Ultimately, 5G network investment is about much more than differentiation through network quality.

2. Engage with policy makers and regulators early and often

Policy makers and regulators will have a crucial say in building a healthy investment environment for 5G. This is no easy task: the telecoms sector has historically been heavily regulated, while mobile technology is now coming into sharper focus as part of national industrial strategies.

A new landscape of mobile industry oversight is coming

5G is spurring a closer relationship between the mobile industry and governments who are keen to leverage the productivity benefits of new digital infrastructure. State funding for 5G test beds and support for 5G-centric public-private partnerships reflect this growing intimacy between the public sector and the mobile industry.

Yet, the supply-side landscape is not without its complexities. Spectrum release is an increasingly onerous exercise. The phased release of multiple bands to support various use cases will take many years. Disputes over spectrum auction design my stretch spectrum release timeframes still further.

Accepted notions of spectrum caps may give way to new concepts of spectrum pooling as network sharing regulations evolve in new ways.

Fixed and mobile infrastructures will become more interdependent

Policy makers recognize the convergence opportunities between fiber and 5G in terms of greater choice of connectivity options for consumers and fiber’s critical role in mobile backhaul. Looking ahead, this could pave the way for unified market reviews designed to stimulate complementary investments in both fixed and mobile infrastructure.

Yet, achieving more holistic regulatory frameworks is by no means straightforward. Both telcos and regulators will be keen that regulatory stability and clarity do not suffer as digital infrastructure policies become more holistic. More granular challenges, such as ensuring that dark fibre regulation supports 5G backhaul, also deserve focus.

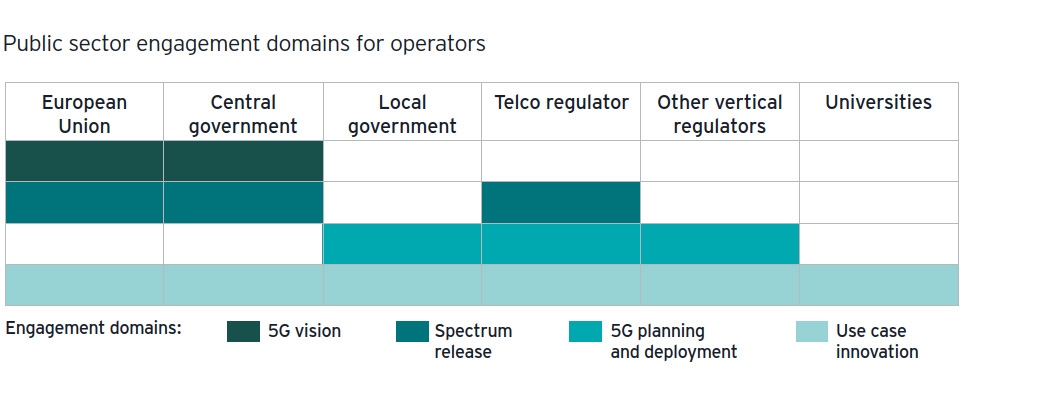

Engage with a wider range of stakeholders

The range of public sector actors with an interest, and role, in 5G deployments will widen. Local governments will have a greater say in network planning and site access, while regulators across different industries are already engaging with each other in order to maximize the industrial transformation heralded by 5G.

Meanwhile, 5G’s impact on wireless radiation is attracting growing attention. This, in turn, poses new challenges to national and regional regulators to mitigate health and environmental concerns. Universities are playing an increasingly important role in trials of new 5G use cases across a range of industries.

With all this potential change, operators must take their destiny into their own hands. Engaging early and often with a wider range of public sector stakeholders can only aid the development of more workable policies and regulatory stipulations. As such, proactive communications and ongoing dialogue are essential.

