Executive summary

On 29 January 2020, the European Commission (The Commission) adopted its 2020 Work Programme (the work programme or programme). The programme, as an accompanying press release notes, sets out the actions the Commission will take in 2020 to turn the Political Guidelines of President Ursula von der Leyen into tangible benefits for European citizens, businesses and society.

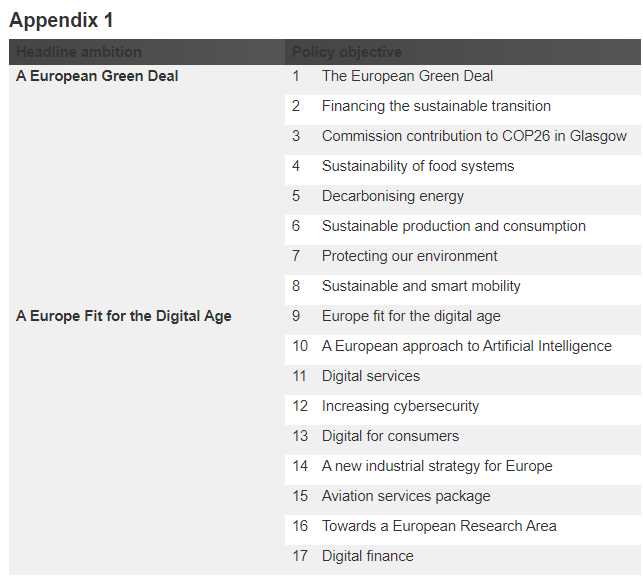

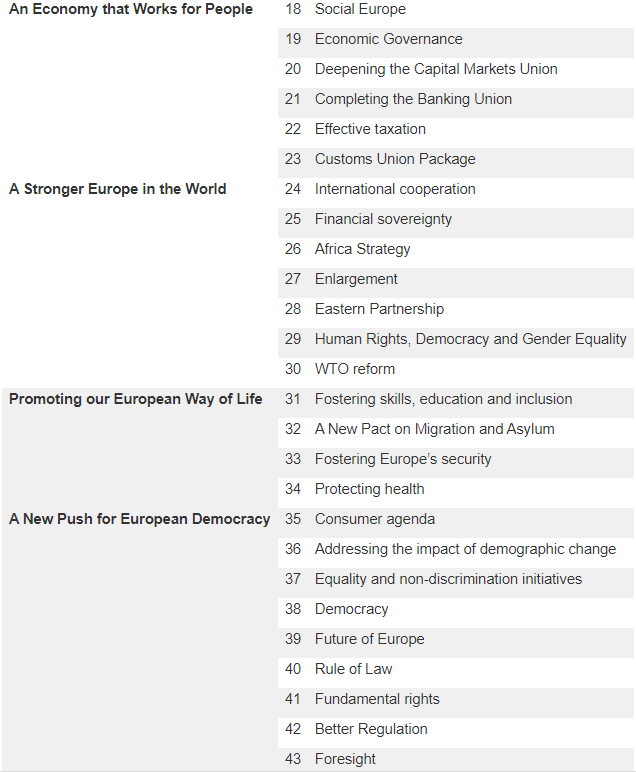

Representing the first major document of this type issued by the new executive layer of the Commission, the work programme sets out43 new policy objectives,1 categorized under six headline ambitions (see Appendix 1 below). It outlines two key tax initiatives, both of which would be new plans, including:

- A Communication on Business Taxation for the 21st Century

- An Action Plan to Fight Tax Evasion and make taxation simple and easy

The programme was silent on removing any existing tax initiatives from the Commission’s roster. It was also silent on tax measures to support the “European Green Deal,” potentially due to the fact that, as discussed in recent media reports, action to support the headline ambition of achieving a “European Green Deal” may be in 2021 rather than 2020. However, an action proposed for 2020 in relation to the “European Green Deal” relates to the review of the non-financial reporting directive, with the aim of delivering more standardized reporting in this area.

In December 2019, one of the (voluntary) international standards on non-financial reporting, the “GRI” standard, introduced a section on tax reporting.2 The GRI standard is used by a wide group of multinational businesses as the basis for their non-financial reporting. Therefore, a key question is whether the review by the European Commission of the non-financial reporting standard may also include tax reporting as one of the elements given the precedent created by the GRI standard.

The work programme does include, in Annex 3, four pending legislative initiatives that should receive priority attention in 2020, namely, Public Country-by-Country reporting (CbCR), the Common Corporate Tax Base (CCTB), the Common Consolidated Corporate Tax Base, and enhanced cooperation in the area of a Financial Transaction Tax (FTT).

The work programme is presented as a “Communication from the Commission to the European Parliament, the Council, The European Economic and Social Committee and the Committee of the regions” and sets out the most important initiatives the Commission intends to take in its first year, including the commitments for the first 100 days.

Detailed discussion

The work programme is presented as a package that will revitalize the European bloc after a period of post-financial crisis stress and it is the first work programme without the United Kingdom as a European Union (EU) Member State. “After years of crisis management, Europe can now look forward again” notes the programme. “This Work Programme frames the way ahead and allows us to find solutions to issues that have divided us in the past.” The work programme puts the United Nations Sustainable Development Goals at the heart of EU policymaking.

