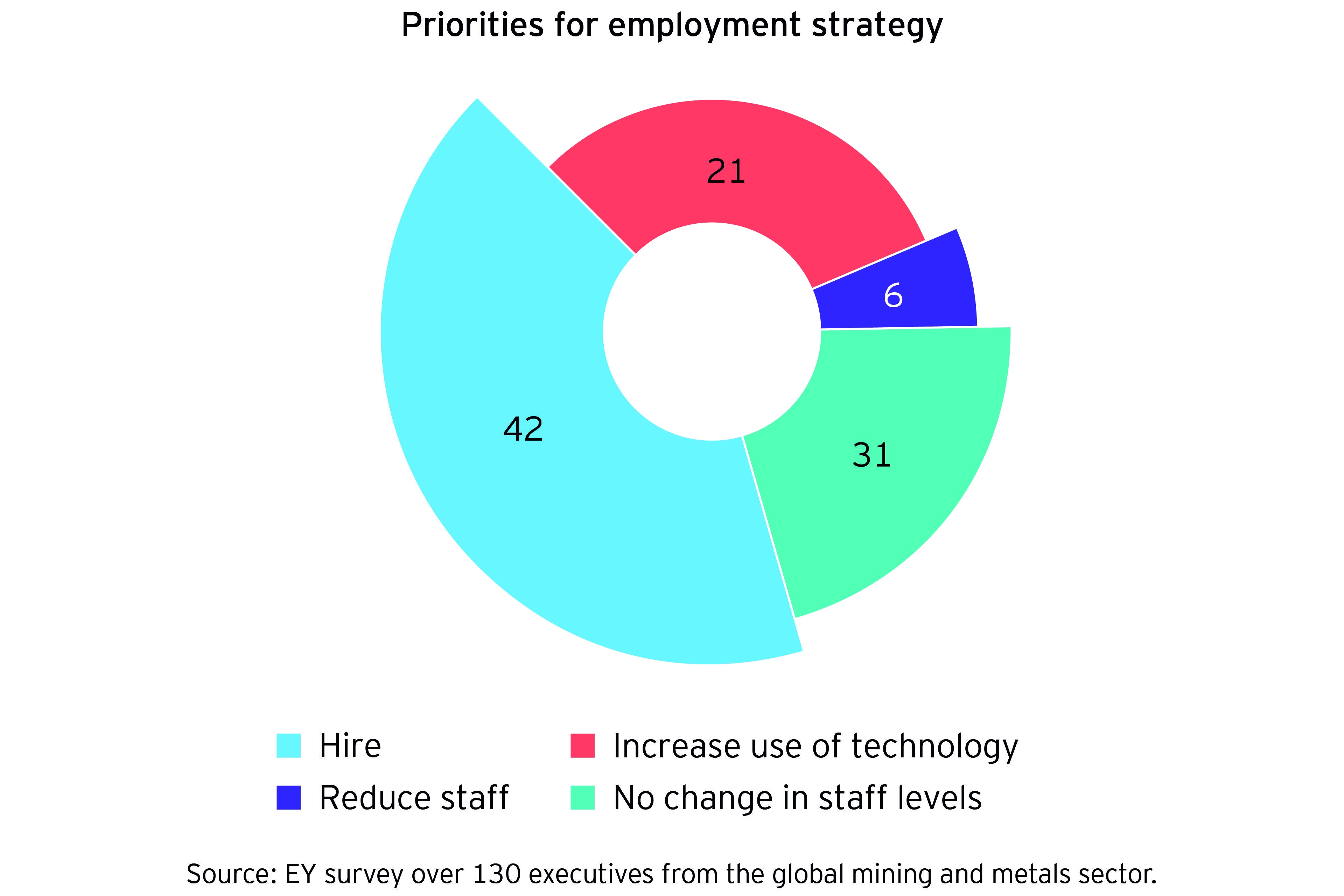

Future of workforce is our No. 2 risk, up from No. 7 last year

Digital and technological innovation has the potential to improve productivity, safety and environmental management in the mining industry.

Companies are grappling with understanding what the workforce might look like in the future, and where they can attain these skills — build or buy? Given the competitive market for digital and data-related skills, they might be hard to get into the mining sector, given the tarnished brand we have vs. other sectors.