3. Adopt new positions in a fluid and fast-changing value chain

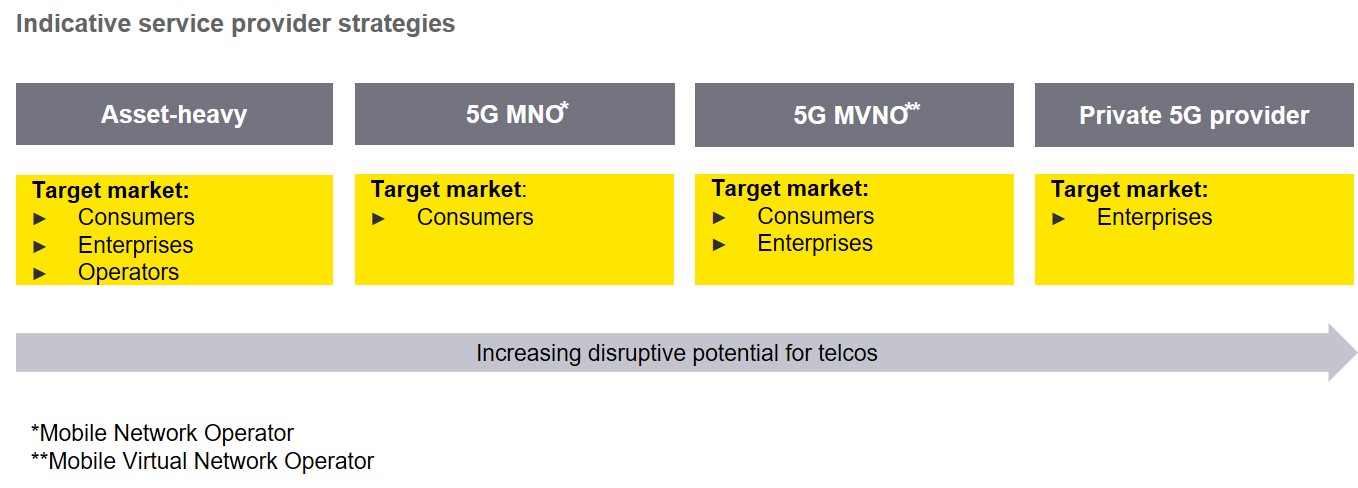

New business models and value chains are key to the 5G opportunity. As operators consider new industrial use cases for mobile, there is much more scope to go beyond the role of a mere connectivity provider.

Yet, the potential for disruption is also real. For instance, various industry actors such as technology specialists and industry vertical leaders, may look to act as 5G mobile virtual network operators (MVNOs), taking advantage of new capabilities in network slicing. The advent of private 5G networks could even see operators fully disintermediated from the connectivity layer.

Take advantage of new retail and wholesale opportunities

Various go-to-market strategies are available to telcos. Incumbents will sensitize their existing retail and wholesale businesses to 5G, with fiber alternative network providers or tower operators looking to broaden their addressable markets. Mobile-centric operators and cable companies will focus on enhancing their consumer retail propositions. New 5G offerings such as fixed wireless access, can be co-opted in various ways, as an extension of broadband capabilities in remote regions or as a tool to disrupt the fixed broadband market in urban areas. Critically, 5G can recast IoT offerings in multiple ways.

Adapt to changing market structures

Efforts to reduce network duplication will evolve further. 5G could signal a more localized approach to “neutral host” networks in order to support smart city services. Meanwhile, the rise of nationwide 5G wholesale networks cannot be discounted. 5G also provides scope for more nuanced infrastructure sharing arrangements depending on the network layer or geographic area.

With all this potential for change, telcos should take care to revisit legacy mobile network sharing arrangements to ensure that they are fit for purpose.

Pre-empt new disruptive scenarios

5G capabilities also drive new disruption risks. Network slicing, for example, allows service providers to provide localized network capability supported by differentiated service level agreements. New business models to support localized networks could prove fundamentally disruptive, especially if private 5G networks provide an alternative to operator-controlled network slicing.

Technology vendors and industry vertical leaders may potentially seek more control of 5G connectivity, undermining operators’ growth ambitions in the process.

Mitigating the disruptive potential of 5G market structures will be essential. Operators should consider how best they can protect and extend their value chain positions – vertical industry needs, the scope for horizontal partnerships and regulatory frameworks will all inform the decisions they make.

The prospect of rising capital expenditure will demand extra consideration of asset-light strategies, where infrastructure sharing and co-investment take on a new prominence as routes to greater CAPEX efficiency.