Under the headline “Kick-starting the transition to a fair, climate-neutral and digital Europe” the work programme takes the six headline ambitions of new Commission President Ursula von der Leyen, translating them into concrete initiatives that will then be negotiated and implemented in cooperation with the European Parliament, Member States and other partners. The six headline ambitions are:

- A European Green Deal

- A Europe fit for the digital age

- An economy that works for people

- A stronger Europe in the world

- Promoting our European way of life

- A new push for European democracy

Each of the six ambitions are discussed in more detail in both the press release and work programme itself.

The work programme also contains, in Annex 2,3 a series of proposals for regulatory simplification, including a “one-in, one-out” approach that the Commission says will ensure that newly introduced burdens are offset by relieving people and businesses – notably Small and Medium-Sized Enterprises (SMEs) – of equivalent administrative costs at the EU level in the same policy area.

In preparing the work programme, the Commission examined all proposals that are currently awaiting decision by the European Parliament and the Council and is proposing to either withdraw or repeal 34 of them, as set out in Annex 4 and 5 of the programme. Only one of the 34 has a linkage to taxation4 and relates to postal fees for customs presentation.

The Commission, notes the press release, cooperated closely with the European Parliament, Member States and the consultative committees to draw up its Work Programme before presenting it.

The work programme goes beyond identifying and prioritizing those projects that will attract investment and resources in the coming year. It also identifies several new techniques, simplifications and advance planning procedures that the Commission believes will improve the quality, timeliness and outcome of key policy initiatives. This includes the Commission preparing its first Foresight Report, identifying major trends and their potential policy implications. This, the Commission says, will help to raise public debate on long-term strategic issues, provide recommendations to help them meet the goals the EU has set itself. It is reasonable to expect that such a report would contain insight and analysis useful to the formation of future tax policies, thought the exact content or approach has not yet been made clear.

Tax elements of the work programme

From a tax perspective, the work programme identifies two key strategic priorities, both of which represent activities over and above those currently pursued by the Commission. “Technological change and globalisation have enabled new business models” says the section of the work programme titled “An economy that works for people.” “This creates opportunities but also means that the international corporate tax framework has to keep pace.” As a result, the work programme says, the Commission will present a Communication on Business Taxation for the 21st century, focusing on taxation aspects relevant in the Single Market.

This will be further complemented by an Action Plan to Fight Tax Evasion which the programme says will “make taxation simple and easy.” The Communication on Business Taxation is likely to be a non-legislative initiative and the Action Plan to Fight Tax Evasion will include both legislative and non-legislative items, as well as an impact assessment. Both of these initiatives are expected to be communicated further during the second quarter of 2020.

No other tax initiatives are set out under the remaining headline ambitions, though the work programme does note that the Commission intends to launch a broad initiative on World Trade Organization (WTO) reform following the next WTO Ministerial Conference in June 2020, with a view to reaching a comprehensive agreement.

Existing European Commission tax initiatives

Annex 2 documenting proposals for withdrawal does not mention any of the Commission’s current tax portfolio, and it therefore should be assumed that such proposals will continue to be taken forward in addition to the two new initiatives outlined in the work programme. Such proposals include:

- The CCCTB Directive

- “Public” CbCR

- The FTT

- State aid scrutiny

- Significant work on value-added tax issues

It is more difficult to forecast potential direction for the Commission’s March 2018 proposed directives5 in relation to the taxation of digitalized business activity, including how they may be integrated into the Commissions new programme. These directives center upon an interim solution, referred to as the Digital Services Tax and a longer-term Council Directive laying down rules relating to the corporate taxation of a significant digital presence. In the same week as the Commission launched its work programme, the Organisation for Economic Co-operation and Development (OECD) held a meeting of the 137 jurisdictions making up the Inclusive Framework on Base Erosion and Profit Shifting (BEPS IF) and published a series of updating materials.6

Failure, significant delay, or a lack of agreement on this work at the BEPS IF level by the end of 2020 may in turn result in increased European activity in this area – as well as, potentially, unilateral actions by individual countries.

As a final note, no mention was made in any section of the work programme of Qualified Majority Voting (QMV), an issue that has been under debate in the Commission for some time and which would have a significant impact on tax policy formation should it come to pass. Post-Brexit, the dynamics of European policy-making may shift, and that smaller Member States in particular may be able to drive tax policy in a more proactive way in the future, should QMV ever be implemented.

Implications

The two new tax programs will likely result in increasing output from the Commission in 2020 and taxpayers may therefore find themselves having to monitor, assess and engage with a higher volume of tax policy output than anticipated.

Given the potential overlap with both the OECD work on similar topics, as well as similar work (such as the proposed CCCTB Directive) within the EU, taxpayers will be expecting more substantial information from the European Commission in the short term if business and tax uncertainty are to be avoided. Taxpayers may also wish to engage directly with national-level policy-makers to start the process of understanding the thinking of the Commission on each program.