Some questions to consider:

- How are you going to build, recruit or borrow the right skills and capabilities across the organization?

- How will you retain senior employees to minimize the negative impact of attrition?

- How do you create a compelling employee value proposition?

- How will you equip future leaders with the skills needed to manage teams in a digital age?

- What creative strategies can you employ to ready your workforce for the future?

- Should you be looking at benchmarking to work toward best practices as an industry?

Chapter 3

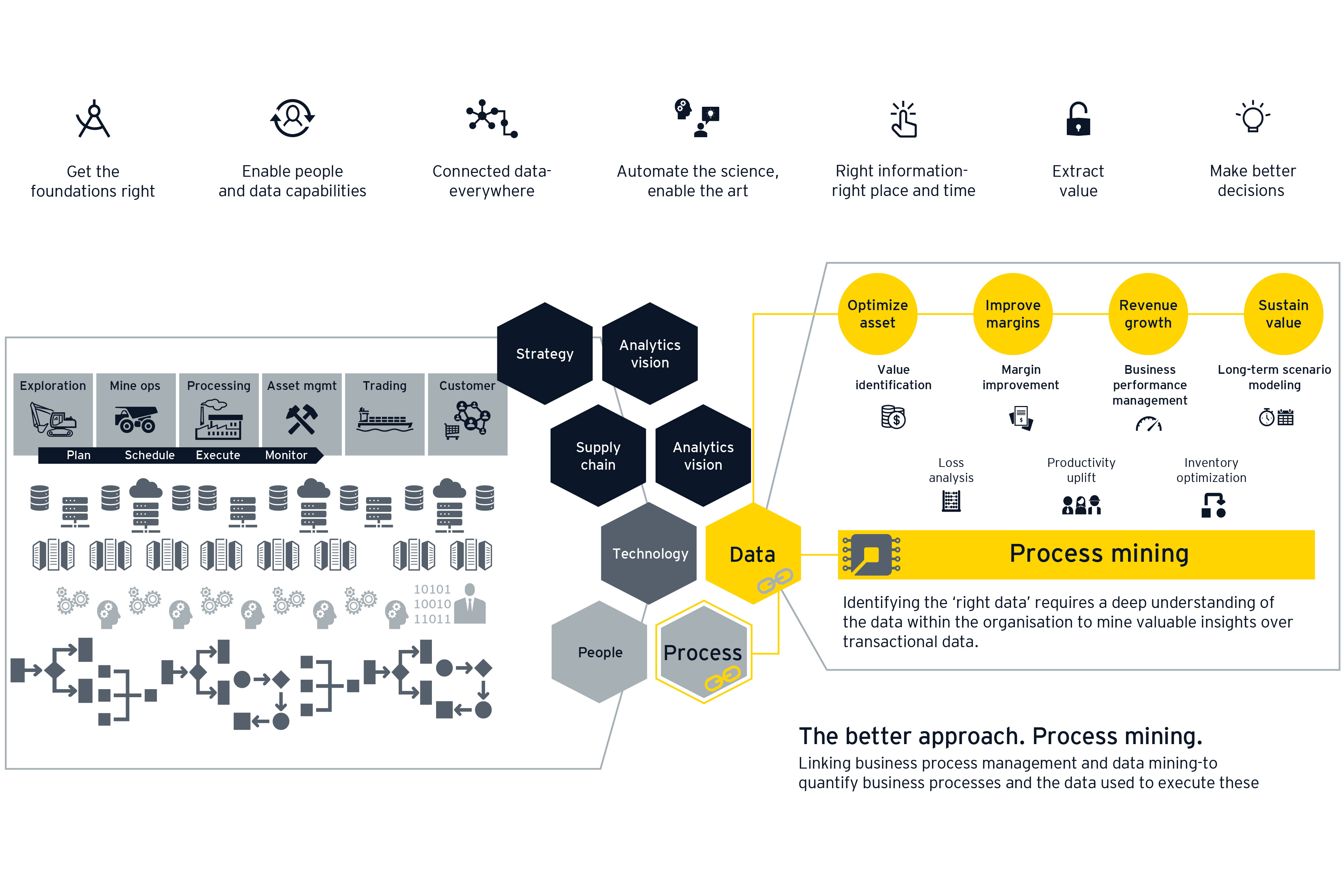

Digital remains in the top three

Digital effectiveness remains in the top three risks and opportunities for miners and continues to be a topic executives want to discuss.

