CEOs should begin to reimagine RemainCo as part of the portfolio review process. Planning for RemainCo operations based on the company’s long-term vision should be more closely examined once it’s determined which businesses and assets will be included in the deal perimeter versus which elements stay with RemainCo.

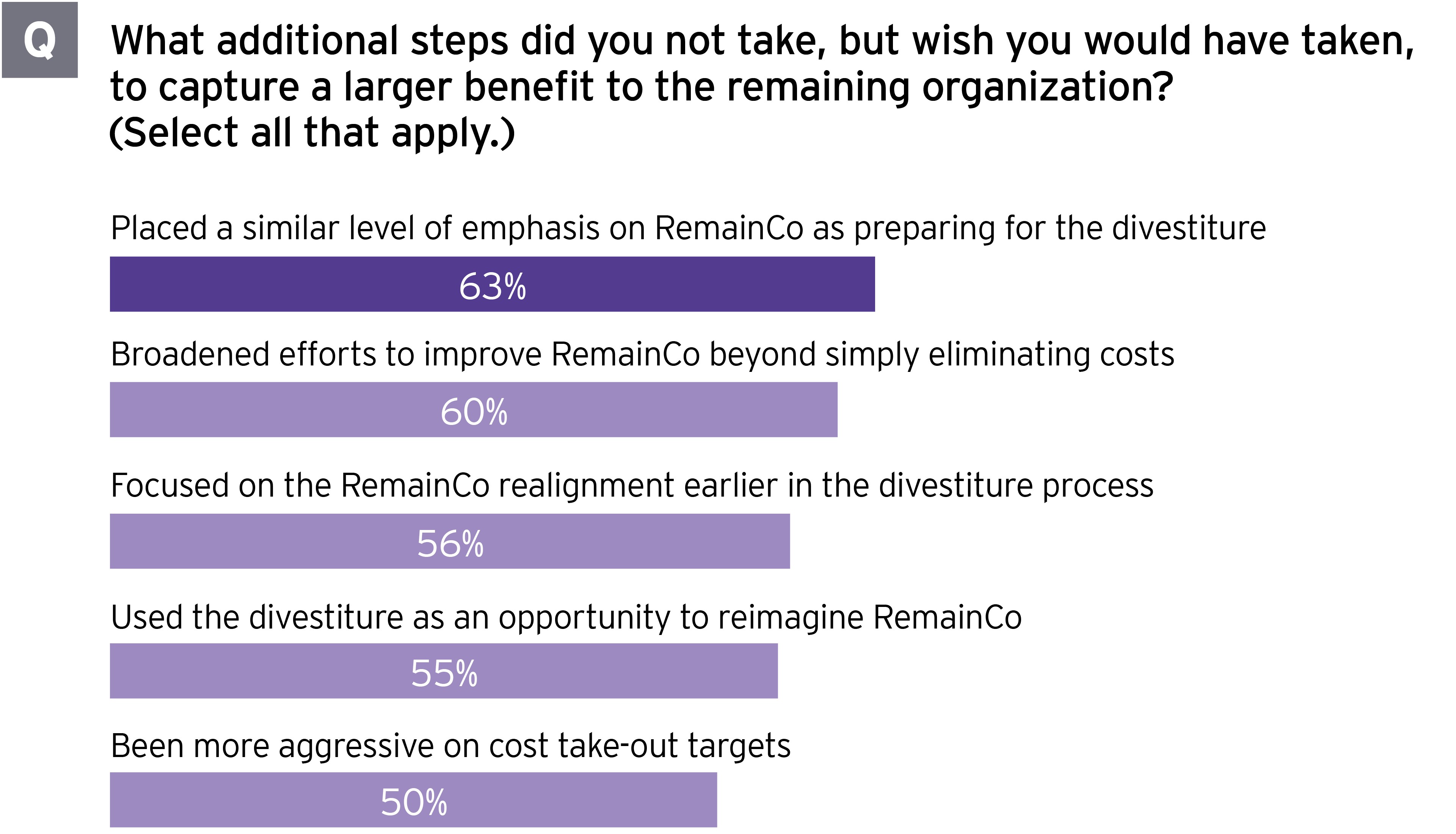

During a divestment, every function of the organization is disrupted as resources and infrastructure are pulled to create the divested business. But leading organizations see this as a chance to challenge the status quo and rebuild an organization for the future — not just looking to cut costs, but also identifying areas where investment can generate greater returns in the core business and which functions can be centralized or even outsourced.

Create a RemainCo enterprise structure that is fit for purpose

The corporate strategy that led to the divestment can form the basis for developing a new enterprise structure, or archetype, for RemainCo. The archetype should focus on how the business will create value and provide a competitive advantage. For example, a significant divestment could leave a company that had multiple business lines with one primary product, requiring a new archetype that moves away from product centric to geocentric.

Business archetype examples include:

- Product centric: focus on characteristics of the end product and drive excellence in those products, with an improved centralized cost structure

- Market centric: support unique commercial and operational requirements across geographies, with a strong link between regional sales and service delivery

- Value-chain centric: streamline operations based on manufacturing processes with competitiveness in each step of the value chain

- Function led: produce cost savings with a lean corporate structure and push control to regional, product or value-chain level

- Hybrid model: combine elements of the above to fit the corporate strategy

Develop a new operating model to increase efficiency and generate outsized returns

The old operating model may need to be changed to fit the new archetype. For example, in a product-centric archetype, R&D spend would be determined centrally by the product owner, while in a market-centric archetype, R&D would be heavily influenced by regional leaders.

