Renewable energy presents governments with a “no regrets” path to economic recovery, delivering emissions reduction, jobs and economic growth.1 Moreover, by pulling on key policy levers, countries can unlock private sector investment contributing over 90% of the total investment opportunity or US$2t.

In the research commissioned by the European Climate Foundation (ECF), the EY energy team has analyzed the investible pipeline of energy and resources opportunities across 47 key economies capable of supporting green recovery plans. Working with a wide range of sources, including the EY proprietary Renewable Energy Country Attractiveness Index (RECAI) database, and consulting investors, developers, think-tanks and industry experts, projects in four renewable energy sub-sectors – offshore wind, inshore wind, solar and hydro – have been identified. The research focuses on projects that are shovel-ready or capable of launch in the near term.

Mapping the potential impact of identifiable projects in 47 economies that together comprise around 88% of global GDP isn’t a prediction of renewables deployment, but it describes what could be achieved if concerted action is taken now. International co-operation and private-public sector collaboration can together ignite a global green recovery. It can also regenerate depressed communities hit by legacy industries in developed economies and help developing economies build essential infrastructure and clean energy generation for the future.

What does a green recovery mean for climate change?

Deploying the visible pipeline of investable projects over a period of three years would more than double the current rate of global renewables deployment, providing 1 terawatt (TW) of renewable generation capacity. In some countries, the visible project pipeline alone is enough to realize existing nationally determined contribution (NDC) targets under the Paris Agreement. For the 47 countries included in the study, the visible project pipeline will deliver 22% of the UNFCCC NDC (the Paris Agreement) emissions reduction target for 2030.

Beyond direct emissions abatement, decarbonizing the power sector through renewable energy lays the foundation for reducing emissions in the rest of the economy through electrification. Deployment of good-to-go projects would reduce greenhouse gas emissions by 2.5 giga tonnes of CO2 equivalent (GtCO2e) annually, helping to close 9% of the global emissions reduction target for 2030 set out by the Intergovernmental Panel on Climate Change (IPCC) to limit global warming below 1.5°C. This highlights both the opportunity presented by the visible project pipeline and the scale of additional action required to meet IPCC’s global targets.

What does a green recovery mean for jobs?

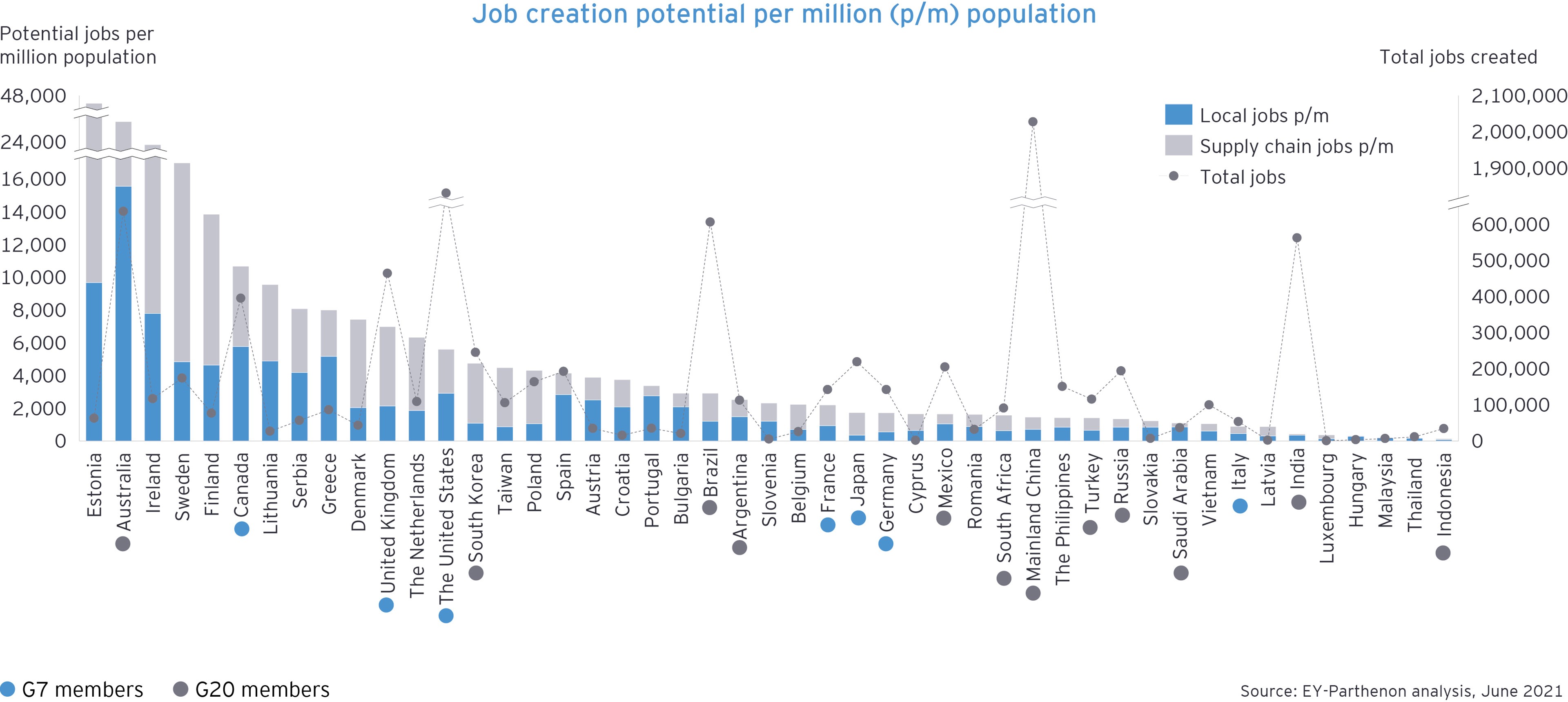

The visible project pipeline could create up to 10 million jobs, both counting jobs local to the projects, and jobs in the supply chain. Within countries, renewable energy can be particularly effective as a tool for creating employment opportunities outside of urban economic centers, especially when deliberate effort is put into strengthening local supply chains. One example of the impact this can have is in the Humber region of the UK. Established as a cluster for offshore wind power to reverse a long period of economic decline, the region is now home to six operational offshore windfarms (including the world’s largest – Hornsea One), and is a central plank in providing the UK government’s commitment of 40GW offshore energy capacity by 2030. The deployment has led to a 60% drop in local unemployment claimants.

It is sometimes argued that green energy jobs are focused on highly educated science, technology, engineering and mathematics (STEM) graduates, but this is not borne out by analysis. In reality, lower skilled jobs are created through construction, installation and manufacturing, while there are new skilled employment opportunities in, for example, engineering and project management.

Moreover, deployment of off-grid and behind-the-meter projects can greatly exceed the visible pipeline. In Vietnam, rooftop solar capacity installed from 2019-2020 exceeded the visible four-year solar PV pipeline in 2018 by almost 100%. Installations in rooftop solar PV capacity in Vietnam have increased by 2,435% since the beginning of 2019, driven largely by a feed-in-tariff scheme. In December 2020, the feed-in-tariff scheme concluded leading to an increase in installed solar rooftop capacity by 6.7GW in that month alone.

Renewable energy investment does more than create jobs: it creates employment opportunities in some of the regions of the world where the need is greatest and where the alternatives are lacking.