Conscientious employment

60%Of millennials would take a pay cut to work for a responsible company.

How corporate responsibility hit a tipping point

Pressure on governments to take drastic action has increased in line with global carbon emissions. Yet despite all UN members signing the 2016 Paris Agreement, global emissions continue to increase. In September 2019, buoyed by growing public activism and extreme weather events, citizens around the world decided they’d had enough. Record numbers took to the streets in the lead-up to the UN Global Climate Action Summit. Their demand, in the words of young Swedish activist Greta Thunberg: “Real climate action.”

Similarly, the business community isn’t immune.

People are demanding more from the businesses they work for, buy from and invest in. And, in part, the economy is responding. Even though global banks have extended $1.9 trillion in financing to the fossil-fuel industry since the signing of the Paris Agreement — some 14 times the amount issued in green bonds and loans — there are signs of change. Positive incentive loan financing, which links a lower cost of capital to favorable environmental outcomes, is growing. Large banks are aligning their investment and loan portfolios with the emissions targets agreed to in Paris.

We are also seeing the rise of B Corporations — certified purpose-driven businesses that are legally required to consider all stakeholders, including the environment. Other organizations have set internal carbon taxes to reduce risk and drive innovation. And a handful of leading organizations have completely reframed their business models to support a healthy ecological, social and economic system.

Related article

Transformational change

45%The percentage of emissions cuts the IPCC recommends enacted by 2030.

Business needs huge strides, not baby steps

While these steps are laudable, they’re far from the transformational change needed. Slashing emissions by 45% from 2010 levels by 2030, as the IPCC recommends, requires the business community to step up as an agent of systemic change. It means organizations need to embed climate action in everything from strategy and culture to supply chain and financial incentives. They also need to adopt greenhouse gas reduction targets that are in line with climate science.

“If you look at climate change in any depth, you quickly see that no clever mix of technological or market forces is going to save us,” says Adam Carrel, Partner, Climate Change and Sustainability, Ernst & Young. “Big data and digital will certainly help, but not in the absence of big ideas and even bigger compromises.”

If you look at climate change in any depth, you quickly see that no clever mix of technological or market forces is going to save us. Big data and digital will certainly help, but not in the absence of big ideas and even bigger compromises.

So, why have most organizations taken only incremental steps at best? While a lack of heavy-duty legislation at a country level is one reason, there’s a prioritization problem: boards rate the threat of climate change lower than CEOs, who in turn rate it lower than investors. Perhaps they are not aware of the expansive new risks posed by climate change, or they are ignoring that the value proposition is changing as renewable energy is becoming continuously less expensive, cheaper than fossil fuels in many instances.

That said, there are exceptions, for sure. More than 500 investors representing more than $35tr in assets have pledged (pdf) their support for the Paris Agreement and taking action on climate change. A group of 204 major companies have committed to go 100% renewable by 2050 at the latest. And some businesses, nations and cities are setting science-based emissions targets.

Yet the lack of prioritization on the part of boards could not only sideline efforts to address the climate emergency, it could stunt their organizations’ efforts to grow in a global economy increasingly measured by climate action (or a lack of it). Whatever the reason for the lag, boards have to catch up.

Boards are best placed to drive real change

We’re encouraged that the EY survey shows boards, along with CEOs and investors, expect public-private partnerships addressing global challenges to become more common. But the climate emergency transcends more than the public/private divide. Tackling it means organizations need to work collaboratively with everyone from NGOs to competitors to find innovative ways to address the climate emergency and broader global challenges. Investors are already fully behind them. Boards now need to take the lead.

With climate change, as with all issues the UN Sustainable Development Goals seek to address, organizations need to first understand how they could be affected. Next, they need to work out exactly how they can contribute to meeting the targets. Finally, they need to build concrete actions into every part of their strategy, not just sprinkle a few on top.

Boards should be disclosing their governance of an organization’s climate risks and opportunities, as recommended by the Task Force on Climate-Related Financial Disclosures. Equally, they need to define management’s roles in assessing and managing climate-related risks and opportunities.

To do so will mean that boards need to gain enough experience in the topic, have access to adequate information about the financial impacts of climate change risks, and dedicate a standing agenda item in the boardroom to discuss climate risks and opportunities on an ongoing basis. At the end of the day, setting KPI’s to drive behavior is the change needed if organizations are going to future-proof their existence.

Boards are in a unique position to transform the pressure to act into incentives and strategies that empower management’s efforts to respond:

