Chapter 1

Customers wield the power in transformation

Failure to align the ecosystem around eMobility could halt progression.

eMobility is already here. We are, as described in our latest report, Power sector accelerating e-mobility: can utilities turn EVs into a grid asset? (pdf), written in collaboration with European industry body Eurelectric, at the end of the beginning of a very long journey.

The pace of EV adoption has surpassed expectations. In 2021, one in five new vehicle registrations in Europe was electric.1 And while EVs represent just 1.5% of Europe’s total 326 million vehicle parc today,2 EY analysts predict the share will grow to 65 million vehicles by 2030 and double to 130 million vehicles by 2035. This is driven by a supporting ecosystem that is firmly behind eMobility:

- Many countries have committed to zero-emission new car and van sales by 2035, with others promising to follow by 2040.3

- Automakers are rewriting business models and reinventing powertrains. The biggest players have pledged to increase the numbers of electric models available and boost production of light commercial vehicles (LCVs).4 Some plan to introduce electric heavy-duty vehicles too.5,6

- Regulators are strengthening carbon dioxide (CO2) emission standards for passenger cars and LCVs under the European Commission’s Fit for 55 package7 of environmental reforms. Governments are offering incentives, including bonus payments and tax perks, to purchasers of EVs.

- Customers are being tempted by incentive schemes, cheaper operating costs and enhanced vehicle performance.8 The total cost of ownership of compact and mid-sized EVs now compares with petrol and diesel alternatives in most European countries.9,10

- Battery costs have already fallen exponentially, and energy density is going up, making electrification a viable option for smaller trucks.

- Corporates, already embracing electric for their passenger car fleets, are now electrifying their LCVs, which are increasingly cost competitive with diesel alternatives. The switch to electric augments their green credentials and corporate reputations too.11

2021 EV adoption

1 in 5new vehicle registrations in Europe was electric.

So, if the conditions align, regulations, policies and incentives will do their work. But how do we maintain the momentum of the transition and the appetite for electric? That will only come by making EVs as easy, or easier, to use as conventional fuel vehicles and by delivering convenience, ease and reliability to customers. It is, after all, the customer who wields the real power in this transformation and decides whether to choose electric or not. And, in that respect, customer acceptance is as big a driver of eMobility as the economic and environmental imperatives that conceived it.

Right now, however, business leaders from the automotive, utilities, fleet management, city planning and charging infrastructure sectors are telling us that there is a very real risk that EV uptake will accelerate faster than the ecosystem that will sustain it. And, if the vehicles are available but the supporting infrastructure is not, customer appetite will wane. It could even stop eMobility in its tracks.

Related article

There is a very real risk that EV uptake will accelerate faster than the ecosystem that will sustain it.

Chapter 2

Charging infrastructure presents sticking point

Slow and patchy rollout of chargers impacts driver confidence.

Vehicle range is improving so that EVs can travel further on a single charge. But drivers are worried about the adequacy and availability of public charging infrastructure, especially for longer journeys away from home or the depot. As more EVs hit the road, more drivers will compete for the opportunity to charge. Queues will grow and aggravation will increase.

