Updated Form 1721-VI, Form 1721-VII and Form 1721-A1

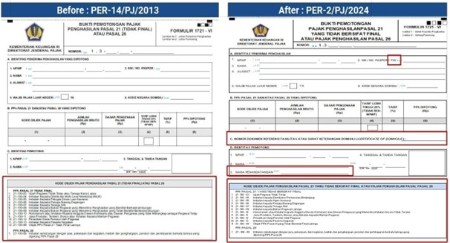

Form 1721-VI

Form 1721-VI is withholding tax slip for WHT21 that is non-final in nature, covering WHT21 for non-permanent employees or free-lancers, MLM distributors, insurance agents, merchants/retailers, professionals, compensation paid to non-employees, honorarium or compensation to members of commissioners or supervisory boards that are not permanent employees, certain payment to ex-employees, withdrawal of pension funds by employees, fees to event participant, and others. This form is also used as evidence of withholding tax on payments to foreigners under Article 26 of the Income Tax Law.

There are no major changes on the form - mainly an update on presentation of information. In addition, the form now provides a single category of tax code for non-employees (under the previous form there was a separation of tax code for non-employees receiving payments continuously and not continuously). This is consistent with PMK-168, which no longer differentiates tax calculations for non-employees.

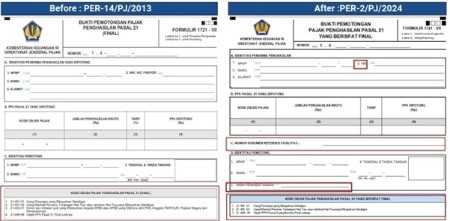

Form 1721-VII

Form 1721-VII is withholding tax slip for WHT21 that is final in nature, which covers WHT21 on severance paid in full, pension benefit and old-age allowance paid in full.

There are also no major changes on the form, mainly an update on presentation of information.

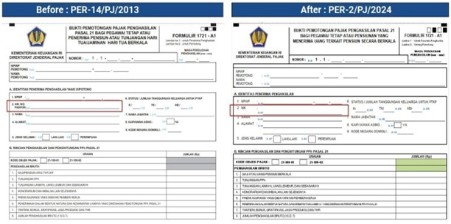

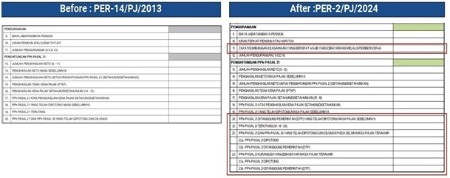

Form 1721 A1

Form 1721-A1 is the annual withholding slip for WHT21 of permanent employees, recipients of pension, or recipients of routine old-age allowance. Modification to Form 1721-A1 were made to accommodate the recent developments of allowable deduction on zakat/compulsory religious donation. The new form has also been designed to accommodate any potential tax incentives on WHT 21 which, in the past, required separate reporting.