Trends and opportunities: from energy to construction

1. Energy sector: penetration in key renewable energy applications to reach 70% by 2028

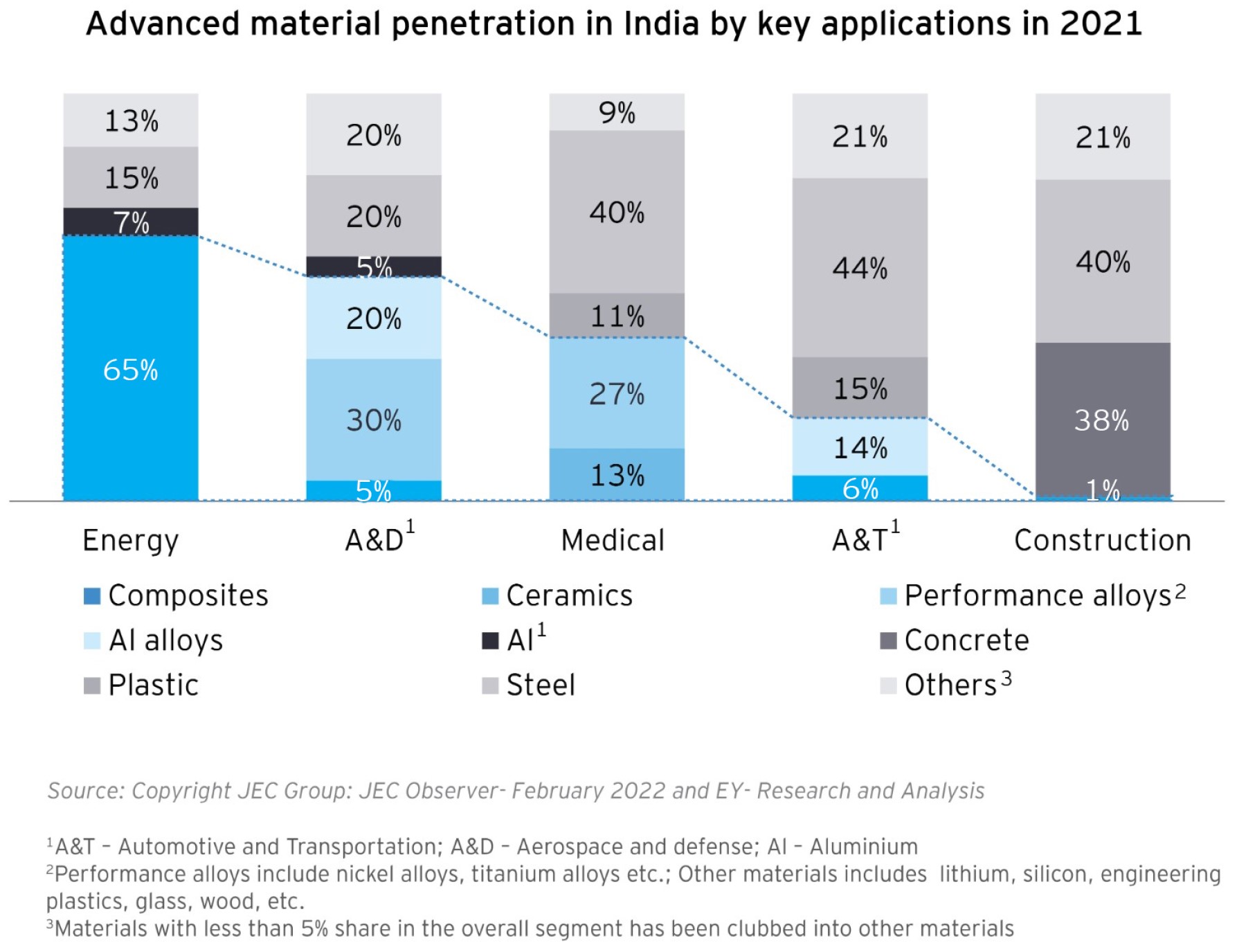

The energy sector is witnessing higher demand for clean energy, thus pushing capacity expansions in wind and solar and increasing focus on energy storage. As a result of this, the advanced material market is expected to reach US$1.96 billion in 2028 from US$0.99 billion in 2021.The growth is driven by demand for materials such as carbon, glass composites, silicon, lithium and nickel that are used in wind blades, photovoltaic cells, batteries and smart grids.

2. Aerospace and defense: Penetration in key structural applications to reach 65% by 2028

Aerospace and defense industry is transitioning to lightweight and hypersonic aircraft with drones also becoming an integral part of the ecosystem. With a CAGR of 8% to 10%, the advanced materials market in this sector is expected to hit US$0.55 billion in 2028 from US$0.31 billion in 2021 driven by rising demand for super alloys and composites for structural applications as well as shape memory alloys and piezoelectric materials for sensors and active control components in autonomous aircraft and drones.

3. Healthcare: penetration in implants and prosthetics to reach 45% by 2028

Healthcare trends such as 3D printing, nanotechnology and smart prosthetics are driving the demand for advanced materials. The market is anticipated to reach US$300 million in 2028 from US$130 million with 12% to 14% CAGR. The demand will be majorly driven by increasing consumer preference for ceramic implants and other materials such as titanium and alloys, silicon, biomaterials across applications such as prosthetic limbs, spinal screws and sensors, among others.

4. Automotive and transportation: penetration in key passenger vehicle applications to reach 25% by 2028

Automotive sector is witnessing a surge in demand for advanced materials driven by the need for light weighting to meet higher fuel efficiency norms and extended battery range. The market is estimated to witness a 10% to 12% CAGR from 2021 to 2028 to reach a sizable market of US$3.83 billion from US$1.83 billion. The demand is for materials such as glass and carbon composites, lithium, silicon, and nickel across applications such as battery casings, body panels, temperature and pressure sensors.

5. Construction: penetration in key structural and non-structural applications to almost double by 2028

Smart cities are expected to be one of the biggest pockets of demand within the building and construction sector, thus spurring the need for advanced materials. Greater adoption of modular construction as well as sharper focus on sustainability is increasing the need for green and lightweight substitute materials. The market is currently valued at US$0.6 billion to grow by a CAGR ranging from 12% to 14% to reach US$1.41 billion by 2028. Materials such as glass, carbon and wood composites along with green steel are being used, majorly finding applications in structural components, walls, rebars, facades, metro tunnels among others.