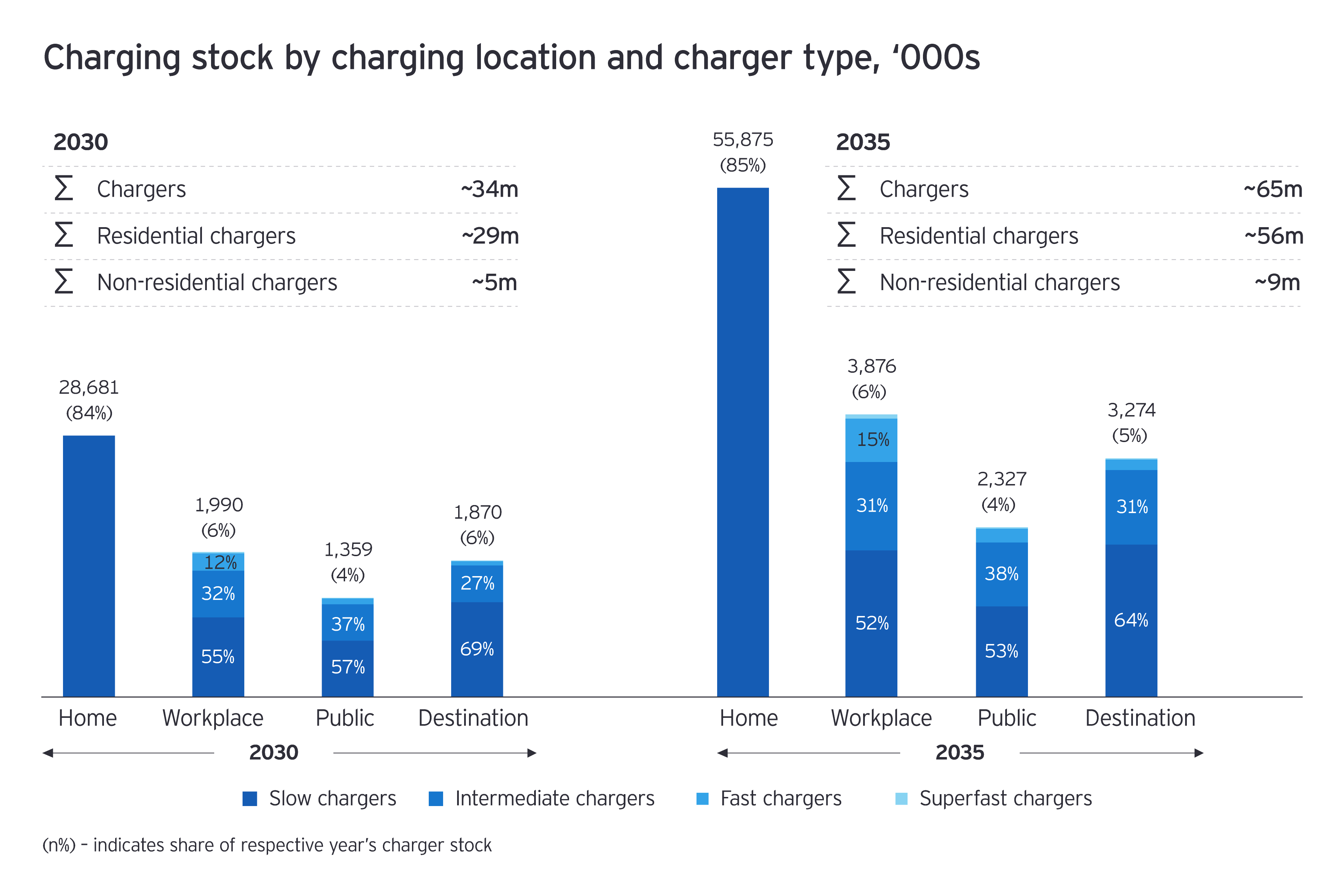

Today, there are 374,000 public charging points in Europe, up by 40% in 2021.12 But adoption is patchy. Ten European countries do not have a single charger per 100 kilometers of road,13 while France, Germany, Italy, the Netherlands and the UK account for 66% of total public charger stock.14 Rural locations tend to be underserved compared with urban areas, while a lack of off-street parking creates significant demand for on-street chargers in residential zones in cities. In the UK, for instance, one-third of homes do not have driveways where chargers can be installed. That rises to 70% in the Netherlands.15 EY teams calculate that the predicted surge in EVs will warrant at least 65 million charge points – 9 million of which will be public and 56 million residential – by 2035 across Europe.

Charger needs

65m+charge points will be needed across Europe by 2035.

The European network of public charge points is not expanding fast enough. There are three principal reasons for that:

- Permitting delays and availability and access to real estate: local authorities often lack dedicated teams to administer the rollout of EV charge points. It can take months for charge point operators (CPOs), responsible for installing and maintaining charging stations, to get permission to site their infrastructure.

- Delays and costs in getting a grid connection: anecdotally, some industry leaders reveal that CPOs in some European countries can wait up to 36 months to get a connection. Significant local bottlenecks are commonplace, especially where grid upgrades are needed to accommodate hubs of rapid and high-powered chargers. There are questions too about who pays for grid connections, as well as policy options for funding public chargers.