While application of technology has become business as usual, is anyone really doing it well? It’s more an opportunity than a risk now, and the one issue miners are challenged with is how to better manage data to extract value from it.

There are four new risks on the radar this year: reducing carbon footprint, high-impact risks, replacement of production and innovation.

Chapter 4

Pressure is on miners to reduce impact in carbon emissions and energy use

The transition to a low-carbon economy is well underway and the pressure to accelerate this transition seems to grow every day.

Leading mining companies are recognizing the importance of reducing their carbon emissions.

Minimization strategies

- Renewable energy

- Electrification of mines

- Focus on Scope 3 emissions

The clean energy transition is going to be mineral intensive, providing an enormous opportunity for mining companies. There are significant opportunities for lithium, cobalt, copper, aluminum, nickel and many other minerals.

Chapter 5

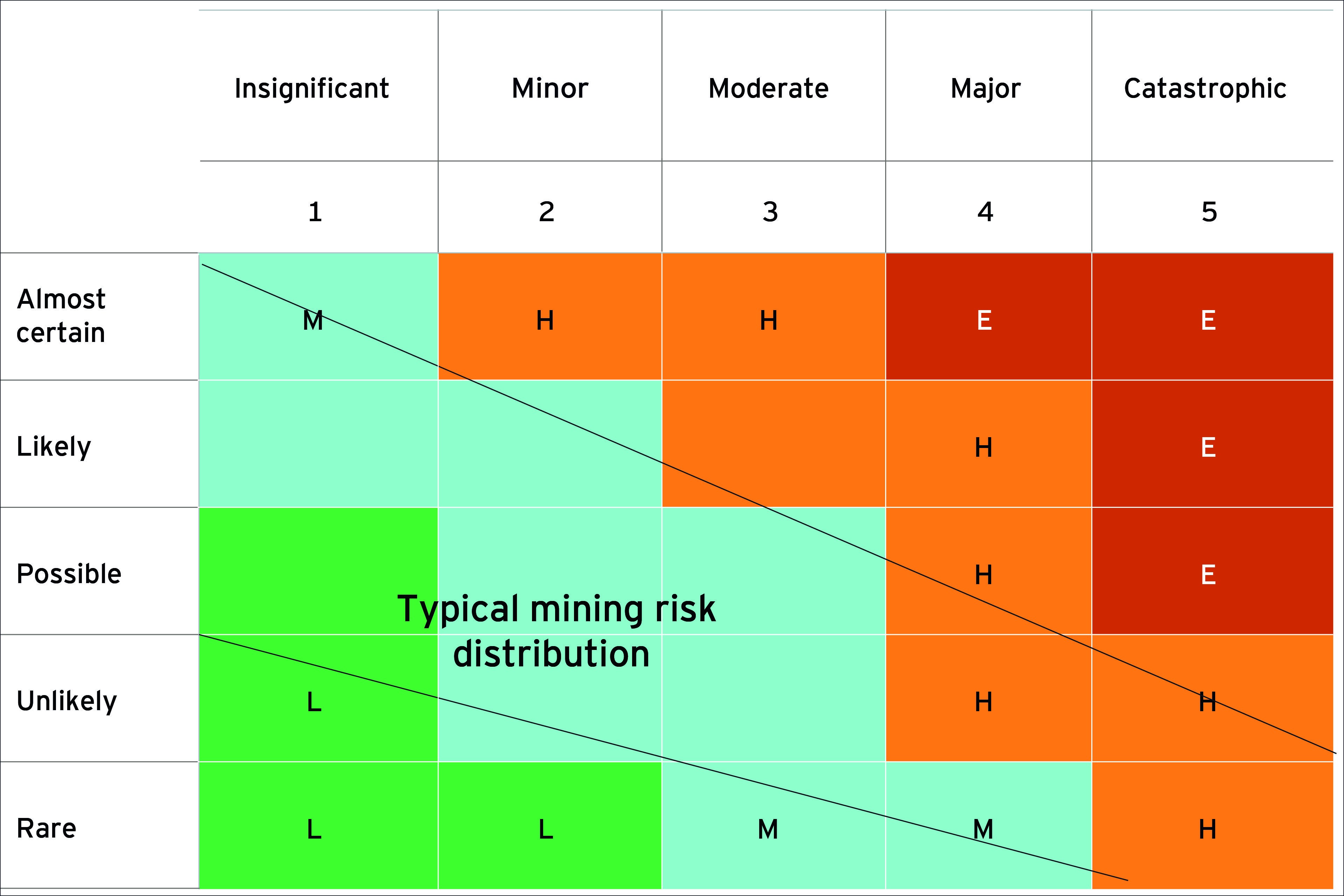

Does the traditional risk matrix work for a mining company?

Most mining companies can clearly state their critical risks and manage the visible, high-frequency risks in their business.

Traditional risk matrix

However, in our experience, these critical risks are often static and stay on the risk register in much the same “format” for many years.

Companies need to assess portfolios in terms of what would happen if something radical happens. For example, what if:

- Energy becomes free, then what happens to copper?

- There is a massive technological breakthrough in the composition of plastic or other advanced materials — how does that affect demand for metals?

Chapter 6

Miners should think more broadly on how to maximize their returns

The long-term goal is to increase the return on capital, while reducing the volatility of those returns.