Related content

4. Take a selective and phased approach to monetizing new use cases

5G’s ability to enable new use cases is not in question. Beyond the consumer connectivity market, 5G can catalyze various industry-specific use cases, from autonomous transport to smart buildings and remote surgery. Yet circumspection is important: while the field of innovation is wide, operators should take a phased and selective approach to service innovation and revenue diversification.

Sophisticated 5G use cases will take time to mature

Game-changing 5G use cases will not appear overnight. Fully autonomous vehicles will not become commercially available for many years; remote surgery delivered using robots is also in a very nascent phase. A number of factors, from data protection regulation to the burden of legacy IT within specific industries, will mean that the road map to game-changing innovation is necessarily incremental.

Enhanced mobile broadband offers initial upside

Operators should bring realistic expectations to bear on their timelines for proposition development. Enhanced mobile broadband will act as the first large-scale 5G use case - with improved capacity in densely-populated areas, and fixed-wireless access in suburban and rural areas coming to the fore – ahead of innovations in augmented reality content. While 5G-based IoT unlocks limitless potential for industrial transformation, direct-to-consumer services will still be vital in the near-term.

Build a balanced view of 5G-enabled IoT

As operators leverage 5G in the IoT, careful value chain positioning is essential. Devices, platforms and applications account for the majority of IoT revenues, well ahead of straightforward connectivity. Yet, the efforts of telcos to move beyond a basic bandwidth play should be cautious.

The demand for higher-value connectivity via network slicing, ecosystem complexity and willingness to partner will vary from industry to industry.

By focusing on use case clusters, operators may be able to unveil hidden adjacencies that cut across different industry domains. The ability to exploit these can strengthen the business case for both network investment and service customization, ultimately enabling them to scale their propositions more rapidly.

While considering 5G’s role as a catalyst for their IoT strategies, operators should not overlook its role in serving existing use cases. The successful introduction of 5G – with a focus on consumer connectivity and content – will hinge on effective refinements to existing 4G-based value propositions.

5. Reboot your relationships with enterprises and industry verticals

Previous mobile upgrade cycles have been consumer-driven. The arrival of 4G coincided with the advent of touchscreen smartphones. However, 5G’s promise is predicated on its ability to transform entire industries. For this to happen, telcos should overhaul their enterprise relationships.

Customized solutions for industry verticals provided in conjunction with partners will come to the fore, and sales teams must focus on more consultative dialogue if they are to unlock new forms of enterprise demand.

Demystify 5G use cases and benefits for businesses

5G is much more than a new wave of mobile infrastructure that enables faster connectivity delivered to more endpoints – it is fundamentally transformational and disruptive. Cloud computing and storage are now entering the very fabric of business processes, and 5G can build on this, helping organizations unlock new horizons in digital transformation.

Explaining the true business value of 5G, and the role that telcos and their partners can play will allow enterprises to invest with confidence and ensure that 5G becomes a core part of overarching business strategy in years to come.

Understand your customer – and your customer’s customer

Operator-led dialogues that focus on the legacy attributes of corporate mobility, such as total cost of ownership or workforce productivity, are likely to understate the potential of 5G – and limit its potential to deliver top- and bottom-line benefits. Providers that can develop more granular 5G propositions sensitized to vertical needs will be best placed to win the hearts and minds of their corporate customers in the future.

Come closer to the enterprise transformation agenda

Organizations investing in 5G are looking for better business outcomes for the next decade and beyond. This requires telcos to move beyond their historic role as mere connectivity suppliers. Engaging in consultative dialogue that positions 5G within the broader context of enterprise transformation is vital.

Telcos should articulate 5G’s relationship to other emerging technologies while alleviating concerns regarding cybersecurity and integration with existing technologies.

With 5G, operators can take on new roles as both technology distributors and information-centric service providers. Yet, this can only happen if they engage more productively with their enterprise customers. The technology push of the past should give way to the business outcome of the future.

Summary

5G will play a critical role in the digital economy for decades to come. This new era of intelligent connectivity offers the chance to recast customer value propositions, accelerate industrial transformation, and reinvigorate the digital society. However, a positive outlook for the European mobile industry is by no means certain.

Vision should translate into action, and new competencies must come to the fore, if telcos are to maximize their return on investment (ROI). (Download the PDF.)