- Lack of interoperability between charger networks: using a charge point is not as straightforward as filling up with fuel. Lack of interoperability, due in large part to an absence of common standards, restricts user choice about where to charge and how to pay. Meanwhile, poor reliability on some networks, and variable levels of customer service, add to driver frustration.

Source: EY analysis, November 2021.

Greater cooperation across the supporting ecosystem can tackle obstacles to rollout. For instance, the CPO that works with city planners, local authorities and administrative functions will be better placed to ensure that infrastructure is sited in the right locations, where it will get the highest usage, make the greatest environmental return on investment and deliver maximum convenience to the customer.

CPOs will also need to work closely with DSOs, which may be incentivized by government to speed up connections to the grid, potentially at reduced costs, and to invest in reinforcement of the network. But there is a complication. The more charging infrastructure we install to accommodate the massive influx in EVs, the greater the demands on the electricity grid. Grid capacity will have to adapt to unpredictable EV charging and increased load.

Chapter 3

The indispensable role of the DSO in eMobility

How DSOs will manage the oncoming mass penetration of EVs.

Despite all the scaremongering, EVs will not overload the electricity grid. It will cope and manage to juggle simultaneously the increased burden from distributed energy resources, heat pumps and the electrification of industry. Even so, Europe’s power grids do face an almighty challenge from the imminent rollout of 130 million EVs. If EV drivers are to charge wherever and whenever they choose, the existing grid infrastructure must be expanded, reinforced and digitized.

Electricity demand from EV charging is expected to grow by 11% per year, adding 200TWh by the end of this decade. By then, EVs will account for around 5% of total electricity demand in Europe.16 Any destabilizing impact will come not from demand growth but from thousands, or even millions, of EVs attempting to charge simultaneously – an “unmanaged charging” scenario. The more vehicles that connect to conventional electrical networks, the greater the risk to the adequacy, security and quality of power supply. This can lead to voltage drops, voltage fluctuations and power losses.17 DSOs need to stop that from happening.

Source: EY analysis, November 2021.

Studies show that once EV penetration reaches 50%, network voltage deviations go beyond the standard level.18 For that reason, a “fit and forget” approach to charger connections risks exacerbating congestion in already heavily loaded grids. It will be further accentuated where peak load periods – for example, the end of the working day – coincide with peak EV charging periods.19