Miners need to think more broadly about how to maximize their returns and adopt new approaches that may be radically different from those of the past. Mining companies will also need to re-evaluate their appetite for risk to ensure they are not missing out on new opportunities by taking a complacent or conservative approach to allocating capital.

Some areas for consideration:

- Funding transformation

- Rethinking portfolio

- Joint ventures

Chapter 7

Data holds the key to increase productivity and minimizing costs

It enables decision automation to minimize loss across the entire value chain.

As digital becomes business as usual, the threat surface that can be attacked is increasing exponentially. This is largely due to contributing factors such as Information Technology (IT)/Operational Technology (OT) convergence, Internet of Things (IOT) sensors, data analytics and optimization AI.

Every cybersecurity transformation should promote three key principles across culture, governance and capabilities:

- Excellence in security fundamentals

- Strong governance program and a culture of accountability

- Continuous improvement

Chapter 8

There could be a significant supply crunch in the next 10–15 years

Exploration technologies have already made significant advances as miners explore new digital technologies.

Lower exploration budgets, fewer major discoveries and declining grades in existing deposits are particularly concerning when you consider that the outlook is for growing mineral demand as a result of the global growth and the demands of new world infrastructure.

Exploration spend has declined significantly and even though there has been some recovery in the last two years, budgets are still half of what they were in 2012.2

Strategies for growth in mine supply:

- Access to capital

- Acquire existing projects or mines

- Ramp up innovation to both find new resources and extract more value from current resources