Five areas that executives can tackle to revamp the operating model are:

- Process: Can automation be used to streamline some processes, such as order fulfillment or back-office accounting?

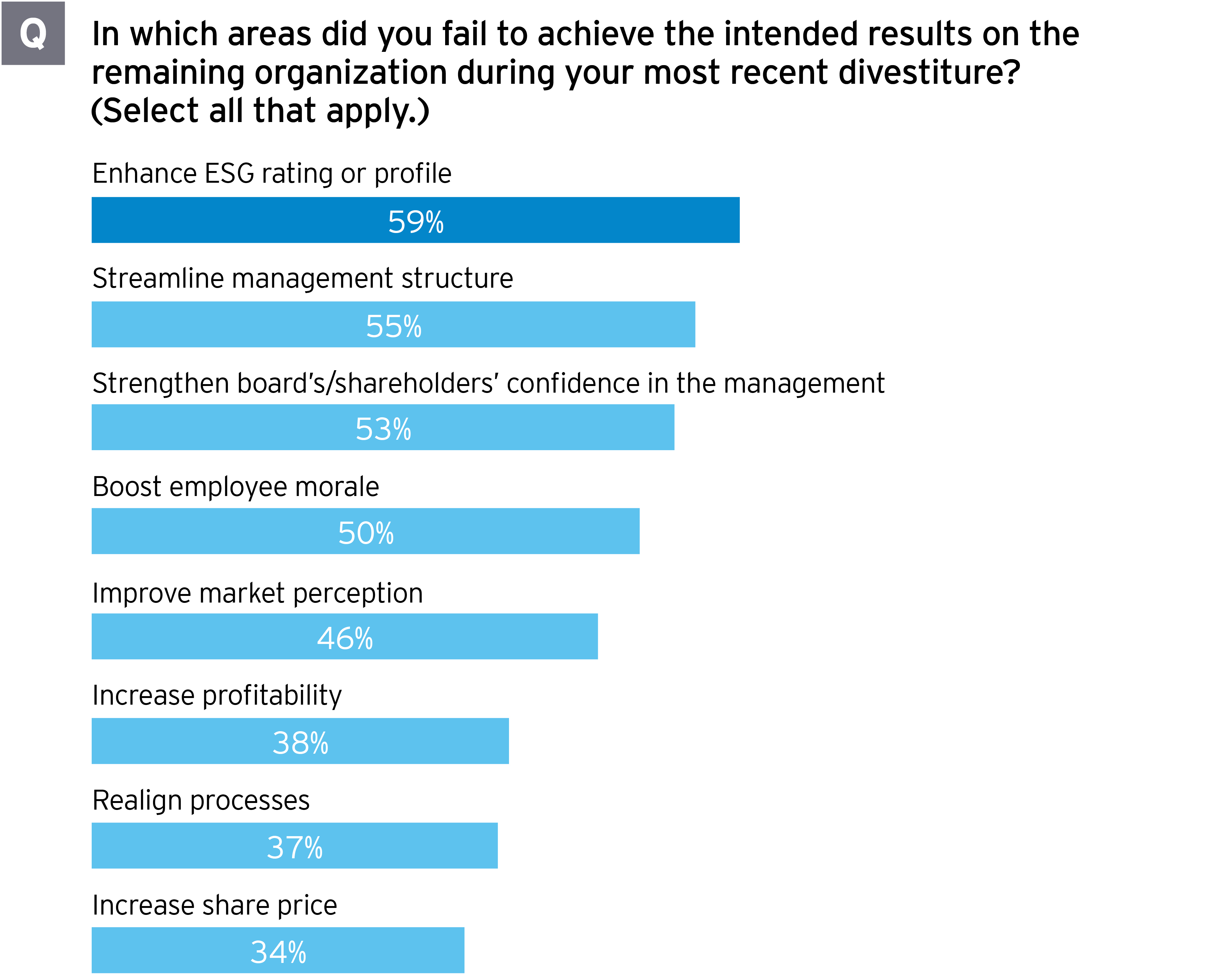

- People: Are there too many layers for the organization to run efficiently? Fifty-five percent of companies said they failed to achieve the intended RemainCo management structure streamlining during the divestment. At the same time, consider whether parts of corporate functions, such as human resources or finance and accounting, can be combined into “centers of excellence” and if less strategic, but essential, activities like accounts payable processing can be moved to lower-cost labor centers or even outsourced.

- Systems: A major divestment, with IT already being disentangled, is a perfect time to evaluate the organization’s systems. It could make sense to shift from data centers to the cloud. It could also make sense to consolidate systems, such as enterprise resource planning (ERP), from several down to one. IT spend as a percentage of revenue should also be analyzed.

- Suppliers: Companies can examine spending with third-party vendors, consolidate products and services under fewer vendors, and negotiate new terms for those economies of scale.

- Assets: Does the company need to continue to own the assets it has to run its business, or are there areas to monetize those assets and create a more flexible cost structure by selling the assets and contracting with the buyer to use them? RemainCo may also not need to own transportation and distribution assets like truck fleets and distribution centers. A smaller company will also be able to rationalize its real estate assets, a process that has already been spurred by the COVID-19 pandemic and by more businesses allowing people to work from home post-pandemic.