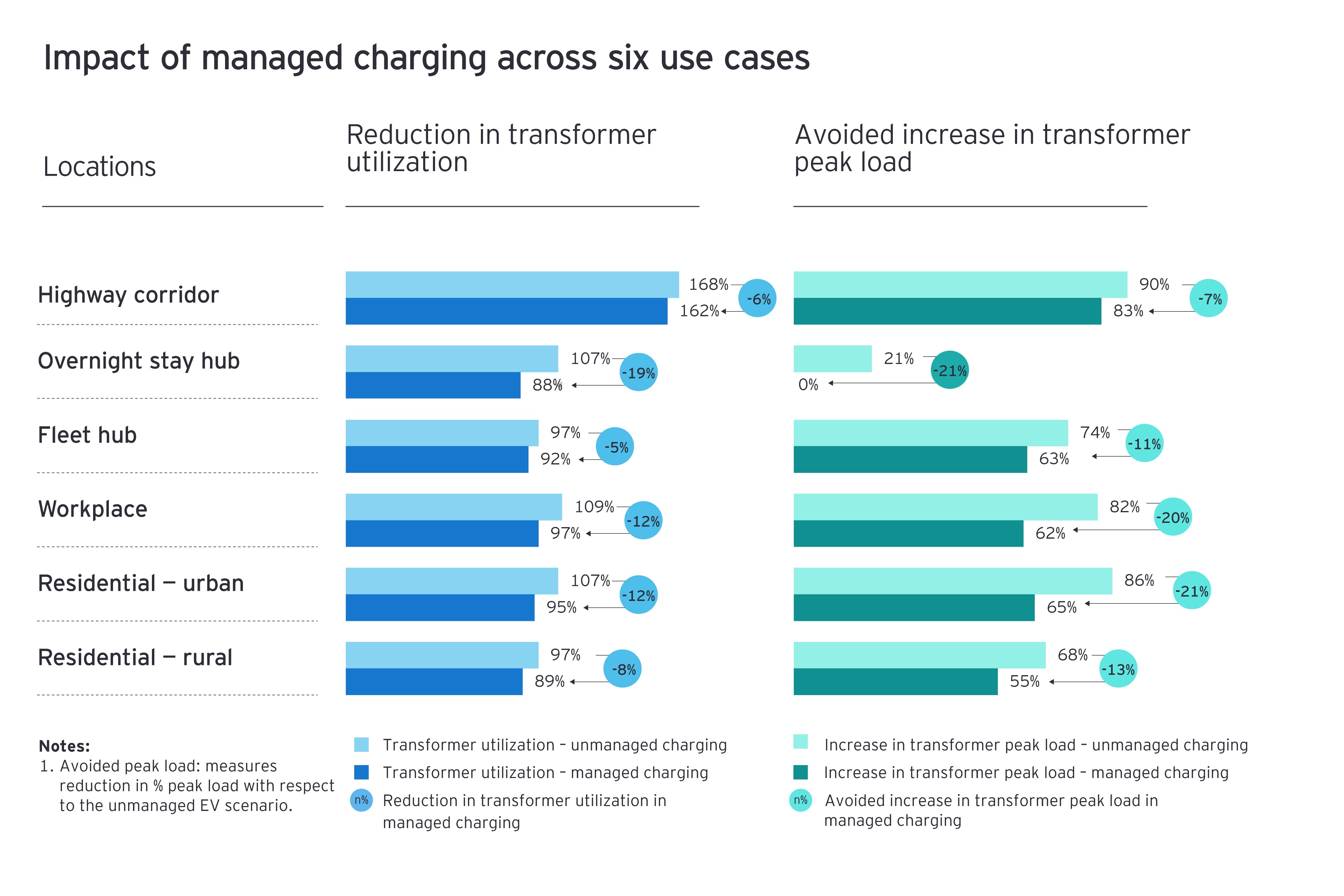

Analysis of the six most common charging use cases – residential (rural and urban), workplace, fleet hub, overnight stay hub and highway corridor – finds that peak load will increase by 21% to 90%, and transformer utilization will rise by 19% to 80% in 2035. In particular, EY analysts predict an 86% increase in peak load in multi-unit dwellings and a 90% increase on highway corridors where rapid and high-powered chargers draw large amounts of electricity from the grid. Transformers, in most cases, will have to operate above their rated capacity.

Peak load

86%increase in peak load expected in multi-unit dwellings in 2035.

Managed charging is a game changer. It allows DSOs to transform the liability that comes from millions of EVs, charging at will, into an asset. Aided by real-time operational systems and advanced applications, managed charging will control the available capacity, time and duration of charging and mitigate the risk of overloading the grid. Charging can then take place when the electricity network has sufficient or surplus capacity, or when there is reduced demand (overnight, for instance) or when electricity is cheaper. Across different charging segments, managed charging indicates savings of 7% to 21% of peak load. And that is a win-win for the grid and for the customer.

Managed charging is a game changer. It allows DSOs to transform the liability that comes from millions of EVs, charging at will, into an asset.

Managed charging solutions can be supplier-managed, via a data connection, to channel energy in one direction, from the grid to the vehicle. In time, as vehicle-to-grid (V2G) technologies mature, EVs will become energy storage units on wheels. They will discharge power from the EV battery to the grid, or to a building, to level out energy production and consumption, reducing the need for additional generation or network reinforcement.

Other solutions are also being piloted. Solar distributed generation and storage co-location, for instance, may be deployed at highway corridor service stations where grid supply is insufficient for fast and superfast charging. Smart wires, to actively balance power flows on transmission lines, and wireless charging are novel concepts that are also being explored. Each of these demand-side solutions creates synergies between the grid and the EV. And though they will not resolve every scenario, they will help to mitigate the impact of large clusters of EVs charging simultaneously. They should:

- Reduce the need for massive grid investment

- Shift a centrally operated power system to a decentralized paradigm, populated by autonomous smart participants

- Allow EV drivers, operating as part of a decentralized and regulated model, to provide balancing capacity to the power system and to be properly remunerated for it

As these solutions mature, digitizing the grid to monitor and validate performance against assumptions will be critical for understanding, anticipating and optimizing customer behaviors, grid impacts and network needs, both now and long into the future.