Chapter 9

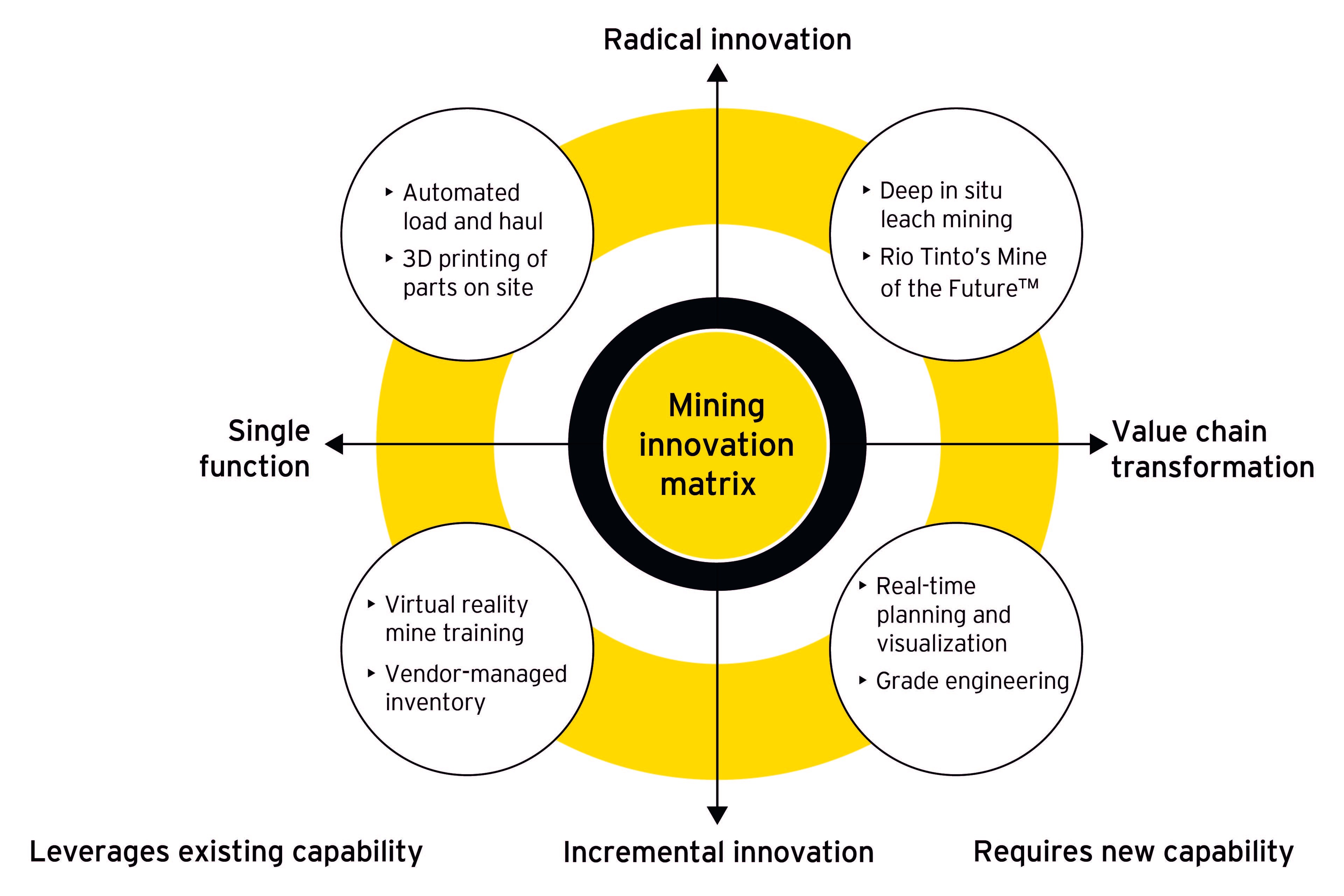

Innovation needs to disrupt the status quo

Innovation could bring a much-needed step change to the mining sector.

The burning platform for innovation is clear — some mining companies may need to innovate to survive, while others may be looking at embracing innovation to thrive in today’s fast-changing environment, and to improve return on capital. There is certainly clear recognition that significant productivity gains can be made possible by rethinking how work is being done, and by being prepared to innovate.

Innovation could bring a much-needed step change to address key structural issues in the mining sector, namely:

- Declining ore grades

- Increased mining in remote and difficult locations

- Access and cost of energy and infrastructure

- Increasing operational complexity

- Improving water management

Chapter 10

Rising costs to remain on the radar as the complexity of mining increases

Cost reduction needs to be sustainable and a keen focus on productivity will help to manage the impact of rising costs.

Automation and increased maturity in the use of data is proving to have significant benefits to large mining operations, in terms of providing an uplift in productivity and hence reduction in production costs per tonne.

Steps companies can take to respond to this risk:

- Focus on sustainable cost reduction programs

- Encourage innovation and partnerships to help with longer-term reduction of costs

- Divest non-core assets

- Review capital tied up in high levels of pre-stripping, advance development and stockpiles

- Consider the use of contract mining vs. sale or leaseback

- Review supplier and service contracts

- Outsource

- Create strategic joint ventures to optimize economies of scale

- Reduce costs from a support function — automation in the back office

Summary

The themes of license to operate and disruption run through this year’s risks, as social responsibility and broader stakeholder demands intensify alongside the need for digital transformation, greater risk taking and innovation.