Boards can focus on actions that change behavior …

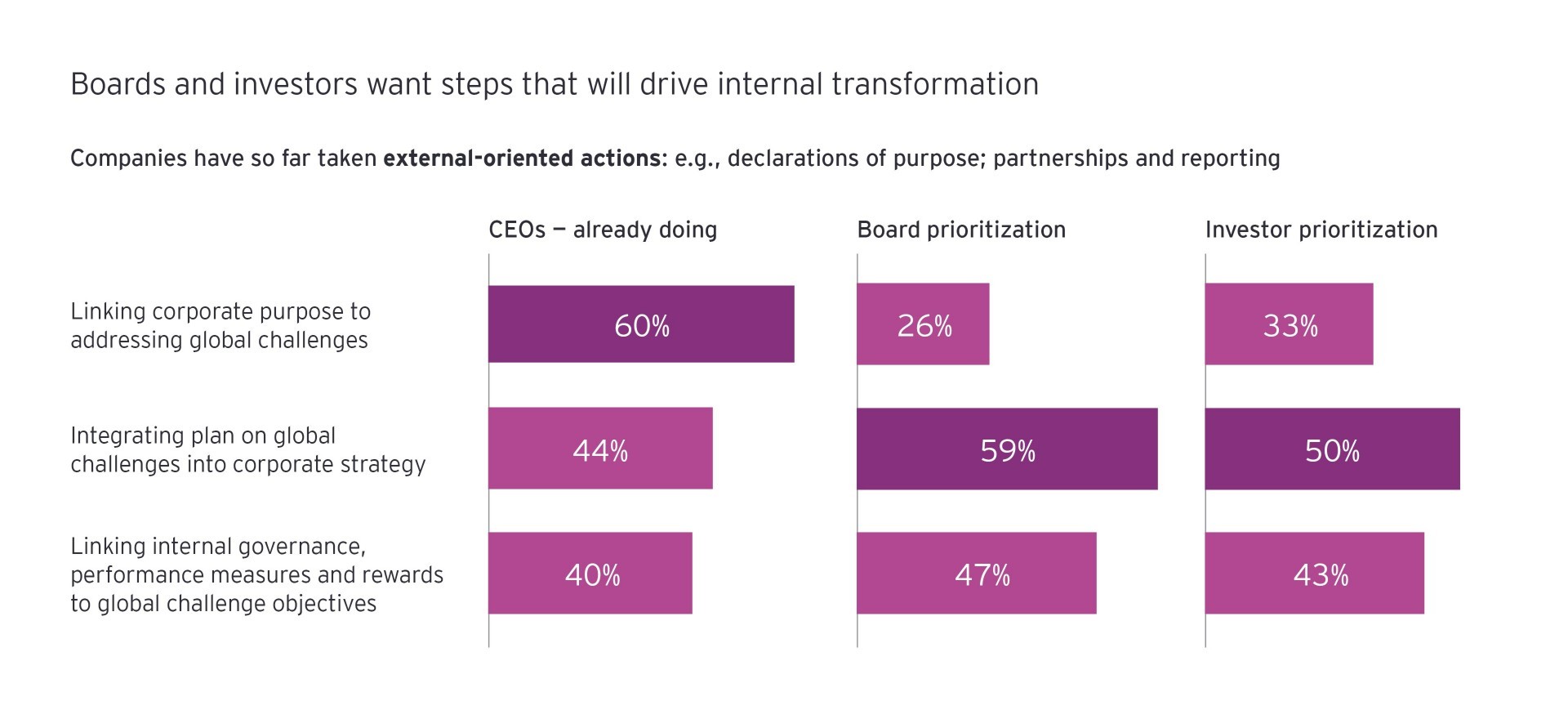

The EY survey found that CEOs focus on linking corporate purpose to global challenges. Boards, on the other hand, prioritize integrating actions into corporate strategy, internal governance and performance measures. In other words, they’ve focused on the actions that will use reward and recognition to incentivize behavior – and make the changes stick.

… but they need to step up

Transformational change is never easy. But what systemic factors do CEOs regard as the biggest constraint on them becoming more vocal and involved in helping to solve global challenges? The attitudes, skills, composition and leadership of their board. To support their organizations in becoming hotbeds of sustainable innovation, boards need the courage to change — and to show vulnerability by admitting they don’t have all the answers.

Related article

Questions boards can ask themselves and their management teams

- Have we assessed how accelerating climate disruptions will impact our key markets and stakeholders?

- Do we understand our contribution to the global carbon footprint, and have we set science-based targets that reflect globally accepted planetary boundaries? If not, how can we gather the data we need to set those targets?

- How can we help management identify effective, non-financial KPIs that measure our progress on setting (and taking action on) climate targets that reflect the recommendations outlined by the Task Force on Climate-related Financial Disclosures?

- What stakeholder engagement mechanisms do we currently have for capturing what investors, customers, activists, governments and our employees are saying? How can we support the management team to meet those expectations?

- How can we measure the multiple levels of value created by leading on climate – attracting/retaining talent, customer, reduced political risk, operational resilience, innovation, reduced energy costs, etc.? How can we align our management and investors to a sustainable program of investment in the climate challenge?

- How can we align our management and investors to a sustainable program of investment in the climate challenge?

- How can we spur our company to acquire the capabilities for an effective climate response?

- Boards around the world agree that solving global challenges will require systemic change. What opportunities exist for us to show leadership and create innovative partnerships with our peers and governments?

- Have we considered the big picture — how could we change our strategy to make sure we’re still around in 20, 30 or 100 years? Are we investing or exploring how to transform our business model to create products or services that takes advantage of the transition to a low-carbon economy?

Summary

Boards rate the threat of climate change lower than CEOs and investors. This lack of prioritization could not only sideline efforts to address the climate emergency but could also stunt their organizations’ efforts to grow in a global economy. Whatever the reason for the lag, boards have a responsibility to catch up.