DSOs will play a pivotal role in eMobility expansion. They are responsible for planning grid development and managing distribution operations and new connections for chargers. But they also have a social obligation to deliver the best environmental outcomes, at the lowest possible cost, by investing in the right locations, at the right time, while avoiding the risk of stranded assets. Their oversight of local networks allows them to identify areas of congestion, to assess the impact from EV charging on electricity demand, and to anticipate future grid investment needs. And, as Europe shifts to smart grids and local flexibility markets, DSOs will be equipped to integrate maturing solutions to shave peak consumption, reduce congestion, and improve power quality and reliability.

As the momentum for EVs gathers pace, planning the power system for electrification is a massive undertaking. To succeed, DSOs need:

- A better understanding of what is happening and where, by improving visibility over low- and medium-voltage networks

- The right skill sets, capabilities and investments to support a fully automated and harmonized customer experience to promote EV take-up

- An ability to track real-time behaviors from the vehicle to the grid and back again, to help manage an increasingly stressed distribution network

The extension of DSOs’ skill sets, and better execution of their responsibilities, will enhance customer centricity. It will help to bring about more innovative solutions, resulting in a better EV experience for drivers.

Chapter 4

The fundamentals of successful eMobility

Delivering a road transport experience that will withstand the test of time.

EV market growth will be both substantial and rapid, and is expected to be worth more than €150b20 by the end of the decade. Huge societal gains will accompany reductions in emissions from road transport and the pursuit of climate neutrality. Getting there, however, depends on dismantling existing barriers and designing an eMobility system that is resilient and will serve future demands.

There are six fundamental action points for securing the long-term viability of eMobility:

- Carefully plan distribution, digital, IT and grid infrastructure investments, allowing for expected EV uptake

- Simplify local authority approval processes for installing charging infrastructure

- Enable faster and cheaper grid connections for EV chargers

- Focus on the reliability of charging infrastructure to win customer confidence

- Ensure every publicly accessible charger in Europe is digitally connected and capable of smart charging

- Enable interoperability – any vehicle, any contract, any payment mechanism – across charger networks

From a grid perspective, new technologies will support the influx of EVs. They will provide a view across the connected environment from the moment a vehicle plugs in and power begins to flow from the grid.

Interoperability is dependent upon smooth communication between the distribution grid, charging hardware and vehicles. Technologies will allow players in the supporting ecosystem to communicate, share data and cooperate with one another in order to improve efficiency and drive eMobility innovation. Digital intelligence and analytics tools will enable forecasting and modeling to shape and enhance solutions. They will monitor charging infrastructure and, in time, deliver a better customer experience by identifying and fixing issues before they escalate.

Meanwhile, regulatory mechanisms will protect and benefit customers. So, for instance, as V2G emerges as a viable technology, and as localized flexibility markets begin to function, the prosumer will participate in self-generation and consumption of electricity. Any surplus renewable energy will be used to balance the grid and the prosumer will be compensated. This exchange of energy will become a fundamental operating characteristic of eMobility in the decades to come.

We must be mindful too that every intervention and innovation should be geared around delivering convenience to the customer. If charging an EV is more complex, costly or onerous than filling up with petrol or diesel, customer appetite for switching to electric will decline. And if the customer doesn’t continue to buy in to eMobility, EVs will be going nowhere fast.

Summary

We have a great opportunity to rewrite road transport. DSOs, with oversight of the entire network, are the critical cog in eMobility. They can orchestrate the flow of electricity across the grid, ultimately turning EVs from liabilities into assets. Getting the fundamental building blocks, technologies and collaborations in place will ensure that eMobility serves us long into the future. The pace of change is swift, but it must be anchored around the customer. The satisfied customer will drive the eMobility transition; the disillusioned customer will stop it in its tracks.