Executive summary

Following the announcement on 11 May 2020 that Saudi Arabia would increase the standard rate of value-added tax (VAT) from 5% to 15%, the General Authority for Zakat and Tax (GAZT) has announced transitional rules governing supplies taking place around, or spanning, the rate change. In addition, the VAT rate applicable to goods imported after 1 July 2020 has been clarified.

Detailed discussion

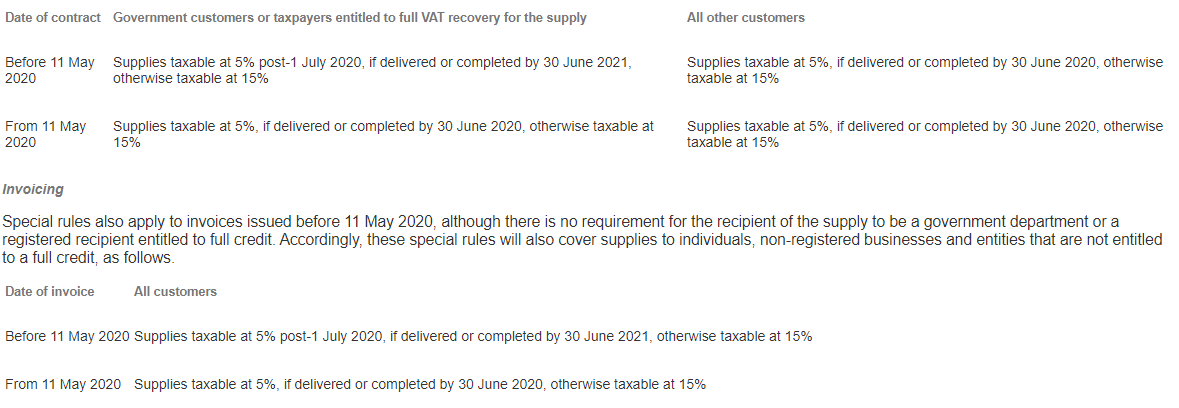

The measures announced relate specifically to the rate applicable to supplies made under contracts signed before 11 May 2020, between select parties, as well as in relation to invoices issued before that date. The concessions relating to contracts and invoices are independent of one another, meaning that supplies may qualify for relief by falling under either one of the measures.

Contracts

Supplies made under contracts signed before 11 May 2020, by registered taxpayers to government departments or tax-registered recipients entitled to full recovery of VAT charged on the supply, will continue to be subject to 5% VAT until renewal of expiry of the contract, or 30 June 2021, as outlined in the table below.

These rules apply to invoicing only, and do not cover pre-payments. Consequently, unless a pre-payment made before 11 May 2020 is accompanied by a corresponding invoice issued from the supplier dated 10 May 2020 or earlier, the normal VAT rules on time of supply will apply.

Continuous supplies

Supplies of a continuous nature – e.g., those provided on an uninterrupted basis over time, such as contracts of insurance or property rental – eligible for transitional relief, will be subject to 5% VAT by reference to the extent the supply is made by 30 June 2021, on a proportional basis, and 15% thereafter. Non-eligible, continuous supplies will be taxable at 5% only to the extent that they are delivered to 30 June 2020. On continuous supplies, transitional relief will cease where the contract expires or is renewed prior to 30 June 2021.

Imports

GAZT has also confirmed that imports of goods made by 30 June 2020 will be taxable at 5%, and subject to 15% import VAT thereafter, with no transitional concessions applicable. Transitional treatment of imported services has not been explicitly clarified. There is no impact on imports that qualify for 0% VAT.

Implications

Businesses will need to examine contracts and invoices in the context of the transitional rules, to identify potential risks and exposures. The restrictions for eligible contractual recipients of supplies – e.g., government departments and tax-registered recipients able to fully recover the VAT on the supply – means that additional diligence will be required by suppliers, and dialogue with their customers, to determine status, will be critical.

In addition, importers will be required to consider the impact of increased import VAT from 1 July 2020 and may wish to consider whether it is possible for some imports to be accelerated, to avoid negative cashflow impacts, or additional cost, where import VAT cannot be recovered.

For additional information with respect to this Alert, please contact the following:

Ernst & Young and Co (Certified Public Accountants), Riyadh

- Asim J. Sheikh, KSA Tax Leader

- Filip Van Driessche

- Mohammed Bilal Akram

- Tina Hsieh

Ernst & Young and Co (Certified Public Accountants), Jeddah

- Robert Dalla Costa

- George Campbell

Ernst & Young and Co (Certified Public Accountants), Al Khobar

- Sanjeev Fernandez, KSA Indirect Tax Leader

- Stefan Majerowski

EY Consulting LLC, Dubai

- David Stevens, MENA Indirect Tax Leader

- Aamer Bhatti

- Francois Malan

Ernst & Young LLP (United States), Middle East Tax Desk, New York

- Asmaa Ali