In this article, Kristine Commons, Tax Technology and Transformation Lead, EY Ireland, discusses how tax functions can embrace change to reshape the future.

R

ecent global events underline just how important collaboration by people, technology and processes is to respond to crisis and reshape the future.

We live in a world that is increasingly connected and linked by rapid advances in technology that can connect groups of stakeholders across new platforms.

Today’s working world demands an intelligent tax function, with a new way of obtaining, processing and using data, bolstered by a new mix of talent, training and technology – all working together to create sustainable long-term growth.

For the tax function, this means responding with speed, accuracy and transparency to a highly complex environment. Tax functions, through full-scale transformation or incremental change, face a number of challenges in embracing disruption.

The EY 2020 Global Tax Technology and Transformation Survey, of 100 of the largest multinationals, offers high-level insights into the current challenges and trends redefining how tax functions must operate.

1.Close the data and technology gap

The 2020 survey found significant issues with how tax functions extract maximum value from tax data and technology. Data is often called the most valuable raw material, but value can only be derived by determining the right purpose, the data collection strategy, analytical methods and tools and finally by deciding how to put insights to good use.

As tax authorities strive to implement digital tax administration (DTA), multinationals are being compelled to adapt to more electronic requests and requirements impacting corporate taxpayers.

These changes require filing through digital methods, more information, more real-time filing and the employment of data analytics for risk profiling and auditing. The question we hear from clients is, ‘what can we do to ensure we are prepared for these digital information requests?’ The answer is to continuously review processes and improve the quality of data to ensure readiness and respond by providing accurate information in an efficient manner.

We are seeing a move towards specialist data cleansing products to improve data quality. Interestingly 70% of companies use decades-old technology but newer end-user data cleansing tools have already been adopted by 51%. As such, we are seeing more clients leverage analytics for analysing data, identifying risks and opportunities, real-time monitoring and providing reports to key stakeholders.

2.Tailor ERP outputs for tax usage

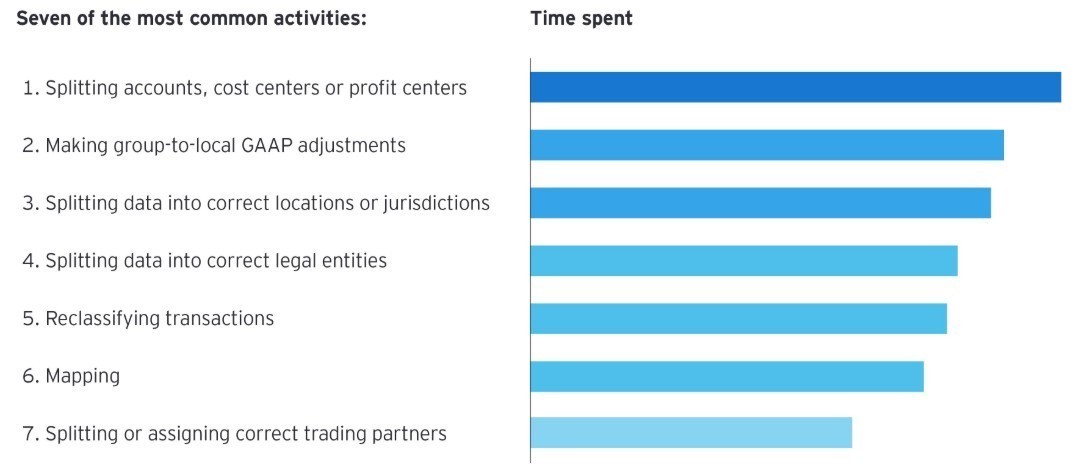

The need to access specific information in a timely manner makes companies increasingly aware of the inadequacies of ERP systems that haven’t been configured with a tax lens. Multiple spreadsheets are often the symptom of multiple data sources and systems not being set up correctly for Tax.